Detailed Look At The House GOP's Trump Tax Cut Legislation

Table of Contents

Core Tax Rate Reductions

The proposed legislation centers around significant reductions in both individual and corporate tax rates. These changes aim to stimulate economic growth through increased investment and consumer spending. However, the distributional effects of these cuts remain a subject of intense debate.

Individual Income Tax Rates

The proposed changes to individual income tax brackets represent a substantial shift from previous tax policies.

- Proposed Rate Changes: Specific rate reductions would vary across income brackets. For example, the highest bracket might see a reduction from X% to Y%, while lower brackets would experience smaller percentage decreases. (Note: Replace X and Y with actual proposed rates if available. Use data from reputable sources such as the Congressional Budget Office or the Tax Policy Center).

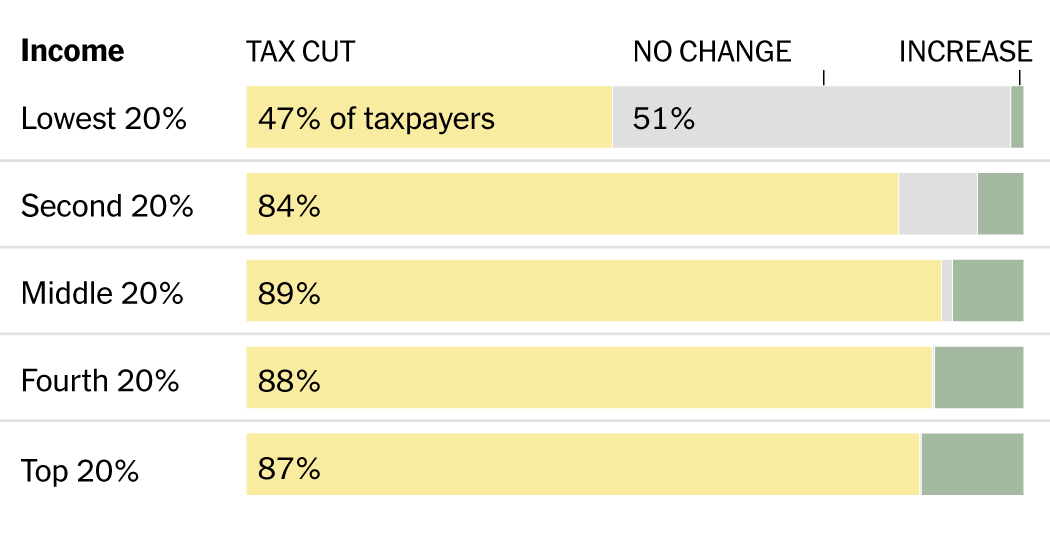

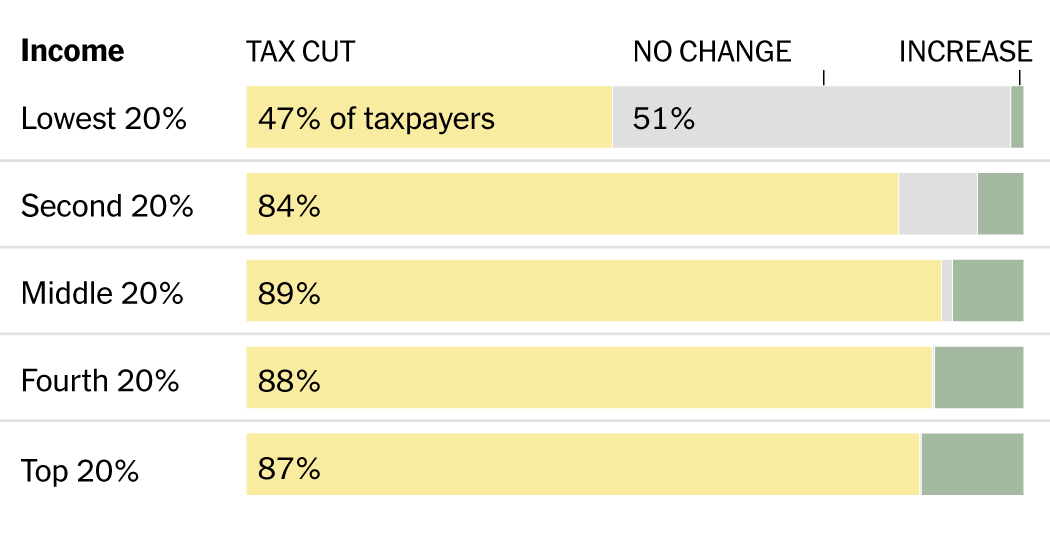

- Impact on Different Income Levels: Lower-income earners might see smaller tax savings compared to higher-income individuals. This disparity has fueled concerns about potential increases in income inequality. Careful analysis is needed to assess the precise distributional effects.

- Standard Deductions and Personal Exemptions: The proposed legislation may also include adjustments to standard deductions and personal exemptions. These changes could further influence the overall impact of the tax cuts on different income groups. Understanding these modifications is crucial for a complete picture.

Corporate Tax Rate Cuts

A central component of the House GOP's Trump Tax Cut Legislation is a significant reduction in the corporate tax rate. The proposed reduction aims to boost corporate profitability and investment.

- Impact on Corporate Profitability and Investment: Proponents argue the lower rate will incentivize businesses to invest more, leading to job creation and economic growth. Critics counter that the benefits might primarily accrue to shareholders rather than translating into tangible job growth.

- Job Creation or Loss: The effect on job creation or loss is a key area of contention. Economic models predicting job growth should be critically assessed for underlying assumptions and limitations. Consideration of potential job displacement due to automation also remains critical.

- Effect on the National Deficit: Lower corporate tax rates could significantly reduce government revenue, potentially exacerbating the national deficit. The long-term fiscal sustainability of the proposed cuts warrants careful examination.

Impact on Specific Sectors

The House GOP's Trump Tax Cut Legislation is not expected to impact all sectors equally. Certain groups will likely benefit more than others, leading to potential shifts in the economic landscape.

Effect on Small Businesses

Small businesses represent a significant portion of the US economy, and their response to the proposed tax cuts is crucial.

- Potential Benefits and Drawbacks: The legislation may offer specific tax credits or deductions tailored to small businesses. However, the overall impact may depend on factors such as business structure and profitability.

- Comparison to Previous Legislation: Analyzing how this legislation compares to previous tax laws aimed at supporting small businesses is critical for understanding its novelty and potential effects.

- Tax Credits and Deductions: Specific details about any proposed tax credits or deductions for small businesses must be carefully examined to assess their true effectiveness.

Impact on High-Income Earners

The impact of the proposed changes on high-income earners is a point of considerable debate.

- Tax Loopholes: The extent to which the legislation closes or expands existing tax loopholes for high-income individuals is a key factor to consider. Analysis of the details of the bill is crucial to evaluating this aspect.

- Capital Gains and Estate Taxes: Any proposed changes to capital gains taxes or estate taxes will significantly affect high-net-worth individuals. Understanding these changes is important for evaluating the legislation's overall impact.

- Comparison to Previous Administrations: A comparison of the proposed tax rates for high-income earners under this legislation to those under previous administrations is essential for putting the changes in context.

Economic and Political Implications

The House GOP's Trump Tax Cut Legislation carries significant economic and political ramifications that extend beyond the immediate tax implications.

Economic Projections

Various economic models and forecasts attempt to predict the impact of the legislation.

- GDP Growth, Inflation, and Unemployment: Economic projections related to GDP growth, inflation, and unemployment should be examined critically, considering the assumptions and limitations of each model.

- Diverse Viewpoints: It's crucial to include diverse viewpoints and analyses from different economic experts to gain a balanced understanding of potential outcomes.

- Long-Term Effects on National Debt and Deficit: The potential for long-term increases in the national debt and deficit should be thoroughly investigated and debated.

- Income Inequality: The legislation's potential impact on income inequality is a significant concern, requiring careful analysis and consideration of distributional effects.

Political Fallout and Public Opinion

The political landscape surrounding the legislation is highly charged.

- Partisan Divides: Understanding the partisan divides and potential legislative hurdles facing the bill is essential to its trajectory.

- Lobbyists and Special Interest Groups: The influence of lobbyists and special interest groups on the legislation and its eventual form must be considered.

- Public Opinion: Public opinion polls and surveys regarding the tax plan provide valuable insight into public perception and potential political repercussions.

Conclusion

The House GOP's Trump Tax Cut Legislation promises significant changes to the US tax code, with projected impacts varying across different income groups and economic sectors. While proponents argue it will stimulate economic growth and benefit businesses, critics express concerns about its potential to exacerbate income inequality and increase the national debt. Understanding the detailed provisions, along with potential economic and political ramifications, is crucial for informed debate and policy evaluation. Further research and analysis of the House GOP's Trump Tax Cut Legislation are needed to fully grasp its long-term consequences. Stay informed on updates and developments regarding this crucial piece of legislation. Continue to research the intricacies of the House GOP's Trump Tax Cut Legislation to form your own informed opinion.

Featured Posts

-

Nba Tankathon A New Way For Miami Heat Fans To Engage Off Season

May 13, 2025

Nba Tankathon A New Way For Miami Heat Fans To Engage Off Season

May 13, 2025 -

Ali Larter On Angela Reverse Engineering A Trophy Wife In Season 2 Of She

May 13, 2025

Ali Larter On Angela Reverse Engineering A Trophy Wife In Season 2 Of She

May 13, 2025 -

Aces Cut Forward Training Camp Roster Moves

May 13, 2025

Aces Cut Forward Training Camp Roster Moves

May 13, 2025 -

Four Walls Announces New Ceo

May 13, 2025

Four Walls Announces New Ceo

May 13, 2025 -

Reaktsiya Kostyuk Na Smenu Grazhdanstva Kasatkinoy Rukopozhatie Kak Simvol

May 13, 2025

Reaktsiya Kostyuk Na Smenu Grazhdanstva Kasatkinoy Rukopozhatie Kak Simvol

May 13, 2025