D-Wave Quantum (QBTS) Stock Crash: Causes And Analysis

Table of Contents

Market Sentiment and Investor Expectations

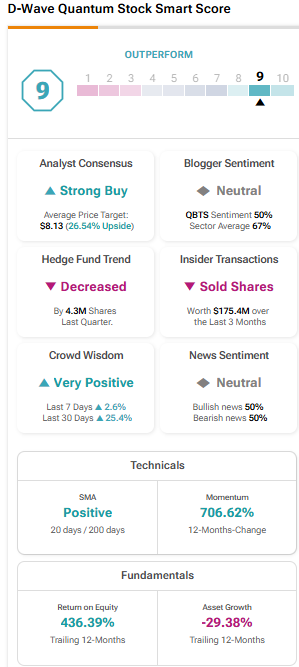

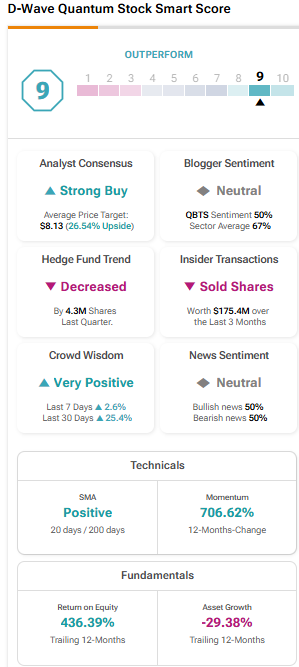

The sharp drop in QBTS stock price may be partly attributed to shifts in market sentiment and investor expectations. Two key aspects played a significant role: overvaluation concerns and intensifying competition.

Overvaluation Concerns

Prior to the crash, some analysts argued that QBTS stock was overvalued. This perception stemmed from several factors:

- High Valuation Compared to Competitors: D-Wave's market capitalization, relative to its revenue and stage of development, exceeded that of some competitors with similar or potentially more advanced technologies.

- Lack of Substantial Revenue: The company's reliance on future potential, rather than current profitability, made it a riskier investment compared to more established tech companies.

- Limited Near-Term Revenue Streams: The absence of significant near-term revenue streams contributed to concerns about the sustainability of the company's operations and its ability to generate returns for investors.

This disconnect between market valuation and the company's actual financial performance created a situation ripe for a correction. Investor enthusiasm, fueled by the hype surrounding quantum computing, might have led to an inflated stock price, leaving it vulnerable to a sell-off when reality set in.

Competition in the Quantum Computing Market

The quantum computing industry is becoming increasingly competitive. D-Wave faces stiff competition from major players like:

- IBM: IBM has made significant strides in developing its own quantum computing technology and cloud services, attracting significant investment and attention.

- Google: Google's quantum computing efforts, particularly its claims of achieving "quantum supremacy," have put pressure on other companies in the field.

- IonQ: IonQ, a publicly traded company, presents a direct competitor focusing on a different type of quantum computing technology.

This competitive landscape may have eroded investor confidence in D-Wave's unique approach to quantum annealing, potentially contributing to the QBTS stock decline. Investors might have shifted their focus toward companies perceived as having a greater chance of commercial success in the near term.

Financial Performance and Company Announcements

D-Wave's financial performance and any related announcements also played a significant role in the QBTS stock crash.

Disappointing Earnings Reports

Any recent earnings reports that fell short of market expectations likely exacerbated the decline. For example:

- Lower-than-anticipated revenue: If D-Wave reported revenue figures below analyst predictions, it would have negatively impacted investor confidence.

- Increased operating losses: Growing operating losses could indicate challenges in scaling operations and achieving profitability, further dampening investor enthusiasm.

- Reduced guidance for future performance: A downward revision of the company's future revenue or profitability projections would have likely triggered further selling pressure.

Such negative financial news can undermine investor confidence and lead to a rapid decrease in stock price.

Negative News and Press Coverage

Negative news or press coverage can also significantly influence investor sentiment. This could include:

- Product delays: Delays in the development or launch of new products can signal setbacks and undermine investor confidence in the company's technological capabilities.

- Leadership changes: Unexpected changes in top management can create uncertainty and raise concerns about the company's strategic direction.

- Regulatory hurdles: Any regulatory challenges or compliance issues could negatively impact the company's prospects and investor perception.

Such negative publicity can fuel a sell-off, exacerbating the stock price decline.

Macroeconomic Factors and Broader Market Trends

External factors beyond D-Wave's control also influenced the QBTS stock crash.

Overall Market Volatility

The broader macroeconomic climate and market volatility played a part.

- Tech sector correction: A broader downturn in the technology sector, possibly driven by rising interest rates or concerns about economic growth, could have disproportionately impacted high-growth, speculative stocks like QBTS.

- Inflationary pressures: Increased inflation and rising interest rates can negatively impact investor appetite for riskier investments, leading to a sell-off in growth stocks.

- Geopolitical uncertainty: Geopolitical events and global economic instability can increase market volatility and negatively impact investor sentiment towards speculative investments.

These broader market trends contributed to the sell-off, regardless of QBTS-specific issues.

Investor Risk Aversion

A shift in investor sentiment towards risk aversion likely impacted QBTS disproportionately.

- High-risk profile: QBTS, as a company operating in a relatively nascent technology sector, carries inherent risks. Investors might have sought safer, more established investments during a period of increased uncertainty.

- Long-term investment horizon: The long-term nature of the quantum computing market might have discouraged investors seeking quicker returns, contributing to the decline in QBTS stock.

Conclusion

The D-Wave Quantum (QBTS) stock crash appears to be a multifaceted issue resulting from a combination of factors: overvaluation concerns, heightened competition, disappointing financial performance, negative news, and broader macroeconomic trends. Understanding these contributing elements is crucial for investors navigating the quantum computing sector. Further research into QBTS's future strategic initiatives is essential to assess its long-term viability. Closely monitor D-Wave Quantum (QBTS) stock for future developments and diversify your investment portfolio to mitigate risk. Consider the long-term potential of quantum computing technology before making any investment decisions related to QBTS or other quantum computing stocks.

Featured Posts

-

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025

Nyt Mini Crossword April 26 2025 Helpful Hints

May 20, 2025 -

Kroyz Azoyl Ston Teliko Champions League Xari Ston Giakoymaki

May 20, 2025

Kroyz Azoyl Ston Teliko Champions League Xari Ston Giakoymaki

May 20, 2025 -

Understanding The Market Reaction D Wave Quantum Qbts Stock Drop On Thursday

May 20, 2025

Understanding The Market Reaction D Wave Quantum Qbts Stock Drop On Thursday

May 20, 2025 -

Mikhael Shumakher Stal Dedushkoy Pervye Podrobnosti

May 20, 2025

Mikhael Shumakher Stal Dedushkoy Pervye Podrobnosti

May 20, 2025 -

Patra Odigos Efimerion Iatron Gia To Savvatokyriako

May 20, 2025

Patra Odigos Efimerion Iatron Gia To Savvatokyriako

May 20, 2025