D-Wave Quantum Inc. (QBTS) Stock Drop On Monday: Reasons And Analysis

Table of Contents

On Monday, shares of D-Wave Quantum Inc. (QBTS) experienced a significant drop, leaving many investors wondering about the cause. This article delves into the potential reasons behind this sudden decline in QBTS stock, analyzing market factors, company-specific news, and broader trends impacting the quantum computing sector and the QBTS stock price. We'll examine the implications for investors and consider future prospects for QBTS stock performance.

Market Sentiment and the Broader Tech Sector

Monday's downturn in QBTS stock needs to be considered within the context of the broader market. Was the decline in D-Wave Quantum Inc. (QBTS) stock simply a reflection of a wider sell-off, or were there company-specific factors at play? Analyzing the overall market conditions is crucial to understanding the QBTS stock price movement.

-

Broader Market Conditions: The Nasdaq Composite, a key benchmark for technology stocks, experienced a [insert percentage]% decline on Monday. [Cite source - e.g., Yahoo Finance, Google Finance]. This general negative sentiment in the tech sector could have contributed to the selling pressure on QBTS stock, irrespective of company-specific news. Furthermore, [mention any relevant economic news, e.g., interest rate hikes, inflation reports] could have negatively impacted investor confidence across the board.

-

Performance of Related Stocks: It's essential to compare QBTS performance with other quantum computing stocks and related technology companies. Did competitors like [mention competitors, e.g., IonQ, Rigetti] also experience declines? A general downturn in the quantum computing sector might suggest broader industry headwinds affecting QBTS stock. If competitors held steady or even rose while QBTS fell, it indicates company-specific issues could be a major factor.

-

Comparative Analysis: A direct comparison of QBTS stock performance against its competitors is necessary to isolate whether the drop was unique to D-Wave or part of a sector-wide trend. Analyzing the daily, weekly, and monthly performance charts will offer a clearer picture.

Company-Specific News and Announcements

Investigating any company-specific news or announcements released by D-Wave Quantum around Monday is critical in determining the QBTS stock drop's cause. Negative news often triggers immediate selling pressure.

-

Press Releases and Earnings Reports: Did D-Wave Quantum release any press releases, announcements, or earnings reports on Monday or in the preceding days? Negative news, such as lower-than-expected earnings, missed projections, or delays in project milestones, could have directly impacted investor confidence and led to the QBTS stock decline. [Include links to relevant news articles and company press releases, if available].

-

Analyst Ratings and Price Target Changes: A change in analyst ratings or price targets for QBTS stock can significantly affect investor sentiment. Did any major investment banks downgrade their rating for D-Wave Quantum, or lower their price target? Such actions often lead to immediate selling pressure, driving down the QBTS stock price. [Cite sources for any analyst reports].

-

Impact Assessment: Each piece of company-specific news must be carefully evaluated for its potential impact on investor perception. A negative announcement, even if seemingly minor, could trigger a disproportionate reaction in the market, especially in the volatile quantum computing sector.

Technical Analysis of QBTS Stock Chart

Analyzing the QBTS stock chart using technical indicators can offer insights into the reasons behind the price drop. Technical analysis focuses on price and volume patterns to predict future price movements.

-

Support and Resistance Levels: Did the QBTS stock price break through significant support levels, triggering stop-loss orders and further downward pressure? Support levels represent price points where buyers are likely to step in, while resistance levels indicate areas where selling pressure is expected. A break below a key support level often signals a bearish trend.

-

Moving Averages: Did the QBTS stock price cross below key moving averages, like the 50-day or 200-day moving average? These indicators provide a trend overview. A break below a long-term moving average is often considered a bearish signal.

-

Volume Analysis: High volume accompanying the price drop suggests strong selling pressure, while low volume may indicate a less significant event. Examining trading volume is essential in confirming the significance of the price movement. [Include charts or graphs to illustrate price movements and volume changes].

Impact of Competition in the Quantum Computing Market

The competitive landscape of the quantum computing industry plays a crucial role in shaping investor sentiment. News from competitors can indirectly influence D-Wave’s stock price.

-

Competitive Advancements: Did competitors make significant breakthroughs or announcements that might have overshadowed D-Wave Quantum's progress? Advancements from competitors can shift investor focus and potentially reduce enthusiasm for QBTS stock. [Name key competitors and mention any recent news].

-

Market Share Concerns: Increased competition can raise concerns about D-Wave Quantum's market share and its ability to maintain a competitive edge. This can lead to investor apprehension and selling pressure on QBTS stock.

-

Long-Term Implications: The competitive landscape significantly affects the long-term outlook for QBTS stock. Analyzing the competitive dynamics is crucial in assessing the long-term investment potential of D-Wave Quantum Inc.

Conclusion

Monday's QBTS stock drop can be attributed to a combination of factors: a general downturn in the tech sector, potentially negative company-specific news (requiring further investigation), bearish signals from technical analysis, and the ever-present pressure from competitors in the rapidly evolving quantum computing market. The drop's long-term significance remains unclear; further observation and analysis are necessary.

Future Outlook: The future performance of QBTS stock depends on how D-Wave Quantum addresses the challenges and opportunities discussed above. Close monitoring of company news, market trends, and technical indicators is essential for investors.

Call to Action: Before making any investment decisions regarding D-Wave Quantum Inc. (QBTS) stock, conduct thorough research. Analyze QBTS stock performance in relation to market trends and competitor activity. Monitor QBTS stock closely and understand the significant risks and rewards associated with investing in this developing sector of the quantum computing market. Further research into QBTS stock and the quantum computing investment landscape is highly recommended.

Featured Posts

-

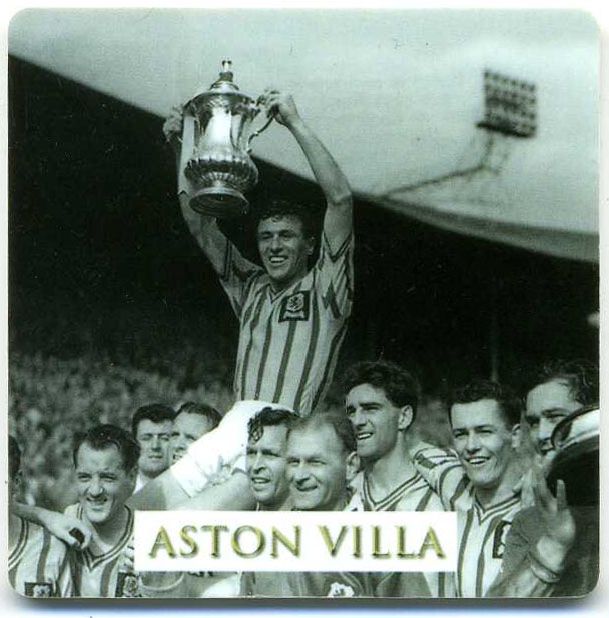

Aston Villas Rashford Shines In Fa Cup Rout Of Preston

May 21, 2025

Aston Villas Rashford Shines In Fa Cup Rout Of Preston

May 21, 2025 -

Porsches Struggle Balancing Ferraris Sportiness And Mercedes Luxury In A Trade War Climate

May 21, 2025

Porsches Struggle Balancing Ferraris Sportiness And Mercedes Luxury In A Trade War Climate

May 21, 2025 -

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 21, 2025

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 21, 2025 -

Amazon Syndicat Des Travailleurs Et Fermetures De Depots Audience Au Tribunal Du Travail Du Quebec

May 21, 2025

Amazon Syndicat Des Travailleurs Et Fermetures De Depots Audience Au Tribunal Du Travail Du Quebec

May 21, 2025 -

Global Trade Tensions An Fp Video Report On Tariff Volatility At Home And Abroad

May 21, 2025

Global Trade Tensions An Fp Video Report On Tariff Volatility At Home And Abroad

May 21, 2025

Latest Posts

-

International Premiere Grand Ole Opry Live From The Royal Albert Hall

May 23, 2025

International Premiere Grand Ole Opry Live From The Royal Albert Hall

May 23, 2025 -

Royal Albert Hall Hosts Grand Ole Oprys First International Broadcast

May 23, 2025

Royal Albert Hall Hosts Grand Ole Oprys First International Broadcast

May 23, 2025 -

Grand Ole Opry Goes Global Royal Albert Hall To Host First International Broadcast

May 23, 2025

Grand Ole Opry Goes Global Royal Albert Hall To Host First International Broadcast

May 23, 2025 -

Zimbabwe Cricket Sylhet Test Victory Marks A Turning Point

May 23, 2025

Zimbabwe Cricket Sylhet Test Victory Marks A Turning Point

May 23, 2025 -

Grand Ole Oprys Historic London Show First International Broadcast From Royal Albert Hall

May 23, 2025

Grand Ole Oprys Historic London Show First International Broadcast From Royal Albert Hall

May 23, 2025