Direct Lender No Credit Check Loans: Understanding Guaranteed Approval

Table of Contents

What are Direct Lender No Credit Check Loans?

Understanding the terminology is key. A direct lender is a financial institution (bank, credit union, or online lender) that provides loans directly to borrowers, without using intermediaries like brokers. This contrasts with brokers who connect you with multiple lenders, often charging fees in the process. The "no credit check" aspect means the lender won't perform a hard credit inquiry that impacts your credit score. However, it's crucial to understand that this often means a "soft credit check" might still occur, which typically doesn't affect your credit score.

Direct lender no credit check loans come in various forms, including:

- Payday loans: Short-term, small-amount loans typically due on your next payday.

- Installment loans: Loans repaid in regular installments over a longer period.

Here’s a summary of their characteristics:

- Faster application process: Often quicker than traditional loans.

- Potentially higher interest rates: The absence of a credit check usually results in higher interest rates to compensate for increased risk.

- Smaller loan amounts: Loan amounts are typically smaller than traditional loans.

- Shorter repayment terms: Repayment periods tend to be shorter.

Understanding "Guaranteed Approval" – Managing Expectations

The term "guaranteed approval" is often misleading. While many lenders advertise this, it doesn't mean you'll automatically receive a loan. "Guaranteed approval" typically signifies that the lender will assess your application based on criteria other than your credit score. Successful loan approval hinges on factors such as:

- Income verification: Lenders need proof you can repay the loan. Expect to provide pay stubs or bank statements.

- Employment history: A stable employment history significantly increases your chances of approval.

Even without a traditional credit check, lenders still assess risk. Defaulting on a loan can have serious consequences, including damage to your credit report and potential legal action. Remember:

- Income verification is crucial.

- Proof of employment is often required.

- Lenders assess risk even without a formal credit score.

- "Guaranteed approval" usually implies a higher interest rate.

Benefits and Risks of Direct Lender No Credit Check Loans

These loans offer several benefits, especially for those with bad credit:

- Quick access to funds: Get the money you need quickly, often within the same day.

- Suitable for emergencies: Ideal for handling unexpected expenses.

- No impact on credit score (for soft credit checks): A soft credit check typically doesn't affect your credit score.

However, it's essential to weigh the risks:

- High interest rates and fees: These loans often come with significantly higher interest rates than traditional loans.

- Risk of accumulating debt: The short repayment terms can make it difficult to repay, leading to a debt cycle.

- Potential for predatory lending practices: Be wary of lenders using aggressive sales tactics or charging excessive fees.

Finding Reputable Direct Lenders for No Credit Check Loans

Finding a trustworthy lender is paramount when considering no credit check loans. Thorough research is vital to avoid scams and predatory lending practices. Here's how to identify legitimate lenders:

- Check the lender's license and registration: Ensure they operate legally in your state or country.

- Read online reviews and testimonials: Look for independent reviews on websites like Trustpilot or the Better Business Bureau.

- Compare interest rates and fees from multiple lenders: Don't settle for the first offer you receive.

- Be wary of lenders with aggressive sales tactics: Legitimate lenders won't pressure you into borrowing more than you need.

Conclusion: Making Informed Decisions about Direct Lender No Credit Check Loans

Direct lender no credit check loans offer a fast way to access funds, particularly beneficial for those with bad credit or facing urgent financial needs. However, the "guaranteed approval" claim often misleads borrowers, and these loans typically come with high interest rates and potential risks. Careful research, comparison shopping, and responsible borrowing are crucial. Before applying, understand the terms, fees, and repayment schedule completely.

Need fast cash? Find a reputable direct lender for no credit check loans today! Remember to carefully compare offers and prioritize responsible borrowing practices to avoid potential debt traps.

Featured Posts

-

Fenerbahce Hayranlari Icin Heyecan Ronaldo Nun Portekiz Kampindaki Suerpriz Goeruentueler

May 28, 2025

Fenerbahce Hayranlari Icin Heyecan Ronaldo Nun Portekiz Kampindaki Suerpriz Goeruentueler

May 28, 2025 -

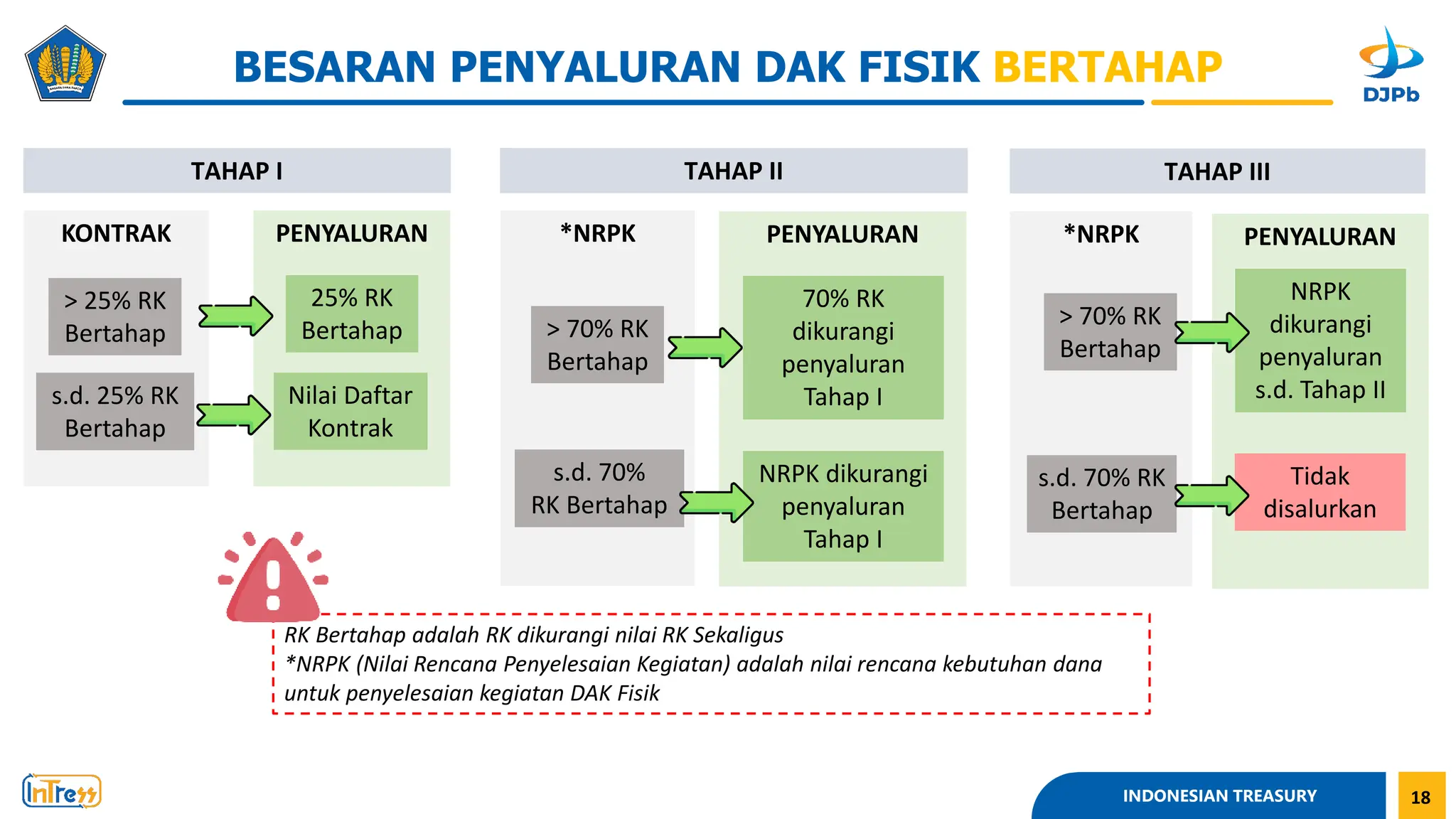

6 Kabupaten Prioritas Gubernur Koster Tetapkan Mekanisme Penyaluran Bkk Untuk Program Strategis

May 28, 2025

6 Kabupaten Prioritas Gubernur Koster Tetapkan Mekanisme Penyaluran Bkk Untuk Program Strategis

May 28, 2025 -

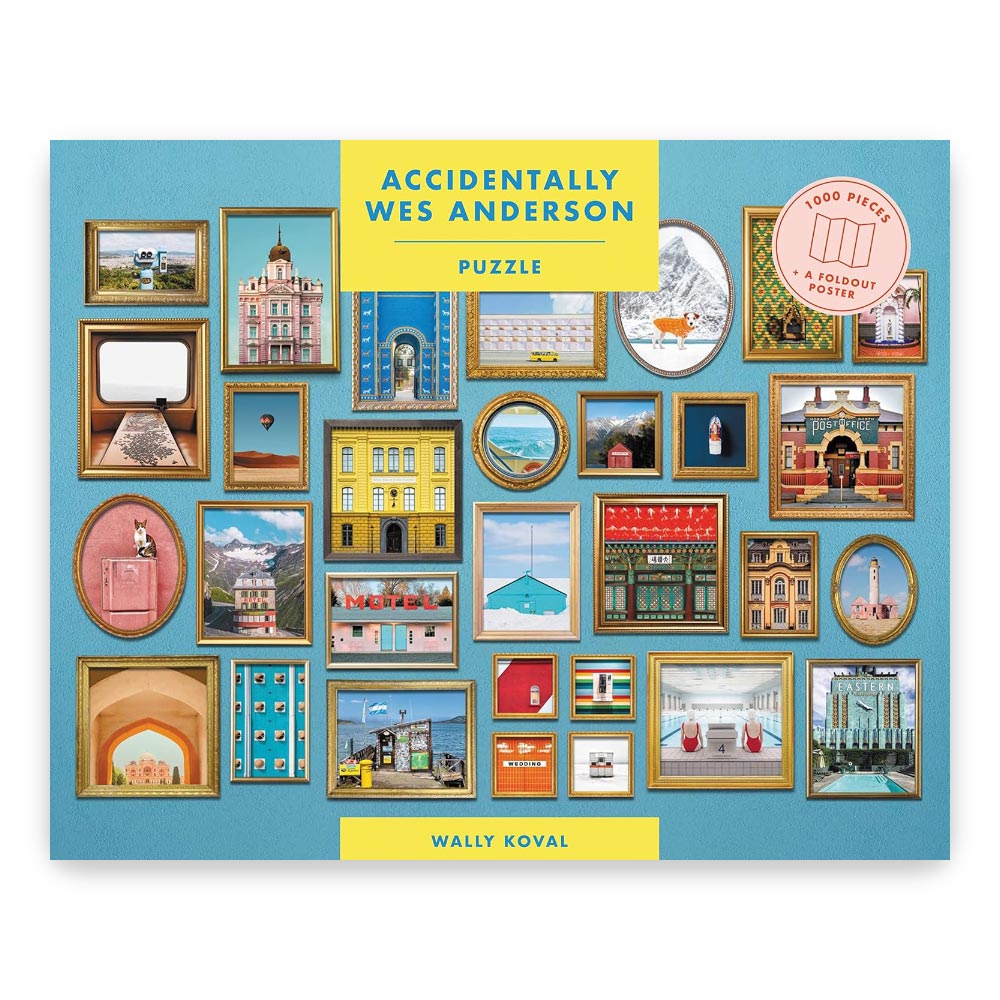

Exploring The Wes Anderson Archives A Design Museum Exhibition

May 28, 2025

Exploring The Wes Anderson Archives A Design Museum Exhibition

May 28, 2025 -

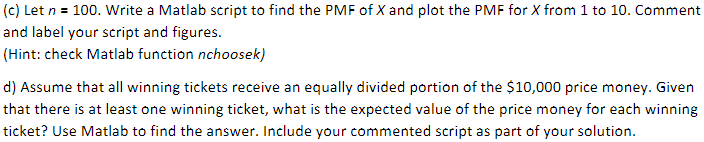

Discover The Shop Where A Winning Lotto Ticket Was Sold Claim Your Fortune

May 28, 2025

Discover The Shop Where A Winning Lotto Ticket Was Sold Claim Your Fortune

May 28, 2025 -

Hailee Steinfeld Opens Up About Engagement To Josh Allen A Rare Interview

May 28, 2025

Hailee Steinfeld Opens Up About Engagement To Josh Allen A Rare Interview

May 28, 2025

Latest Posts

-

Hbo To Adapt Gisele Pelicots Book A French Rape Victims Story

May 30, 2025

Hbo To Adapt Gisele Pelicots Book A French Rape Victims Story

May 30, 2025 -

Marine Le Pen Et La Justice L Analyse De Laurent Jacobelli

May 30, 2025

Marine Le Pen Et La Justice L Analyse De Laurent Jacobelli

May 30, 2025 -

Medine En Concert La Region Grand Est Subventionne Le Rn S Insurge

May 30, 2025

Medine En Concert La Region Grand Est Subventionne Le Rn S Insurge

May 30, 2025 -

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025