CoreWeave (CRWV) Stock Surge: Understanding Thursday's Jump

Table of Contents

Analyzing CoreWeave's (CRWV) Recent Financial Performance

Understanding CoreWeave's financial health is crucial to comprehending the recent stock surge. Analyzing key performance indicators provides valuable context for the market's positive reaction.

Revenue Growth and Profitability

CoreWeave's recent financial reports paint a picture of impressive growth. Let's delve into the specifics:

- Revenue Growth: [Insert specific percentage of revenue growth from recent reports]. This substantial increase showcases strong demand for CoreWeave's cloud computing services.

- Significant Contracts: The signing of [mention specific large clients or contracts] significantly contributed to the revenue surge, demonstrating CoreWeave's ability to secure major partnerships.

- Profitability: While detailed profit margin information may require accessing official financial statements, any notable improvements in profitability should be highlighted here, using concrete numbers if available. For example: "Improved profit margins, showing an increase of [insert percentage or number] compared to the previous quarter, further boosted investor confidence."

Relevant keywords: CRWV financials, CoreWeave revenue, earnings report, profitability, financial performance, CRWV earnings.

Strategic Partnerships and Client Acquisition

CoreWeave's strategic partnerships have played a pivotal role in its success. New alliances and client acquisitions fuel significant growth:

- Key Partnerships: Partnerships with [mention key partners and their significance] have expanded CoreWeave's reach and capabilities.

- Client Acquisition: The successful acquisition of [mention significant clients if any] demonstrates the increasing demand for CoreWeave's specialized cloud computing services. These new clients are projected to contribute [insert projected revenue contribution].

Relevant keywords: CoreWeave partnerships, strategic alliances, client acquisition, customer growth, CRWV partnerships.

Market Sentiment and Investor Confidence in CoreWeave (CRWV)

The overall market climate and investor sentiment significantly impact stock prices. Let's examine how these factors influenced the CoreWeave (CRWV) stock surge.

Impact of General Market Trends

The broader market conditions played a role in CRWV's performance.

- Market Sentiment: A generally bullish market sentiment, coupled with positive news within the tech sector, likely contributed to the increase in investor confidence in CRWV.

- Interest Rate Impact: The current interest rate environment [mention if it's positive or negative for tech stocks in general] may have influenced investment decisions.

- Tech Sector Performance: Strong overall performance within the technology sector provided a favorable backdrop for CoreWeave's positive performance.

Relevant keywords: Market sentiment, stock market trends, interest rate impact, tech stock performance, CRWV market sentiment.

Analyst Ratings and Price Target Adjustments

Analyst opinions and price target adjustments significantly impact investor confidence.

- Analyst Ratings: [Mention specific analyst firms and their ratings (e.g., "Goldman Sachs upgraded CRWV to a buy rating").] Explain the reasoning behind these ratings.

- Price Target Adjustments: Increased price targets from leading analysts [mention specific increases and the associated rationale] further boosted investor optimism.

Relevant keywords: Analyst ratings, price target, buy rating, sell rating, investor confidence, CRWV price target.

Industry Trends Fueling CoreWeave (CRWV)'s Growth

CoreWeave operates within a rapidly expanding market, benefiting from several key industry trends.

The Expanding Cloud Computing Market

The cloud computing market is experiencing explosive growth, presenting significant opportunities for CoreWeave.

- Market Size and Growth Projections: The cloud computing market is projected to reach [insert market size projections] by [insert year], providing a vast landscape for CoreWeave to expand its operations.

- Competitive Advantages: CoreWeave's specialization in [mention CoreWeave's unique selling points, e.g., GPU computing for AI workloads] provides a significant competitive advantage.

- Market Share Analysis: While precise market share data may be difficult to obtain, any available information on CoreWeave's market share and growth trajectory should be included here.

Relevant keywords: Cloud computing market, cloud infrastructure, AI computing, data center, GPU computing, CRWV market share.

Increased Demand for AI and Machine Learning

The surge in demand for AI and machine learning is a major catalyst for CoreWeave's growth.

- AI/ML Applications: CoreWeave's services are directly relevant to the burgeoning AI/ML market, providing critical infrastructure for training and deploying AI models.

- Client Use Cases: Highlight examples of how CoreWeave's clients are leveraging its services for AI/ML applications.

- Future Growth Potential: The continued expansion of the AI/ML market positions CoreWeave for substantial future growth.

Relevant keywords: Artificial intelligence, machine learning, AI infrastructure, deep learning, GPU acceleration, CRWV AI.

Conclusion: Understanding the CoreWeave (CRWV) Stock Surge and Future Outlook

The CoreWeave (CRWV) stock surge can be attributed to a confluence of factors: strong financial performance demonstrated by impressive revenue growth and strategic partnerships, positive market sentiment fueled by analyst upgrades and a bullish tech sector, and significant industry tailwinds driven by the expanding cloud computing and AI/ML markets. While the future always holds inherent risks, CoreWeave's strong position within these rapidly growing sectors suggests promising prospects. However, potential investors should always conduct thorough due diligence before making investment decisions.

Learn more about CoreWeave (CRWV) investments and analyze the CRWV stock performance to make informed decisions aligned with your risk tolerance and investment goals. Understanding the factors driving the CoreWeave (CRWV) surge is crucial for navigating the complexities of the stock market.

Featured Posts

-

Millions Stolen Office365 Executive Accounts Targeted In Data Breach

May 22, 2025

Millions Stolen Office365 Executive Accounts Targeted In Data Breach

May 22, 2025 -

Second Translocated Colorado Gray Wolf Dies In Wyoming

May 22, 2025

Second Translocated Colorado Gray Wolf Dies In Wyoming

May 22, 2025 -

Mummy Pigs Extravagant Gender Reveal At Iconic London Location

May 22, 2025

Mummy Pigs Extravagant Gender Reveal At Iconic London Location

May 22, 2025 -

Raw Video Pub Landladys Uncensored Rant Following Employees Notice

May 22, 2025

Raw Video Pub Landladys Uncensored Rant Following Employees Notice

May 22, 2025 -

Love And Loss The High Profile Ceo Scandal

May 22, 2025

Love And Loss The High Profile Ceo Scandal

May 22, 2025

Latest Posts

-

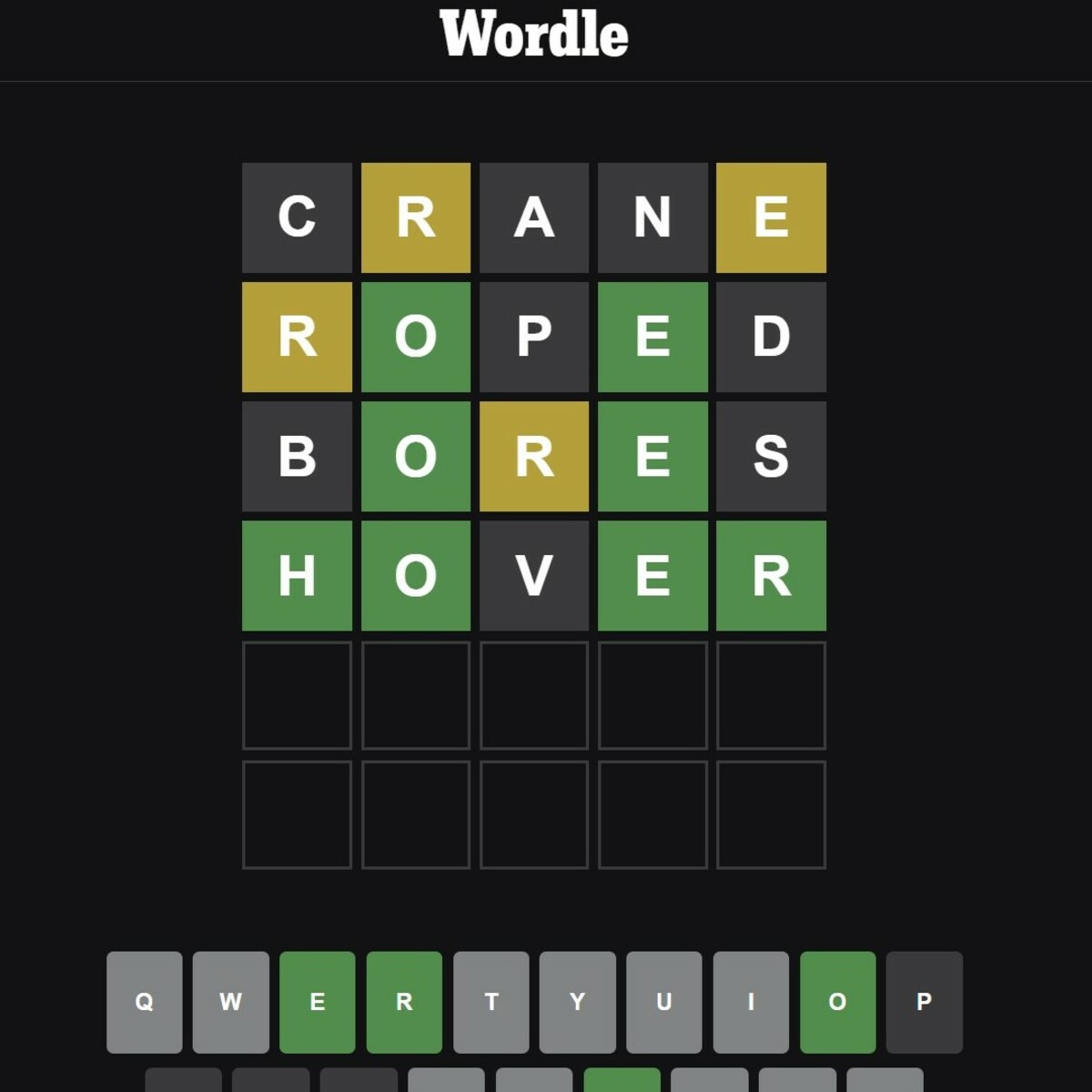

Solve Wordle Today March 6th Hints And Answer For 1356

May 22, 2025

Solve Wordle Today March 6th Hints And Answer For 1356

May 22, 2025 -

Wordle 1356 March 6th Clues And Solution

May 22, 2025

Wordle 1356 March 6th Clues And Solution

May 22, 2025 -

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025 -

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025