Dalton And A Murakami-Linked Fund's Strategic Investment In Fuji Media

Table of Contents

Dalton's Investment Strategy and Focus

Dalton Capital Partners, a renowned private equity firm, is known for its meticulous investment approach. Their investment thesis centers on identifying undervalued assets with significant growth potential within specific sectors. This involves a thorough due diligence process, encompassing detailed market analysis, risk assessment, and a comprehensive understanding of the target company's financials and operational capabilities. Dalton's focus is firmly on long-term value creation, eschewing short-term gains for sustainable, profitable growth. Their portfolio reflects a commitment to this strategy, showcasing a history of successful investments in media and related sectors. Key aspects of Dalton's investment strategy include:

- Focus on Undervalued Assets: Dalton actively seeks companies with intrinsic value not yet reflected in their market capitalization.

- Rigorous Due Diligence: A comprehensive process involving financial modeling, competitive analysis, and management team assessments.

- Long-Term Value Creation: A preference for investments offering sustained growth potential rather than quick returns.

- Proven Track Record: A history of successful investments in media and related industries provides strong evidence of their expertise.

The Murakami-Linked Fund's Role and Influence

The involvement of a Murakami-linked fund adds another layer of complexity and intrigue to this strategic investment. While the exact fund remains to be fully identified, its association with the prominent investor, Yoshiaki Murakami, suggests a potential activist investing approach. Murakami is known for his involvement in corporate governance improvements and financial restructuring. The fund's participation might signify a desire to influence Fuji Media's strategic direction, perhaps pushing for changes in management, operational efficiency, or even a broader restructuring of the company. Several factors warrant closer examination:

- Fund Identification and Investment History: Uncovering the specific fund's past investments will reveal its typical investment strategy and preferred targets.

- Influence on Fuji Media's Management: The fund's stake could provide leverage to influence key decisions within Fuji Media.

- Motives for Investment: Understanding the fund's goals—whether it's improved corporate governance, financial restructuring, or strategic partnerships—is crucial.

- Synergies with Dalton: The collaboration between Dalton and the Murakami-linked fund could leverage their respective expertise for optimal results.

Fuji Media's Current Situation and Future Outlook

Fuji Media Holdings currently occupies a significant position within the Japanese media market. However, the industry is undergoing rapid transformation, driven by digitalization and evolving consumer preferences. Fuji Media's current financial performance, while relatively stable, needs to adapt to these shifts. Analyzing its market share, competitive landscape, and recent financial results provides a crucial context for understanding the investment's implications.

- Market Share and Competition: Fuji Media faces competition from established players and new entrants in the digital media space.

- Financial Performance and Trends: Analyzing recent revenue, profit margins, and debt levels paints a picture of the company's health.

- Growth Strategies: Fuji Media's ability to adapt and innovate will be crucial for navigating the changing media landscape.

- Impact of the Investment: Dalton and the Murakami-linked fund's investment could inject capital, expertise, and a renewed strategic vision.

Potential Impact on the Japanese Media Landscape

This strategic investment carries significant implications for the broader Japanese media market. The involvement of a prominent private equity firm and a potentially activist fund could trigger a wave of industry consolidation, accelerate digital transformation efforts, and reshape the competitive landscape. Several key areas will be affected:

- Increased Competition: The investment could intensify competition among media companies, driving innovation and potentially leading to mergers and acquisitions.

- Industry Restructuring: This investment could act as a catalyst for larger-scale restructuring within the Japanese media industry.

- Digital Transformation: The infusion of capital and expertise could accelerate Fuji Media's adoption of new technologies and digital platforms.

- Changes in Media Content: The strategic direction of Fuji Media may influence the type and quality of content produced and distributed.

Conclusion

Dalton Capital Partners' and the Murakami-linked fund's strategic investment in Fuji Media represents a significant development in the Japanese media sector. This move underscores the ongoing transformation of the industry and highlights the growing influence of private equity and activist investors. The investment’s success will hinge on Fuji Media's ability to adapt to the evolving digital landscape and leverage the expertise brought in by its new investors. The long-term impact on the competitive landscape and the overall Japanese media market remains to be seen, but one thing is certain: this is a pivotal moment for Fuji Media and the industry as a whole. Stay informed about future strategic investments in the Japanese media sector and learn more about the impact of this significant investment in Fuji Media by following our publication for further analysis.

Featured Posts

-

Bauarbeiten In Pulheim Aktuelle Einschraenkungen Und Umleitungen

May 29, 2025

Bauarbeiten In Pulheim Aktuelle Einschraenkungen Und Umleitungen

May 29, 2025 -

Air Jordan May 2025 Releases Dates Styles And Where To Buy

May 29, 2025

Air Jordan May 2025 Releases Dates Styles And Where To Buy

May 29, 2025 -

Canadians Boycotting Us Are American Tourists Still Welcome

May 29, 2025

Canadians Boycotting Us Are American Tourists Still Welcome

May 29, 2025 -

Venlose Politiek Jozanne Van Der Velden Streeft Naar Wethouderschap

May 29, 2025

Venlose Politiek Jozanne Van Der Velden Streeft Naar Wethouderschap

May 29, 2025 -

Tate Mc Rae And Morgan Wallen Collaboration Sparks Political Backlash

May 29, 2025

Tate Mc Rae And Morgan Wallen Collaboration Sparks Political Backlash

May 29, 2025

Latest Posts

-

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025 -

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025 -

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025 -

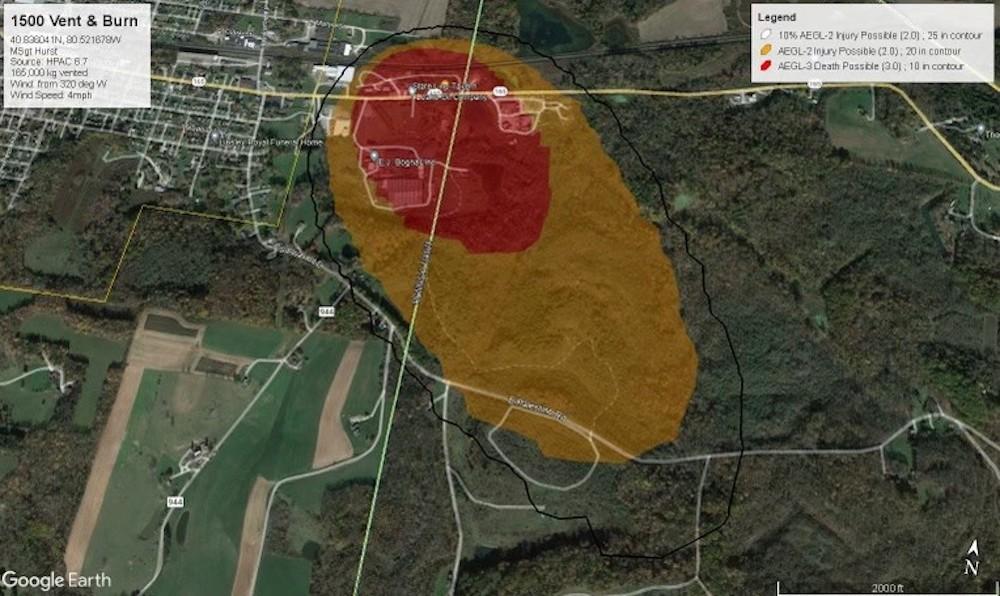

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

May 31, 2025

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

May 31, 2025 -

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 31, 2025

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 31, 2025