Desjardins Forecasts Three Further Bank Of Canada Interest Rate Reductions

Table of Contents

Desjardins' Rationale for Predicted Interest Rate Cuts

Desjardins' forecast of three more interest rate cuts stems from a careful analysis of several key economic factors. The institution is signaling a more pessimistic view of the Canadian economy than the Bank of Canada currently projects. Their reasoning hinges on several crucial observations:

-

Weakening Economic Growth in Canada: Desjardins points to slowing GDP growth as a primary concern. Recent economic indicators suggest a significant deceleration in economic activity, raising concerns about a potential recession.

-

Concerns About a Potential Recession: The risk of a recession is a central element in Desjardins' prediction. Several leading economic indicators are flashing warning signs, prompting the institution to anticipate a need for stimulative monetary policy.

-

Easing Inflation, Though Still Above Target: While inflation is showing signs of cooling, it remains stubbornly above the Bank of Canada's target range. Desjardins likely believes that further rate cuts are necessary to push inflation down without triggering a severe economic downturn. This requires a delicate balance – lowering inflation without stifling economic growth.

-

Rising Unemployment (or Forecasts Thereof): Even if current unemployment figures are relatively stable, Desjardins' forecast might incorporate projections of rising unemployment in the near future, which would further justify interest rate reductions as a counter-cyclical measure.

-

Analysis of Recent Economic Indicators: Desjardins' forecast is not simply a gut feeling; it's based on rigorous analysis of recent data on various economic indicators such as GDP growth, consumer spending, and business investment. These data points paint a picture of slowing momentum that warrants intervention.

-

Comparison with Other Economic Analysts' Predictions: It's crucial to note how Desjardins' forecast compares to other economic analysts. Are they outliers, or is this a converging view amongst many experts? Understanding the consensus view offers additional context to Desjardins' prediction.

Potential Impact of Further Interest Rate Reductions

The potential impact of three further interest rate reductions is multifaceted and significant. It will affect various segments of the Canadian economy, both positively and negatively.

-

Lower Mortgage Rates and Increased Affordability for Homebuyers: Lower interest rates will directly translate to lower mortgage rates, making homeownership more affordable and potentially boosting demand in the housing market.

-

Reduced Borrowing Costs for Businesses, Potentially Stimulating Investment: Lower borrowing costs can incentivize businesses to invest in expansion, new equipment, and hiring, thus fostering economic growth. This is a key element of the intended stimulus.

-

Increased Consumer Spending Driven by Lower Interest Rates: Lower interest rates can increase consumer confidence and lead to higher levels of spending, further boosting economic activity.

-

Potential Impact on Inflation – Could it Reignite Inflation or Help Control it?: This is a crucial balancing act. Lower rates could potentially reignite inflationary pressures if not carefully managed. However, the current focus is on mitigating economic slowdown. This could help to moderate inflation through increased supply.

-

Possible Risks Associated with Aggressive Interest Rate Cuts: While interest rate cuts can stimulate the economy, aggressive cuts can carry risks. These include potentially fueling inflation, weakening the Canadian dollar, and creating asset bubbles.

Impact on the Canadian Housing Market

The predicted interest rate cuts will likely have a profound impact on the Canadian housing market.

-

Potential Increase in Homebuyer Demand: Lower mortgage rates are expected to increase the demand for homes, potentially leading to increased competition and higher prices.

-

Possible Upward Pressure on House Prices: The increased demand, combined with limited supply in many areas, could lead to upward pressure on house prices, further impacting affordability.

-

Impact on Mortgage Payment Affordability: While lower interest rates make mortgages cheaper, they don't necessarily offset other costs like property taxes and home insurance which are rising. This must be considered in the overall affordability equation.

-

Analysis of the Potential for a Housing Market Bubble: The combination of lower rates and increased demand raises concerns about the potential for another housing bubble. Careful monitoring is critical to prevent a repeat of past excesses.

Comparison with Bank of Canada's Current Stance

Desjardins' forecast differs from the current stance of the Bank of Canada, which has indicated a more cautious approach to further interest rate adjustments.

-

Summary of the Bank of Canada's Recent Announcements and Statements: The Bank of Canada's recent communications should be carefully reviewed to understand their current perspective on inflation, economic growth, and monetary policy.

-

Comparison of Desjardins' Predictions with the Bank of Canada's Projected Interest Rate Path: A direct comparison reveals the divergence between Desjardins' more aggressive prediction of rate cuts and the Bank of Canada's outlook.

-

Discussion of Potential Factors Contributing to Any Differences in Outlook: The discrepancies likely arise from differing interpretations of economic data, risk tolerance levels, and the relative weighting of various economic factors in their forecasting models. There could also be differences in what constitutes the "ideal" rate of inflation and how quickly it should be reached.

Conclusion

Desjardins' forecast of three further Bank of Canada interest rate reductions presents a compelling case for a more accommodative monetary policy. The forecast is grounded in concerns about weakening economic growth, easing inflation (though still above target), and the potential for a recession. These predicted interest rate reductions could significantly impact the Canadian economy, especially the housing market, by lowering borrowing costs and potentially stimulating economic activity. However, it's crucial to acknowledge the potential risks associated with aggressive interest rate cuts, particularly with respect to inflation and the creation of asset bubbles. Careful monitoring of economic indicators will be crucial in the coming months.

Call to Action: Stay informed about the ongoing evolution of the Canadian economy and the Bank of Canada's monetary policy decisions. Regularly check for updates on the Bank of Canada's interest rate announcements and follow Desjardins' economic forecasts for insights into potential future interest rate reductions. Understanding these forecasts is crucial for effective financial planning and navigating the complex economic landscape.

Featured Posts

-

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025 -

Apple Stock Soars I Phone Sales Exceed Expectations In Q2

May 24, 2025

Apple Stock Soars I Phone Sales Exceed Expectations In Q2

May 24, 2025 -

Bardellas Candidacy A New Face For The French Right

May 24, 2025

Bardellas Candidacy A New Face For The French Right

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 24, 2025 -

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Latest Posts

-

Protest Der Essener Taxifahrer Die Neuesten Entwicklungen Und Reaktionen

May 24, 2025

Protest Der Essener Taxifahrer Die Neuesten Entwicklungen Und Reaktionen

May 24, 2025 -

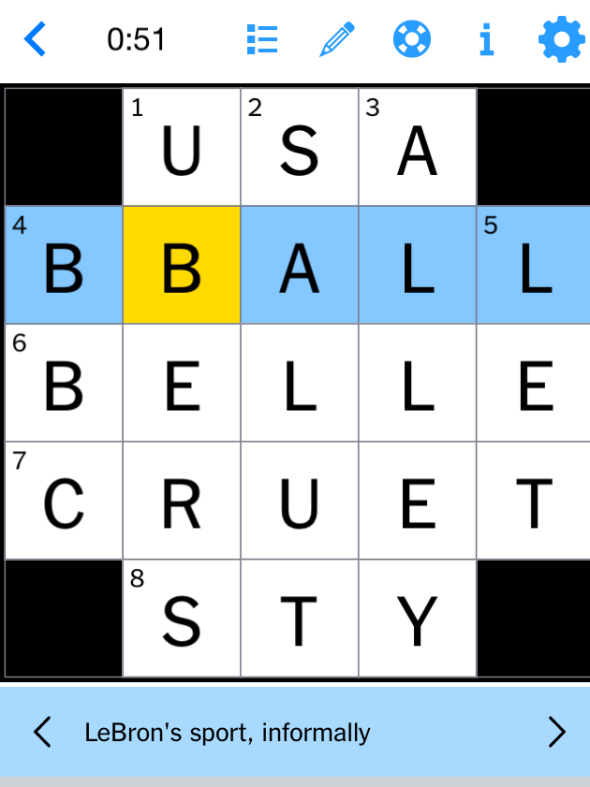

Nyt Mini Crossword Help Hints And Answers For Sunday April 19

May 24, 2025

Nyt Mini Crossword Help Hints And Answers For Sunday April 19

May 24, 2025 -

Essen Shajee Traders An Der Schuetzenbahn Wegen Hygienemaengeln Geschlossen

May 24, 2025

Essen Shajee Traders An Der Schuetzenbahn Wegen Hygienemaengeln Geschlossen

May 24, 2025 -

Get The Answers Nyt Mini Crossword March 16 2025

May 24, 2025

Get The Answers Nyt Mini Crossword March 16 2025

May 24, 2025 -

Complete Guide To Nyt Mini Crossword March 26 2025

May 24, 2025

Complete Guide To Nyt Mini Crossword March 26 2025

May 24, 2025