D-Wave Quantum Inc. (QBTS): A Comprehensive Investment Analysis

Table of Contents

D-Wave Quantum Inc. (QBTS) is a pioneering company at the forefront of the rapidly expanding field of quantum computing. This comprehensive investment analysis explores the potential and risks associated with investing in QBTS, examining its groundbreaking technology, market position, financial performance, and future prospects. We will determine whether D-Wave represents a compelling investment opportunity within the dynamic quantum computing landscape.

Understanding D-Wave Quantum's Technology and Business Model

Quantum Annealing Explained:

D-Wave's approach to quantum computing differs from the more commonly discussed gate-based models. D-Wave utilizes quantum annealing, a specialized technique designed to solve optimization problems. Instead of manipulating qubits through a series of logic gates, quantum annealing leverages the principles of quantum mechanics to find the lowest energy state of a system, representing the optimal solution to a given problem.

- Specific applications of quantum annealing: Logistics optimization, financial modeling, materials science research, drug discovery, and artificial intelligence.

- Current technological limitations: Quantum annealing is best suited for specific types of problems; it's not a general-purpose quantum computer like gate-based systems aspire to be. The number of qubits, while increasing, is still relatively limited compared to some theoretical projections.

- Future development plans: D-Wave continues to improve its quantum annealing processors, increasing qubit count and connectivity, and developing advanced control systems to enhance performance and scalability.

D-Wave's Target Market and Customers:

D-Wave's quantum computing solutions are finding applications across diverse industries. Major players in automotive, finance, and materials science are already leveraging D-Wave's technology to tackle complex challenges.

- Examples of successful collaborations and partnerships: Collaborations with companies like Volkswagen, NEC, and Los Alamos National Laboratory demonstrate the real-world application of D-Wave's technology.

- Case studies demonstrating real-world applications: D-Wave's systems have been used to optimize traffic flow, improve financial modeling accuracy, and accelerate materials discovery, showcasing the practical impact of its technology.

Revenue Streams and Financial Performance:

D-Wave's revenue is primarily derived from the sale of its quantum computers and cloud-based access to its systems. Analyzing D-Wave's financial statements reveals insights into its revenue growth, profitability, and R&D investment.

- Key financial metrics (revenue, net income, operating margin): Investors should closely monitor these metrics to gauge the company's financial health and growth trajectory. Access to detailed financial reports is crucial for a thorough analysis.

- Comparison to competitors (if any direct competitors exist): While direct competitors in the quantum annealing space are limited, comparison to companies offering alternative quantum computing approaches provides valuable context.

- Analysis of debt levels: Assessing D-Wave's debt levels is essential for understanding its financial stability and risk profile.

Competitive Landscape and Market Potential

Key Competitors and Market Share:

The quantum computing industry is still nascent, with several players pursuing different technological approaches. While D-Wave is a leader in quantum annealing, it faces competition from companies developing gate-based quantum computers.

- Comparison of D-Wave's technology with competitors' approaches: Understanding the strengths and weaknesses of each approach is crucial for evaluating D-Wave's competitive position.

- Assessment of D-Wave's market share and growth potential: D-Wave's current market share is relatively small, but the potential for significant growth in the broader quantum computing market is substantial.

Market Growth Projections for Quantum Computing:

Industry reports consistently project substantial growth for the quantum computing market in the coming years. This growth is driven by increasing investment, technological advancements, and growing awareness of quantum computing's potential.

- Market size predictions: Market research firms offer various predictions for the size of the quantum computing market, ranging from billions to trillions of dollars in the next decade.

- Growth drivers: Factors such as government funding, private investment, and technological breakthroughs are fueling the growth of the quantum computing sector.

- Potential challenges and risks to market growth: Technological hurdles, regulatory uncertainty, and competition remain potential risks to the market's projected growth.

Investment Risks and Potential Rewards

Risks Associated with Investing in QBTS:

Investing in QBTS, like any technology stock, carries inherent risks. Technological challenges, intense competition, and market volatility are all potential concerns.

- Specific risks (e.g., technological failure, regulatory uncertainty, competition from larger tech companies): A thorough understanding of these risks is crucial for informed investment decisions.

- Mitigation strategies (if any): Investors should consider diversification and a long-term investment horizon to mitigate some of the risks associated with QBTS.

Potential Returns and Long-Term Outlook:

Despite the risks, the potential returns from investing in QBTS could be substantial, given the transformative potential of quantum computing.

- Scenario analysis of potential returns: Developing different scenarios based on various growth rates and market conditions can help assess potential returns.

- Valuation methods (e.g., discounted cash flow analysis): Using appropriate valuation methods is important for assessing the intrinsic value of QBTS.

- Comparison to other high-growth technology stocks: Comparing QBTS to other high-growth technology companies provides context for evaluating its risk-reward profile.

Conclusion

Investing in D-Wave Quantum (QBTS) presents a unique opportunity to participate in the burgeoning field of quantum computing. While risks exist, D-Wave's pioneering technology in quantum annealing, its growing customer base, and the immense potential of the quantum computing market offer significant long-term upside. This analysis highlights the importance of understanding D-Wave's technology, competitive landscape, and financial performance before making any investment decisions. However, the potential rewards could be substantial for those willing to embrace the inherent risks associated with this innovative sector. Consider adding D-Wave Quantum to your portfolio as part of a diversified strategy, aligning with your individual risk tolerance and investment goals. Learn more about investing in QBTS and the future of quantum computing by visiting D-Wave's investor relations page.

Featured Posts

-

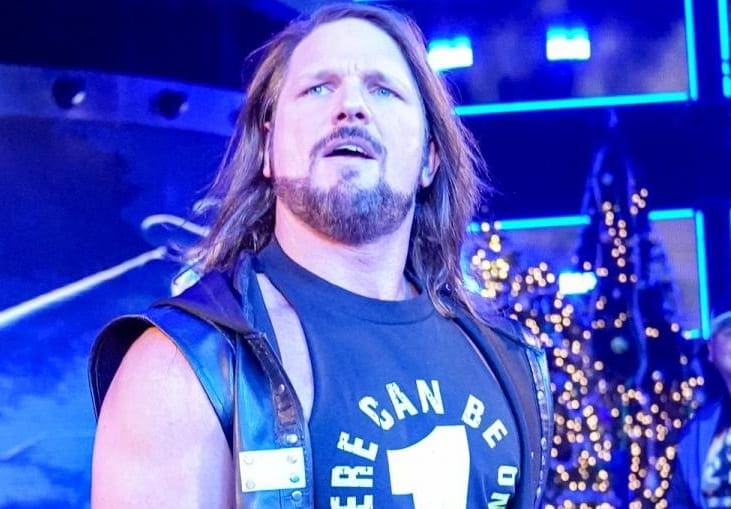

Wwes Aj Styles Contract Status And Future Speculation

May 21, 2025

Wwes Aj Styles Contract Status And Future Speculation

May 21, 2025 -

Sabalenkas Powerful Rally Secures Madrid Open Victory Over Mertens

May 21, 2025

Sabalenkas Powerful Rally Secures Madrid Open Victory Over Mertens

May 21, 2025 -

Joint Statement Switzerland And China Seek Dialogue On Tariffs

May 21, 2025

Joint Statement Switzerland And China Seek Dialogue On Tariffs

May 21, 2025 -

Trinidad Trip Curtailed Dancehall Artists Visit Limited

May 21, 2025

Trinidad Trip Curtailed Dancehall Artists Visit Limited

May 21, 2025 -

Can A British Ultrarunner Break The Australian Speed Record

May 21, 2025

Can A British Ultrarunner Break The Australian Speed Record

May 21, 2025

Latest Posts

-

The Sound Perimeter Effect How Music Creates Community

May 22, 2025

The Sound Perimeter Effect How Music Creates Community

May 22, 2025 -

Exploring The Sound Perimeter The Science Of Musical Connection

May 22, 2025

Exploring The Sound Perimeter The Science Of Musical Connection

May 22, 2025 -

Is An Arsenal Great The Next Manchester City Manager Report Suggests Guardiolas Successor

May 22, 2025

Is An Arsenal Great The Next Manchester City Manager Report Suggests Guardiolas Successor

May 22, 2025 -

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025 -

Sound Perimeter And Community The Impact Of Shared Musical Experiences

May 22, 2025

Sound Perimeter And Community The Impact Of Shared Musical Experiences

May 22, 2025