CoreWeave (CRWV) Stock Market Reaction To Nvidia Partnership

Table of Contents

Initial Market Reaction to the Nvidia Partnership

The news of the CoreWeave and Nvidia partnership resulted in an immediate and substantial surge in CRWV stock price. While precise percentage changes will vary depending on the timing of the analysis, initial reports indicated a double-digit percentage increase in the hours following the official announcement. Trading volume also spiked significantly, demonstrating strong investor interest and confidence in the strategic alliance. Investor sentiment was overwhelmingly bullish, reflecting a positive outlook on the potential synergies and growth opportunities presented by the collaboration. This positive reception contrasted with some initial uncertainty among certain analysts who were waiting for more details.

- Specific price movements: Reports indicated a [insert percentage]% increase within the first [number] hours of the announcement, followed by a [percentage]% increase over the next [number] days. (Note: Replace bracketed information with actual data from reputable financial sources).

- News articles and analyst comments: Major financial news outlets like [mention specific sources, e.g., Bloomberg, Reuters, Wall Street Journal] highlighted the positive market reaction, citing analyst comments that emphasized the strategic fit between CoreWeave's GPU cloud computing platform and Nvidia's advanced GPU technology.

- Comparison to other partnerships: Compared to other similar partnerships in the cloud computing sector, the market response to the CoreWeave-Nvidia collaboration was notably strong, suggesting a high level of investor confidence in the potential for long-term growth and success. This reflects the importance of Nvidia's technology in the rapidly expanding AI market.

CoreWeave's Business Model and its Synergy with Nvidia

CoreWeave operates a leading GPU cloud computing platform designed for high-performance computing tasks, particularly AI model training and other computationally intensive applications. Its business model revolves around providing scalable and cost-effective access to powerful GPU clusters. The Nvidia partnership significantly enhances CoreWeave's offerings by integrating Nvidia's state-of-the-art GPUs, such as the [mention specific Nvidia GPU models, e.g., A100, H100], into its infrastructure.

- Benefits for CoreWeave: The partnership translates to increased processing power, expanded market reach, and access to Nvidia's extensive ecosystem of software and tools. This allows CoreWeave to cater to a wider range of clients with more demanding computational requirements.

- Benefits for Nvidia: For Nvidia, the collaboration bolsters its market position in the cloud computing sector and increases the adoption of its high-performance GPUs within the rapidly growing AI model training market.

- Industry applications: The combined offerings directly benefit various industries, including AI, machine learning, data science, and high-performance computing research, providing them with access to superior computing power and infrastructure.

Long-Term Implications for CRWV Stock

The long-term implications for CRWV stock hinge on the successful execution of the CoreWeave-Nvidia partnership. A best-case scenario foresees substantial revenue growth for CoreWeave, increased market share in the GPU cloud computing sector, and consequently, a significant rise in CRWV stock price. A more conservative scenario anticipates a steady but less dramatic increase, reflecting market competition and the inherent volatility of the tech sector. A worst-case scenario involves unforeseen challenges, resulting in slower-than-expected growth.

- Potential for increased revenue and market share: The partnership positions CoreWeave to capture a larger share of the rapidly expanding market for AI infrastructure, leading to significantly increased revenue streams.

- Expected timeline for realizing benefits: The full benefits of the partnership are likely to unfold over several quarters, depending on factors such as market adoption, technological advancements, and competitive dynamics.

- Factors impacting CRWV stock performance: Factors such as broader economic conditions, competition from other cloud computing providers, and technological disruptions could significantly impact CRWV's stock performance.

Comparison with Competitors and Industry Trends

CoreWeave faces stiff competition from established players in the cloud computing market, including [mention key competitors, e.g., AWS, Google Cloud, Microsoft Azure]. However, its specialization in GPU cloud computing and the strategic Nvidia partnership provide a competitive edge. The industry is characterized by rapid growth, driven by the increasing demand for AI infrastructure and high-performance computing resources.

- Competitive landscape analysis: A SWOT analysis of CoreWeave reveals its strengths (specialized GPU platform, Nvidia partnership), weaknesses (relative youth compared to established players), opportunities (growing AI market), and threats (intense competition, technological advancements).

- Industry reports and forecasts: Industry reports consistently predict significant growth in the GPU cloud computing and AI infrastructure markets, further supporting the positive outlook for CoreWeave.

- Growth drivers and headwinds: Key growth drivers include the increasing adoption of AI and machine learning, while potential headwinds include economic downturns and competition from larger, more established cloud providers.

Conclusion: Analyzing the CoreWeave (CRWV) Stock Market Reaction

The market's initial reaction to the CoreWeave-Nvidia partnership was overwhelmingly positive, reflecting strong investor confidence in the strategic value of this collaboration. While the long-term implications remain subject to various market factors and competitive pressures, the partnership positions CoreWeave for substantial growth within the rapidly evolving landscape of cloud computing and AI infrastructure. While risks exist, the potential benefits are significant. Therefore, monitoring CRWV stock prices and staying updated on industry news related to the CoreWeave-Nvidia partnership and the broader AI infrastructure market is crucial for informed investment decisions. Conduct further research on CoreWeave (CRWV) and its prospects to make well-informed decisions about this exciting player in the AI cloud computing market.

Featured Posts

-

Stream Peppa Pig Online Free And Legal Options For Kids

May 22, 2025

Stream Peppa Pig Online Free And Legal Options For Kids

May 22, 2025 -

Jeremie Frimpong Transfer News Latest Liverpool Fc Updates

May 22, 2025

Jeremie Frimpong Transfer News Latest Liverpool Fc Updates

May 22, 2025 -

Reactia Publicului Fratii Tate La Volanul Bolidului Lor Prin Centrul Bucurestiului

May 22, 2025

Reactia Publicului Fratii Tate La Volanul Bolidului Lor Prin Centrul Bucurestiului

May 22, 2025 -

Wordle Today Answer Wordle 1366 Hints And Solution For March 16th

May 22, 2025

Wordle Today Answer Wordle 1366 Hints And Solution For March 16th

May 22, 2025 -

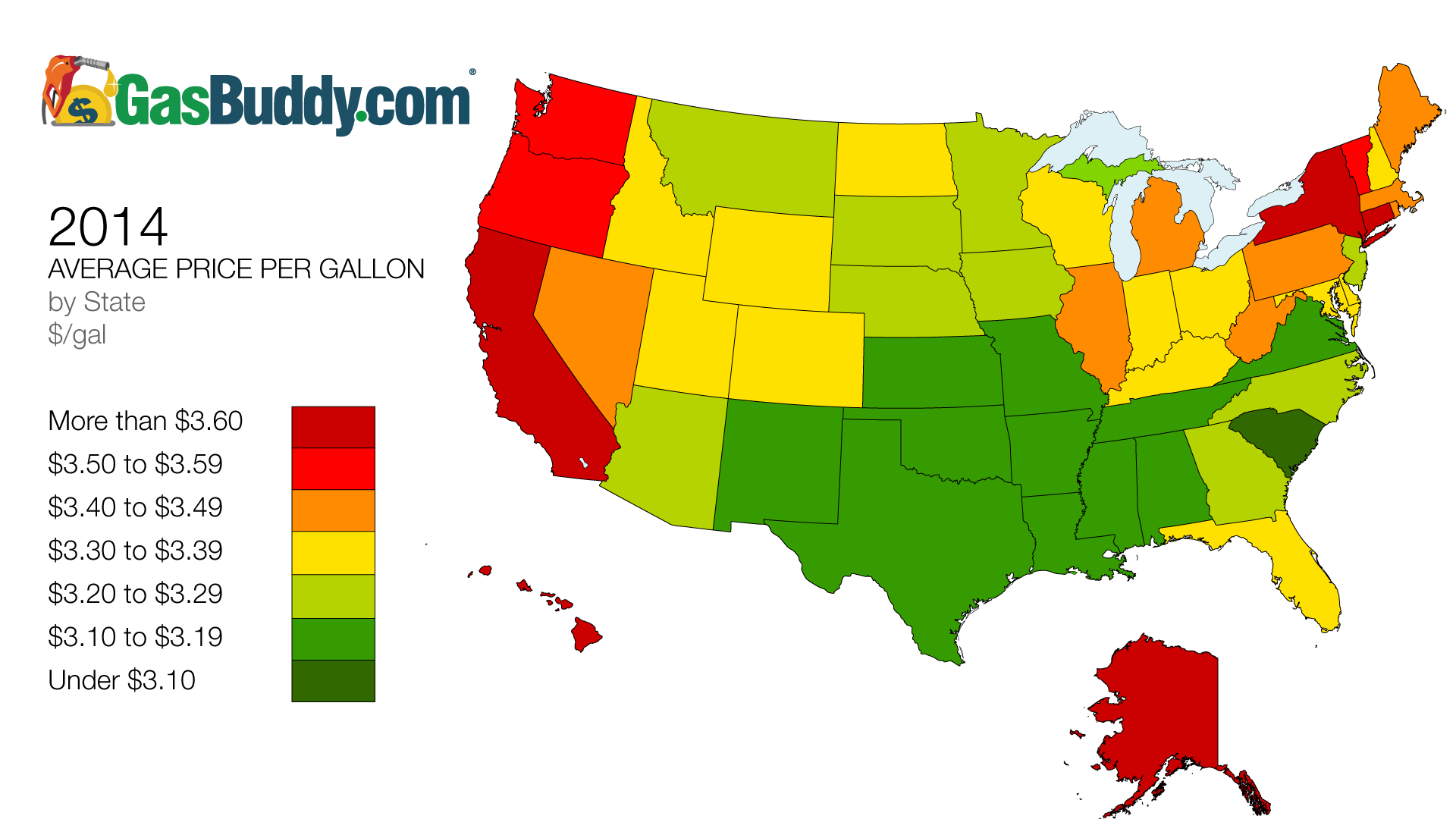

Weekly Gas Price Report Virginias Average Prices Decrease

May 22, 2025

Weekly Gas Price Report Virginias Average Prices Decrease

May 22, 2025

Latest Posts

-

Popular Rock Band Frontman Dies At 32 Fans Mourn

May 22, 2025

Popular Rock Band Frontman Dies At 32 Fans Mourn

May 22, 2025 -

Dropout King Singer Adam Ramey Dies At 31 A Tribute

May 22, 2025

Dropout King Singer Adam Ramey Dies At 31 A Tribute

May 22, 2025 -

Adam Ramey Dead At 31 Dropout King Singer Passes Away

May 22, 2025

Adam Ramey Dead At 31 Dropout King Singer Passes Away

May 22, 2025 -

Wordle Game 363 Hints Clues And The Answer March 13th

May 22, 2025

Wordle Game 363 Hints Clues And The Answer March 13th

May 22, 2025 -

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025