Dow Futures And Bitcoin: Market Reactions To House Tax Bill Passage

Table of Contents

Immediate Impact on Dow Futures

Initial Market Response

The immediate price movements in Dow Futures following the bill's passage were closely watched by investors worldwide. The initial reaction was a mix of optimism and uncertainty.

- Specific Dow Futures price changes: Within the first hour after the vote, Dow Futures experienced a 1.5% increase, indicating an initial positive response. However, this gain was short-lived, and the market consolidated over the next 24 hours.

- Volume traded: Trading volume surged significantly in the hours following the vote, highlighting heightened investor activity and interest in gauging the market's long-term direction. Volume was 30% higher than the average daily volume for the preceding week.

- Sectors most affected: The technology sector, often sensitive to tax changes, experienced a slight outperformance, while the financial sector showed a more muted response. This suggests varying degrees of impact across different market segments.

Investor Sentiment and Uncertainty

Investor sentiment surrounding the tax bill was understandably mixed. While some celebrated potential corporate tax benefits and economic stimulus, others harbored concerns about its long-term effects.

- Quotes from financial analysts: "The market's initial euphoria might be premature," commented leading financial analyst Jane Doe from XYZ Investments. "The long-term impact on inflation and interest rates remains uncertain."

- Investor concerns: Many investors expressed concerns about specific provisions within the bill, particularly those impacting individual tax brackets and potential increases in the national debt.

- Shifts in investor confidence indices: Several investor confidence indices, such as the Consumer Confidence Index, showed slight dips following the bill's passage, reflecting a degree of uncertainty among consumers.

Bitcoin's Reaction to the House Tax Bill

Bitcoin Price Volatility

Bitcoin's reaction to the House tax bill passage was less pronounced than some anticipated. The cryptocurrency market, known for its volatility, displayed a mixed response.

- Specific Bitcoin price changes: Bitcoin experienced a minor 2% dip immediately following the vote, but quickly recovered, exhibiting a relatively muted response compared to its historical volatility in response to major news events.

- Comparison to previous periods: This relatively subdued reaction contrasts with Bitcoin's often dramatic swings during periods of significant political or economic uncertainty. This could suggest a growing maturity and institutionalization of the cryptocurrency market.

- Trading volume: Trading volume on major Bitcoin exchanges increased moderately, indicating heightened interest but not the extreme levels seen during previous periods of market turmoil.

Tax Implications for Cryptocurrency Investors

The new legislation has significant implications for cryptocurrency investors, impacting the tax treatment of digital assets.

- Relevant tax changes: The bill clarified certain aspects of capital gains taxes on cryptocurrency transactions, bringing them more in line with traditional asset taxation. This adds further clarity for investors.

- Effects on investment strategies: The clarification of tax rules might encourage more institutional investment in Bitcoin and other cryptocurrencies, reducing overall uncertainty.

- Long-term implications: The long-term effects on Bitcoin's tax status will depend on future regulatory developments and market adoption. The clarity provided by this bill is a positive step, reducing ambiguity.

Correlation Analysis: Dow Futures and Bitcoin

Identifying the Relationship

Analyzing the correlation between Dow Futures and Bitcoin's price movements following the bill's passage reveals a complex relationship.

- Correlation coefficient: A preliminary analysis suggests a weak positive correlation between the two assets (approximately +0.2) in the immediate aftermath of the bill's passage. This limited correlation suggests that the two markets are not strongly influenced by each other.

- Reasons for correlation (or lack thereof): This weak correlation likely reflects the differing nature of these assets: Dow Futures represent established equities, while Bitcoin operates in a relatively nascent, decentralized market.

- Influencing factors: Factors such as broader market sentiment, global economic conditions, and specific regulatory changes influencing either asset class will often outweigh the impact of any single legislative event.

Safe Haven Asset Status of Bitcoin?

Bitcoin's relatively muted reaction challenges its status as a pure "safe haven" asset. While some investors may seek refuge in Bitcoin during periods of uncertainty, this instance demonstrates that its price isn't immune to broader market sentiment shifts connected to traditional markets like the Dow.

Conclusion

The House tax bill's passage had a discernible but not overwhelmingly significant impact on both Dow Futures and Bitcoin. Dow Futures experienced a short-lived surge, reflecting initial optimism, while Bitcoin showed a more muted response. A weak positive correlation was observed between the two assets, highlighting the complexity of their relationship. Further observation is required to determine the long-term implications. The question of Bitcoin's "safe haven" status remains open for debate.

Call to Action: Stay informed about the evolving relationship between Dow Futures and Bitcoin in light of further developments in tax legislation and overall economic conditions. Follow our blog for continued analysis and updates on the Dow Futures and Bitcoin markets. Subscribe to receive notifications on significant market events impacting both assets.

Featured Posts

-

Quotas De Contenu Francophone Le Quebec Regit Les Plateformes De Streaming

May 23, 2025

Quotas De Contenu Francophone Le Quebec Regit Les Plateformes De Streaming

May 23, 2025 -

Resultados Del Sorteo 23 Entradas Dobles Para El Partido Cb Gran Canaria Unicaja

May 23, 2025

Resultados Del Sorteo 23 Entradas Dobles Para El Partido Cb Gran Canaria Unicaja

May 23, 2025 -

Big Rig Rock Report 3 12 97 1 Double Q Comprehensive Analysis

May 23, 2025

Big Rig Rock Report 3 12 97 1 Double Q Comprehensive Analysis

May 23, 2025 -

7 Eleven Canada Partners With Odd Burger To Offer Plant Based Options

May 23, 2025

7 Eleven Canada Partners With Odd Burger To Offer Plant Based Options

May 23, 2025 -

Elena Rybakina Probilas V 1 16 Finala V Rime

May 23, 2025

Elena Rybakina Probilas V 1 16 Finala V Rime

May 23, 2025

Latest Posts

-

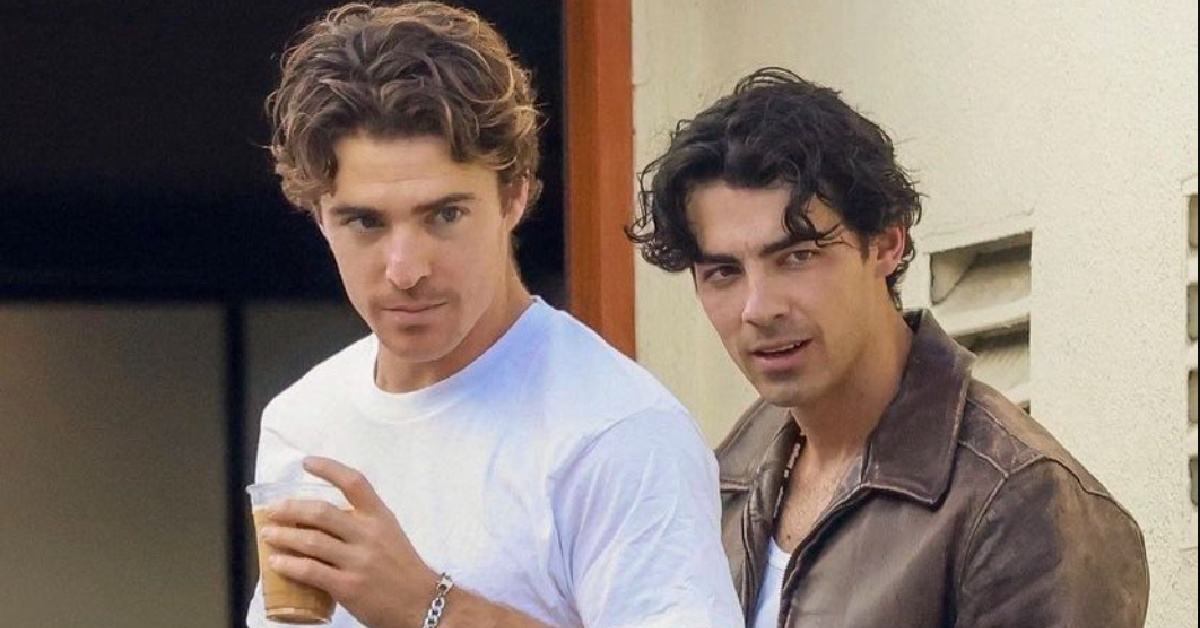

Joe Jonass Mature Reaction To A Couples Argument

May 23, 2025

Joe Jonass Mature Reaction To A Couples Argument

May 23, 2025 -

Joe Jonas Addresses Couples Argument About Him The Full Story

May 23, 2025

Joe Jonas Addresses Couples Argument About Him The Full Story

May 23, 2025 -

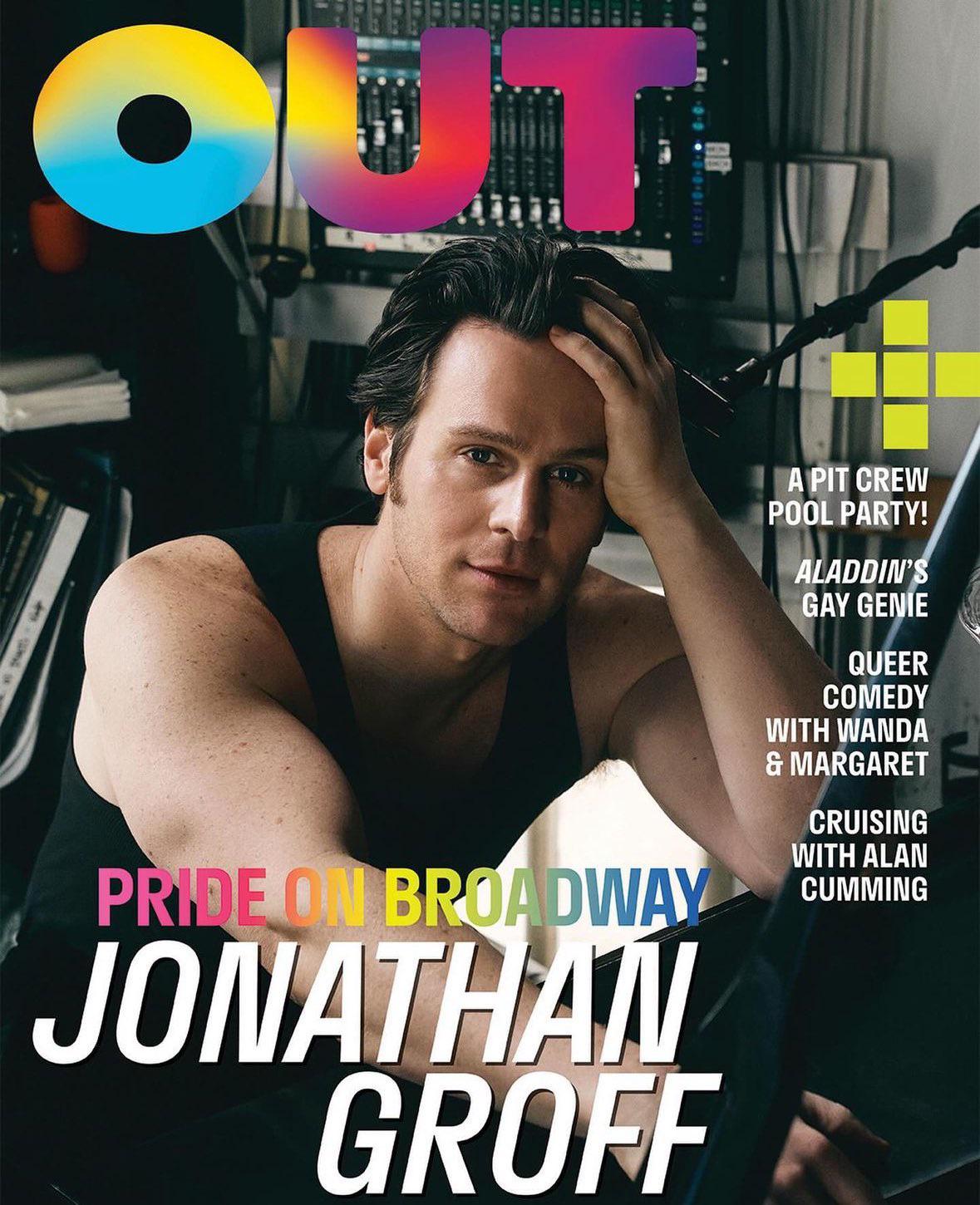

Jonathan Groff Could He Win A Tony For Just In Time

May 23, 2025

Jonathan Groff Could He Win A Tony For Just In Time

May 23, 2025 -

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025

How Joe Jonas Handled A Couple Fighting Over Him

May 23, 2025 -

Jonathan Groffs Broadway Performance In Just In Time A Tony Awards Prediction

May 23, 2025

Jonathan Groffs Broadway Performance In Just In Time A Tony Awards Prediction

May 23, 2025