Dismissing Valuation Concerns: BofA's Argument For A Bullish Stock Market

Table of Contents

BofA's Core Argument: Why High Valuations Aren't a Barrier to Further Growth

BofA's bullish outlook rests on three primary pillars: robust corporate earnings exceeding inflationary pressures, the ongoing influence of accommodative monetary policies, and the powerful engine of long-term technological advancements driving economic expansion.

Strong Corporate Earnings Growth Outpacing Inflation

BofA projects continued strong corporate earnings growth, significantly outpacing inflation. Their research indicates that companies possess considerable pricing power, enabling them to maintain profit margins despite rising input costs. This resilience is further supported by resilient consumer spending and ongoing technological innovation that drives productivity gains. Specific sectors anticipated to lead this growth include technology, healthcare, and select consumer staples.

- Strong profit margins: Companies are effectively passing increased costs onto consumers.

- Pricing power: Strong brands and market dominance allow businesses to maintain pricing despite inflationary pressures.

- Resilient consumer spending: Consumer demand remains robust, fueling continued sales growth.

- Technological innovation driving productivity gains: Automation and technological advancements increase efficiency and lower production costs.

The Role of Low Interest Rates and Quantitative Easing

Despite inflationary pressures, BofA highlights the continued influence of low interest rates and past quantitative easing (QE) policies in supporting higher valuations. Low interest rates reduce corporate borrowing costs, stimulating investment and expansion. Furthermore, this environment encourages higher risk appetite among investors, driving demand for equities.

- Reduced borrowing costs stimulate investment: Companies can readily access capital for growth and expansion.

- Low interest rates encourage higher risk appetite: Investors seek higher returns in a low-yield environment.

- Quantitative easing increases liquidity in the market: Increased money supply fuels demand for assets, including stocks.

Long-Term Growth Potential and Technological Innovation

BofA emphasizes the powerful long-term growth potential fueled by technological innovation. They highlight the transformative impact of technologies such as artificial intelligence, renewable energy, e-commerce expansion, and advancements in biotechnology as key drivers of economic growth and higher stock valuations.

- Artificial intelligence: AI is poised to revolutionize numerous industries, driving efficiency and creating new markets.

- Renewable energy: The transition to sustainable energy sources represents a massive investment opportunity.

- E-commerce growth: The ongoing shift to online shopping continues to fuel expansion in the digital economy.

- Biotechnology advancements: Breakthroughs in biotechnology offer significant potential for improving healthcare and extending lifespans.

Addressing Counterarguments: Rebutting Common Valuation Concerns

While acknowledging the high price-to-earnings (P/E) ratios and the lingering effects of inflation, BofA offers compelling counterarguments to address these concerns.

High Price-to-Earnings Ratios (P/E)

BofA acknowledges the elevated P/E ratios but argues that these are justified given the robust growth prospects discussed earlier. Their analysis compares current P/E ratios to historical data during periods of similar economic growth, demonstrating that current valuations are not unprecedented. Moreover, they perform detailed sector-specific analysis to highlight specific instances where valuations are justified.

- Long-term growth potential justifies higher multiples: High-growth companies command higher valuations due to their future earnings potential.

- Comparison to historical valuations during periods of similar growth: Current valuations are not necessarily excessive when compared to past periods of strong economic expansion.

- Sector-specific analysis showing justifiable valuations: Not all sectors are equally overvalued; a nuanced view is necessary.

Inflationary Pressures

BofA addresses concerns about inflation's dampening impact on stock valuations by highlighting the pricing power of corporations and their ability to mitigate inflationary pressures. They project that inflation will eventually moderate, and that companies' ability to adjust pricing will help offset the negative impacts of inflation on earnings.

- Corporate pricing power: Companies can pass along increased costs to consumers, maintaining profit margins.

- Wage growth expectations: While wage growth can contribute to inflation, it also fuels consumer spending.

- Government policy response to inflation: Government interventions can help moderate inflation.

Conclusion

BofA's bullish stock market outlook, while contrarian to some perspectives, rests on a strong foundation of projected earnings growth that outpaces inflation, the continued supportive influence of monetary policy, and the substantial potential for long-term growth driven by technological innovation. By addressing head-on the concerns surrounding high valuations, BofA provides a compelling argument for a positive market outlook. Their analysis suggests that while risks exist, the potential for reward outweighs these concerns. Learn more about BofA's bullish stock market predictions and understand the reasons behind BofA's bullish outlook and make informed investment choices by exploring their research and analysis. [Link to relevant BofA research/financial news article].

Featured Posts

-

Ahdth Altsrybat Waltwqeat Hwl Blay Styshn 6

May 02, 2025

Ahdth Altsrybat Waltwqeat Hwl Blay Styshn 6

May 02, 2025 -

Lotto Results Wednesday April 16 2025

May 02, 2025

Lotto Results Wednesday April 16 2025

May 02, 2025 -

Cincinnati Edges Out Lady Raiders In Tight 59 56 Home Game

May 02, 2025

Cincinnati Edges Out Lady Raiders In Tight 59 56 Home Game

May 02, 2025 -

Pakstan Awr Kshmyr Ky Jngwn Ka Jayzh Army Chyf Ka Mwqf

May 02, 2025

Pakstan Awr Kshmyr Ky Jngwn Ka Jayzh Army Chyf Ka Mwqf

May 02, 2025 -

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Climate

May 02, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Climate

May 02, 2025

Latest Posts

-

Solving The Nyt Crossword April 6 2025 Edition A Comprehensive Guide

May 10, 2025

Solving The Nyt Crossword April 6 2025 Edition A Comprehensive Guide

May 10, 2025 -

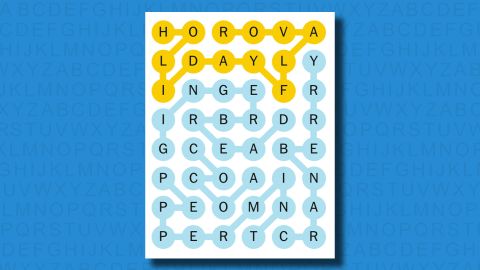

Strands Nyt Puzzle Solutions Wednesday March 12 Game 374

May 10, 2025

Strands Nyt Puzzle Solutions Wednesday March 12 Game 374

May 10, 2025 -

Complete Guide To Nyt Strands Game 357 February 23 Sunday

May 10, 2025

Complete Guide To Nyt Strands Game 357 February 23 Sunday

May 10, 2025 -

Nyt Strands Game 357 Hints And Answers For February 23rd

May 10, 2025

Nyt Strands Game 357 Hints And Answers For February 23rd

May 10, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 10, 2025