Definity's Strategic Acquisition: $3.3 Billion Investment In Travelers Canada

Table of Contents

Understanding the Significance of the Acquisition for Definity

This acquisition represents a bold move for Definity, significantly bolstering its position in the Canadian insurance market. Definity's strategic goals clearly center on expanding its market share and diversifying its product offerings. Acquiring Travelers Canada, a well-established player with a strong reputation and substantial customer base, directly aligns with these ambitions.

The benefits for Definity are multifold:

- Increased Market Capitalization: The acquisition instantly increases Definity's market capitalization, solidifying its standing among leading Canadian insurers.

- Expanded Market Share: This acquisition grants Definity immediate access to a larger segment of the Canadian insurance market, potentially leading to significant revenue growth.

- Diversification of Product Offerings: Travelers Canada's existing product portfolio complements Definity's current offerings, creating a more comprehensive and attractive suite of insurance solutions for customers.

- Synergies with Existing Definity Operations: Opportunities for cost savings and operational efficiencies exist through the integration of Travelers Canada's operations with Definity's existing infrastructure.

- Enhanced Competitive Advantage: The acquisition creates a stronger, more formidable competitor in the fiercely competitive Canadian insurance landscape.

Analyzing the Implications for Travelers Canada

Travelers Canada's decision to sell likely stems from a strategic refocusing of Travelers' global operations. By divesting its Canadian operations, Travelers can concentrate its resources on other key markets and business lines worldwide.

For Travelers Canada employees, the acquisition presents both challenges and opportunities. While there's potential for job security under Definity's ownership, there may also be adjustments during the integration process. For shareholders, the sale translates into substantial capital gains, representing a successful exit strategy. Key implications for Travelers Canada include:

- Strategic Refocusing of Travelers' Global Operations: This divestiture allows Travelers to streamline its global portfolio and focus on higher-growth areas.

- Capital Gains for Shareholders: The sale provides significant returns for Travelers Canada's shareholders.

- Potential Smoother Transition for Employees: Under Definity's management, employees might experience a more seamless transition compared to other potential scenarios.

The Broader Impact on the Canadian Insurance Market

This $3.3 billion acquisition has profound implications for the Canadian insurance market's competitive landscape. While it could lead to increased competition in some sectors, it also has the potential to foster consolidation, with smaller players potentially facing increased pressure.

The acquisition may also influence insurance premiums and services. Increased competition could potentially lead to more competitive pricing, but the integration process could also lead to short-term adjustments. Regulatory bodies will undoubtedly scrutinize the deal to ensure it doesn't lead to anti-competitive practices.

Key impacts on the broader market include:

- Increased Competition or Consolidation?: The acquisition may lead to increased competition or, conversely, further consolidation within the Canadian insurance sector.

- Potential Changes in Insurance Pricing and Policy Offerings: Premiums and policy offerings might change in response to the increased market share of Definity.

- Regulatory Scrutiny and Approval Process: The acquisition will be subject to thorough regulatory review and approval.

- Impact on Smaller Insurance Providers in Canada: Smaller insurers may face increased competition and pressure to innovate and adapt.

Financial Aspects and Future Outlook of the Deal

The financial terms of the acquisition will likely involve a combination of cash and potentially other financial instruments. The timeline for completing the acquisition will depend on regulatory approvals and the integration of Travelers Canada into Definity's existing structure.

Definity's long-term financial projections following the acquisition will be closely watched by investors. Successful integration and synergy realization will be crucial to maximizing returns.

Key financial aspects:

- Financing Mechanisms Used for the Acquisition: A mix of cash, debt financing, and potentially other financial instruments will likely be used.

- Projected Timeline for Integration of Travelers Canada into Definity: The integration process will likely take several months or even years to fully complete.

- Long-Term Financial Forecasts and Expected ROI for Definity: Definity will need to demonstrate a clear path to significant returns on its substantial investment.

- Potential Impact on Definity's Stock Price: The market's response to the acquisition will significantly influence Definity's stock price in the short and long term.

Conclusion: Definity's Strategic Acquisition: A Defining Moment for the Canadian Insurance Sector

Definity's $3.3 billion acquisition of Travelers Canada is a defining moment for the Canadian insurance sector. This strategic move significantly strengthens Definity's position, alters the competitive landscape, and has far-reaching implications for both companies and the market as a whole. The long-term success of this ambitious undertaking hinges on effective integration, regulatory approvals, and the ability to generate substantial returns on investment. The impact on insurance premiums, services, and smaller players remains to be seen.

To learn more about Definity's strategic acquisitions and their impact on the Canadian insurance market, visit [link to Definity website or relevant news source]. Understanding Definity's strategic acquisitions is key to understanding the future of the Canadian insurance market.

Featured Posts

-

Des Moines Memorial Day Weekend Events Parades And Remembrance

May 30, 2025

Des Moines Memorial Day Weekend Events Parades And Remembrance

May 30, 2025 -

House Of Kong Exhibition Gorillaz Take Over Londons Copper Box Arena This Summer

May 30, 2025

House Of Kong Exhibition Gorillaz Take Over Londons Copper Box Arena This Summer

May 30, 2025 -

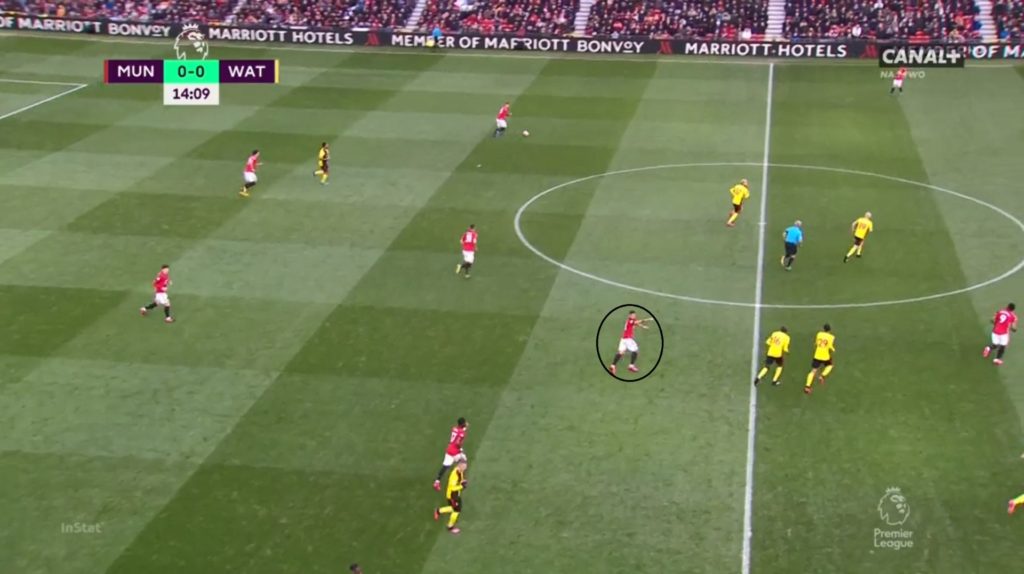

O Impacto De Bruno Fernandes No Manchester United Uma Analise

May 30, 2025

O Impacto De Bruno Fernandes No Manchester United Uma Analise

May 30, 2025 -

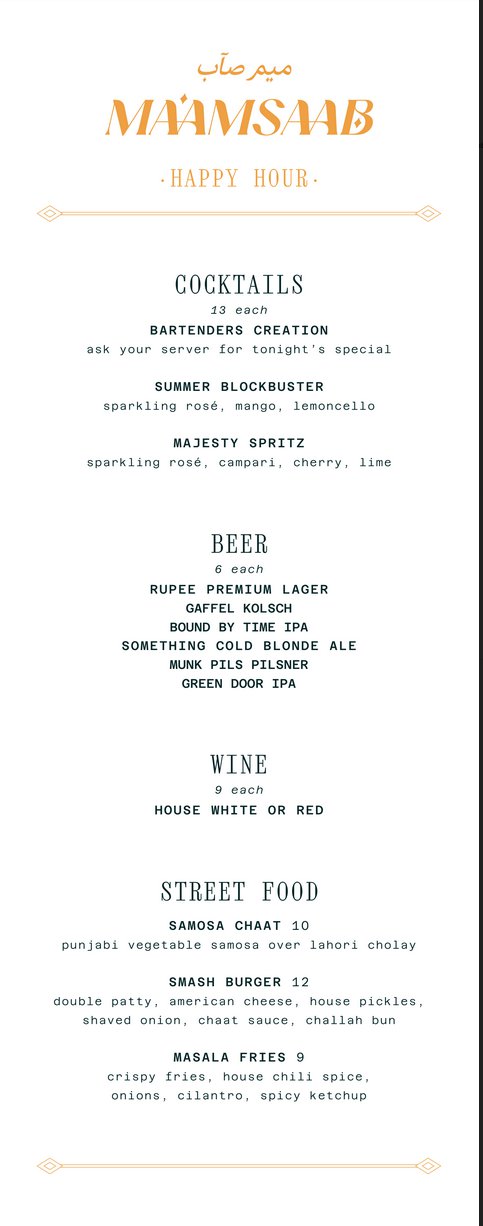

Post Credit Scenes A Pop Culture Happy Hour Analysis Marvel Sinner Etc

May 30, 2025

Post Credit Scenes A Pop Culture Happy Hour Analysis Marvel Sinner Etc

May 30, 2025 -

Strategie De Mobilite Durable L Exemple De La Cooperation France Vietnam

May 30, 2025

Strategie De Mobilite Durable L Exemple De La Cooperation France Vietnam

May 30, 2025

Latest Posts

-

Ben Shelton Defeats Luciano Darderi Advances To Munich Semifinals

May 31, 2025

Ben Shelton Defeats Luciano Darderi Advances To Munich Semifinals

May 31, 2025 -

Italian International Key Matches And Results From Day One

May 31, 2025

Italian International Key Matches And Results From Day One

May 31, 2025 -

The Challenges Thompson Faced In Monte Carlo

May 31, 2025

The Challenges Thompson Faced In Monte Carlo

May 31, 2025 -

Rome Masters Alcaraz Advances Passaro Creates Upset

May 31, 2025

Rome Masters Alcaraz Advances Passaro Creates Upset

May 31, 2025 -

Bmw Open Zverev Rallies Into Semifinals

May 31, 2025

Bmw Open Zverev Rallies Into Semifinals

May 31, 2025