D-Wave Quantum (QBTS) Stock: Investment Potential And Risks.

Table of Contents

Understanding D-Wave Quantum's Business Model and Technology

D-Wave Quantum's business model centers around its unique approach to quantum computing: quantum annealing. Unlike gate-based quantum computing pursued by other companies, quantum annealing utilizes a different method to solve specific optimization problems. This technology is implemented in their flagship product, the Advantage system, a powerful quantum processing unit (QPU).

-

Quantum Annealing: This technique leverages the principles of quantum mechanics to find the lowest energy state of a system, efficiently solving complex optimization problems. This differs significantly from gate-based quantum computing, which focuses on universal quantum computation.

-

The Advantage System: D-Wave's Advantage system is a commercially available quantum computer designed for real-world applications. It features a significantly increased number of qubits compared to previous generations, enhancing its computational power and problem-solving capabilities. This system is a key driver of D-Wave's revenue and future growth potential.

-

Hybrid Quantum-Classical Computing: D-Wave emphasizes a hybrid approach. This combines the power of their quantum annealers with classical computing resources. This hybrid approach is crucial for handling complex problems that require both quantum and classical computational power, making the technology more accessible and applicable to diverse fields.

-

Target Market: D-Wave's target market includes organizations in various sectors, such as logistics, finance, materials science, and drug discovery, where complex optimization problems are prevalent. The company is actively building partnerships and expanding its customer base to demonstrate the practical applications of its technology.

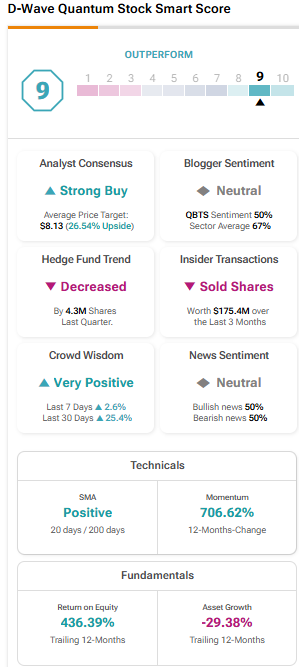

Analyzing the Investment Potential of QBTS Stock

The quantum computing market is projected to experience explosive growth in the coming years. D-Wave, as a leading player with a commercially available quantum computer, is well-positioned to capitalize on this expansion. The potential returns on a QBTS investment are significant, but assessing the current valuation and future performance requires careful consideration.

-

Quantum Computing Market Growth: The burgeoning quantum computing market presents a tremendous opportunity for early investors. Analysts predict substantial growth, making QBTS stock a potentially lucrative long-term investment. However, it's crucial to understand that market projections are subject to uncertainty.

-

QBTS Stock Price and Valuation: While past performance of QBTS stock is limited, its current valuation reflects the market's perception of its potential. This needs to be analyzed in context with its revenue streams and ongoing technological advancements. A detailed financial analysis is crucial before making any investment decisions.

-

Drivers of Future Stock Price Appreciation: Successful product launches (beyond the Advantage system), strategic partnerships with major corporations, and increased adoption of quantum annealing technology across various industries will be key drivers of future stock price appreciation. Positive news regarding technological breakthroughs and expansion into new markets will directly impact QBTS stock.

-

Potential Return on Investment (ROI): The potential ROI for QBTS is speculative and highly dependent on various factors, including market adoption rates, technological advancements, and competitive pressures. Modeling different scenarios and assessing risk tolerance is vital for reasonable ROI expectations.

-

Financial Metrics: Tracking D-Wave's revenue growth, profitability (or lack thereof), and market capitalization will offer valuable insights into the company's financial health and future prospects, contributing significantly to a sound QBTS investment strategy.

Assessing the Risks Associated with Investing in QBTS Stock

Investing in QBTS stock carries substantial risks, inherent to both the early-stage nature of the company and the nascent quantum computing market. It's crucial to thoroughly understand these risks before committing capital.

-

Early-Stage Company Risk: D-Wave, while a pioneer, is still a relatively young company operating in an unproven market. The risks associated with early-stage companies include financial instability, potential product failures, and challenges in scaling operations.

-

Technological Risks: Significant technological hurdles remain in scaling up quantum computing technology. Unforeseen challenges in qubit coherence, error correction, and algorithm development could impede progress and impact D-Wave's future.

-

Financial Risks: The company's financial performance is subject to market volatility and its current financial position needs careful scrutiny. Losses are possible, and this risk is magnified by the inherent volatility of a growth stock in a nascent industry.

-

Market Volatility: The quantum computing sector is highly volatile. News, announcements from competitors, and market sentiment can significantly impact the stock price. This volatility makes it unsuitable for risk-averse investors.

-

Competition: The quantum computing industry is becoming increasingly competitive. The emergence of new players and advancements from established tech giants poses a significant threat to D-Wave's market share and growth potential.

Diversification and Risk Management Strategies for QBTS Investment

To mitigate the significant risks associated with investing in QBTS stock, diversification is paramount. It is crucial to not over-allocate funds to a single, high-risk investment.

-

Portfolio Diversification: Incorporating QBTS into a well-diversified portfolio alongside other assets with less correlation is a crucial risk management strategy. This reduces the impact of potential losses on the overall portfolio value.

-

Investment Strategy: Consider a long-term investment horizon for QBTS, as the quantum computing market is expected to mature over time. Short-term fluctuations should be less relevant to a long-term investor.

-

Asset Allocation: Allocate only a small percentage of your overall investment portfolio to QBTS, limiting potential losses. The percentage should align with your overall risk tolerance and investment goals.

-

Reducing Investment Risk: Staying informed about D-Wave's progress, market trends, and competitive landscape will allow for informed decision-making and timely adjustments to your investment strategy.

Conclusion

Investing in D-Wave Quantum (QBTS) stock offers the potential for substantial returns in the rapidly expanding quantum computing market. However, it carries considerable risk, given the technological challenges, market volatility, and competitive pressures. Before considering a QBTS investment, a thorough understanding of the company’s business model, technology, and financial position is essential. The high-risk, high-reward nature of QBTS requires careful consideration and alignment with your risk tolerance.

Call to Action: Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, conduct thorough due diligence and consult with a qualified financial advisor. Carefully weigh the potential rewards against the inherent risks of a QBTS investment. Remember, investing in QBTS stock, like any other investment, involves risk, so proceed cautiously. Understand the D-Wave Quantum (QBTS) investment landscape completely before making any decisions.

Featured Posts

-

Diskvalifikatsiya Leklera I Khemiltona Analiz Gonki Ferrari

May 20, 2025

Diskvalifikatsiya Leklera I Khemiltona Analiz Gonki Ferrari

May 20, 2025 -

Bbc To Produce Endless Night Tv Series Based On Agatha Christies Novel

May 20, 2025

Bbc To Produce Endless Night Tv Series Based On Agatha Christies Novel

May 20, 2025 -

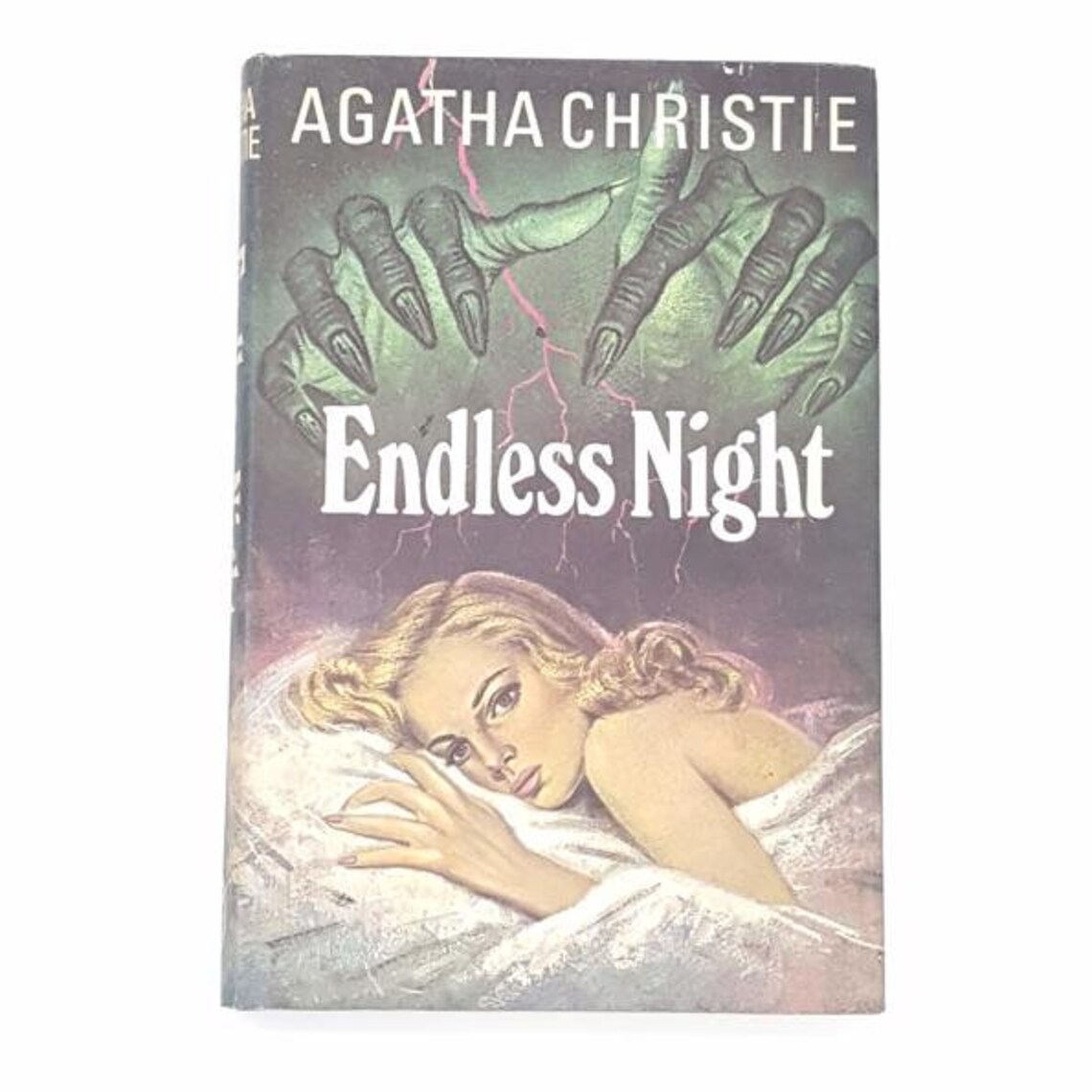

Navy Admiral Faces 30 Years For 500 K Bribery Scheme

May 20, 2025

Navy Admiral Faces 30 Years For 500 K Bribery Scheme

May 20, 2025 -

Former Munster Prop James Cronin Takes Highfield Coaching Role

May 20, 2025

Former Munster Prop James Cronin Takes Highfield Coaching Role

May 20, 2025 -

Analyzing The Success Of Ftv Lives A Hell Of A Run

May 20, 2025

Analyzing The Success Of Ftv Lives A Hell Of A Run

May 20, 2025