D-Wave Quantum (QBTS) Stock Plunge: Kerrisdale Capital's Valuation Concerns

Table of Contents

Kerrisdale Capital's Key Arguments Against D-Wave Quantum's Valuation

Kerrisdale Capital's report presented a multifaceted critique of D-Wave Quantum's valuation, targeting several key areas. Their central argument revolves around an alleged disconnect between the company's current performance and its projected future growth.

Overvalued Revenue and Growth Projections

Kerrisdale's primary concern centers on D-Wave's revenue forecasts, which they deem overly optimistic and unrealistic. The report scrutinizes the company's customer acquisition strategy, highlighting what it considers to be inflated customer acquisition costs. They argue that the limited real-world applications of D-Wave's current quantum annealing technology severely restrict its market potential. Furthermore, Kerrisdale questions the future market demand for quantum annealing itself, suggesting it may be overshadowed by more versatile gate-based quantum computing technologies.

- Inflated customer acquisition costs: The report points to a disproportionate spending on acquiring customers relative to the revenue generated, suggesting inefficiency.

- Limited real-world applications: Kerrisdale contends that D-Wave's technology lacks widespread practical applications, hindering revenue growth.

- Uncertain future market demand for quantum annealing: The report casts doubt on the long-term viability of quantum annealing in the face of competing technologies.

Concerns Regarding D-Wave's Technology and Market Position

Beyond revenue projections, Kerrisdale critically assesses D-Wave's quantum annealing technology and its competitive standing within the quantum computing landscape. They argue that quantum annealing, while a valid approach, suffers from inherent limitations compared to the more widely pursued gate-based quantum computing. This technological disadvantage, coupled with challenges in scaling up the technology, puts D-Wave at a significant competitive disadvantage.

- Technological limitations compared to gate-based quantum computers: Kerrisdale highlights the limitations of quantum annealing in solving certain types of problems, compared to the broader applicability of gate-based systems.

- Challenges in scaling up the technology: The report expresses concern about D-Wave's ability to significantly increase the qubit count and processing power of its systems, a crucial factor for future competitiveness.

- Limited industry adoption: The report points to the relatively low adoption rate of D-Wave's technology within the industry, suggesting limitations in its practical utility.

Analysis of D-Wave's Financial Health and Debt

Kerrisdale's analysis extends to D-Wave's financial health, highlighting what it views as significant financial risks. The report examines D-Wave's debt levels, expressing concern about its high debt-to-equity ratio and its implications for long-term sustainability. The analysis includes a cash burn rate assessment and a projection of its financial runway, raising questions about the company's future profitability and its continued dependence on external funding.

- High debt-to-equity ratio: This indicates a significant reliance on debt financing, posing potential risks in case of financial difficulties.

- Cash burn rate and runway analysis: The report likely analyzes the rate at which D-Wave is spending cash and projects how long its current funding will last.

- Dependence on external funding: This reliance on external investors introduces uncertainty and vulnerability to changes in market sentiment.

Market Reaction and Investor Sentiment

The immediate market response to Kerrisdale Capital's report was a sharp decline in QBTS stock price. Trading volume significantly increased as investors reacted to the negative news. Investor confidence plummeted, reflecting concerns about D-Wave's valuation and future prospects. The impact extended beyond QBTS, influencing investor sentiment toward other quantum computing stocks and potentially dampening overall investment in the sector.

- Stock price decline percentage: A substantial drop in QBTS share price was observed following the report's release.

- Trading volume increase/decrease: Increased trading volume suggests heightened market activity and investor reaction.

- Investor confidence and sentiment shifts: The report negatively affected investor confidence and shifted sentiment towards a more cautious outlook.

- Impact on other quantum computing stocks: The negative sentiment surrounding D-Wave might have spilled over to other companies in the quantum computing space.

Counterarguments and Rebuttals to Kerrisdale's Claims

While Kerrisdale's report painted a bleak picture, it's crucial to consider potential counterarguments. D-Wave Quantum may have issued a formal response addressing the criticisms, defending its technology, market strategy, and financial projections. Industry experts and analysts may also offer alternative perspectives, potentially pointing out flaws in Kerrisdale's analysis or highlighting the potential for future breakthroughs in D-Wave's technology.

- D-Wave's defense of its technology and market position: D-Wave may argue that the report underestimates the potential of quantum annealing or overlooks key partnerships and strategic initiatives.

- Arguments against Kerrisdale's valuation methodologies: Counterarguments might challenge the assumptions and methodologies used by Kerrisdale in their valuation.

- Potential future applications and breakthroughs for D-Wave's technology: Proponents of D-Wave might highlight emerging applications and potential technological advancements that could significantly impact the company's future.

Conclusion

Kerrisdale Capital's report on D-Wave Quantum (QBTS) has triggered a significant stock plunge, raising crucial questions about the company's valuation and long-term prospects. The report highlighted concerns regarding overvalued revenue projections, technological limitations, and financial risks. While the market reacted negatively, it’s essential to consider counterarguments and conduct thorough due diligence before making investment decisions. The D-Wave Quantum (QBTS) situation underscores the inherent risks and complexities associated with investing in the still-emerging quantum computing sector. While the D-Wave Quantum (QBTS) stock plunge raises significant concerns, understanding the nuances of Kerrisdale Capital's valuation concerns is crucial for informed investment decisions in the dynamic quantum computing sector. Continue your research on D-Wave Quantum and other quantum computing stocks to make well-informed choices based on comprehensive analysis and risk assessment. Further investigation into the D-Wave Quantum (QBTS) situation is strongly encouraged.

Featured Posts

-

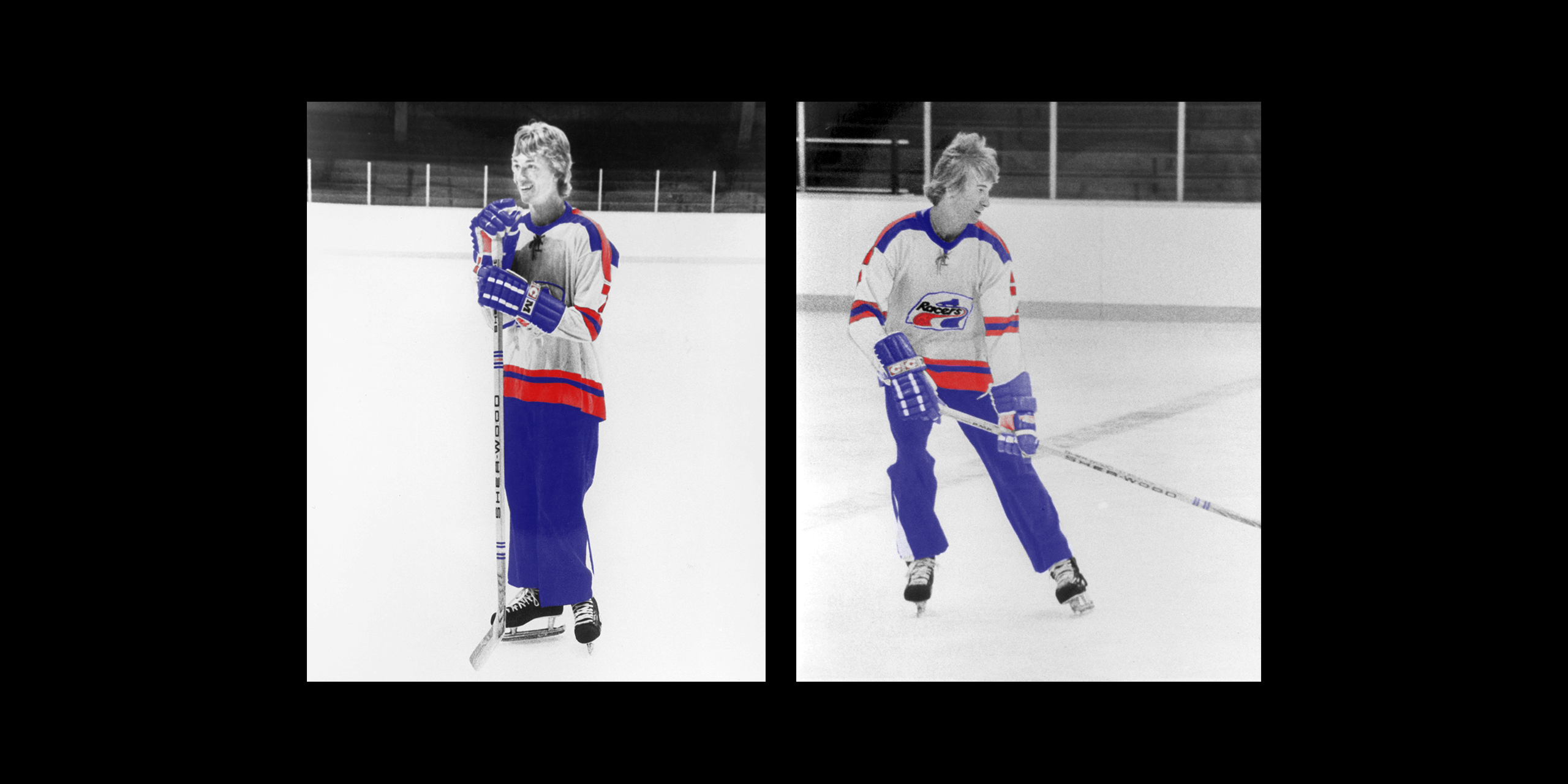

Wayne Gretzkys Legacy Under Scrutiny The Trump Factor

May 20, 2025

Wayne Gretzkys Legacy Under Scrutiny The Trump Factor

May 20, 2025 -

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025

Wwe Raw 5 19 2025 Review Hits And Misses

May 20, 2025 -

Trump Presidency Fuels Surge In American Applications For European Citizenship

May 20, 2025

Trump Presidency Fuels Surge In American Applications For European Citizenship

May 20, 2025 -

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025 -

The Evolution Of Hercule Poirot In Agatha Christies Novels

May 20, 2025

The Evolution Of Hercule Poirot In Agatha Christies Novels

May 20, 2025