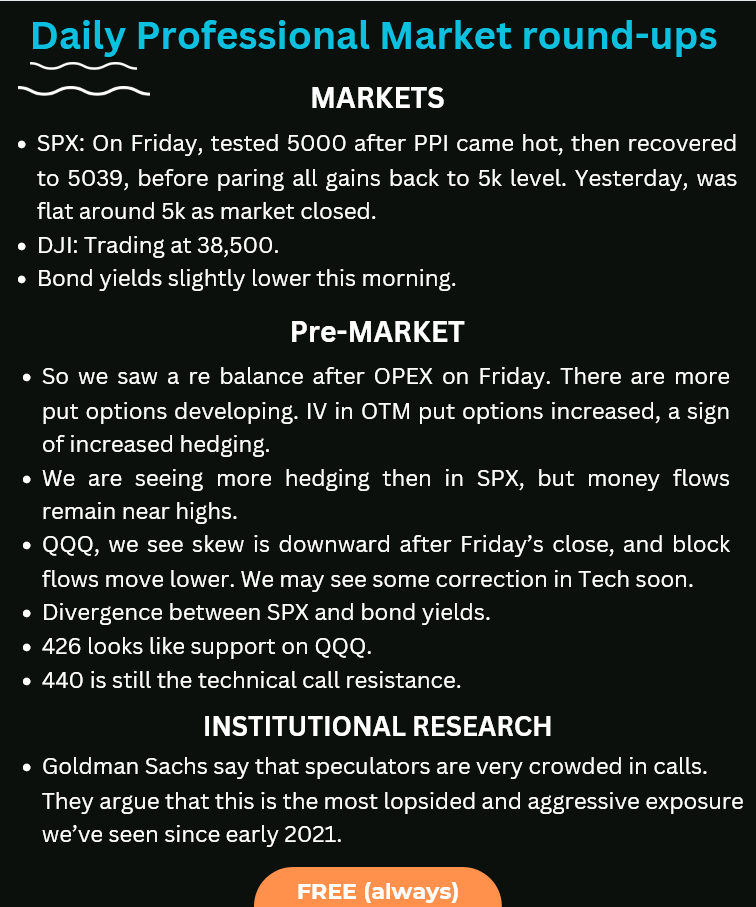

D-Wave Quantum (QBTS) Stock Price Increase: A Deep Dive Into The Market Drivers

Table of Contents

Technological Advancements and Market Adoption of Quantum Computing

The D-Wave Quantum stock price increase is intrinsically linked to advancements in quantum computing technology and its growing market adoption. Understanding D-Wave's unique approach and the expanding demand for quantum solutions is crucial.

D-Wave's Unique Quantum Annealing Approach

D-Wave's technology differentiates itself through its focus on quantum annealing, a method designed to solve specific optimization problems. While not a universal quantum computer like gate-based models, its specialized approach offers advantages in certain applications. However, limitations exist compared to other approaches.

- Recent Breakthroughs: D-Wave has consistently released new generations of its quantum annealers with increased qubit counts and improved performance metrics. These advancements directly impact the company's potential and investor confidence.

- Key Partnerships: Collaborations with leading organizations across various industries are accelerating the adoption of D-Wave's technology, showcasing real-world applications and validating its potential. These partnerships bolster the QBTS stock price.

- Applications: D-Wave's quantum annealers are finding applications in diverse fields, including:

- Financial modeling and risk management

- Drug discovery and materials science

- Logistics and supply chain optimization

- Artificial intelligence and machine learning

Growing Market Demand for Quantum Computing Solutions

The quantum computing market is experiencing explosive growth, creating a favorable environment for companies like D-Wave Quantum. This surge in demand fuels the QBTS stock price increase.

- Market Growth: Market research firms project substantial growth in the quantum computing market over the next decade, with billions of dollars in potential revenue.

- Key Industries: Industries like finance, healthcare, and logistics are actively exploring quantum computing's potential to solve complex problems and gain a competitive edge. This expanding application base supports the D-Wave Quantum stock price increase.

- Competitive Landscape: While competition is emerging in the quantum computing field, D-Wave maintains a strong position as a leader in quantum annealing, a niche with significant potential.

Financial Performance and Investor Sentiment

Analyzing D-Wave's financial performance and investor sentiment provides further insight into the QBTS stock price increase. Understanding financial reports and analyst opinions is crucial for evaluating the investment opportunity.

D-Wave's Financial Reports and Key Metrics

D-Wave's financial reports offer valuable insights into its operational performance and future outlook. Tracking key metrics such as revenue growth, expenses, and profitability helps understand the drivers behind the QBTS stock price.

- Key Financial Highlights: Analyzing revenue streams, operating margins, and research and development spending helps determine the company's financial health and growth trajectory. Positive trends contribute to the QBTS stock price increase.

- Revenue Streams: Monitoring the diversification of revenue streams and the success of new product launches or service offerings is vital for understanding the sustainability of growth.

- Investor Relations: Transparency and proactive communication with investors are essential. D-Wave's investor relations activities influence investor sentiment and consequently the QBTS stock price.

Analyst Ratings and Stock Recommendations

Analyst ratings and stock recommendations play a significant role in shaping investor sentiment and trading activity. These opinions directly impact the QBTS stock price increase.

- Analyst Reports: Tracking ratings from prominent financial analysts provides a consensus view of the stock's potential. Positive reviews often contribute to increased investor confidence and a higher QBTS stock price.

- Consensus View: The overall sentiment expressed by analysts impacts the market's perception of D-Wave Quantum's future prospects and influences trading volume.

- Impact on Investor Sentiment: Positive analyst ratings can boost investor confidence, leading to increased demand and a higher QBTS stock price.

External Factors Influencing QBTS Stock Price

Beyond internal factors, macroeconomic conditions and geopolitical events also influence the QBTS stock price. Understanding these external forces provides a more complete picture.

Macroeconomic Conditions and Market Trends

Broader economic conditions and market trends significantly influence the technology sector, including D-Wave Quantum. This context is critical for understanding the QBTS stock price increase.

- Macroeconomic Indicators: Interest rates, inflation, and overall economic growth affect investor risk appetite and investment decisions in the technology sector.

- Market Trends: General market trends and investor sentiment towards technology stocks impact the performance of individual companies like D-Wave Quantum.

- Investor Risk Appetite: During periods of economic uncertainty, investors may become more risk-averse, impacting the valuation of growth stocks like QBTS.

Geopolitical Events and Regulatory Changes

Geopolitical events and regulatory changes can also influence the quantum computing industry and, consequently, the QBTS stock price.

- Geopolitical Instability: Global events can create uncertainty and impact investment decisions, potentially affecting the QBTS stock price.

- Regulatory Landscape: Government policies and regulations related to quantum computing technology can either stimulate or hinder market growth and impact the QBTS stock price.

- Government Initiatives: Government funding and support for quantum computing research and development can positively influence the sector's growth and the QBTS stock price.

Conclusion: Investing in the Future of D-Wave Quantum (QBTS)

The D-Wave Quantum (QBTS) stock price increase is driven by a confluence of factors, including technological advancements, growing market demand, strong financial performance, positive analyst sentiment, and favorable macroeconomic conditions. Understanding these interconnected elements is crucial for investors considering a position in QBTS. Key takeaways include the importance of D-Wave's technological progress, the expanding market for quantum computing solutions, and the influence of external market forces. Learn more about investing in D-Wave Quantum, stay informed on the future of QBTS stock price, and analyze the potential of D-Wave Quantum's technology for long-term growth. Consider adding D-Wave Quantum to your portfolio after conducting thorough due diligence.

Featured Posts

-

Understanding Ftv Lives A Hell Of A Run

May 20, 2025

Understanding Ftv Lives A Hell Of A Run

May 20, 2025 -

Abc Cbs And Nbc Face Criticism For Censoring New Mexico Gop Arson Attack Coverage

May 20, 2025

Abc Cbs And Nbc Face Criticism For Censoring New Mexico Gop Arson Attack Coverage

May 20, 2025 -

Eurovision 2025 Finalist Ranking From Captivating To Catastrophic

May 20, 2025

Eurovision 2025 Finalist Ranking From Captivating To Catastrophic

May 20, 2025 -

Biarritz Celebre Le 8 Mars Evenements Autour Du Parcours Des Femmes

May 20, 2025

Biarritz Celebre Le 8 Mars Evenements Autour Du Parcours Des Femmes

May 20, 2025 -

Endgueltige Formgebung Am Bau Entscheidungen Der Architektin

May 20, 2025

Endgueltige Formgebung Am Bau Entscheidungen Der Architektin

May 20, 2025