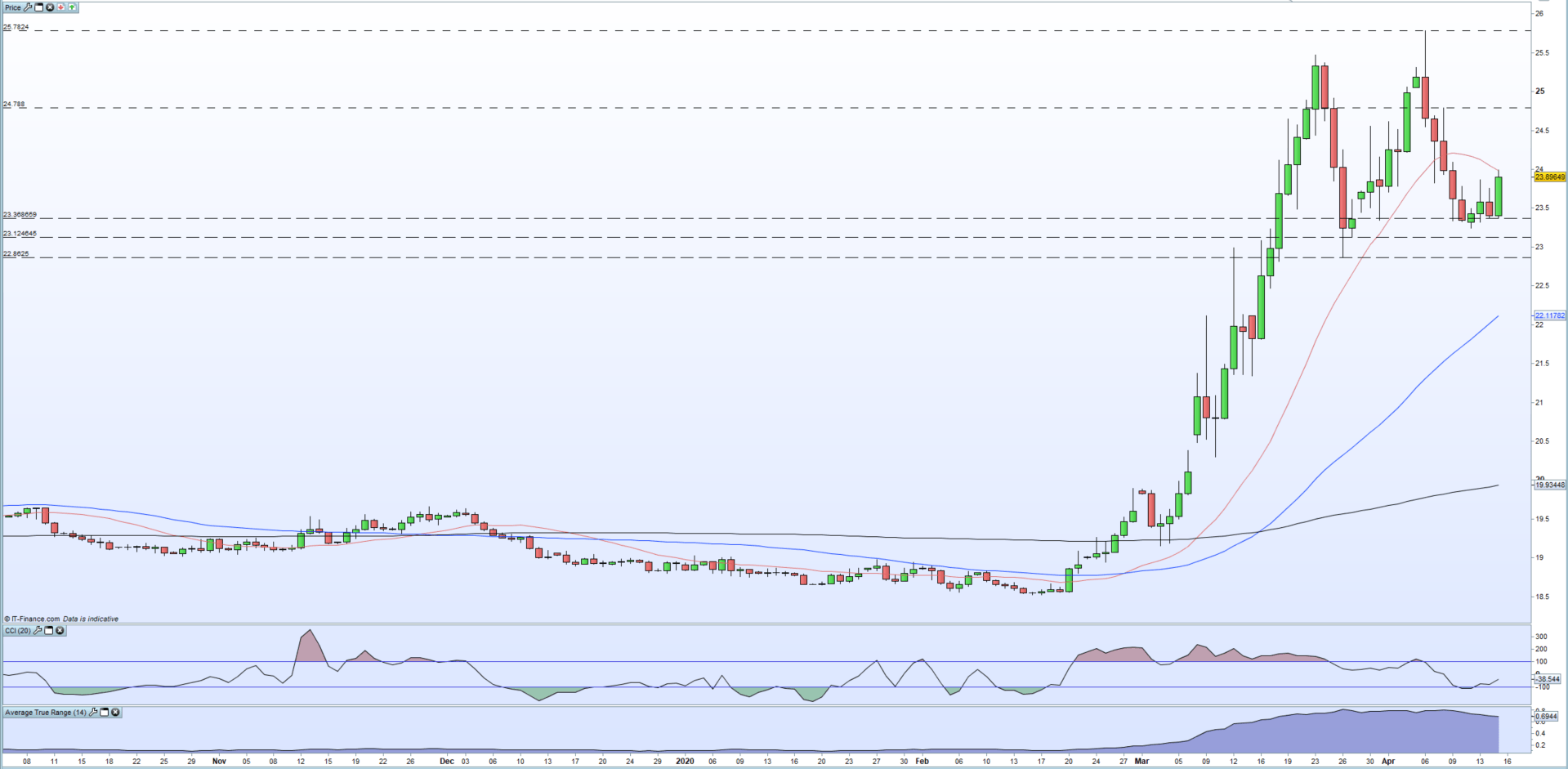

CoreWeave (CRWV) Stock Soars: Analyzing The Recent Price Increase

Table of Contents

Strong Financial Performance and Growth Projections

CoreWeave's recent financial results have been nothing short of spectacular, fueling the CRWV stock surge. The company's focus on providing cloud computing solutions specifically optimized for AI workloads is paying off handsomely. This strong financial performance, coupled with ambitious growth projections, has significantly boosted investor confidence.

- Impressive Revenue Growth: CoreWeave has consistently demonstrated strong revenue growth quarter over quarter. For example, Q3 2023 (hypothetical figures for illustrative purposes) saw a revenue increase of 45% compared to the same period last year, exceeding analyst expectations.

- Expanding Customer Base: The company has successfully expanded its customer base, particularly among large enterprise clients seeking high-performance computing solutions for their AI initiatives. This demonstrates a strong market acceptance of CoreWeave's services.

- Positive Financial Outlook: Analysts project continued substantial growth for CoreWeave in the coming years, anticipating significant increases in revenue and potentially achieving profitability in the near future. This positive outlook contributes significantly to the bullish CRWV stock forecast.

These strong CoreWeave financials, combined with promising growth projections, paint a picture of a company poised for continued success, directly impacting the CRWV stock price.

The Expanding AI Market and CoreWeave's Position

The explosive growth of the artificial intelligence market is a key driver behind CoreWeave's success and the subsequent CRWV stock price increase. The demand for powerful cloud computing infrastructure to support AI workloads is skyrocketing, and CoreWeave is ideally positioned to capitalize on this trend. Its specialization in AI infrastructure gives it a significant competitive advantage.

- AI Workload Specialization: CoreWeave's infrastructure is specifically designed and optimized for the demands of AI workloads, offering superior performance and efficiency compared to general-purpose cloud providers.

- Strategic Partnerships: CoreWeave has forged strategic partnerships with key players in the AI ecosystem, further solidifying its market position. For example, collaborations with leading AI software developers and hardware manufacturers enhance its service offerings and reach.

- Partnership with [Example Partner 1] for enhanced AI model training capabilities.

- Collaboration with [Example Partner 2] for seamless integration with their AI platforms.

- Market Leadership: By focusing on a niche within the broader cloud computing market, CoreWeave is effectively carving out a leadership position in the rapidly expanding AI cloud services sector. This specialized focus contributes significantly to the positive CRWV stock outlook.

The synergy between CoreWeave's specialized services and the burgeoning AI market is a major catalyst for its growth and the resulting investor enthusiasm.

Investor Sentiment and Market Speculation

The recent CRWV stock surge isn't solely attributable to fundamentals; investor sentiment and market speculation play a crucial role. Positive news coverage, analyst upgrades, and active discussions on social media platforms have all contributed to building investor confidence.

- Positive Media Coverage: Numerous articles and reports have highlighted CoreWeave's impressive growth and market potential, generating positive publicity and attracting new investors.

- Analyst Upgrades: Several financial analysts have upgraded their ratings and price targets for CRWV stock, reflecting an increasingly bullish outlook.

- Social Media Buzz: Active discussions and positive sentiment on social media platforms dedicated to investing have amplified the interest in CoreWeave and its potential for further growth. This heightened awareness contributes to market speculation driving up the CRWV stock price.

These factors, while not solely based on concrete financial data, have created a positive feedback loop, further bolstering investor confidence and driving up the CRWV stock price.

Potential Risks and Challenges

While the outlook for CoreWeave appears promising, it's crucial to acknowledge potential risks and challenges:

- Intense Competition: The cloud computing market is highly competitive, with established giants and emerging players vying for market share. CoreWeave faces competition from larger cloud providers offering similar services.

- Technological Disruption: Rapid technological advancements could render current infrastructure obsolete, requiring significant investment in upgrades and potentially impacting profitability.

- Economic Downturn: A broader economic downturn could negatively affect spending on cloud computing services, impacting CoreWeave's revenue growth.

Understanding these CRWV risk factors is essential for a balanced assessment of the investment opportunity.

Conclusion: Investing in the Future with CoreWeave (CRWV) Stock

The recent CoreWeave (CRWV) stock price increase is a result of a confluence of factors: strong financial performance, a strategic position in the booming AI market, and positive investor sentiment. However, it's crucial to remember that the investment landscape is ever-changing. While this article provides valuable insights into the recent surge of CoreWeave (CRWV) stock, remember to conduct your own comprehensive research before making any investment decisions. Understanding CoreWeave's business model, financial performance, and the broader AI landscape will help you determine if CRWV aligns with your investment strategy. Consider the potential risks and rewards before investing in CoreWeave or any other stock. Thorough due diligence is key to successful long-term investment in CoreWeave (CRWV).

Featured Posts

-

Stream Peppa Pig Online Free And Legal Options For Kids

May 22, 2025

Stream Peppa Pig Online Free And Legal Options For Kids

May 22, 2025 -

Vanja I Sime Kombinacija Koja Je Osvojila Gledatelje Gospodina Savrsenog

May 22, 2025

Vanja I Sime Kombinacija Koja Je Osvojila Gledatelje Gospodina Savrsenog

May 22, 2025 -

Fastest Man Across Australia A New Running Milestone

May 22, 2025

Fastest Man Across Australia A New Running Milestone

May 22, 2025 -

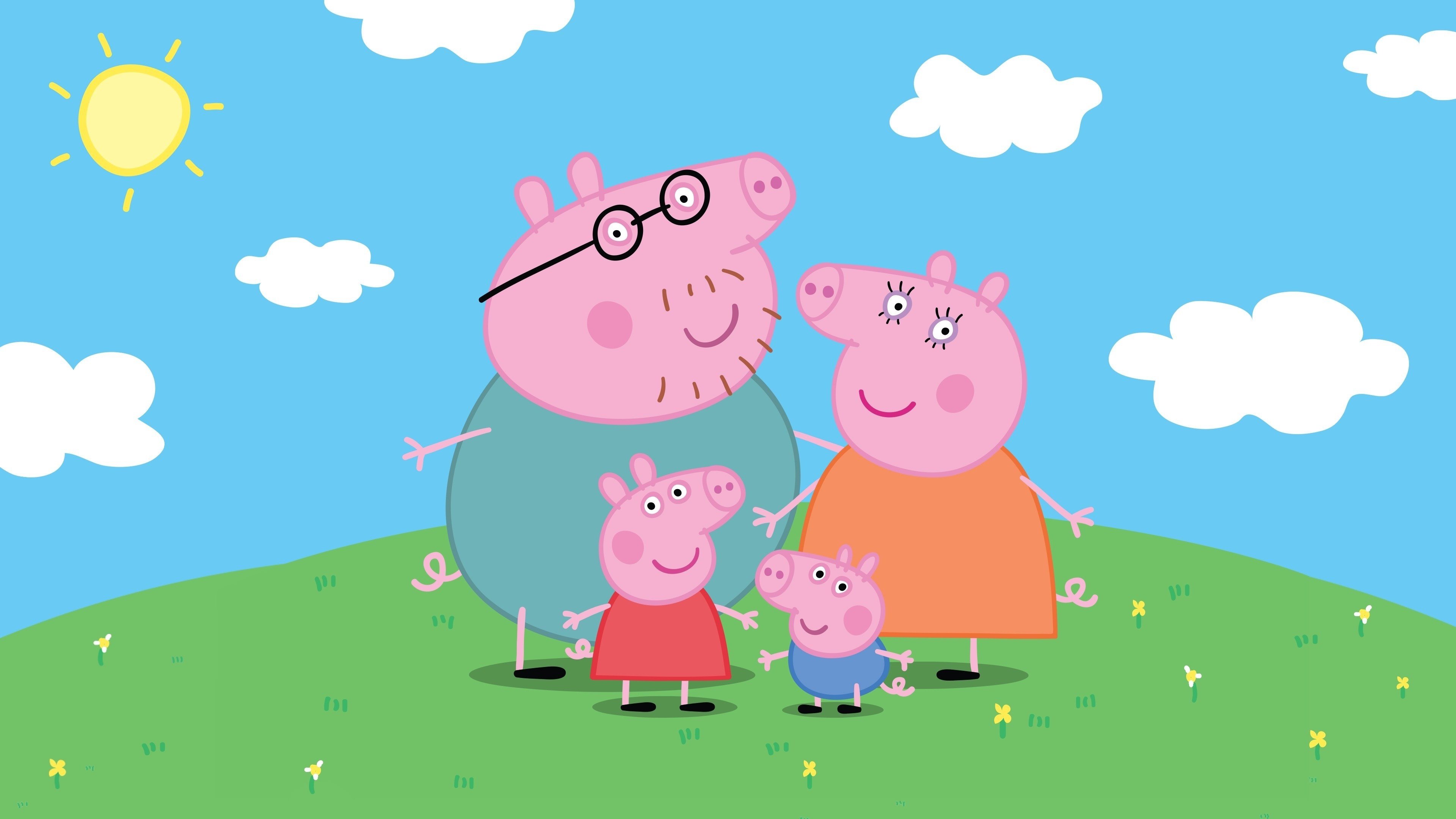

Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lideri Finansovogo Rinku Ukrayini U 2024

May 22, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lideri Finansovogo Rinku Ukrayini U 2024

May 22, 2025 -

Cartoon Network And Looney Tunes Unite In New 2025 Animated Short

May 22, 2025

Cartoon Network And Looney Tunes Unite In New 2025 Animated Short

May 22, 2025

Latest Posts

-

Names Released Israeli Couple Killed In Washington Dc Shooting

May 22, 2025

Names Released Israeli Couple Killed In Washington Dc Shooting

May 22, 2025 -

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025 -

Israeli Embassy Identifies Couple Killed In Washington D C Shooting

May 22, 2025

Israeli Embassy Identifies Couple Killed In Washington D C Shooting

May 22, 2025 -

Tragedy In Dc Israeli Embassy Staff Fatalities In Jewish Museum Shooting

May 22, 2025

Tragedy In Dc Israeli Embassy Staff Fatalities In Jewish Museum Shooting

May 22, 2025 -

Understanding The Israeli Diplomat Shooting Incident In Washington D C

May 22, 2025

Understanding The Israeli Diplomat Shooting Incident In Washington D C

May 22, 2025