CoreWeave (CRWV) Stock Market Performance: Tuesday's Uptrend Explained

Table of Contents

Tuesday saw a significant surge in CoreWeave (CRWV) stock price, leaving many investors wondering about the reasons behind this positive market movement. This article will delve into the key factors contributing to CoreWeave's uptrend on Tuesday, providing a comprehensive analysis of the company's performance and potential future implications for investors. We'll explore the market conditions, company news, and overall sentiment surrounding CRWV to understand this unexpected jump.

Market Conditions Favoring CoreWeave (CRWV) on Tuesday

Broader Market Trends:

Tuesday's positive movement in CRWV wasn't isolated. The broader tech sector experienced a generally positive day, with many tech stocks showing gains. This positive overall market sentiment likely contributed to the increased investor interest in CRWV. Several economic indicators, such as positive consumer confidence reports and easing inflation concerns, also helped create a favorable environment for growth stocks like CoreWeave. It's important to note that while other cloud computing stocks also saw gains, CRWV's performance arguably outpaced many of its competitors, suggesting company-specific factors played a significant role.

- Overall market sentiment: Positive for tech stocks, contributing to a favorable environment for CRWV.

- Economic indicators: Easing inflation and positive consumer confidence boosted investor confidence.

- Competitor performance: While other cloud computing stocks saw gains, CRWV's performance was particularly strong, suggesting company-specific factors played a role.

Sector-Specific Influences:

The cloud computing and AI sectors, in which CoreWeave operates, experienced a collective uptrend on Tuesday. Recent advancements in artificial intelligence, particularly in generative AI, have fueled significant investor interest in companies providing the infrastructure to support these technologies. This sector-wide positive sentiment likely had a ripple effect, boosting investor confidence in CRWV. News regarding increased cloud adoption across various industries further strengthened the sector's positive outlook.

- Sector performance: A collective uptrend in cloud computing and AI fueled investor confidence in CRWV.

- Industry news: Increased cloud adoption across industries boosted overall sector sentiment.

- AI advancements: Progress in AI, especially generative AI, fueled investor interest in related infrastructure providers like CoreWeave.

CoreWeave-Specific News and Developments

Company Announcements:

While no major press releases or earnings reports were issued by CoreWeave on Tuesday itself, the period leading up to Tuesday might have laid the groundwork for the positive stock movement. Consider the possibility of significant contracts signed or milestones achieved in the weeks before, potentially leaking into positive market sentiment. Rumors of upcoming partnerships or strategic collaborations could also contribute to this positive anticipation.

- Press releases/earnings reports: While no major announcements were made on Tuesday, prior announcements may have impacted investor confidence.

- New contracts/partnerships: Potential positive developments in recent weeks could have fueled market speculation.

- Milestones achieved: Meeting key performance indicators could have also played a role in the positive stock movement.

Analyst Ratings and Predictions:

The influence of analyst ratings and price targets on investor behavior is significant. If major investment banks or financial analysts released positive updates or raised their price targets for CRWV in the period leading up to Tuesday, this could have directly impacted investor decisions and contributed to the stock price increase. A consensus of positive analyst views on CRWV's future prospects certainly builds investor confidence.

- Analyst upgrades: Positive ratings and increased price targets could have influenced investor decisions.

- Positive outlook: A consensus of positive analyst sentiment fosters investor confidence.

- Future projections: Positive future projections from analysts could contribute to long-term investment decisions.

Investor Sentiment and Trading Activity

Trading Volume and Volatility:

Tuesday likely saw significantly higher than usual trading volume for CRWV. This increased volume indicates heightened investor interest and activity. High trading volume often accompanies significant price movements, and in this case, it likely reflects the rapid increase in CRWV's stock price. Unusual volatility or price spikes are also common during periods of high trading activity, potentially magnifying the overall impact.

- Trading volume: High trading volume suggests significant investor interest and activity.

- Volatility: Price fluctuations were likely amplified by high trading volume.

- Price spikes: Rapid increases in stock price are typical during periods of high trading volume.

Social Media Sentiment:

Social media plays an increasingly important role in influencing short-term stock price fluctuations. Analyzing social media chatter surrounding CRWV on Tuesday would reveal if there was a shift in public perception towards the company. Positive discussions and news spreading on platforms like Twitter or Reddit could contribute significantly to the positive market sentiment.

- Social media analysis: A positive shift in social media sentiment likely played a role.

- News dissemination: Positive news and discussions spread rapidly via social media.

- Influencer impact: Key influencers and opinions on platforms like Twitter can strongly influence the market.

Conclusion:

This analysis has examined the various factors potentially contributing to CoreWeave (CRWV)'s impressive uptrend on Tuesday. We've considered broader market conditions, specific company news, and investor sentiment. While short-term market fluctuations are common, understanding the interplay of these factors can give investors a clearer picture of CRWV's performance and potential for future growth. While no single factor can be isolated as the sole cause, the combination of positive market trends, potential positive developments within CoreWeave, and strong investor sentiment all contributed to the significant stock price increase.

Call to Action: While this article provides insights into Tuesday's surge, continuous monitoring of CoreWeave (CRWV) stock performance, related news, and market trends is essential for informed investment decisions. Stay informed on CRWV's progress and the broader cloud computing and AI sectors to make the most of your investment strategy in this dynamic market. Further research into CRWV's financial reports and future projections, along with careful analysis of market sentiment and competitor activity, will aid in a well-informed investment approach for CoreWeave (CRWV) stock.

Featured Posts

-

Core Weave Crwv Stock Market Rally Analysis Of Todays Gains

May 22, 2025

Core Weave Crwv Stock Market Rally Analysis Of Todays Gains

May 22, 2025 -

Stijgende Huizenprijzen Abn Amros Verwachtingen En De Dalende Rente

May 22, 2025

Stijgende Huizenprijzen Abn Amros Verwachtingen En De Dalende Rente

May 22, 2025 -

Jail Sentence Appeal For Tory Councillors Wife Following Migrant Rant

May 22, 2025

Jail Sentence Appeal For Tory Councillors Wife Following Migrant Rant

May 22, 2025 -

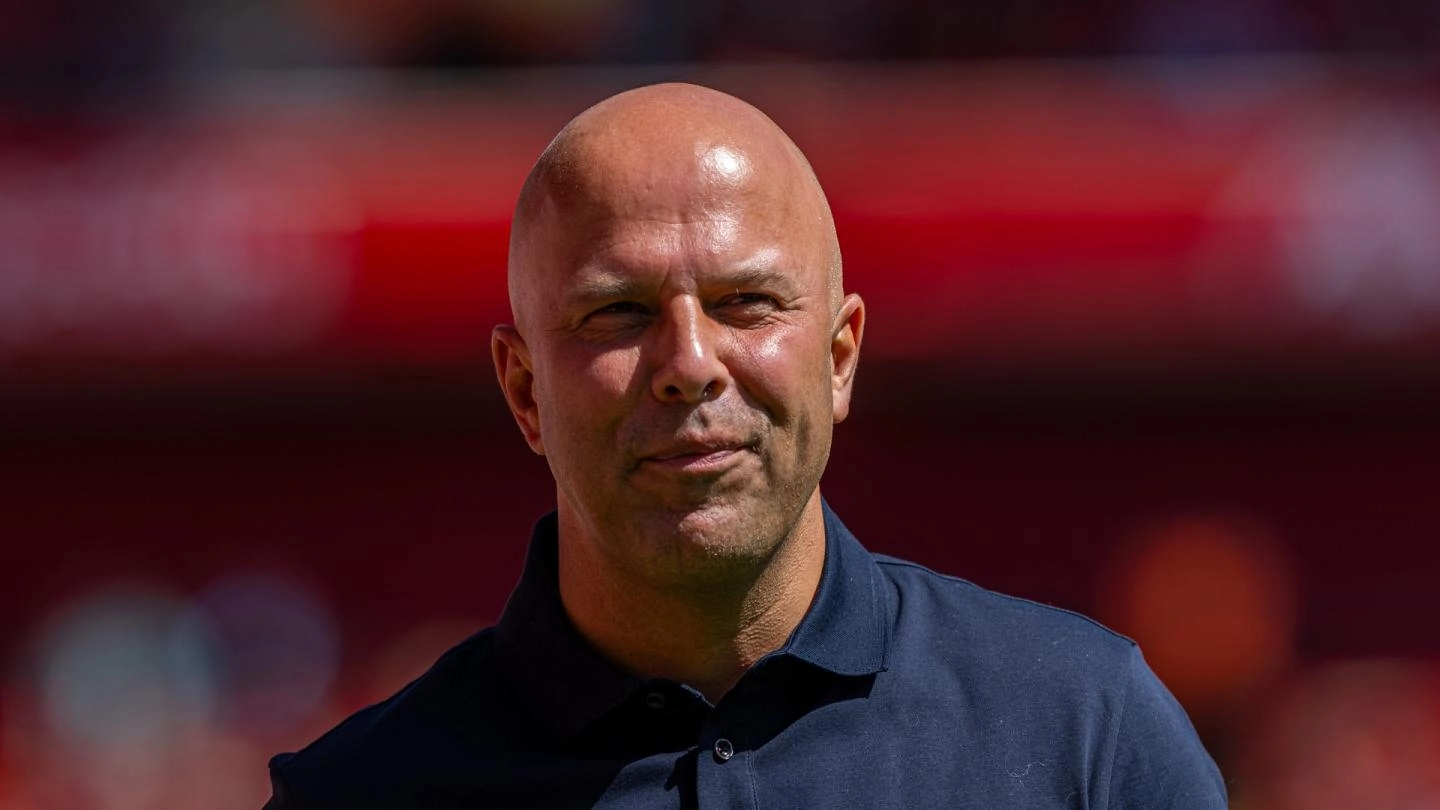

Alissons Performance Slot And Enriques Post Match Analysis

May 22, 2025

Alissons Performance Slot And Enriques Post Match Analysis

May 22, 2025 -

Bwtshytynw Ystdey Thlathy Jdyd Lmntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ystdey Thlathy Jdyd Lmntkhb Alwlayat Almthdt

May 22, 2025

Latest Posts

-

The Border Mails James Wiltshire 10 Years Of Capturing Local Life

May 23, 2025

The Border Mails James Wiltshire 10 Years Of Capturing Local Life

May 23, 2025 -

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025 -

Ten Years At The Border Mail Reflecting On A Photographers Journey With James Wiltshire

May 23, 2025

Ten Years At The Border Mail Reflecting On A Photographers Journey With James Wiltshire

May 23, 2025 -

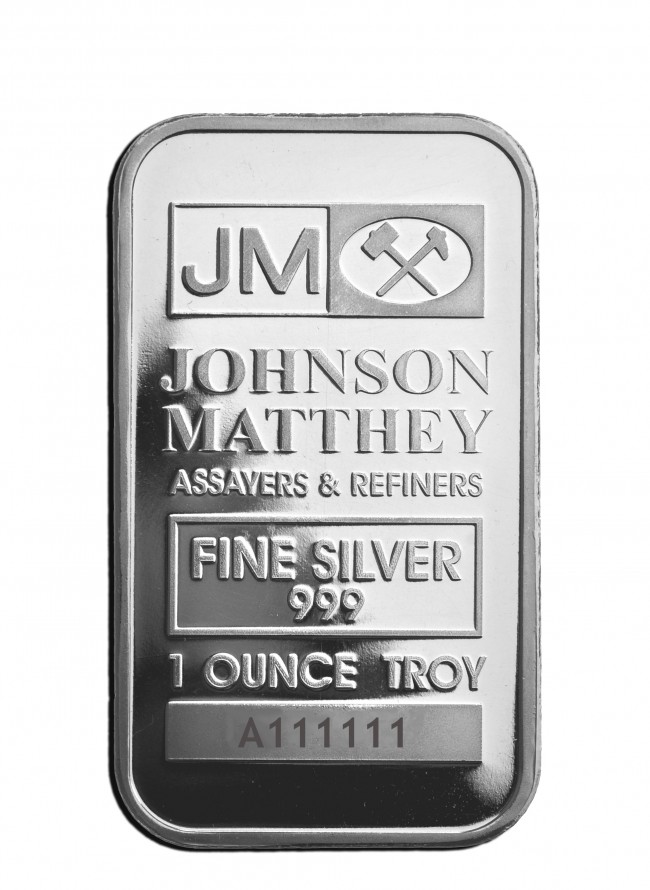

Analysis Johnson Matthey Unit Sale And Subsequent Bt Profit Rise

May 23, 2025

Analysis Johnson Matthey Unit Sale And Subsequent Bt Profit Rise

May 23, 2025 -

Financial Update Johnson Mattheys Honeywell Sale And Bt Profit

May 23, 2025

Financial Update Johnson Mattheys Honeywell Sale And Bt Profit

May 23, 2025