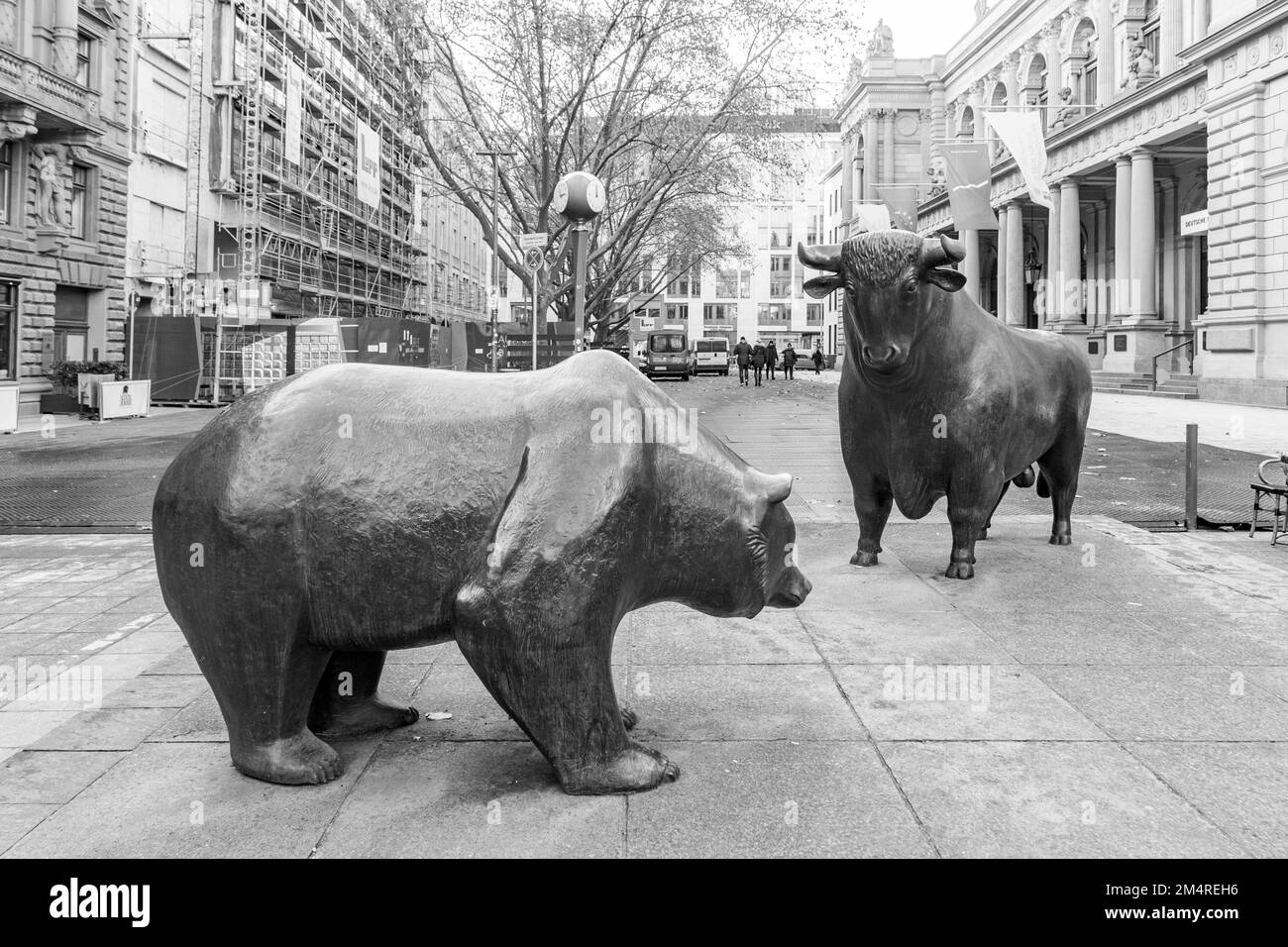

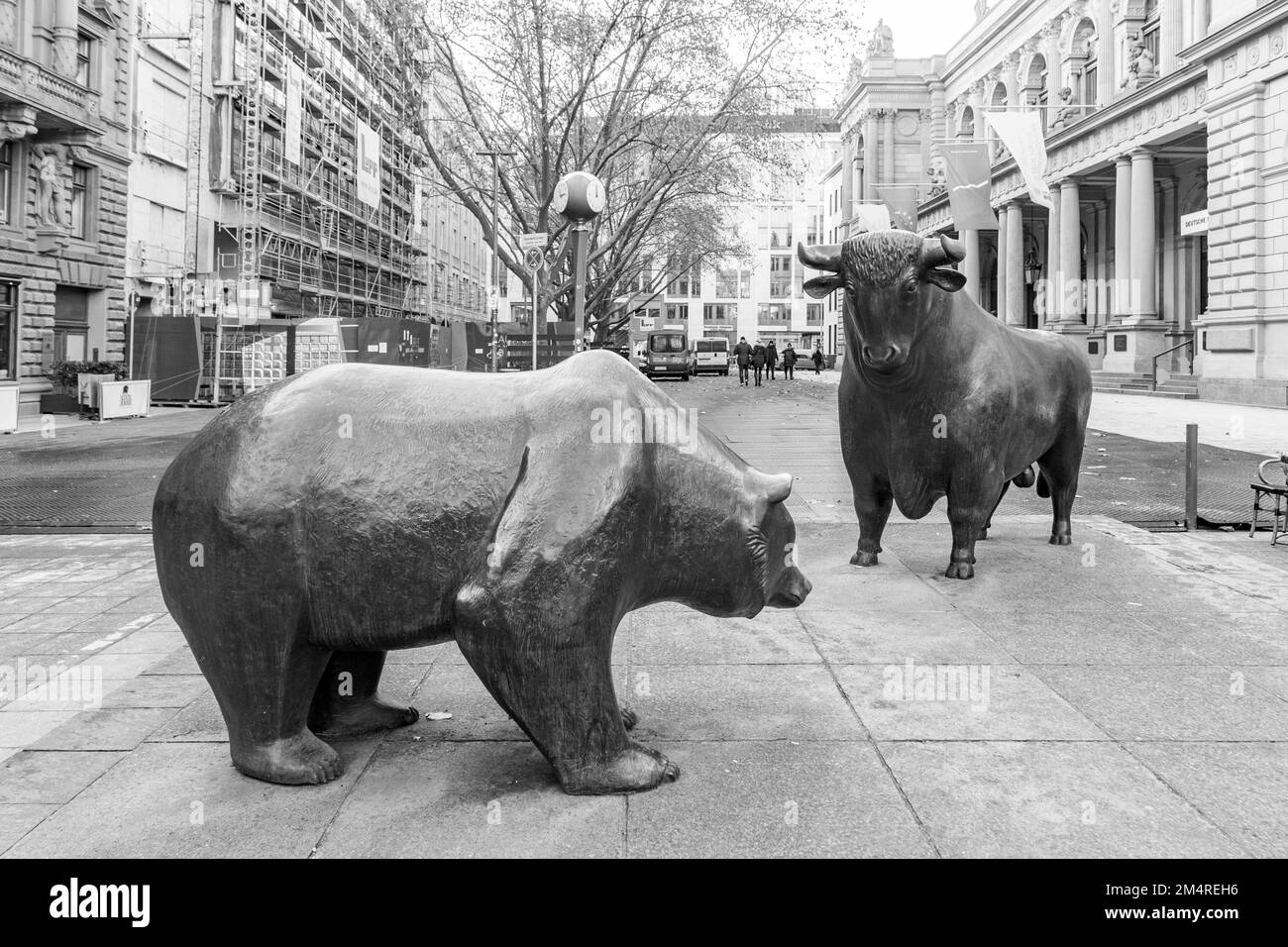

DAX Stability At Frankfurt Stock Exchange Opening: Analysis

Table of Contents

Pre-Market Indicators and their Impact on DAX Stability

Several pre-market indicators significantly influence the DAX's opening stability. Analyzing these indicators provides valuable insights for traders and investors seeking to understand the market's initial direction.

Global Market Trends

Overnight changes in US and Asian markets heavily influence the DAX's opening. A positive or negative sentiment often spills over into European trading.

- Impact of Dow Jones performance: A strong close on the Dow Jones Industrial Average usually suggests positive momentum carrying over to Europe, potentially leading to DAX stability or even growth at the opening. Conversely, a weak Dow Jones performance can signal a negative start for the DAX.

- Asian stock market fluctuations: Similar to the Dow Jones, significant movements in major Asian markets like the Nikkei or Shanghai Composite can foreshadow the DAX's opening behavior. A surge in Asian markets can indicate a positive global outlook, while a decline might suggest caution among European investors.

- Currency exchange rates (especially EUR/USD): Fluctuations in the Euro against the US dollar directly impact the DAX, as many German companies are involved in international trade. A strengthening Euro can positively affect the DAX, while a weakening Euro could lead to increased volatility.

The speed at which global market sentiment impacts the DAX is remarkable; news and events often transmit across markets rapidly, making real-time data analysis crucial for accurate prediction of DAX stability.

Economic Data Releases

Key economic data releases before the Frankfurt Stock Exchange opens significantly impact DAX stability. These releases provide insights into the health of the German and European economies.

- German inflation (CPI): Higher-than-expected inflation figures often lead to increased volatility and potential downward pressure on the DAX, reflecting concerns about economic growth and potential interest rate hikes.

- German GDP growth: Strong GDP growth figures usually signal positive investor sentiment and contribute to DAX stability or upward movement. Conversely, weak GDP growth can lead to increased uncertainty and market volatility.

- Manufacturing PMI (Purchasing Managers' Index): The PMI provides a snapshot of manufacturing activity. A strong PMI indicates healthy industrial production and can positively influence DAX stability; a weak PMI can negatively impact the market.

The market's reaction time to these data releases is usually very quick, often within minutes of the announcement.

Futures Contracts

DAX futures contracts, traded before the official opening, offer valuable insights into the expected opening levels and volatility.

- Predictive power of futures prices: Futures prices act as a leading indicator, reflecting the collective expectations of market participants about the DAX's opening price.

- Volume and price action: High trading volume in futures contracts, combined with significant price movements, often signals strong investor sentiment and potential volatility at the opening.

The futures market provides a crucial window into pre-market sentiment, giving traders and investors a head-start in understanding potential DAX stability.

Impact of Geopolitical Events on DAX Opening Stability

Geopolitical events significantly impact investor confidence and consequently, the DAX's opening stability. Uncertainty and risk aversion often lead to increased volatility.

International News and Conflicts

Global political instability or significant international events can directly influence DAX opening values.

- International tensions: Escalating geopolitical tensions, such as international conflicts or trade disputes, often create uncertainty and lead to risk-averse behavior among investors, increasing DAX volatility.

- Political instability in key trading partners: Political instability in major trading partners of Germany can create uncertainty and negatively affect investor sentiment, potentially leading to DAX instability.

These events directly affect investor confidence and consequently influence trading decisions.

Regulatory Changes and Policy Announcements

New regulations or policy announcements impacting German or European businesses can significantly influence DAX stability.

- Impact of new regulations: Unexpected or stringent regulatory changes can create uncertainty and volatility, particularly if they affect major companies listed on the DAX.

- Consequences of policy announcements: Announcements regarding fiscal policy, monetary policy, or industry-specific regulations can have significant short-term and long-term effects on the DAX's performance.

Anticipation of policy announcements often influences pre-market trading activity and can impact the DAX opening.

Investor Sentiment and its Role in DAX Stability

Investor sentiment, shaped by various factors, plays a crucial role in DAX stability. Understanding prevailing sentiment is essential for predicting market behavior.

Analyst Ratings and Reports

Pre-market analyst reports and ratings significantly shape investor sentiment and the DAX opening.

- Influence of major investment banks: Recommendations and ratings from major investment banks often carry considerable weight, influencing investors' decisions and trading activity.

- Impact of positive or negative ratings: Positive ratings generally boost investor confidence and can lead to DAX stability or growth, while negative ratings can trigger selling pressure and increase volatility.

Analyst reports act as a powerful influencer of investor behavior.

Social Media Sentiment

Social media and news sentiment increasingly influence the opening DAX values.

- Impact of social media trends: Trends and discussions on social media platforms can reflect overall market sentiment, influencing investor behavior and potentially impacting DAX stability.

- Influence of news headlines: Positive or negative news headlines concerning German companies or the broader economy directly impact investor perception and, consequently, the DAX opening.

Social media amplifies market sentiment and contributes significantly to pre-market prediction of DAX stability.

Conclusion

The stability of the DAX at the Frankfurt Stock Exchange opening is a complex interplay of pre-market indicators, geopolitical events, and investor sentiment. Understanding these factors is crucial for effective investment strategies. By analyzing global market trends, economic data releases, geopolitical events, and investor sentiment, a more informed assessment of DAX stability can be made. To stay updated on the daily fluctuations and factors influencing DAX stability, continue to monitor pre-market indicators and global news affecting the German economy. Regularly check for analyses on DAX stability to optimize your trading strategies. Mastering the prediction of DAX stability requires consistent monitoring and in-depth analysis of all these factors.

Featured Posts

-

Sutton Hoos Mysterious Sixth Century Vessel A Burial Urn For Cremated Remains

May 25, 2025

Sutton Hoos Mysterious Sixth Century Vessel A Burial Urn For Cremated Remains

May 25, 2025 -

Gambling On Disaster The Rise Of Wildfire Betting And What It Means

May 25, 2025

Gambling On Disaster The Rise Of Wildfire Betting And What It Means

May 25, 2025 -

Joy Crookes Unveils Haunting New Music I Know You D Kill

May 25, 2025

Joy Crookes Unveils Haunting New Music I Know You D Kill

May 25, 2025 -

5 Must See Action Episodes Of Lock Up

May 25, 2025

5 Must See Action Episodes Of Lock Up

May 25, 2025 -

Soiree Transformiste Avec Zize A Graveson Le 4 Avril

May 25, 2025

Soiree Transformiste Avec Zize A Graveson Le 4 Avril

May 25, 2025