CoreWeave Stock Performance: A Current Analysis

Table of Contents

CoreWeave's Financial Performance: A Deep Dive

Revenue Growth and Projections

CoreWeave's revenue growth is a key indicator of its stock performance. While precise figures may require access to private financial documents, publicly available information (if any exists) should be analyzed to understand the trajectory of its revenue. This analysis would ideally compare CoreWeave's revenue growth to projections made by analysts and benchmarks established within the cloud computing sector.

- Quarterly Revenue: (Insert data if available, otherwise state "Data unavailable publicly"). Comparing quarterly results reveals growth patterns and seasonality.

- Year-over-Year Growth: (Insert data if available, otherwise state "Data unavailable publicly"). This metric highlights the overall growth trend.

- Comparison to Competitors: (Insert comparison to competitors like AWS, Google Cloud, Azure, etc., if data is available and relevant). This contextualizes CoreWeave's performance within its competitive landscape.

- Revenue Drivers: (Identify key factors contributing to revenue growth, e.g., strategic partnerships, successful product launches, expanding customer base). Understanding these drivers helps predict future performance.

Profitability and Key Metrics

Assessing CoreWeave's profitability is crucial for evaluating its long-term sustainability and stock performance. Key metrics provide insight into its operational efficiency and financial health.

- Gross Margin: (Insert data if available, otherwise state "Data unavailable publicly"). A higher gross margin suggests efficient cost management.

- Operating Margin: (Insert data if available, otherwise state "Data unavailable publicly"). This reflects CoreWeave's operational profitability.

- Net Income: (Insert data if available, otherwise state "Data unavailable publicly"). This is the ultimate measure of profitability after all expenses are considered.

- Return on Investment (ROI): (Insert data if available, otherwise state "Data unavailable publicly"). A strong ROI indicates efficient capital allocation.

Cash Flow and Liquidity

CoreWeave's cash flow and liquidity position are critical indicators of its financial stability and ability to fund growth initiatives.

- Cash Flow from Operations: (Insert data if available, otherwise state "Data unavailable publicly"). A positive cash flow indicates strong operational performance.

- Cash Flow from Investing: (Insert data if available, otherwise state "Data unavailable publicly"). This reflects investments in growth and expansion.

- Cash Flow from Financing: (Insert data if available, otherwise state "Data unavailable publicly"). This shows how CoreWeave is funding its operations (e.g., debt, equity).

- Debt Levels and Credit Rating: (Insert data if available, otherwise state "Data unavailable publicly"). High debt levels can negatively impact stock performance.

Market Factors Influencing CoreWeave Stock

Overall Market Sentiment and Industry Trends

The broader market sentiment and prevailing industry trends significantly impact CoreWeave's stock price.

- Market Sentiment: (Describe the current market sentiment – bullish, bearish, or neutral – and its potential influence on CoreWeave’s stock).

- Industry Trends: The growth of cloud computing, the increasing adoption of AI and machine learning, and the demand for high-performance computing are all positive industry trends that can boost CoreWeave's stock.

- Macroeconomic Factors: Interest rate hikes, inflation, and overall economic conditions can influence investor decisions and impact CoreWeave's stock price.

Competitive Landscape Analysis

Analyzing CoreWeave's competitive landscape is essential for understanding its market positioning and potential for future growth.

- Key Competitors: (List key competitors, including their market share and strategies). This clarifies CoreWeave's competitive position.

- Competitive Advantages: (Highlight CoreWeave's strengths, such as its technology, pricing, or customer service). This shows its unique value proposition.

- Potential Threats: (Discuss potential threats, such as new entrants, technological disruptions, or changing market dynamics). Identifying threats helps assess risk.

Investor Sentiment and Analyst Ratings

Analyst Recommendations and Price Targets

Analyst ratings and price targets offer valuable insight into investor expectations and the potential future trajectory of CoreWeave's stock.

- Buy, Hold, Sell Recommendations: (Summarize the consensus among analysts). This provides a general overview of investor sentiment.

- Price Targets: (Present a range of price targets and their rationale). This gives a perspective on the potential future price range.

- Changes in Analyst Sentiment: (Note any significant shifts in analyst ratings over time). This indicates changing market perceptions.

Social Media Sentiment and Investor Discussion

Social media and online forums offer a glimpse into the sentiment of individual investors regarding CoreWeave’s stock.

- Positive and Negative Opinions: (Summarize the overall sentiment expressed on social media platforms and investment forums). This helps gauge public perception.

- Significant Events: (Identify any news items or events that triggered significant changes in investor sentiment). This pinpoints key drivers of price fluctuations.

Conclusion: Assessing CoreWeave Stock Performance and Future Outlook

In conclusion, analyzing CoreWeave stock performance requires a multifaceted approach, encompassing financial performance, market dynamics, and investor sentiment. While publicly available data on CoreWeave’s financial performance is currently limited, understanding the factors discussed above – revenue growth, profitability, market trends, and competitive landscape – is crucial for any assessment of CoreWeave’s potential. A cautious outlook is advisable until more transparent financial information is made available. The current limited data prevents a definitive prediction of future CoreWeave stock performance. However, continued monitoring of its financial releases, industry trends, and investor sentiment is key for staying informed. Stay informed on future developments in CoreWeave stock performance by regularly checking reputable financial news sources and analyst reports, once such reports become available.

Featured Posts

-

Ukrayina Ta Nato Scho Oznachaye Vidmova Vid Chlenstva Dlya Krayini Ta Yevropi

May 22, 2025

Ukrayina Ta Nato Scho Oznachaye Vidmova Vid Chlenstva Dlya Krayini Ta Yevropi

May 22, 2025 -

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025 -

Analyse Stijgende Occasionverkoop Bij Abn Amro En De Toekomst Van De Automarkt

May 22, 2025

Analyse Stijgende Occasionverkoop Bij Abn Amro En De Toekomst Van De Automarkt

May 22, 2025 -

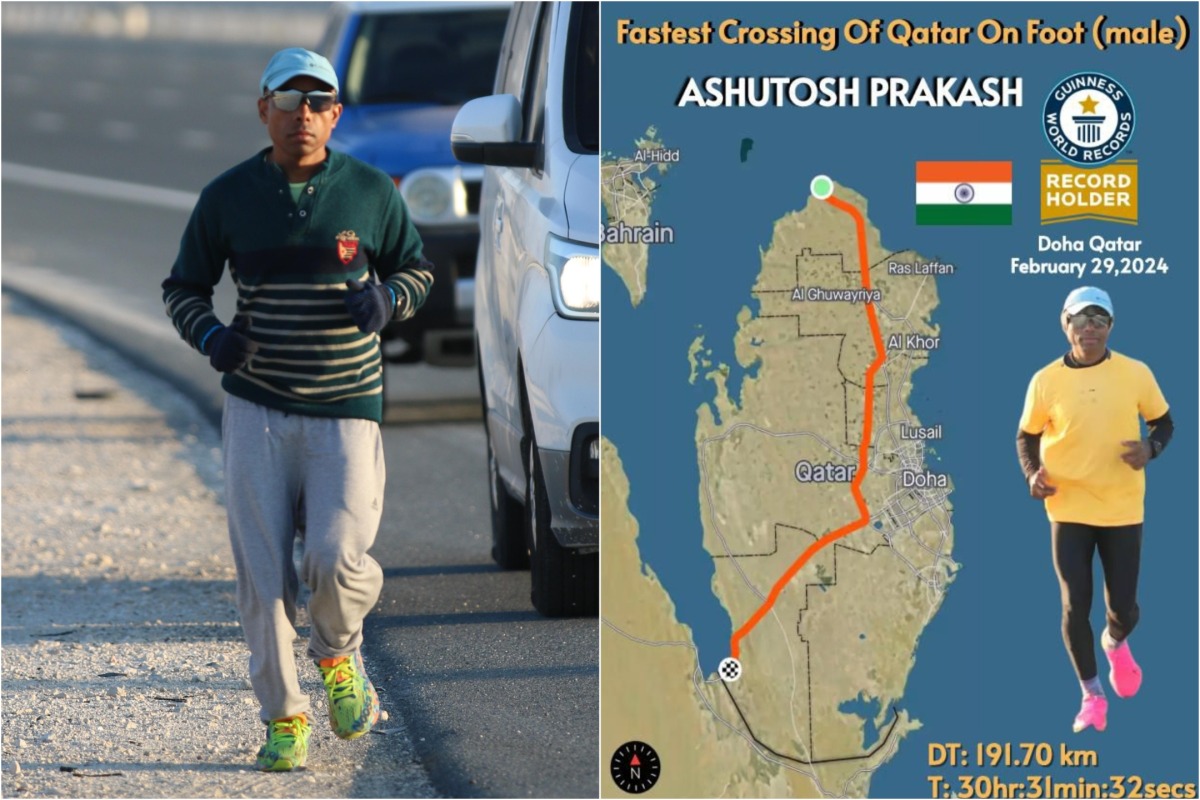

New Record Man Breaks Fastest Time For Crossing Australia On Foot

May 22, 2025

New Record Man Breaks Fastest Time For Crossing Australia On Foot

May 22, 2025 -

Experiencing Googles Prototype Ai Smart Glasses

May 22, 2025

Experiencing Googles Prototype Ai Smart Glasses

May 22, 2025

Latest Posts

-

Sarah Milgrim A Life Cut Short Remembering The Jewish American Victim Of The Dc Shooting

May 22, 2025

Sarah Milgrim A Life Cut Short Remembering The Jewish American Victim Of The Dc Shooting

May 22, 2025 -

Who Was Sarah Milgrim Details On The Second Victim Of The Dc Shooting

May 22, 2025

Who Was Sarah Milgrim Details On The Second Victim Of The Dc Shooting

May 22, 2025 -

Post Us Attack Security Concerns Rise At Londons Israeli Embassy

May 22, 2025

Post Us Attack Security Concerns Rise At Londons Israeli Embassy

May 22, 2025 -

Zayavlenie Senata S Sh A Usilenie Sanktsionnogo Davleniya Na Rossiyu

May 22, 2025

Zayavlenie Senata S Sh A Usilenie Sanktsionnogo Davleniya Na Rossiyu

May 22, 2025 -

Sarah Milgrim Dc Shooting Victim Identified

May 22, 2025

Sarah Milgrim Dc Shooting Victim Identified

May 22, 2025