Disney's Positive Profit Revision: Parks And Streaming Fueling Growth

Table of Contents

Parks, Experiences and Products Division: A Significant Contributor

Disney's Parks, Experiences and Products division has emerged as a significant driver of the company's positive profit revision. Strong performance across multiple areas contributed to this success. Keywords: Disney parks attendance, Disney World revenue, Disneyland revenue, Disney cruise line, Disney merchandise sales

-

Stronger-than-anticipated attendance: Both domestic parks like Disney World and Disneyland, and international theme parks, saw higher-than-projected visitor numbers. This surge in attendance directly translates to increased revenue streams. Factors contributing to this include new attractions, enhanced guest experiences, and effective marketing campaigns.

-

Increased per-guest spending: Guests are spending more per visit on merchandise, food and beverage, and premium park experiences. The introduction of new, high-priced experiences and the continued popularity of Disney merchandise have significantly boosted revenue.

-

Positive contributions from Disney Cruise Line and other experiences: The Disney Cruise Line and other experiential offerings, such as guided tours and special events, contributed significantly to the overall revenue growth. The high demand and premium pricing of these experiences underscore Disney’s ability to capitalize on its brand.

-

Successful merchandise sales: Merchandise sales remained robust, leveraging the immense popularity of Disney’s franchises and characters. Strategic product placement within the parks and effective online sales channels fueled this success.

-

Effective pricing strategies: Disney implemented effective pricing strategies, maximizing revenue generation while maintaining a balance between affordability and premium offerings. This demonstrated a sophisticated understanding of guest willingness to pay for exceptional experiences.

Disney+ Subscription Growth and Enhanced Monetization Strategies

The success of Disney+ played a crucial role in the positive Disney profit revision. The streaming service demonstrated significant growth in subscribers and implemented effective monetization strategies. Keywords: Disney+ subscriber growth, Disney+ pricing, Disney+ content strategy, Disney+ advertising revenue, Hulu subscribers, ESPN+ subscribers

-

Increased subscriber numbers: Disney+ exceeded initial subscriber projections, demonstrating strong demand for its streaming content. This success is a result of a strategic content release schedule and targeted marketing campaigns.

-

Successful ad-supported tiers: The introduction of ad-supported tiers added a new revenue stream, broadening the appeal of Disney+ to price-sensitive consumers without alienating existing subscribers.

-

Strategic content releases: The release of high-profile Marvel and Star Wars series, along with original movies and family-friendly content, drove subscriber acquisition and retention. A consistent stream of high-quality content is key to maintaining subscriber numbers.

-

Improved content diversity: Disney+ expanded its content library to offer greater diversity across genres and age demographics. This broader appeal attracted a wider range of subscribers and increased overall engagement.

-

Bundling strategies: Bundling Disney+ with Hulu and ESPN+ offered a compelling value proposition, encouraging subscribers to opt for the bundled package and increasing overall revenue.

Impact of New Content Releases on Streaming Performance

New content releases, particularly from the Marvel and Star Wars franchises, significantly impacted Disney+'s performance. Keywords: Marvel Disney+, Star Wars Disney+, Disney+ original movies, Disney+ original series, Disney+ content library

-

High viewership figures: New Marvel and Star Wars series achieved exceptionally high viewership figures, driving subscriber growth and engagement.

-

Success of original movies and series: Original movies and series on Disney+ also proved successful, attracting new subscribers and retaining existing ones. The high production quality and appeal to various demographics contributed to this success.

-

Effective marketing campaigns: Well-executed marketing campaigns effectively promoted new releases, driving awareness and increasing viewership.

Overall Financial Health and Future Outlook

The positive profit revision significantly impacts Disney's overall financial health and investor confidence. Keywords: Disney stock price, Disney investor confidence, Disney future growth, Disney long-term strategy

-

Positive impact on Disney's financial health: The strong performance in both parks and streaming significantly improved Disney's overall financial health. This is reflected in a positive outlook for the future.

-

Strong indication of continued growth: The results indicate continued growth potential in both the Parks, Experiences and Products and the streaming divisions. This provides a solid foundation for future investments and expansion.

-

Potential for further expansion and innovation: Disney has significant opportunities for further expansion and innovation in both parks and streaming. New technologies, attractions, and content offerings will further drive growth.

-

Challenges and risks: While the outlook is positive, challenges remain. These include maintaining high attendance at theme parks, managing competition in the streaming market, and navigating economic uncertainties.

Conclusion:

Disney's positive profit revision is a testament to the synergistic success of its Parks, Experiences and Products division and the continued growth of its Disney+ streaming service. Strong attendance at theme parks, increased spending per guest, and a robust streaming subscriber base are key factors driving this positive financial performance. The strategic implementation of ad-supported tiers on Disney+ and the continued success of its franchise content further solidified this positive outcome. The strong performance across both divisions points to a bright future for the entertainment giant.

Call to Action: Stay informed on Disney's continued success and future financial projections by following our regular updates on Disney's performance. Learn more about the factors influencing Disney's profit revision and the future of this entertainment giant by subscribing to our newsletter.

Featured Posts

-

Impacts Of Real Id Enforcement On Summer Travel Plans

May 10, 2025

Impacts Of Real Id Enforcement On Summer Travel Plans

May 10, 2025 -

White House Withdraws Key Nomination Opting For Maha Influencer For Surgeon General Role

May 10, 2025

White House Withdraws Key Nomination Opting For Maha Influencer For Surgeon General Role

May 10, 2025 -

Young Thugs Latest Music A Confession And A Promise

May 10, 2025

Young Thugs Latest Music A Confession And A Promise

May 10, 2025 -

Community Activist Advocates For Womb Transplants To Enable Transgender Mothers

May 10, 2025

Community Activist Advocates For Womb Transplants To Enable Transgender Mothers

May 10, 2025 -

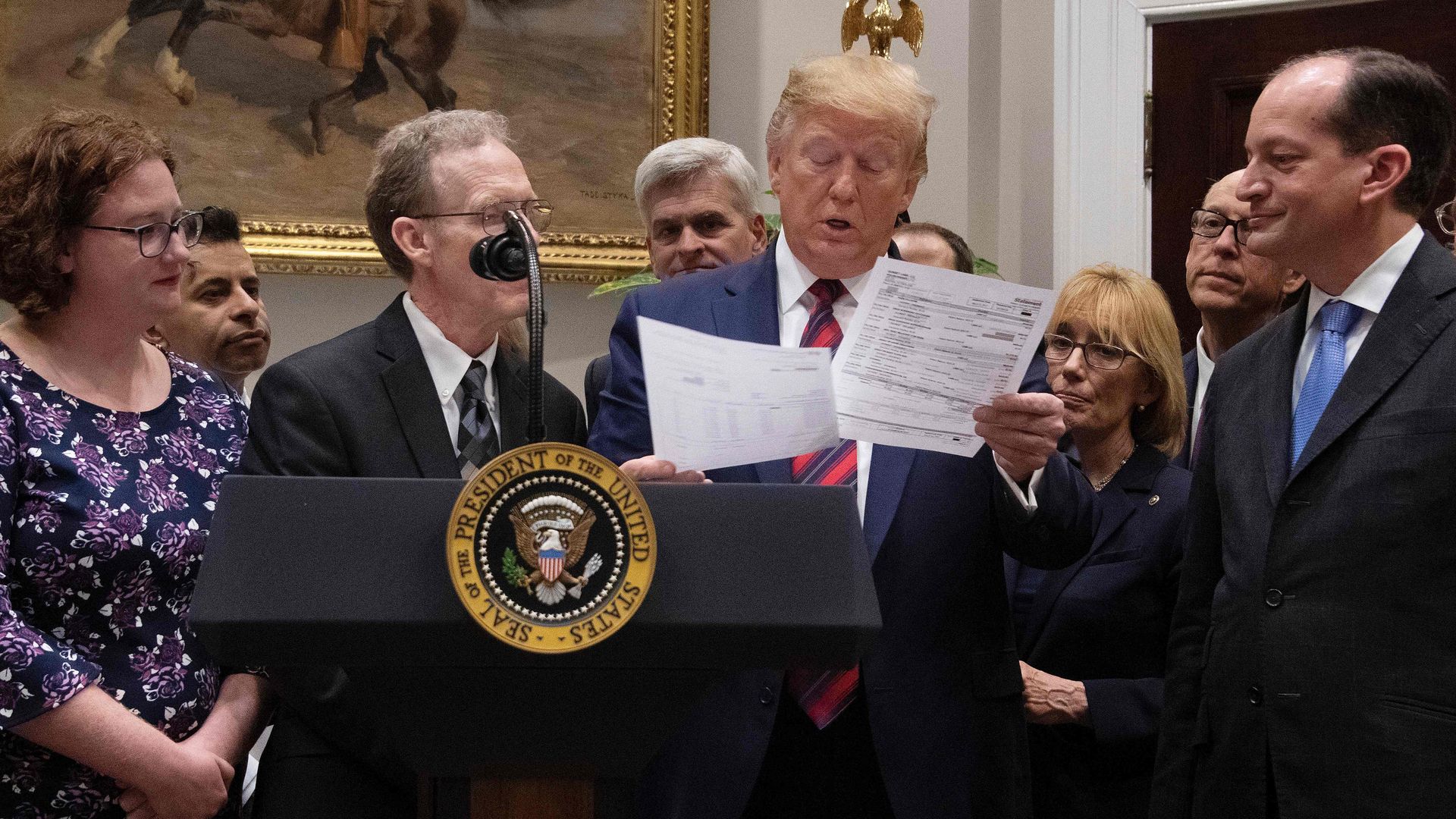

Understanding Trumps Policy On Transgender Individuals In The Military

May 10, 2025

Understanding Trumps Policy On Transgender Individuals In The Military

May 10, 2025