CoreWeave (CRWV) Stock Plunge: Understanding Thursday's Decline

Table of Contents

Pre-Market Trading Activity and Initial Reactions

Pre-market indicators offered a glimpse into the impending CoreWeave (CRWV) stock decline. Trading volumes were unusually high, suggesting significant investor activity before the official market opening. This heightened activity, coupled with a noticeable downward price trend, foreshadowed the day's events.

- Pre-market price movements: CRWV saw a significant drop of X% in pre-market trading, setting a negative tone for the day's trading session.

- Unusual trading activity: The high volume of pre-market trades suggested a potential catalyst was at play, influencing investor sentiment before the official market opening.

- Initial media response: Early news reports hinted at potential negative news affecting the company, further contributing to the negative sentiment surrounding CRWV.

The Role of Analyst Ratings and Price Target Adjustments

Analyst ratings and price target adjustments played a significant role in the CoreWeave stock plunge. The release of several downgrades and negative analyst reports before and during Thursday's trading session significantly impacted investor confidence. These reports highlighted concerns about various aspects of CoreWeave's business model or outlook, leading many investors to sell their shares.

- Specific analyst downgrades: Analyst A downgraded CRWV from "Buy" to "Hold," citing concerns about [specific reason]. Analyst B lowered their price target from $X to $Y, reflecting a similar pessimistic outlook.

- Quantifiable changes in price targets: The collective downward revision of price targets by various analysts solidified the negative sentiment surrounding CRWV, further driving the stock price down.

- Reasoning behind negative revisions: The analysts' concerns often revolved around [mention specific concerns like competition, revenue growth projections, or market saturation].

Market-Wide Influences and Sector-Specific Trends

The CoreWeave (CRWV) stock decline wasn't solely attributable to company-specific factors. Broader market conditions on Thursday played a role, with a general negative sentiment impacting various sectors, including technology. Additionally, sector-specific trends within the cloud computing industry added to the pressure on CRWV.

- Macroeconomic factors: A general market downturn or concerns about [mention specific macroeconomic factors like interest rate hikes or inflation] contributed to the overall negative investor sentiment.

- Competitor stock performance: The performance of competitor stocks within the cloud computing sector also played a role, with many experiencing declines, exacerbating the pressure on CRWV.

- News impacting the cloud computing industry: Negative news regarding the overall cloud computing market, such as regulatory changes or slowing growth predictions, added to the downward pressure on CRWV.

Potential Long-Term Implications for CoreWeave Investors

The CoreWeave stock plunge raises questions about the company's long-term prospects. While the short-term outlook may appear bleak, analyzing CoreWeave's financial health and future growth potential is crucial for long-term investors. Several strategies could be considered depending on individual risk tolerance and investment goals.

- CoreWeave's financial health and future growth potential: Despite the recent decline, CoreWeave still possesses [mention positive aspects, like innovative technology or strong market position]. Long-term investors should consider the company’s capacity for innovation and market adaptability.

- Potential risks and opportunities: Investors need to carefully assess the risks associated with the current market conditions and the company's ability to navigate these challenges. Opportunities might arise from buying at a lower price point, but careful due diligence is essential.

- Investment approaches (hold, buy, sell): The decision to hold, buy, or sell CRWV stock depends on individual risk tolerance and investment strategy. A thorough analysis of the company's fundamentals and market outlook is crucial for informed decision-making.

Conclusion

The CoreWeave (CRWV) stock plunge was a complex event driven by a confluence of factors. Pre-market indicators, negative analyst reports, broader market trends, and sector-specific pressures all contributed to the significant decline. Understanding these intricacies is key for making informed investment choices. The long-term prospects for CoreWeave remain a subject of debate, demanding careful evaluation of its financial health, growth potential, and the risks and opportunities it presents. Understanding the intricacies of the CoreWeave (CRWV) stock decline is a crucial step in navigating the volatile world of tech investments. Continue your due diligence and stay informed about future developments concerning CoreWeave stock to make well-informed investment decisions.

Featured Posts

-

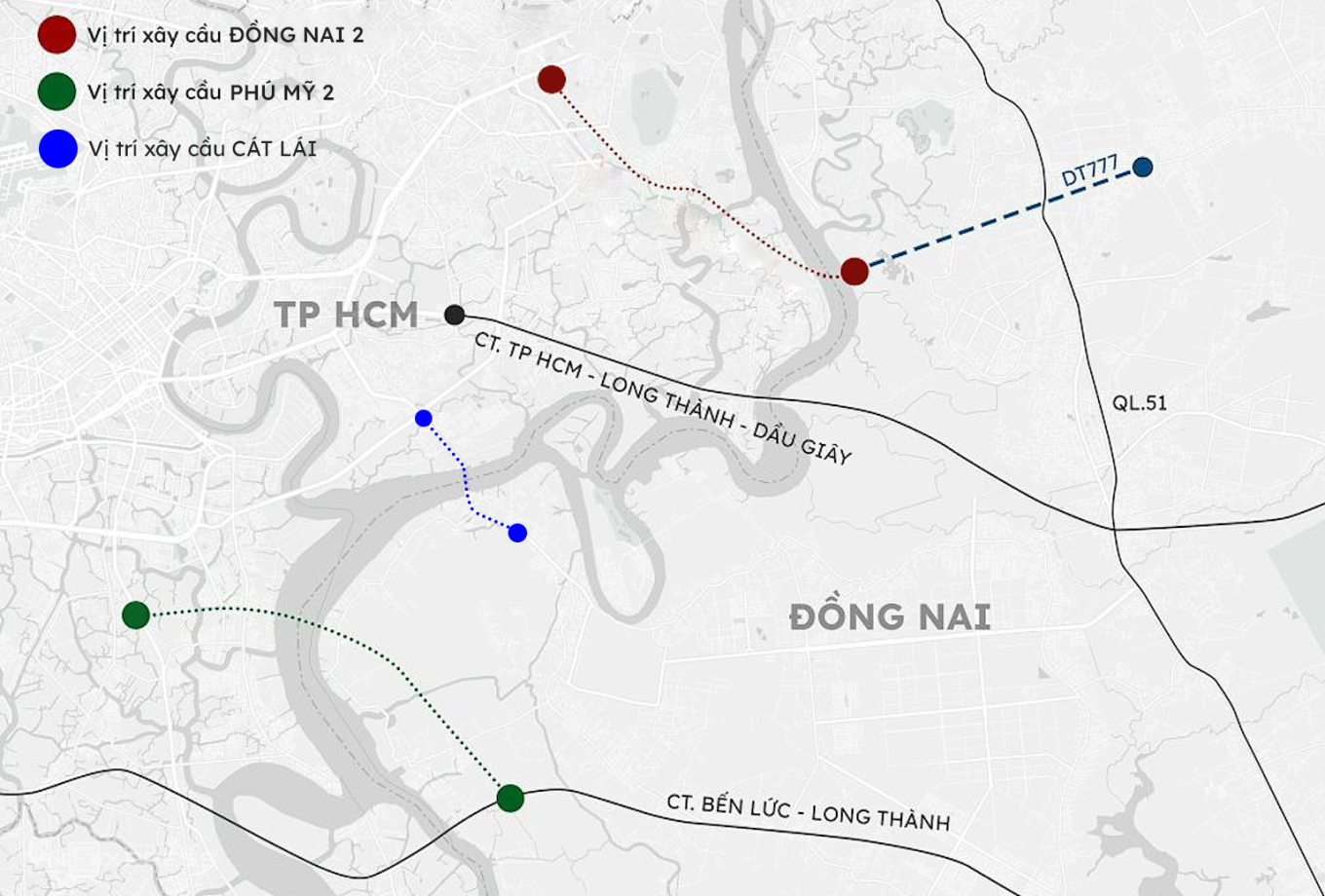

Cau Ma Da Khoi Cong Xay Dung Thang 6 Noi Lien Dong Nai Va Binh Phuoc

May 22, 2025

Cau Ma Da Khoi Cong Xay Dung Thang 6 Noi Lien Dong Nai Va Binh Phuoc

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Wtt Star Contender Chennai A Record Breaking 19 Indian Paddlers Participate

May 22, 2025

Wtt Star Contender Chennai A Record Breaking 19 Indian Paddlers Participate

May 22, 2025 -

Occasionverkoop Abn Amro Flink Gestegen Door Meer Autobezitters

May 22, 2025

Occasionverkoop Abn Amro Flink Gestegen Door Meer Autobezitters

May 22, 2025 -

Real Madrid In Ancelotti Den Sonraki Teknik Direktoer Secimi Guendemdeki Isimler

May 22, 2025

Real Madrid In Ancelotti Den Sonraki Teknik Direktoer Secimi Guendemdeki Isimler

May 22, 2025

Latest Posts

-

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025

Music World Mourns Dropout Kings Adam Ramey Passes Away At 32

May 22, 2025 -

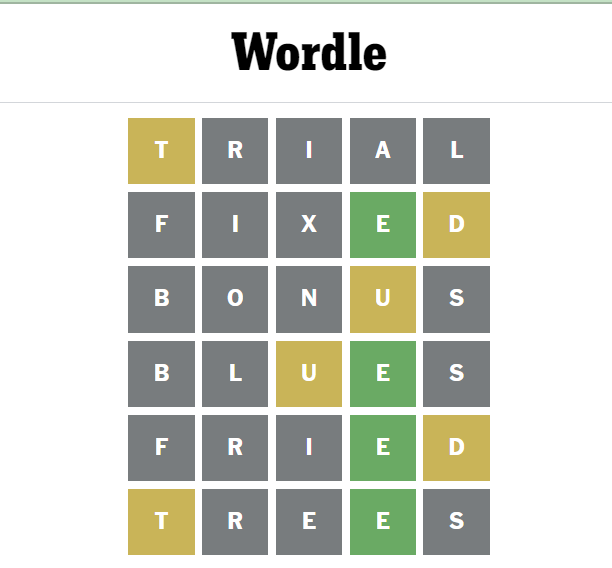

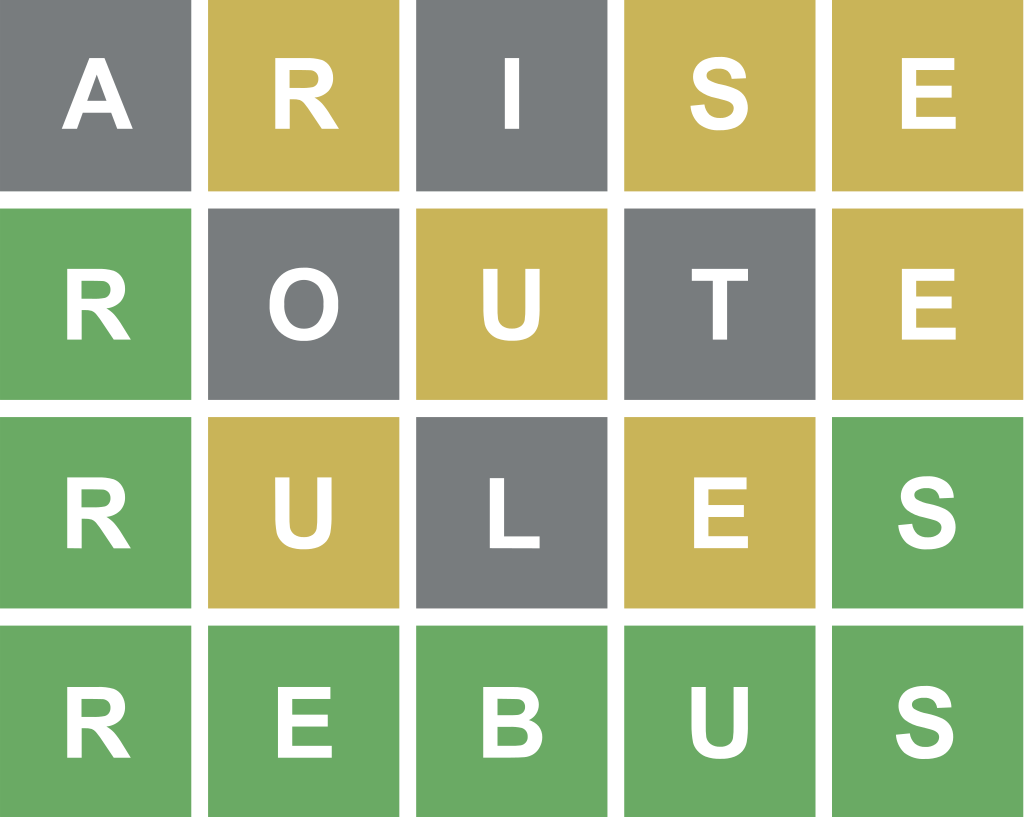

Wordle 363 Clues And Solution For Thursday March 13

May 22, 2025

Wordle 363 Clues And Solution For Thursday March 13

May 22, 2025 -

Wordle 363 Hints And Answer For March 13th Thursday

May 22, 2025

Wordle 363 Hints And Answer For March 13th Thursday

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies By Suicide A Tragic Loss

May 22, 2025 -

Dropout Kings Lose Lead Singer Adam Ramey At 32

May 22, 2025

Dropout Kings Lose Lead Singer Adam Ramey At 32

May 22, 2025