CoreWeave, Inc. (CRWV) Stock Market Performance: A Review Of Last Week's Activity

Table of Contents

CRWV Stock Price Fluctuations

Last week saw notable fluctuations in CRWV's stock price. Analyzing the daily data provides a clearer picture of this market activity. (Note: Replace the placeholder data below with actual data from the relevant week.)

Illustrative Chart/Graph Here: (A visual representation of the daily highs, lows, opens, and closes would be placed here. Tools like Google Sheets or specialized charting software can generate this.)

- Monday: Opening price: $X, Closing price: $Y, High: $Z, Low: $W, Percentage Change: +P%

- Tuesday: Opening price: $A, Closing price: $B, High: $C, Low: $D, Percentage Change: -Q%

- Wednesday: Opening price: $E, Closing price: $F, High: $G, Low: $H, Percentage Change: +R%

- Thursday: Opening price: $I, Closing price: $J, High: $K, Low: $L, Percentage Change: -S%

- Friday: Opening price: $M, Closing price: $N, High: $O, Low: $P, Percentage Change: +T%

The week concluded with a [positive/negative] percentage change of [overall percentage change] compared to the opening price on Monday. Trading volume also experienced [increased/decreased] activity on [specific days], potentially indicating [reason for increased/decreased volume, e.g., news events, market sentiment]. Understanding these daily shifts is crucial for interpreting the overall CRWV stock performance.

Factors Influencing CRWV Stock Performance

Several factors likely influenced CRWV's stock performance last week. Analyzing these factors provides a more nuanced understanding of the price movements.

-

Company News: Any press releases, announcements of partnerships, or new product launches from CoreWeave itself would directly impact investor sentiment and the CRWV stock price. For example, a successful partnership with a major technology company could lead to increased investor confidence.

-

Market Sentiment: The overall market sentiment towards the tech sector, particularly the cloud computing and AI infrastructure segments, significantly affects CRWV's stock. Negative news or economic uncertainty often results in decreased investor confidence and lower stock prices.

-

Competitor Analysis: The performance of CoreWeave's competitors in the cloud computing space is another key factor. If competitors announce impressive results or secure significant deals, it could put pressure on CRWV's stock price. Conversely, negative news for competitors might benefit CRWV.

-

Economic Indicators: Broad economic factors, such as interest rate changes or inflation reports, can influence investor behavior and subsequently impact CRWV's stock price. Higher interest rates can make investments less attractive, potentially leading to lower stock prices.

Technical Analysis of CRWV Stock (Optional)

(This section should only be included if the author has sufficient expertise in technical analysis. Otherwise, it's better to omit this section than to provide inaccurate information.)

A technical analysis of CRWV's stock chart might reveal key support and resistance levels. For example, if the stock price consistently bounces off a particular price point (support), it suggests a potential buying opportunity. Conversely, consistent failures to break through a resistance level could indicate a bearish trend. (Insert specific technical indicators, chart patterns, and support/resistance levels here, if applicable.)

Sentiment Analysis of CRWV Stock

Gauging investor sentiment is crucial for understanding the overall outlook for CRWV.

-

Analyst Ratings: A summary of buy, sell, or hold recommendations from financial analysts would give a strong indication of professional investor opinion.

-

Social Media Sentiment: Analyzing social media mentions and discussions regarding CRWV can provide insights into public opinion, though it should be treated with caution due to potential bias and manipulation.

-

News Sentiment: The overall tone of news articles and reports about CoreWeave would significantly influence investor perception. Positive news generally leads to increased stock prices, while negative news can have the opposite effect.

Conclusion

Last week's CRWV stock performance demonstrated the volatility inherent in the tech sector. Price fluctuations were influenced by a combination of company-specific news, broader market sentiment, and the performance of competitors within the AI infrastructure and cloud computing space. While a detailed technical analysis (if included) might offer additional insights, understanding the interplay of these factors is crucial for informed investment decisions. Stay informed on the latest developments in CoreWeave (CRWV) stock market activity by subscribing to our newsletter! Continue your research on CoreWeave (CRWV) and other related cloud computing stocks to make informed investment decisions. Remember to conduct thorough due diligence before making any investment choices.

Featured Posts

-

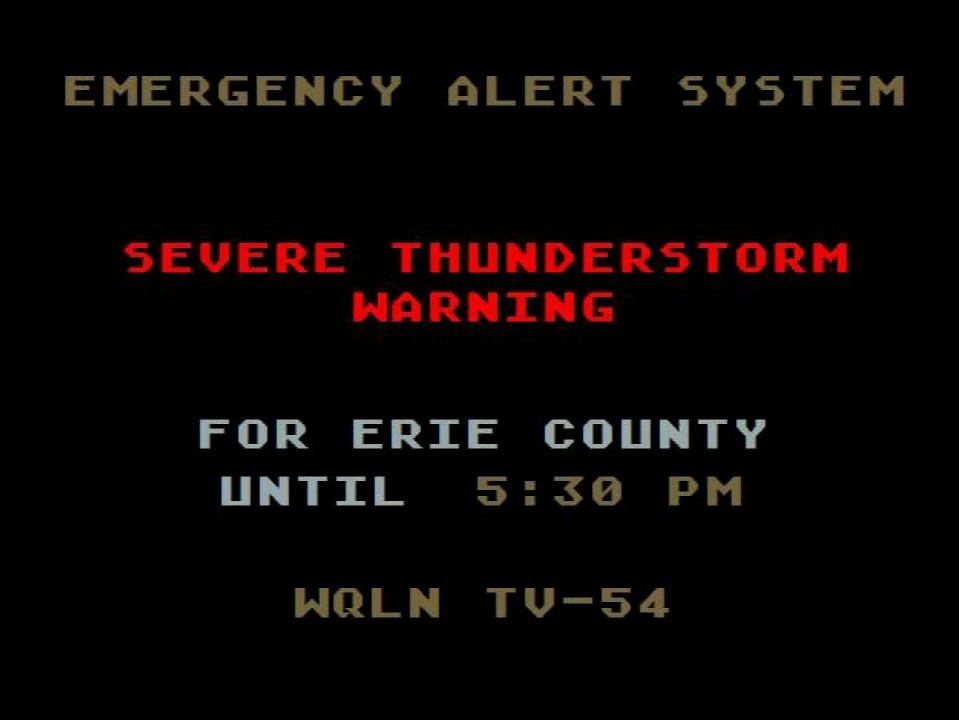

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025 -

Franklin County Pa 600 Foot Chicken Barn Lost To Devastating Fire

May 22, 2025

Franklin County Pa 600 Foot Chicken Barn Lost To Devastating Fire

May 22, 2025 -

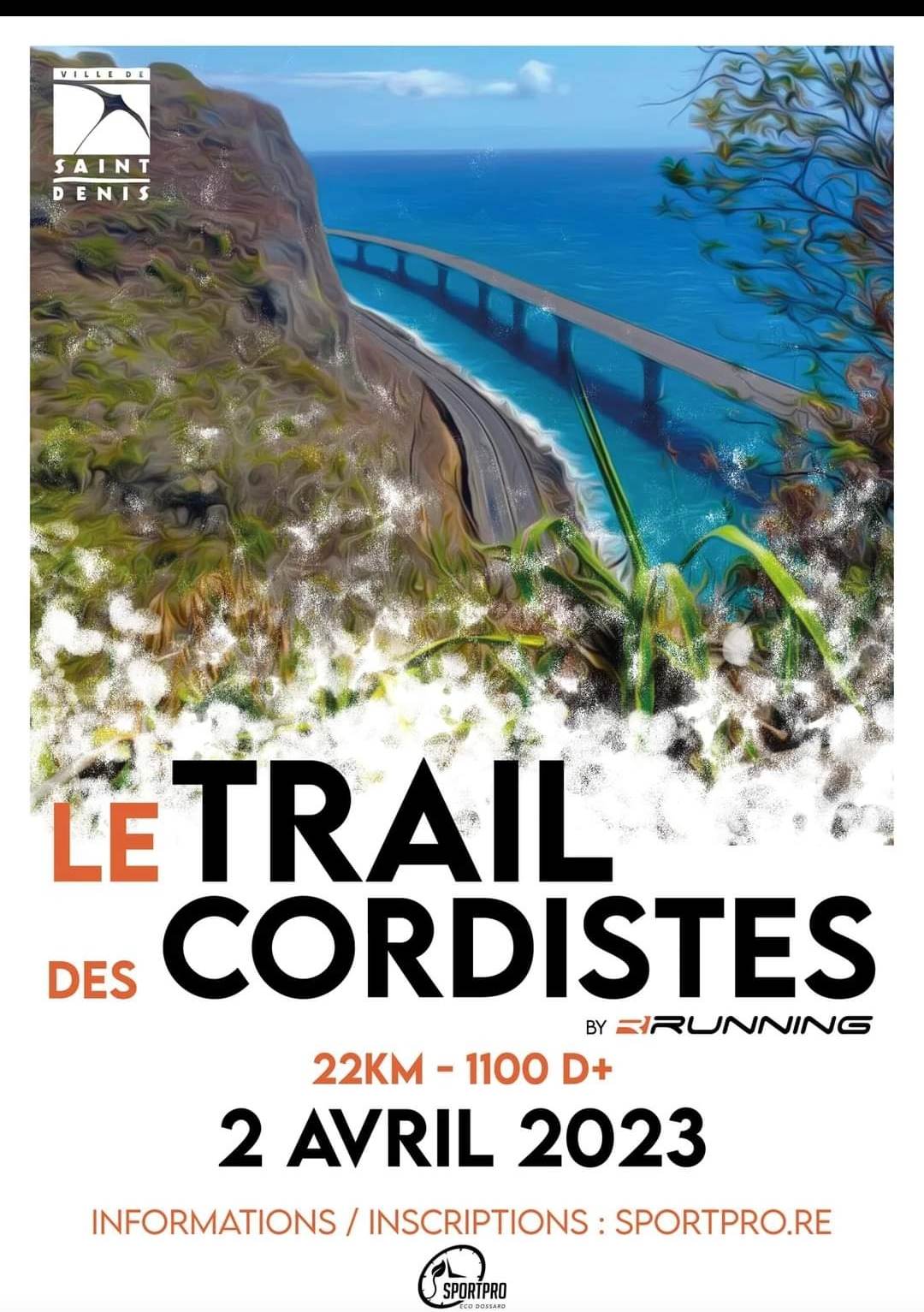

L Essor Des Tours Nantaises Et L Activite Des Cordistes

May 22, 2025

L Essor Des Tours Nantaises Et L Activite Des Cordistes

May 22, 2025 -

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025 -

Dancehall Kingpin Beenie Man Announces New York It Venture

May 22, 2025

Dancehall Kingpin Beenie Man Announces New York It Venture

May 22, 2025

Latest Posts

-

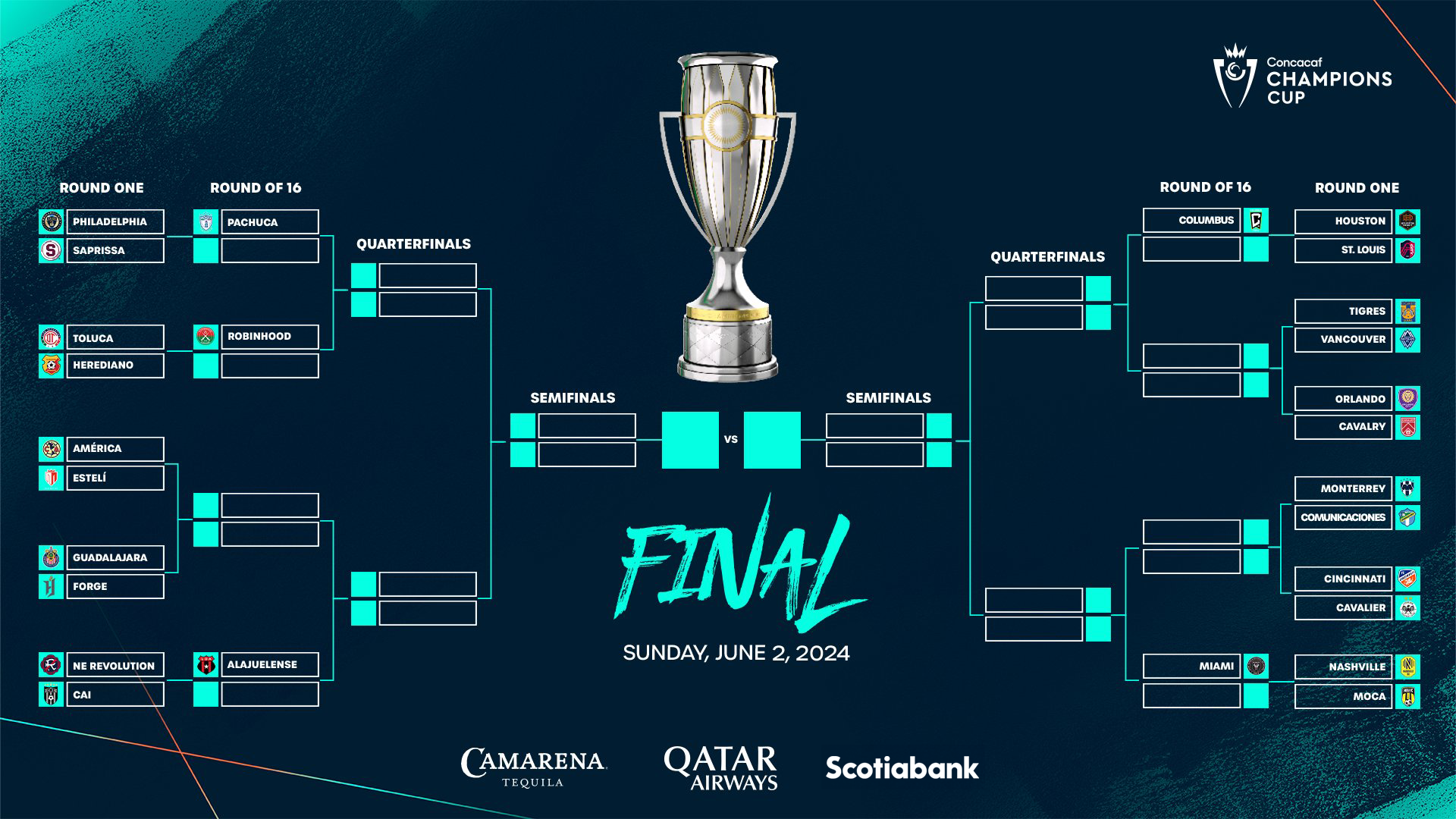

Partido Mexico Vs Panama Todo Sobre La Final De La Liga De Naciones Concacaf

May 22, 2025

Partido Mexico Vs Panama Todo Sobre La Final De La Liga De Naciones Concacaf

May 22, 2025 -

Ver Mexico Vs Panama Final Liga De Naciones Concacaf Guia De Transmision

May 22, 2025

Ver Mexico Vs Panama Final Liga De Naciones Concacaf Guia De Transmision

May 22, 2025 -

Hora Y Canal Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025

Hora Y Canal Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025 -

Seleccion Mexicana Vs Panama Guia Completa Para Ver La Final De La Concacaf

May 22, 2025

Seleccion Mexicana Vs Panama Guia Completa Para Ver La Final De La Concacaf

May 22, 2025 -

Donde Y Cuando Ver El Partido Mexico Vs Panama Final Liga De Naciones Concacaf

May 22, 2025

Donde Y Cuando Ver El Partido Mexico Vs Panama Final Liga De Naciones Concacaf

May 22, 2025