D-Wave Quantum (QBTS) Stock Performance: Explaining Thursday's Decrease

Table of Contents

H2: Market Sentiment and Overall Tech Stock Performance

Thursday's decline in D-Wave Quantum (QBTS) stock wasn't an isolated event. The broader tech market experienced a downturn, impacting many technology stocks. This general negative sentiment significantly contributed to QBTS's decrease.

- Relevant Indices: The Nasdaq Composite, a key indicator of the technology sector's health, experienced a [Insert Percentage]% decline on Thursday. This widespread downturn created a negative ripple effect, impacting even strong performers like D-Wave Quantum.

- Investor Sentiment: Investor sentiment towards technology stocks was cautious to bearish on Thursday. Concerns about [mention specific concerns like interest rate hikes, inflation, or geopolitical instability] played a significant role in this negative outlook. This overall bearishness likely exacerbated the fall in QBTS stock.

- Correlation with Other Tech Stocks: Analysis shows a strong correlation between QBTS's performance and other tech stocks on Thursday. This suggests that the general market downturn was a primary driver of QBTS's price decrease, rather than company-specific issues.

H2: Company-Specific News and Announcements

While no major negative press releases or announcements were issued by D-Wave Quantum around Thursday's stock drop, the absence of positive news likely contributed to the decline. In the volatile tech sector, especially in the emerging field of quantum computing, the lack of positive catalysts can lead to selling pressure.

- Absence of Positive News: The lack of significant positive news, such as new partnerships, contract wins, or product breakthroughs, created a vacuum for investors. Without positive momentum, even companies with strong fundamentals can experience downward pressure.

- Market Reaction to Silence: In the fast-paced world of stock trading, any perceived lack of progress can be interpreted negatively. The silence from D-Wave Quantum on Thursday, in the absence of other positive market signals, may have prompted some investors to sell their shares, contributing to the price decline.

- Analyzing Investor Expectations: Investors in high-growth sectors like quantum computing often have high expectations. If these expectations aren't met with regular positive updates, it can lead to disappointment and subsequent selling.

H2: Industry-Wide Factors Affecting Quantum Computing Stocks

The quantum computing sector, while promising, is still in its nascent stages. Broader industry trends can significantly impact individual company performance.

- Competitor Activity: Increased competition within the quantum computing landscape can influence investor sentiment. News about competitor advancements, funding rounds, or market share gains could indirectly affect QBTS's stock price.

- Government Regulations and Funding: Changes in government regulations or funding policies related to quantum computing research and development can also impact investor confidence. Uncertainty regarding future support can lead to market volatility.

- Technological Advancements: Significant technological breakthroughs, either positive or negative, from competitors could affect the perception of D-Wave Quantum's technology and market position, impacting investor confidence and the QBTS stock price.

H2: Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart on Thursday reveals [Insert specific observations from technical analysis, e.g., increased trading volume, breach of support level].

- Trading Volume: A significant increase in trading volume on Thursday suggests heightened investor activity, likely driven by selling pressure.

- Support and Resistance Levels: The QBTS stock price breached a key support level, indicating a weakening trend and contributing to the downward movement.

- (Optional) Chart: [Insert chart here if available, with proper attribution.] This visual representation can help illustrate the price movement and technical indicators more effectively.

Conclusion:

The decrease in D-Wave Quantum (QBTS) stock price on Thursday was likely a confluence of factors. A general downturn in the tech market, the absence of positive company news, broader industry trends in the quantum computing sector, and technical indicators all contributed to the decline. Understanding these interconnected elements is vital for navigating the complexities of QBTS stock.

Call to Action: Understanding the volatility of D-Wave Quantum (QBTS) stock requires ongoing monitoring of market conditions and company news. Stay informed about future developments impacting D-Wave Quantum (QBTS) stock and the quantum computing industry to make informed investment decisions. Continue to follow our analysis for further insights into D-Wave Quantum (QBTS) stock performance and navigate the intricacies of this dynamic market.

Featured Posts

-

Festival Le Bouillon Clisson Engagement Et Spectacle

May 21, 2025

Festival Le Bouillon Clisson Engagement Et Spectacle

May 21, 2025 -

Australian Foot Crossing Record Smashed By William Goodge

May 21, 2025

Australian Foot Crossing Record Smashed By William Goodge

May 21, 2025 -

Was Liverpool Fortunate Against Psg Arne Slot And Alissons Crucial Roles

May 21, 2025

Was Liverpool Fortunate Against Psg Arne Slot And Alissons Crucial Roles

May 21, 2025 -

Huuhkajien Uusi Valmennus Kohti Mm Karsintoja

May 21, 2025

Huuhkajien Uusi Valmennus Kohti Mm Karsintoja

May 21, 2025 -

How Michael Strahan Secured A Major Interview During A Ratings Battle

May 21, 2025

How Michael Strahan Secured A Major Interview During A Ratings Battle

May 21, 2025

Latest Posts

-

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

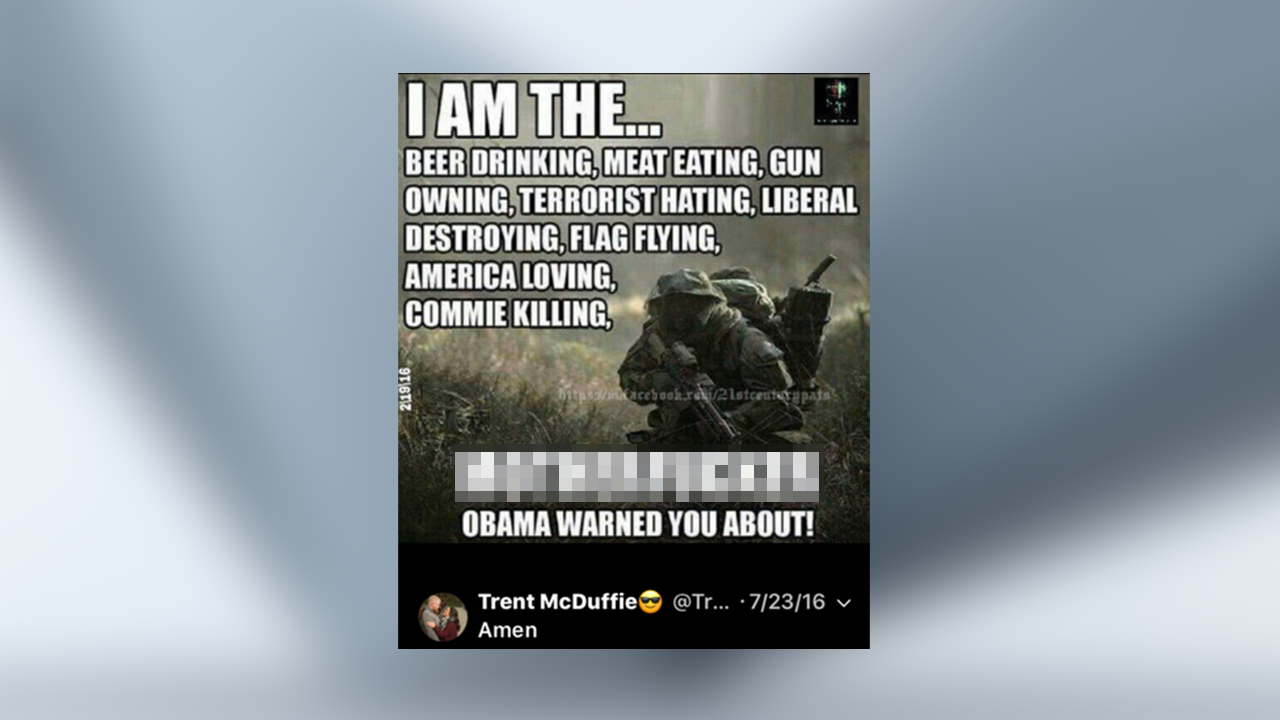

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025