CoreWeave Stock: What's Happening And What To Expect

Table of Contents

CoreWeave's Business Model and Competitive Advantages

CoreWeave is making waves in the cloud computing industry by focusing on a niche market: providing specialized cloud infrastructure tailored for AI and high-performance computing (HPC) workloads. This strategic focus gives them a significant competitive edge.

Focus on AI and High-Performance Computing

CoreWeave's core offering revolves around providing powerful, scalable cloud computing resources optimized for demanding AI and HPC applications. A key differentiator is their innovative use of repurposed GPUs, offering superior performance at a potentially lower cost than traditional cloud providers.

- Superior Performance: CoreWeave leverages advanced hardware and optimized software to deliver exceptional performance for AI training, simulations, and other computationally intensive tasks.

- Cost-Effectiveness: By utilizing repurposed GPUs, CoreWeave aims to provide cost-effective cloud solutions, making high-performance computing more accessible to a broader range of businesses and researchers.

- Ease of Access for Developers: CoreWeave strives to offer a developer-friendly platform, simplifying the process of deploying and managing AI and HPC workloads in the cloud.

Market Position and Growth Potential

While precise market share figures for CoreWeave remain undisclosed, the company is rapidly gaining traction in the burgeoning AI infrastructure market. The market for AI infrastructure is projected to experience explosive growth in the coming years.

- Market Size Estimates: Industry analysts predict massive growth in the global cloud computing market, with AI and HPC segments leading the charge. CoreWeave is well-positioned to capitalize on this expansion.

- Growth Rate Predictions: Several research firms forecast significant year-over-year growth rates for the AI cloud services market, suggesting a promising future for companies like CoreWeave.

- Key Partnerships: Strategic partnerships with leading technology companies and research institutions will likely play a vital role in CoreWeave's expansion and market penetration.

- Market Share Gains: While specific data isn't publicly available, CoreWeave's aggressive expansion and innovative offerings suggest a potential for substantial market share gains.

Recent News and Developments Affecting CoreWeave Stock

Recent developments significantly influence the perception and valuation of CoreWeave stock. Understanding these is crucial for any potential investor.

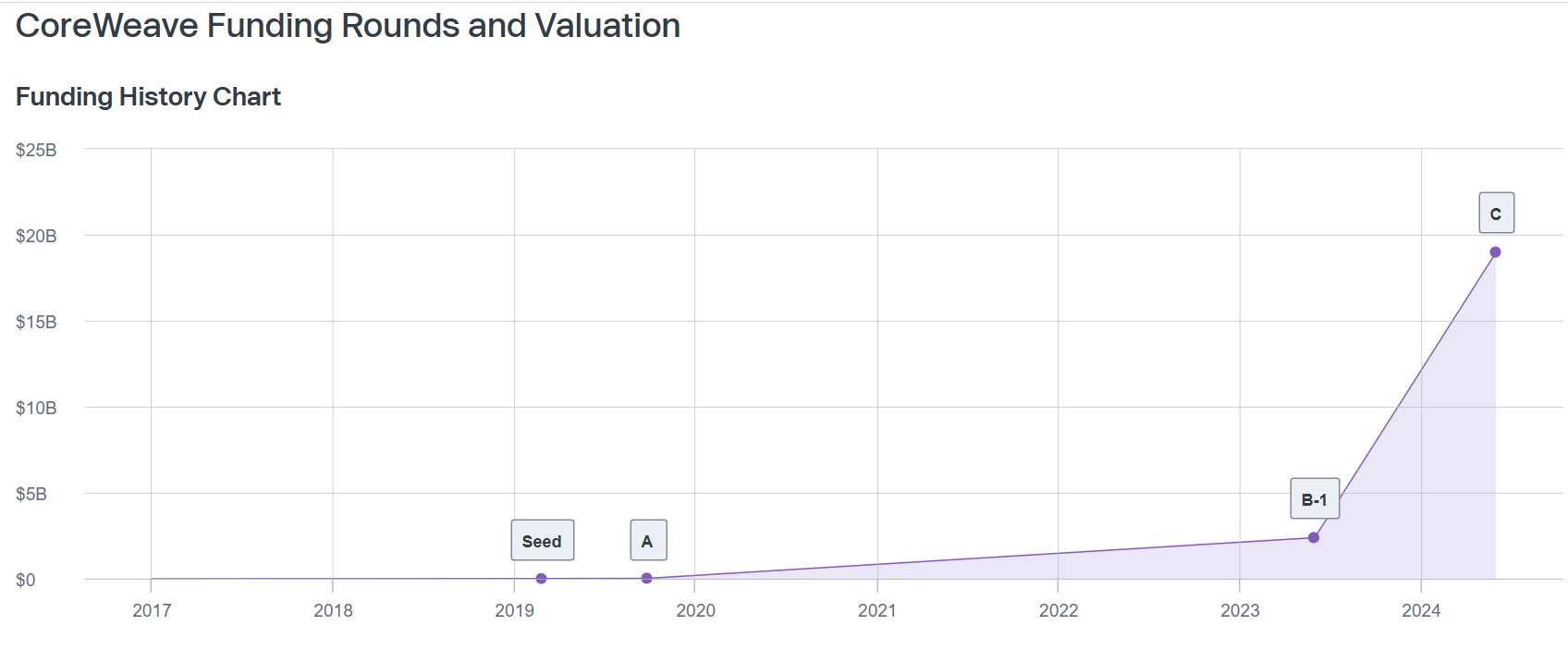

Recent Funding Rounds and Investments

CoreWeave has successfully secured substantial funding through multiple investment rounds. This influx of capital fuels its growth and expansion plans.

- Funding Amounts: Details about funding amounts and valuations are often disclosed in press releases and financial news reports.

- Investors Involved: The caliber and reputation of investors involved in CoreWeave’s funding rounds can signal confidence in the company’s future.

- Use of Funds: The intended use of the funding – such as expanding infrastructure, hiring talent, or developing new technologies – is a key factor in assessing its impact on future performance.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations significantly boost CoreWeave's market reach and credibility.

- Key Partners: Identifying key partners and the nature of the relationships reveals the potential for increased market penetration and technological advancements.

- Nature of Collaboration: Understanding the scope and objectives of each partnership helps to assess their potential impact on CoreWeave's overall growth strategy.

- Expected Benefits: Synergies and mutual benefits from these partnerships will contribute to CoreWeave's value proposition and overall success.

Financial Performance and Key Metrics

While CoreWeave is a privately held company, its financial performance (when available) offers critical insights into its health and growth trajectory.

- Revenue Growth: Analyzing revenue growth patterns provides a valuable indicator of the company's success in acquiring and retaining customers.

- Profitability: While profitability might not be a primary focus in the early stages, tracking profitability metrics helps assess the company’s long-term financial sustainability.

- Customer Acquisition Cost: Understanding the cost of acquiring new customers is crucial for gauging the efficiency of CoreWeave's marketing and sales efforts.

Risks and Challenges for CoreWeave Stock

Investing in CoreWeave stock, like any investment, involves inherent risks. Understanding these challenges is crucial for informed decision-making.

Competition in the Cloud Computing Market

The cloud computing market is fiercely competitive, with established giants like AWS, Google Cloud, and Azure dominating the landscape.

- Major Competitors: A thorough competitive analysis should consider the strengths and weaknesses of these established players.

- Competitive Advantages: CoreWeave's ability to differentiate itself through its focus on AI and HPC, along with its cost-effective solutions, will be key to its success.

Economic Uncertainty and Market Volatility

Macroeconomic factors and general market volatility can significantly influence investor sentiment and impact the stock market.

- Macroeconomic Factors: Interest rate hikes, inflation, and recessionary concerns can all negatively impact investor confidence and potentially depress CoreWeave's stock valuation.

- Market Volatility: Fluctuations in the broader stock market can create uncertainty, making it harder to predict the short-term performance of CoreWeave stock.

Conclusion

CoreWeave presents an intriguing investment opportunity in the rapidly growing AI and HPC cloud computing sector. Its innovative business model, strategic partnerships, and focus on a high-growth niche offer significant potential. However, the intense competition and economic uncertainty introduce substantial risks.

While this analysis provides insights into CoreWeave stock, remember to perform your own due diligence before making any investment decisions. Stay informed about developments in CoreWeave and the broader cloud computing market to make well-informed choices regarding CoreWeave stock. Consider consulting with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Last Weeks Core Weave Crwv Stock Price Increase A Deep Dive

May 22, 2025

Last Weeks Core Weave Crwv Stock Price Increase A Deep Dive

May 22, 2025 -

Vanja Mijatovic O Razvodu Demantira Glasine O Tezini

May 22, 2025

Vanja Mijatovic O Razvodu Demantira Glasine O Tezini

May 22, 2025 -

Cinq Itineraires Velo Pour Decouvrir La Loire Le Vignoble Nantais Et L Estuaire

May 22, 2025

Cinq Itineraires Velo Pour Decouvrir La Loire Le Vignoble Nantais Et L Estuaire

May 22, 2025 -

Bolidul De Milioane Al Fratilor Tate Imagini De La Parada Prin Centrul Bucurestiului

May 22, 2025

Bolidul De Milioane Al Fratilor Tate Imagini De La Parada Prin Centrul Bucurestiului

May 22, 2025 -

Mas Alla Del Arandano El Superalimento Que Reduce El Riesgo De Enfermedades Cronicas Y Promueve La Longevidad

May 22, 2025

Mas Alla Del Arandano El Superalimento Que Reduce El Riesgo De Enfermedades Cronicas Y Promueve La Longevidad

May 22, 2025

Latest Posts

-

Los Memes Mas Graciosos De La Derrota De Panama Ante Mexico

May 22, 2025

Los Memes Mas Graciosos De La Derrota De Panama Ante Mexico

May 22, 2025 -

Washington D C Shooting Israeli Diplomat And Girlfriend Killed

May 22, 2025

Washington D C Shooting Israeli Diplomat And Girlfriend Killed

May 22, 2025 -

Israeli Diplomat Yaron Lischinsky Murdered In Washington D C

May 22, 2025

Israeli Diplomat Yaron Lischinsky Murdered In Washington D C

May 22, 2025 -

Names Released Israeli Couple Killed In Washington Dc Shooting

May 22, 2025

Names Released Israeli Couple Killed In Washington Dc Shooting

May 22, 2025 -

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025

Couple Killed In Washington D C Shooting Identified By Israeli Embassy

May 22, 2025