CoreWeave Stock: News, Analysis, And Predictions

Table of Contents

CoreWeave is a rapidly growing provider of GPU cloud computing services, leveraging the power of graphics processing units for demanding applications like AI, machine learning, and high-performance computing. The company has gained traction through strategic partnerships and significant funding rounds, positioning itself as a key player in a competitive market. This article delves into recent CoreWeave stock news, provides a detailed analysis, and offers cautious predictions for the future.

Recent CoreWeave Stock News and Developments

Recent Funding Rounds and Investor Sentiment

CoreWeave has secured substantial funding in recent rounds, demonstrating strong investor confidence in its business model and future prospects. These funding injections have fueled the company's growth, allowing for expansion of its infrastructure and further development of its services. The sheer amount of capital raised reflects a positive outlook from major players in the venture capital and private equity spheres.

- Series E Funding: A substantial amount was raised in this round, significantly boosting CoreWeave's valuation and providing a strong financial foundation for future expansion. This round included participation from prominent investors, further bolstering investor sentiment.

- Strategic Investments: Several strategic investments have been made by companies within the technology ecosystem, signaling strong belief in CoreWeave's potential to disrupt the GPU cloud computing market. These alliances not only provide capital but also valuable industry connections.

- Increased Valuation: The successful funding rounds have led to a substantial increase in CoreWeave’s valuation, reflecting the market's growing appreciation for its unique technology and position within the industry.

Key Partnerships and Strategic Collaborations

CoreWeave’s strategic partnerships are a key driver of its success. Collaborations with major technology players provide access to wider markets and enhance its service offerings. These alliances strengthen CoreWeave’s competitive positioning and broaden its reach within the industry.

- Partnership with [Partner Name]: This collaboration provides access to [Partner’s resources/technology], enhancing CoreWeave's capabilities and expanding its potential customer base. This partnership exemplifies CoreWeave's strategic approach to market penetration.

- Strategic Alliance with [Partner Name]: This alliance allows for the integration of [Partner’s technology/services] into CoreWeave's platform, further differentiating its offerings and providing significant competitive advantages. The combined expertise promises enhanced performance and a wider array of capabilities.

- Industry Collaborations: CoreWeave is actively engaging with various players across the tech industry, resulting in a robust ecosystem that supports its growth and innovation. These collaborations are fundamental to maintaining CoreWeave's leading-edge position.

Market Analysis and Competitive Landscape

CoreWeave operates in a fiercely competitive GPU cloud computing market, dominated by giants like AWS, Google Cloud, and Azure. However, CoreWeave differentiates itself through [mention specific differentiators, e.g., specialized hardware, unique software solutions, superior customer service]. This allows CoreWeave to carve out a niche and attract customers seeking specialized solutions.

- Competitive Advantages: CoreWeave's focus on [specific niche] provides a distinct advantage over general-purpose cloud providers. This specialized approach allows them to target a specific segment of the market with tailored solutions.

- Market Disruption Potential: CoreWeave’s innovative approach holds the potential to disrupt the existing market dynamics by offering superior performance, cost-effectiveness, or specific functionality not readily available from competitors.

- Market Share Growth: While precise figures may not be publicly available, CoreWeave’s rapid growth and strategic partnerships suggest a positive trajectory in terms of market share acquisition.

CoreWeave Stock Analysis

Financial Performance and Key Metrics

While CoreWeave is a privately held company, limited financial information might be available through news reports and industry analyses. Tracking publicly available metrics provides insight into potential future performance. Analyzing these trends helps assess the company's financial health and growth trajectory.

- Revenue Growth: Estimates based on funding rounds and market share suggest a rapid rate of revenue growth. This rapid growth signals a strong market demand for CoreWeave’s services.

- Customer Acquisition Cost (CAC): The efficiency of acquiring new customers is a crucial metric for assessing the long-term sustainability of the business model. A low CAC is indicative of effective marketing and sales strategies.

- Profitability: While profitability is a long-term goal, any indications of progress towards profitability demonstrate the business model's viability and potential for future returns.

Valuation and Investment Risks

Determining the precise valuation of CoreWeave stock is challenging due to its private status. However, estimations can be made based on funding rounds and comparable public companies. It's crucial to understand the inherent risks associated with investing in a relatively young company.

- Market Volatility: The technology sector is known for its volatility, and CoreWeave stock is likely to experience fluctuations influenced by broader market trends and company-specific news.

- Competition: The intense competition within the GPU cloud computing market poses a significant risk, requiring constant innovation and adaptation to maintain a competitive edge.

- Economic Climate: Overall economic conditions can greatly impact the demand for cloud computing services, influencing CoreWeave’s performance and investor sentiment.

CoreWeave Stock Predictions and Future Outlook

Growth Projections and Market Opportunities

CoreWeave’s future growth hinges on several factors, including the continued expansion of the GPU cloud computing market, technological advancements in AI and machine learning, and the company's ability to successfully execute its business strategy.

- AI and Machine Learning Growth: The burgeoning AI and machine learning sectors are key drivers of demand for GPU cloud computing, presenting significant growth opportunities for CoreWeave.

- Expansion into New Markets: Further expansion into new geographic markets and vertical industries can fuel significant growth and diversification for CoreWeave.

- Technological Innovation: Continuous innovation and the development of new services will be crucial for CoreWeave to stay ahead of the competition and maintain its market position.

Long-Term Investment Potential

The long-term investment potential of CoreWeave stock depends on its ability to navigate the competitive landscape, capitalize on market opportunities, and maintain a strong financial position. The risks involved should not be underestimated.

- Potential Rewards: Successful execution of its strategy could lead to substantial returns for investors, as the GPU cloud computing market is expected to experience significant growth.

- Potential Risks: The highly competitive nature of the market, economic downturns, and the inherent risks of investing in a relatively young company must be considered.

Conclusion

Analyzing CoreWeave stock requires a careful assessment of recent news, financial performance (where available), and the competitive landscape. While the company shows significant promise, investing in CoreWeave carries considerable risk. Remember to conduct thorough due diligence before making any investment decisions.

To stay updated on CoreWeave stock and the broader GPU cloud computing market, continue researching CoreWeave and other key players in the industry. Make informed decisions about CoreWeave investment by carefully evaluating all available information and understanding your own risk tolerance.

Featured Posts

-

Klopp To Real Madrid Agent Comments Fuel Speculation

May 22, 2025

Klopp To Real Madrid Agent Comments Fuel Speculation

May 22, 2025 -

Abn Amro Rapport Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 22, 2025

Abn Amro Rapport Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 22, 2025 -

The Lasting Impact Of Debra Morgan Original Sin And Dexters Regret

May 22, 2025

The Lasting Impact Of Debra Morgan Original Sin And Dexters Regret

May 22, 2025 -

Vybz Kartel Breaks Silence Prison Family And Future Music Plans

May 22, 2025

Vybz Kartel Breaks Silence Prison Family And Future Music Plans

May 22, 2025 -

Musique Du Hellfest Concert Exceptionnel Au Noumatrouff

May 22, 2025

Musique Du Hellfest Concert Exceptionnel Au Noumatrouff

May 22, 2025

Latest Posts

-

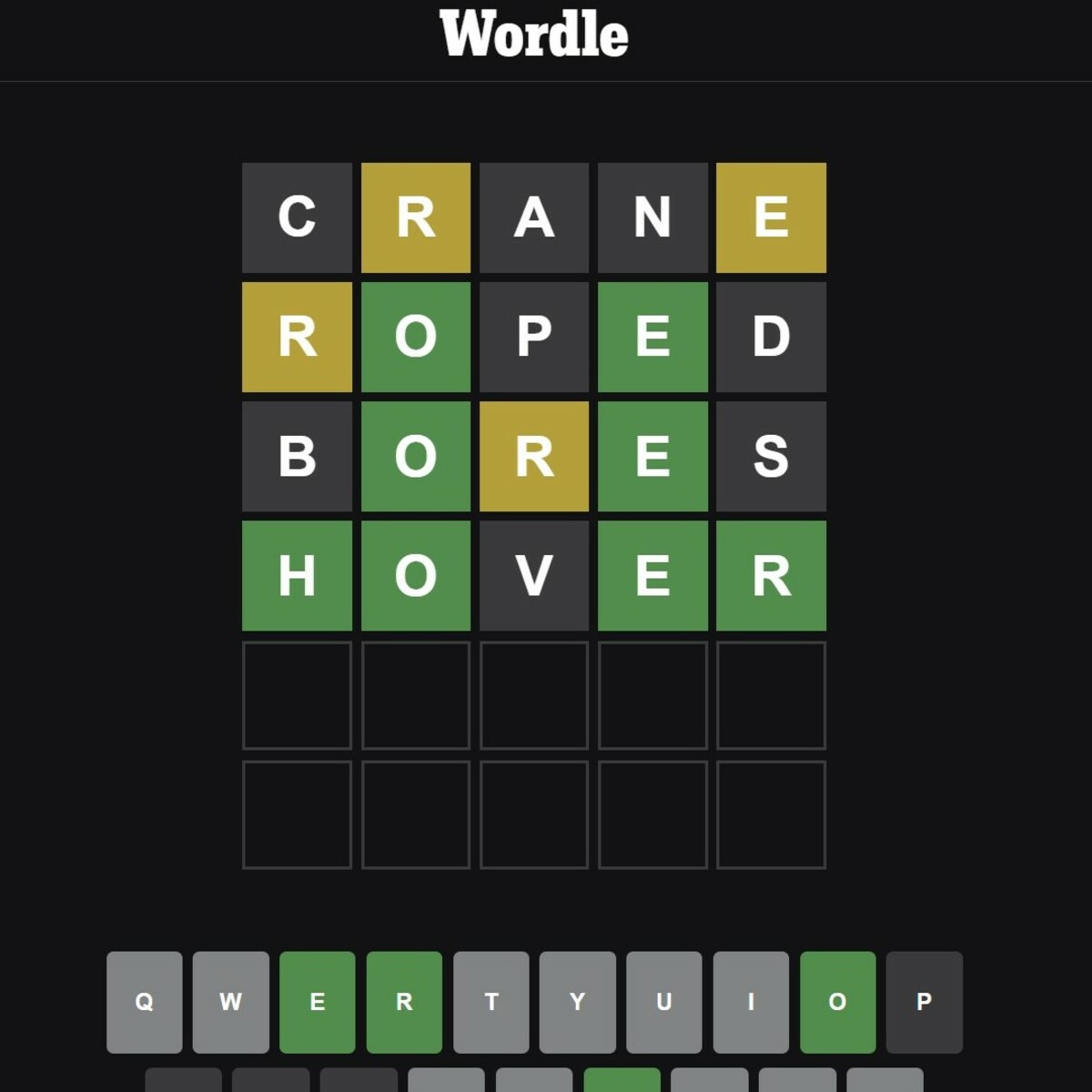

Solve Wordle Today March 6th Hints And Answer For 1356

May 22, 2025

Solve Wordle Today March 6th Hints And Answer For 1356

May 22, 2025 -

Wordle 1356 March 6th Clues And Solution

May 22, 2025

Wordle 1356 March 6th Clues And Solution

May 22, 2025 -

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025

Wordle 370 Hints And Answer For Thursday March 20th

May 22, 2025 -

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025

Wordle Hints And Answer Saturday March 8th Game 1358

May 22, 2025