Delinquent Student Loans: The Government's Aggressive Pursuit And Your Rights

Table of Contents

Understanding Delinquent Student Loan Status

Defining Delinquency

A delinquent student loan is defined as a loan where payments have been missed. The specific definition of delinquency often hinges on the number of missed payments. A grace period usually follows the completion of your studies, offering a temporary reprieve before payments begin.

- 90-day delinquency: Missing three consecutive monthly payments typically results in a 90-day delinquency, triggering more serious consequences.

- Consequences of delinquency: Delinquency leads to negative impacts on your credit score, potential wage garnishment, and tax refund offset.

- Impact on credit score: A delinquent loan significantly damages your credit score, making it harder to secure loans, credit cards, or even rent an apartment in the future.

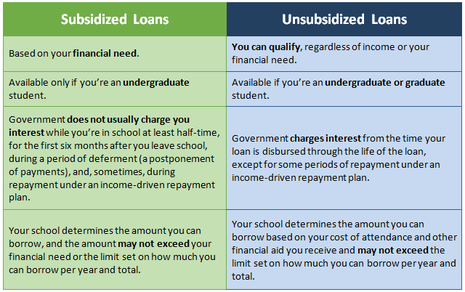

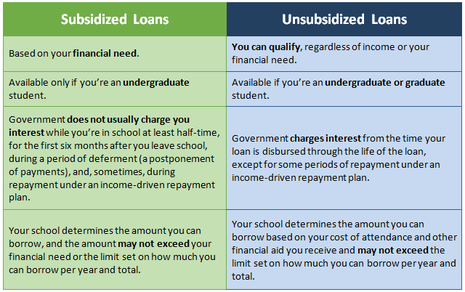

Types of Federal Student Loans

Understanding the type of federal student loan you have is vital. The implications of delinquency differ depending on the loan type.

-

Subsidized loans: The government pays the interest while you're in school and during grace periods.

-

Unsubsidized loans: Interest accrues from the moment the loan is disbursed, even during grace periods.

-

PLUS loans: Loans for parents or graduate students, often with higher interest rates and potentially stricter repayment terms.

-

Interest accrual differences: Subsidized loans avoid interest accrual during certain periods, delaying the growth of your debt. Unsubsidized and PLUS loans accrue interest continuously.

-

Repayment plans: Various repayment plans are available for each loan type, some offering more flexibility than others.

Government Agencies Involved in Collection

Several government agencies play a role in collecting delinquent student loan debt.

-

Department of Education: Oversees the federal student loan program and initially handles collection efforts.

-

Treasury Department: The Treasury Department's role in collections often involves intercepting tax refunds.

-

Private collection agencies: The Department of Education may contract with private agencies to pursue delinquent borrowers.

-

Roles and responsibilities: Each agency has specific responsibilities in the collection process, from initial notification to legal action.

Aggressive Collection Tactics Employed by the Government

The government employs several aggressive tactics to collect delinquent student loans.

Wage Garnishment

Wage garnishment involves the government seizing a portion of your earnings directly from your employer to repay your loan.

- Percentage of wages garnished: The amount garnished is capped by law, typically a percentage of your disposable income.

- Legal protections: While wage garnishment is a powerful tool, there are legal protections in place to prevent excessive seizures and ensure fair treatment.

Tax Refund Offset

The government can intercept and seize your tax refund to apply it towards your student loan debt.

- Process: The IRS automatically offsets refunds for borrowers with delinquent student loans.

- Potential exceptions: There may be exceptions in certain circumstances, but these are rare.

Credit Reporting

Delinquent student loans have a severe negative impact on your credit score.

- Duration of negative information: Negative information remains on your credit report for up to seven years.

- Strategies for improving credit: While difficult to overcome, there are strategies to improve your credit standing after resolving delinquency, such as consistent on-time payments.

Protecting Your Rights as a Borrower

Navigating the complexities of student loan debt requires understanding your rights.

Understanding Your Rights Under the Law

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive collection practices.

- Prohibited practices: The FDCPA prohibits harassing phone calls, threats, and false representations.

- Dispute inaccurate information: You have the right to challenge any inaccurate information reported to credit bureaus.

Exploring Loan Rehabilitation

Loan rehabilitation involves making nine on-time payments within 20 days of the due date to reinstate your loan and potentially remove the default status.

- Removing default status: Successful rehabilitation can remove the default status from your credit report.

- Improving credit score: This can positively affect your credit score over time.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans base your monthly payments on your income and family size. Several plans exist:

-

IBR (Income-Based Repayment): One of the original IDR plans.

-

PAYE (Pay As You Earn): A more generous plan with lower monthly payments.

-

REPAYE (Revised Pay As You Earn): A newer plan that combines features of other IDR plans.

-

ICR (Income Contingent Repayment): An older plan with a longer repayment period.

-

Eligibility requirements: Each plan has specific eligibility requirements.

-

Benefits: IDR plans help manage monthly payments, avoiding default.

Bankruptcy and Student Loans

Discharging student loans through bankruptcy is extremely difficult.

- Undue hardship standard: You must prove that repaying your loans would cause undue hardship.

- Legal process: Bankruptcy involving student loans is a complex legal process requiring legal counsel.

Conclusion

The government's aggressive pursuit of delinquent student loans can have severe financial consequences. However, understanding your rights and exploring options like loan rehabilitation and income-driven repayment plans is crucial. The impact on your credit score can be significant, but it's not insurmountable. Facing delinquent student loans can be overwhelming, but proactive steps can mitigate the damage. Don't face this challenge alone; take control of your delinquent student loan situation today by researching your options and seeking professional guidance if needed. Learn more about managing your delinquent student loan debt and protecting your rights.

Featured Posts

-

Mlb Game Today Tigers Vs Mariners Prediction And Betting Odds

May 17, 2025

Mlb Game Today Tigers Vs Mariners Prediction And Betting Odds

May 17, 2025 -

Understanding The Emirates Id Fee For Newborn Babies In The Uae March 2025

May 17, 2025

Understanding The Emirates Id Fee For Newborn Babies In The Uae March 2025

May 17, 2025 -

Top 3 Reasons To Consider The Ultraviolette Tesseract Electric Scooter

May 17, 2025

Top 3 Reasons To Consider The Ultraviolette Tesseract Electric Scooter

May 17, 2025 -

Condo Crack Crisis Seaweed Breakthrough And Corporate Turmoil Daily News Summary

May 17, 2025

Condo Crack Crisis Seaweed Breakthrough And Corporate Turmoil Daily News Summary

May 17, 2025 -

Angel Reese And Di Jonai Carrington Wnba Players Poised For Strike

May 17, 2025

Angel Reese And Di Jonai Carrington Wnba Players Poised For Strike

May 17, 2025