Deutsche Bank And FinaXai: A New Era In Tokenized Fund Services

Table of Contents

The financial industry is undergoing a significant transformation, driven by the rise of blockchain technology and its application in tokenization. Deutsche Bank, a global leader in financial services, is at the forefront of this innovation, partnering with finaXai to usher in a new era of tokenized fund services. This partnership promises to reshape how funds are managed, traded, and accessed, offering unprecedented levels of efficiency and transparency. This collaboration signifies a major step towards a more efficient and accessible future for fund management and investment.

finaXai's Role in Tokenizing Fund Services

finaXai's platform is instrumental in Deutsche Bank's foray into tokenized fund services. Its technology underpins the entire process, offering several key advantages:

Streamlining Fund Administration

finaXai's platform automates many traditionally manual and time-consuming tasks associated with fund administration. This automation leads to significant improvements across the board:

- Reduced operational costs through automation: Automating tasks like trade processing, settlement, and reporting drastically reduces the need for manual intervention, significantly lowering operational costs.

- Faster settlement times: Blockchain's near-instantaneous transaction capabilities accelerate settlement, allowing for quicker capital deployment and increased liquidity.

- Improved accuracy in record-keeping: The immutable nature of the blockchain eliminates the risk of data manipulation or errors, leading to more accurate and reliable records.

- Enhanced regulatory compliance: The enhanced transparency and auditability of the blockchain simplifies regulatory reporting and enhances compliance efforts. finaXai's platform is designed with regulatory compliance at its core, simplifying the complexities of meeting international standards.

Enhanced Transparency and Security

Blockchain technology is intrinsically secure and transparent, providing substantial benefits for both fund managers and investors:

- Immutable ledger provides audit trails: Every transaction is recorded on the blockchain, creating an immutable audit trail that enhances transparency and accountability.

- Increased transparency for investors: Investors have real-time access to fund information and performance data, promoting trust and greater control.

- Reduced risk of fraud and human error: The decentralized and tamper-proof nature of blockchain minimizes the risk of fraud and human error that can plague traditional systems.

- Improved data security through cryptographic methods: Blockchain's cryptographic security protocols protect sensitive data from unauthorized access and cyber threats.

Improved Accessibility for Investors

Tokenization significantly lowers the barrier to entry for investment in funds:

- Fractional ownership of funds: Tokenization allows for the fractional ownership of funds, making them accessible to investors with smaller capital amounts.

- Lower minimum investment thresholds: Reduced minimum investment requirements broaden participation and democratize access to previously exclusive investment opportunities.

- Broader access to alternative investments: Tokenization opens doors to a wider range of alternative investments, previously unavailable to many individual investors.

- 24/7 access to fund information: Investors can access real-time fund information anytime, anywhere, providing greater control and convenience.

Deutsche Bank's Strategic Advantage

Deutsche Bank's partnership with finaXai represents a strategic move to solidify its position as a leader in the evolving financial landscape:

Expanding Service Offerings

This collaboration allows Deutsche Bank to expand its service offerings and attract a new generation of clients:

- Attracting new clients seeking innovative solutions: Offering tokenized fund services positions Deutsche Bank as an innovator, attracting clients seeking cutting-edge solutions.

- Solidifying market leadership in the digital asset space: This partnership reinforces Deutsche Bank's commitment to and leadership within the rapidly growing digital asset space.

- Leveraging existing infrastructure and expertise: Deutsche Bank leverages its existing infrastructure and expertise in fund management to seamlessly integrate tokenized services.

Technological Innovation and Expertise

Deutsche Bank's commitment to technological innovation is evident in this partnership:

- Investment in blockchain technology: The bank's investment in blockchain technology demonstrates a forward-thinking approach to financial services.

- Strategic alliances with fintech companies: Partnering with fintech companies like finaXai allows Deutsche Bank to access cutting-edge technology and expertise.

- Commitment to developing innovative financial solutions: This collaboration underlines Deutsche Bank's ongoing commitment to providing innovative and efficient financial solutions to its clients.

Regulatory Compliance and Risk Management

Deutsche Bank prioritizes regulatory compliance and robust risk management:

- Collaboration with regulators: Deutsche Bank actively collaborates with regulators to ensure its tokenized fund services adhere to all relevant regulations.

- Robust risk management framework: The bank has implemented a robust risk management framework specifically tailored to the unique aspects of tokenized assets.

- Adherence to KYC/AML regulations: Deutsche Bank adheres strictly to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations throughout its tokenized fund operations.

Conclusion

The partnership between Deutsche Bank and finaXai represents a significant leap forward in the evolution of fund services. By leveraging the power of blockchain technology and tokenization, they are creating a more efficient, transparent, and accessible investment landscape. This collaboration demonstrates a clear commitment to innovation and sets a new standard for the industry. Tokenized fund solutions offer a new paradigm for investment management, and this partnership is leading the charge.

Call to Action: Learn more about how Deutsche Bank and finaXai are reshaping the future of fund services through tokenization. Contact us today to explore the possibilities of tokenized fund management and unlock the benefits of this transformative technology. Invest in the future of finance with tokenized fund solutions.

Featured Posts

-

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

May 30, 2025

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

May 30, 2025 -

Miami Open Anisimova Defeats Andreeva Halting Her Streak

May 30, 2025

Miami Open Anisimova Defeats Andreeva Halting Her Streak

May 30, 2025 -

The Baim Collection Artifacts From A Lifetime Ago

May 30, 2025

The Baim Collection Artifacts From A Lifetime Ago

May 30, 2025 -

Kya Amysha Ptyl Hamlh Hyn An Ky Halyh Tsawyr Ne Bhth Kw Jnm Dya He

May 30, 2025

Kya Amysha Ptyl Hamlh Hyn An Ky Halyh Tsawyr Ne Bhth Kw Jnm Dya He

May 30, 2025 -

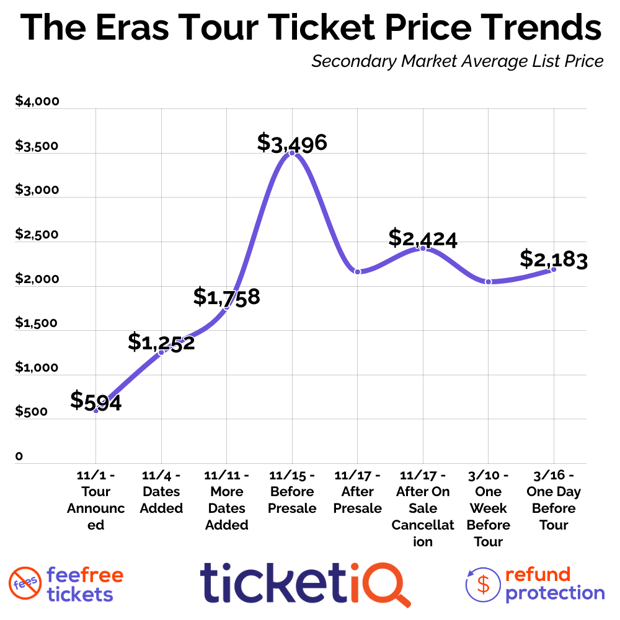

Taylor Swift Ticket Sales Ticketmaster Shows Your Queue Status

May 30, 2025

Taylor Swift Ticket Sales Ticketmaster Shows Your Queue Status

May 30, 2025