Deutsche Bank Selected As Depositary For Epiroc American Depositary Receipts

Table of Contents

Understanding Epiroc and its Global Reach

Epiroc is a leading provider of productivity-enhancing equipment and services for the mining and infrastructure industries. With operations spanning multiple continents, Epiroc boasts a significant global reach and a strong market capitalization, trading on various exchanges worldwide. Its innovative equipment and solutions are crucial for the efficient operation of mines and large-scale infrastructure projects globally.

- Leading provider of mining and infrastructure equipment: Epiroc's product portfolio encompasses a wide range of drilling, rock excavation, and related equipment.

- Significant global presence with operations across multiple continents: This extensive network ensures Epiroc maintains a strong understanding of diverse market needs and regulatory landscapes.

- Strong market position in key sectors: Epiroc's established position in the mining and infrastructure sectors translates to consistent revenue streams and growth potential.

The Role of a Depositary Bank (Focus on Deutsche Bank)

A depositary bank plays a crucial role in facilitating the trading of American Depositary Receipts (ADRs). In the case of Epiroc, Deutsche Bank will act as the custodian for the underlying shares, ensuring seamless trading on US exchanges. This involves managing the ADR program, handling shareholder services, and guaranteeing regulatory compliance. Deutsche Bank's selection highlights their expertise and reputation in this complex area of global finance.

- Facilitates the trading of Epiroc ADRs on US exchanges: This simplifies the process for US-based investors seeking to invest in Epiroc.

- Acts as a custodian for the underlying shares: This ensures the security and proper management of the shares backing the ADRs.

- Handles shareholder services related to ADRs: This includes managing dividend payments, corporate actions, and other investor-related communication.

- Ensures regulatory compliance: Deutsche Bank's compliance expertise ensures adherence to all relevant US and international regulations.

Implications for Investors Interested in Epiroc ADRs

The announcement of Deutsche Bank as the depositary bank for Epiroc ADRs has several key implications for investors: The most significant is increased accessibility. US and international investors now have a more straightforward path to investing in Epiroc, potentially leading to increased trading volume and liquidity. This also offers opportunities for global diversification within an investor's portfolio.

- Easier access for US and international investors: Investing in Epiroc is now more convenient and less complicated.

- Potential for increased trading volume and liquidity: This can lead to more stable pricing and potentially better investment opportunities.

- Opportunities for global diversification: Adding Epiroc ADRs to a portfolio can provide broader exposure to the mining and infrastructure sectors.

- Consideration of currency fluctuations and other market risks: Investors should always be aware of currency exchange rate fluctuations and general market risks when investing internationally.

Deutsche Bank's Expertise in ADR Services

Deutsche Bank's selection underscores their extensive experience and capabilities in managing ADR programs for multinational corporations. They possess a robust infrastructure and a significant network of institutional investors, making them ideally suited to manage the complexities of Epiroc's ADR program. Their long-standing reputation in global banking further strengthens the appeal of Epiroc ADRs to investors.

- Extensive experience in handling ADRs for numerous multinational corporations: Deutsche Bank brings a wealth of experience to this partnership.

- Strong reputation and established infrastructure for efficient ADR management: This ensures smooth and efficient trading and investor services.

- Significant network of institutional investors: This network provides greater access to capital and broader market reach for Epiroc.

Conclusion

In summary, Deutsche Bank's appointment as the depositary bank for Epiroc ADRs is a positive development, enhancing accessibility and liquidity for investors interested in this global leader in mining and infrastructure equipment. The increased convenience and streamlined processes associated with ADRs, facilitated by Deutsche Bank's expertise, present compelling investment opportunities. This development underscores the growing importance of ADRs in global finance and highlights the continued expansion of Epiroc's international reach. Learn more about investing in Epiroc American Depositary Receipts (ADRs) and explore the opportunities offered by this global leader in the mining and infrastructure sectors. Contact your financial advisor or visit [link to relevant resource].

Featured Posts

-

Ilaiyaraajas Musical Triumph Rajinikanths Acknowledgment

May 30, 2025

Ilaiyaraajas Musical Triumph Rajinikanths Acknowledgment

May 30, 2025 -

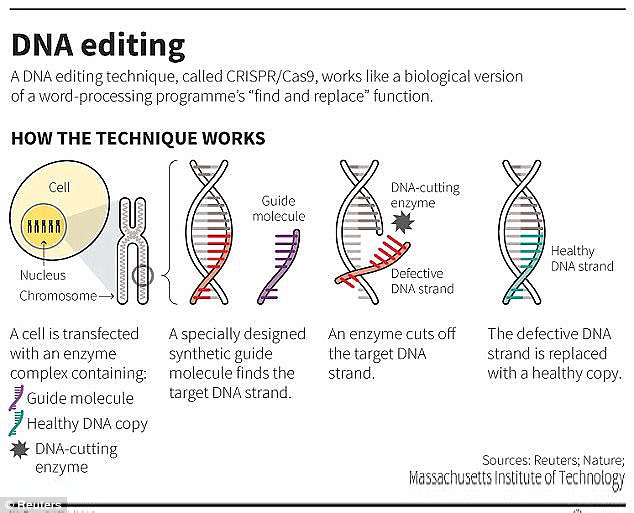

Powerful Crispr Precise Whole Gene Insertion Into Human Dna

May 30, 2025

Powerful Crispr Precise Whole Gene Insertion Into Human Dna

May 30, 2025 -

Mstqbl Almyah Altfawl Alardny Batfaqyat Me Swrya

May 30, 2025

Mstqbl Almyah Altfawl Alardny Batfaqyat Me Swrya

May 30, 2025 -

Federal Investigation Exposes Multi Million Dollar Office365 Data Breach

May 30, 2025

Federal Investigation Exposes Multi Million Dollar Office365 Data Breach

May 30, 2025 -

Kya Amysha Ptyl Hamlh Hyn An Ky Halyh Tsawyr Ne Bhth Kw Jnm Dya He

May 30, 2025

Kya Amysha Ptyl Hamlh Hyn An Ky Halyh Tsawyr Ne Bhth Kw Jnm Dya He

May 30, 2025