Defense Sector Investment Surge: BigBear.ai (BBAI) Maintains Buy Rating

Table of Contents

The Current Defense Sector Investment Boom and its Drivers

The surge in defense sector investment isn't a fleeting trend; it's a response to evolving global dynamics. Increased geopolitical risk, particularly stemming from ongoing conflicts and escalating tensions, is a primary driver. Nations are prioritizing national security and modernizing their defense capabilities at an unprecedented rate. This translates to significantly increased defense spending globally. Furthermore, rapid technological advancements, especially in artificial intelligence (AI) and data analytics, are creating a huge demand for sophisticated defense technologies.

- Increased government budgets for national security: Governments worldwide are allocating significantly larger portions of their budgets to defense modernization and strengthening national security infrastructure.

- Technological advancements driving demand for AI and data analytics in defense: AI-powered systems, predictive analytics, and advanced data processing are revolutionizing defense strategies, driving investment in related technologies and companies.

- Geopolitical uncertainties fueling investment in defense technologies: The complex geopolitical landscape necessitates continuous investment in cutting-edge defense systems, creating a robust market for innovative solutions.

This investment growth is impacting key players across the sector, leading to increased mergers and acquisitions, and fostering a highly competitive but lucrative landscape. The demand for companies offering cutting-edge Defense Technology is at an all-time high.

BigBear.ai (BBAI)'s Strengths and Competitive Advantage

BigBear.ai (BBAI) is a key player in this booming market, leveraging its expertise in AI, data analytics, and cybersecurity to provide critical solutions to the defense sector. Their capabilities extend across various domains, including intelligence analysis, cybersecurity threat detection, and mission support. BBAI's recent achievements solidify its strong position.

- Proven track record in delivering defense-related solutions: BBAI has a history of successfully delivering complex projects, demonstrating its ability to meet the rigorous demands of the defense industry.

- Strong partnerships with key players in the defense industry: Collaborations with leading defense contractors and government agencies provide BBAI with access to valuable resources and expand its market reach.

- Innovative use of AI and machine learning in defense applications: BBAI's expertise in AI and machine learning enables it to develop cutting-edge solutions for various defense applications, providing a significant competitive advantage. This includes applications of AI in Defense systems, and sophisticated Data Analytics in Defense operations.

These BBAI Contracts showcase the company's ability to secure and deliver on significant projects, contributing to its strong financial performance and growth trajectory.

Why the "Buy" Rating Persists Despite the Market Volatility

Despite the inherent volatility in the stock market, the "Buy" rating for BBAI persists due to several key factors. The company's strong financial performance, even amidst market fluctuations, showcases its resilience. More importantly, BBAI's positive future outlook, driven by a robust pipeline of potential contracts and ongoing market expansion, supports the long-term growth potential.

- Strong financial performance despite market fluctuations: BBAI has demonstrated consistent financial growth, indicating its ability to navigate market uncertainties.

- Positive future outlook based on current contracts and pipeline: A healthy backlog of contracts and a strong pipeline of future opportunities point towards sustained revenue growth.

- Potential for significant growth in the expanding defense market: BBAI is well-positioned to capitalize on the continued expansion of the defense technology market, benefiting from increased government spending and technological advancements. This potential for Long-Term Growth is a key driver for the positive investment analysis. The BBAI stock price reflects this potential.

The Buy Recommendation remains strong due to these factors, making BBAI a compelling investment option even in a volatile market.

Potential Risks and Considerations for Investors

While the outlook for BBAI is positive, investors should be aware of potential risks. The defense technology sector is highly competitive, and BBAI faces competition from established players and emerging startups. Regulatory changes and compliance requirements can also impact operations and profitability. Furthermore, dependence on government contracts introduces a degree of uncertainty.

- Competition from other players in the defense technology sector: BBAI competes with a range of companies, both large and small, necessitating continuous innovation and adaptation.

- Regulatory hurdles and compliance requirements: Navigating the complex regulatory landscape of the defense industry presents challenges and potential risks.

- Dependence on government contracts: Fluctuations in government spending and contracting cycles can impact BBAI's revenue streams. This BBAI Risk needs careful consideration.

These Investment Risks must be weighed against the potential rewards before making any investment decision.

Conclusion: Investing in the Future of Defense with BigBear.ai (BBAI)

The surge in Defense Sector Investment presents significant opportunities. BigBear.ai (BBAI), with its strong competitive advantages and positive growth outlook, is well-positioned to capitalize on this trend. The maintained "Buy" rating reflects a positive assessment of the company's long-term potential, despite the market's volatility. The reasons for a Buy BBAI recommendation are clear: strong financials, a healthy pipeline, and a position at the forefront of innovation in a booming sector. Dive deeper into BigBear.ai (BBAI) and explore the potential of this exciting investment opportunity in the booming defense sector. Consider a Defense Sector Investment Strategy that includes BigBear.ai (BBAI) for a diversified and potentially high-growth portfolio. The BBAI Stock Outlook remains positive based on this analysis.

Featured Posts

-

Balancing Act Ferraris Hamilton Leclerc Driver Management

May 20, 2025

Balancing Act Ferraris Hamilton Leclerc Driver Management

May 20, 2025 -

Marche Africain Des Solutions Spatiales Mass Abidjan Accueille La Premiere Edition

May 20, 2025

Marche Africain Des Solutions Spatiales Mass Abidjan Accueille La Premiere Edition

May 20, 2025 -

Talisca Ve Fenerbahce Saha Tartismasi Ve Tadic Transferi

May 20, 2025

Talisca Ve Fenerbahce Saha Tartismasi Ve Tadic Transferi

May 20, 2025 -

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa

May 20, 2025

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa

May 20, 2025 -

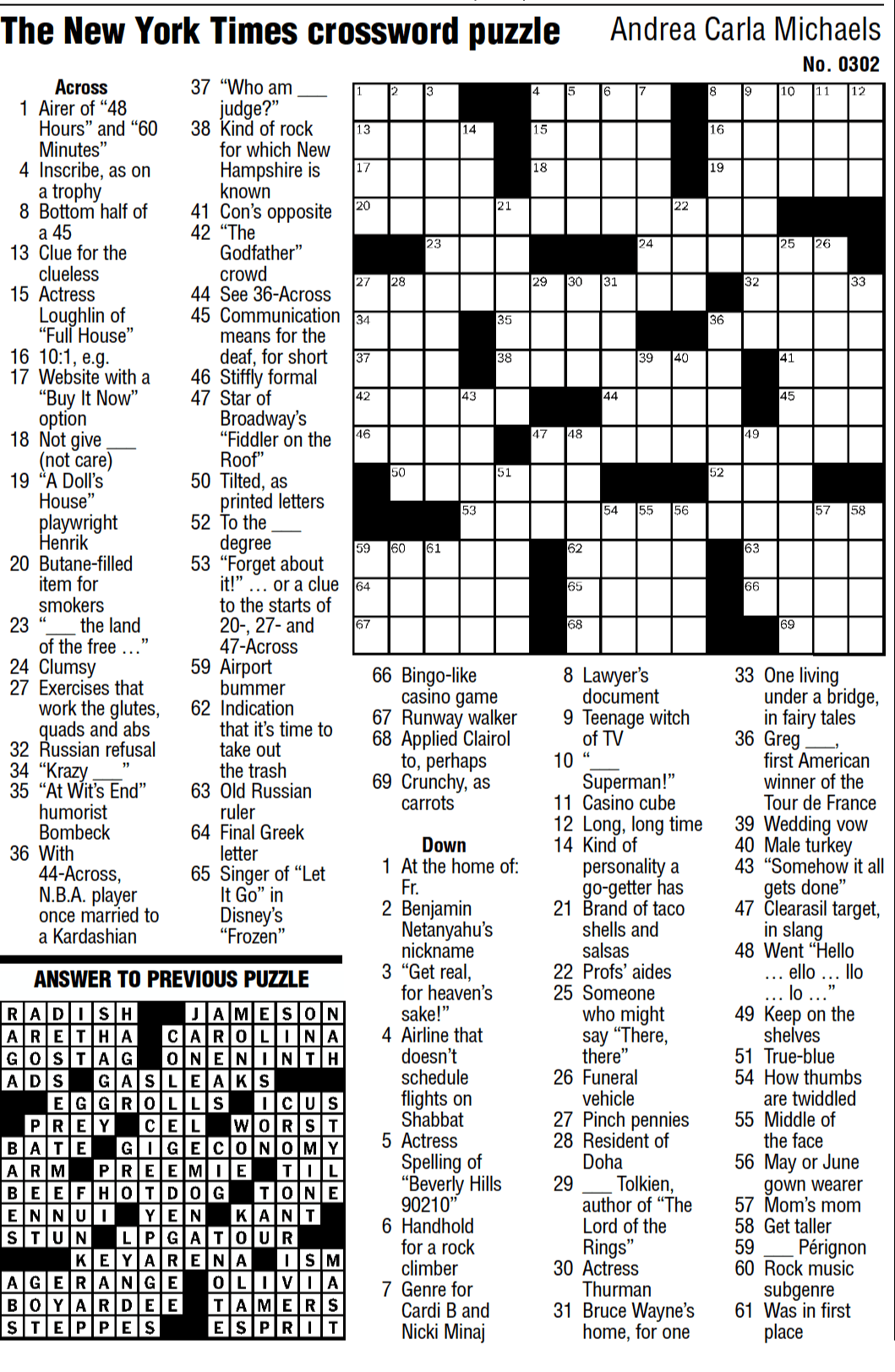

Nyt Crossword Clue Solutions April 25 2025

May 20, 2025

Nyt Crossword Clue Solutions April 25 2025

May 20, 2025