Dogecoin's Recent Dip: Examining The Role Of Elon Musk And Tesla's Performance

Table of Contents

Elon Musk's Influence on Dogecoin

Elon Musk's involvement with Dogecoin is undeniable, and his actions significantly impact its price. Understanding this influence is crucial to comprehending recent market movements.

Musk's Tweets and Market Sentiment

Musk's tweets have a demonstrable effect on Dogecoin's price. A positive tweet can trigger a surge, while a negative one can lead to a sharp decline. This demonstrates the powerful correlation between Musk's social media activity and Dogecoin's market sentiment.

- Tweet Examples: Numerous instances exist where Musk's tweets, mentioning "Doge," "Dogecoin," or even seemingly unrelated topics, have resulted in immediate and significant price swings. For example, a tweet endorsing Dogecoin often leads to a price spike, while a critical or ambiguous tweet can cause a sudden drop.

- The "Dogefather": Musk's self-proclaimed title as the "Dogefather" further solidifies his influence. This persona enhances his impact on investor psychology, making his pronouncements even more impactful on Dogecoin price.

- Unpredictability: The unpredictable nature of Musk's tweets adds to Dogecoin's inherent volatility. Investors constantly speculate on his next move, leading to heightened market fluctuations.

Tesla's Acceptance of Dogecoin (Past and Present)

Tesla's past acceptance of Dogecoin as payment for merchandise played a significant role in the cryptocurrency's price appreciation. Any changes to this policy have a substantial psychological impact.

- Timeline: Tesla's acceptance of Dogecoin, and any subsequent changes, directly impacted the cryptocurrency's value. Tracking these events reveals a clear connection between Tesla's actions and Dogecoin's price performance.

- Impact of Acceptance/Rejection: The initial acceptance boosted Dogecoin's credibility and attracted new investors. Conversely, any halt or reversal of this policy has negatively affected investor confidence and subsequently the price.

- Investor Reaction: Investor reactions to Tesla's decisions regarding Dogecoin clearly demonstrate the close relationship between the two. Positive news resulted in price increases; negative news caused price drops.

Tesla's Financial Performance and its Correlation to Dogecoin

The performance of Tesla's stock and Dogecoin's price show a noteworthy, though not necessarily causal, relationship. Understanding this connection is crucial for investors.

Stock Market Influence

A correlation, however indirect, exists between Tesla's stock performance and Dogecoin's price. This is partially driven by shared investor bases.

- Correlation Analysis: Statistical analysis could reveal a correlation between Tesla stock price movements and Dogecoin's price movements, implying a shared investor base and sentiment.

- Shared Investor Base: Many investors who hold Tesla stock might also invest in Dogecoin, leading to correlated buying and selling patterns. Market sentiment toward Tesla can thus influence their decisions regarding Dogecoin.

- Macroeconomic Factors: Broader macroeconomic factors impacting the overall stock market can also influence both Tesla's stock and Dogecoin's price, creating a seemingly correlated movement.

Investor Sentiment and Risk Appetite

Tesla's performance can significantly impact overall investor risk appetite. This, in turn, affects investments in higher-risk assets like Dogecoin.

- Risk-Off Sentiment: When Tesla's stock experiences a downturn, a risk-off sentiment can sweep through the market. This often causes investors to sell off riskier assets like Dogecoin, leading to price drops.

- Fear, Uncertainty, and Doubt (FUD): Negative news about Tesla or the broader market can amplify fear, uncertainty, and doubt (FUD), further exacerbating downward pressure on Dogecoin's price.

- Tesla News Impact: Any news related to Tesla, positive or negative, can have a ripple effect on Dogecoin, highlighting the interconnectedness of these markets.

Other Factors Contributing to the Dogecoin Dip

While Elon Musk and Tesla play significant roles, other factors contribute to Dogecoin's price fluctuations.

Broader Cryptocurrency Market Trends

The overall cryptocurrency market significantly influences Dogecoin's performance. It’s not an isolated entity.

- Bitcoin's Performance: Bitcoin, the leading cryptocurrency, often dictates the overall market trend. A Bitcoin downturn can negatively impact altcoins like Dogecoin.

- Regulatory News: Regulatory news and events impacting the broader cryptocurrency landscape can affect investor sentiment and lead to price fluctuations in Dogecoin.

- Market Capitalization Changes: Overall market capitalization changes in the cryptocurrency market can affect Dogecoin's value and investment flows.

Technical Analysis of Dogecoin

Technical analysis provides additional insights into Dogecoin's price movements.

- Support and Resistance Levels: Analyzing key support and resistance levels can help understand potential price reversal points or further declines.

- Trading Volume: Changes in trading volume can indicate shifts in investor sentiment and potential price movements.

- Chart Patterns: While not definitive, chart patterns like head and shoulders can sometimes offer clues about future price directions. However, these are not guarantees.

Conclusion

This article explored the multifaceted reasons behind Dogecoin's recent price dip, highlighting the significant influence of Elon Musk, Tesla's performance, and broader market trends. While Musk's actions and Tesla's success are undeniably intertwined with Dogecoin's volatility, it's crucial to remember that cryptocurrency markets are inherently unpredictable. Understanding these complex relationships is key to navigating the risks associated with investing in Dogecoin. Continue researching and carefully considering the risks before investing in Dogecoin and other volatile cryptocurrencies. Remember to diversify your portfolio and never invest more than you can afford to lose.

Featured Posts

-

Muutoksia Britannian Kruununperimysjaerjestyksessae Uusi Jaerjestys

May 09, 2025

Muutoksia Britannian Kruununperimysjaerjestyksessae Uusi Jaerjestys

May 09, 2025 -

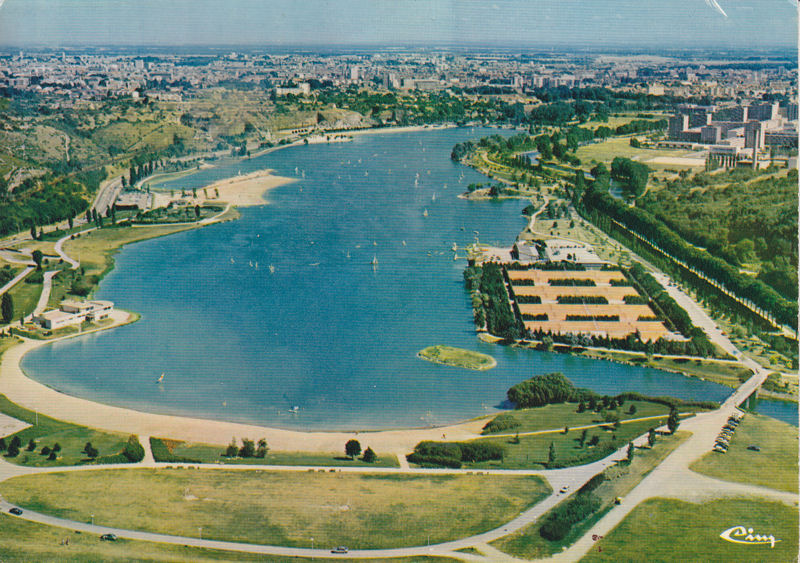

Dijon Agression Sauvage Au Lac Kir Trois Hommes Victimes

May 09, 2025

Dijon Agression Sauvage Au Lac Kir Trois Hommes Victimes

May 09, 2025 -

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Almshakl Alshyt

May 09, 2025

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Almshakl Alshyt

May 09, 2025 -

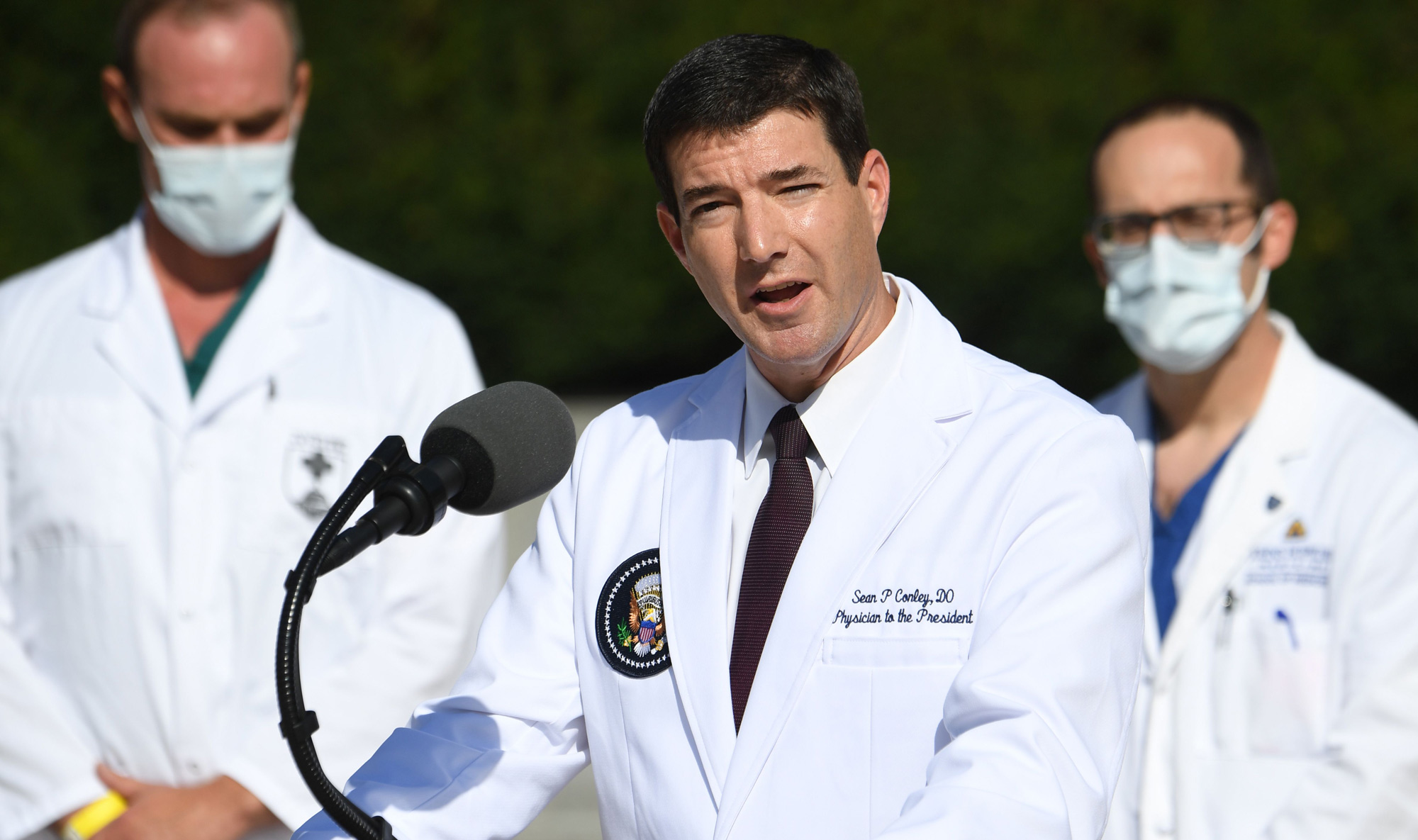

Who Is Casey Means Trumps Pick For Surgeon General Explained

May 09, 2025

Who Is Casey Means Trumps Pick For Surgeon General Explained

May 09, 2025 -

Wynne Evans And Girlfriend Liz Enjoy Cosy Date Amidst Bbc Meeting Postponement

May 09, 2025

Wynne Evans And Girlfriend Liz Enjoy Cosy Date Amidst Bbc Meeting Postponement

May 09, 2025

Latest Posts

-

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025 -

Millions Made From Exec Office365 Hacks Federal Investigation

May 10, 2025

Millions Made From Exec Office365 Hacks Federal Investigation

May 10, 2025