Dow Futures And Dollar Slide After Moody's US Downgrade

Table of Contents

Moody's Downgrade: The Catalyst for Market Volatility

Moody's decision to downgrade the US credit rating wasn't arbitrary; it stemmed from a confluence of factors impacting the nation's fiscal strength and economic outlook. Their report highlighted significant concerns regarding the US government's fiscal trajectory, citing persistent political polarization hindering effective fiscal policy, and the recurring threat of debt ceiling crises. The agency expressed worries about the erosion of governance strength and the increasing debt burden relative to GDP.

- Key Concerns Raised by Moody's: The report emphasized the US government's weakened fiscal strength, characterized by rising debt levels, recurring struggles to raise the debt ceiling, and a lack of substantial progress in addressing long-term fiscal challenges.

- Impact on US Treasury Yields: The downgrade led to increased uncertainty surrounding US Treasury bonds, pushing yields higher, reflecting a growing risk premium demanded by investors. This increase reflects a decline in confidence in the US government's ability to repay its debts.

- Historical Context: While rare, credit rating downgrades of major economies have historically triggered significant market volatility. Previous downgrades have led to similar declines in market confidence, illustrating the serious consequences of this action.

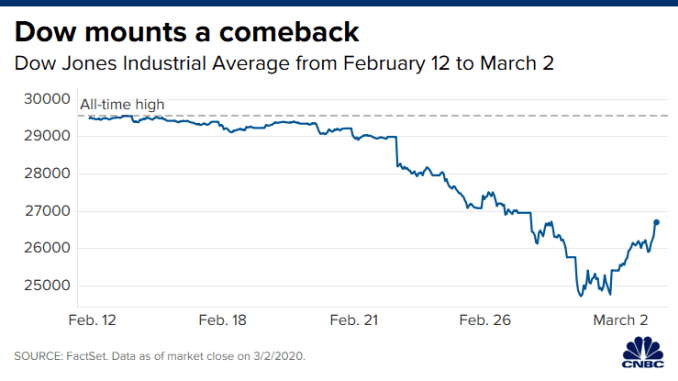

Dow Futures React to Negative Sentiment

The immediate impact of Moody's downgrade was a sharp decline in Dow futures contracts during pre-market trading. This reflected a rapid deterioration in market sentiment and a significant erosion of investor confidence. The negative news fueled a sell-off, indicating a widespread expectation of further economic uncertainty.

- Quantifying the Drop: The Dow futures experienced a substantial point drop, signaling a significant loss of potential value in the upcoming trading session. The exact figures would depend on the specific time of observation.

- Implications for Upcoming Trading Sessions: The initial drop in Dow futures foreshadowed a volatile trading day and potentially a period of sustained market uncertainty. The extent of the correction remained uncertain, dependent on the subsequent market reaction.

- Sectors Most Affected: Sectors highly sensitive to economic conditions, such as technology and consumer discretionary, were among the hardest hit, experiencing a disproportionate fall in their futures contracts.

The Weakening US Dollar: A Consequence of the Downgrade

The decline in the US dollar's value against other major currencies followed directly from the Moody's downgrade. This weakening reflects a decreased demand for the dollar as a safe-haven asset, a perception traditionally associated with the US economy.

- US Dollar as a Safe-Haven Currency: The US dollar is typically seen as a safe haven during times of global economic uncertainty. However, the downgrade challenged this perception, causing investors to seek alternative safe havens.

- Implications for International Trade and Investments: A weaker dollar can make US exports more competitive while simultaneously increasing the cost of imports. This will have significant implications for international trade balances and investment flows.

- Alternative Currencies: Currencies of countries perceived as having greater economic stability might benefit from increased demand as investors seek alternatives to the weakening dollar.

Analyzing the Broader Market Implications

The Moody's downgrade's impact extends far beyond Dow futures and the US dollar. It triggered a wave of risk aversion, impacting global markets and various asset classes.

- Impact on Other Major Indices: The S&P 500 and Nasdaq experienced correlated declines, reflecting the interconnectedness of global financial markets and the shared sentiment of uncertainty.

- Impact on Emerging Markets: Emerging markets, often more susceptible to changes in global investor sentiment, faced considerable pressure due to increased risk aversion. Capital flight from emerging markets is a potential consequence.

- Flight to Safety: Investors likely sought refuge in traditional safe-haven assets such as gold, which typically sees increased demand during periods of economic uncertainty and market volatility.

Conclusion: Understanding the Dow Futures and Dollar Slide Post-Downgrade

Moody's downgrade of the US credit rating created a perfect storm, triggering a decline in Dow futures, a weakening US dollar, and broader market volatility. The interconnectedness of credit ratings, market sentiment, and currency fluctuations is clearly demonstrated by this event. Understanding this interplay is crucial for navigating the complexities of global financial markets. Stay informed on the latest developments concerning Dow futures and the US dollar by following our updates for continued analysis on this evolving situation.

Featured Posts

-

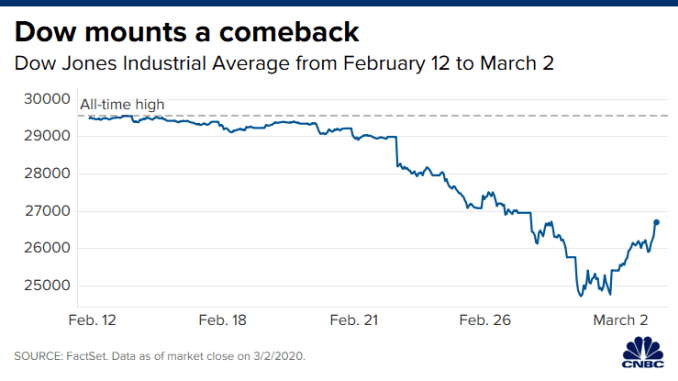

Mondays D Wave Quantum Qbts Stock Fall Understanding The Market Reaction

May 21, 2025

Mondays D Wave Quantum Qbts Stock Fall Understanding The Market Reaction

May 21, 2025 -

Ten Man Juventus Held To 1 1 Draw By Lazio In Serie A Thriller

May 21, 2025

Ten Man Juventus Held To 1 1 Draw By Lazio In Serie A Thriller

May 21, 2025 -

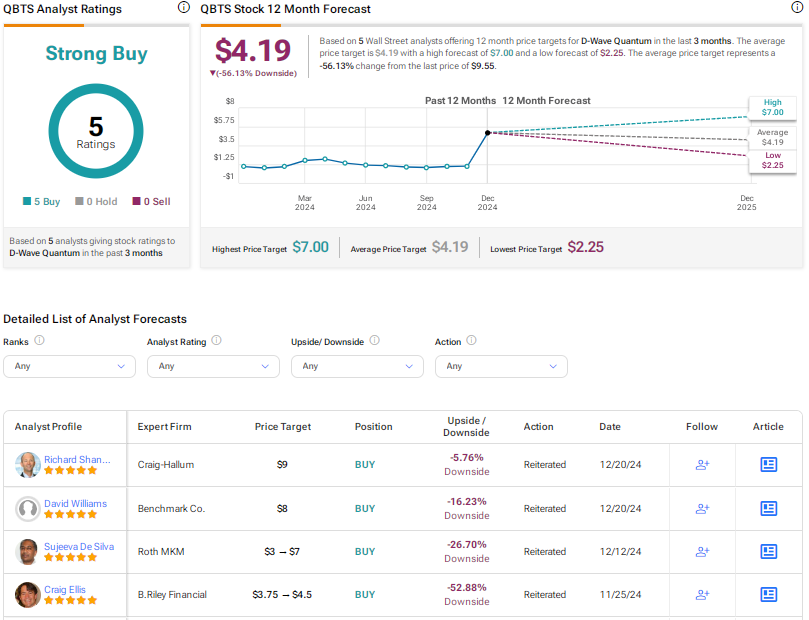

Abn Amro Aex Kwartaalresultaten Leiden Tot Koersstijging

May 21, 2025

Abn Amro Aex Kwartaalresultaten Leiden Tot Koersstijging

May 21, 2025 -

Abn Amro Florius En Moneyou Benoemen Karin Polman Als Directeur Hypotheken

May 21, 2025

Abn Amro Florius En Moneyou Benoemen Karin Polman Als Directeur Hypotheken

May 21, 2025 -

Peppa Pigs New Baby Sister A Pink Celebration

May 21, 2025

Peppa Pigs New Baby Sister A Pink Celebration

May 21, 2025

Latest Posts

-

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025

Quarterfinal Preview Germanys Path To Victory Against Italy

May 21, 2025 -

Germany Italy Quarterfinal A Clash Of Titans

May 21, 2025

Germany Italy Quarterfinal A Clash Of Titans

May 21, 2025 -

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025

Bangladeshinfo Com Reliable Information And Data On Bangladesh

May 21, 2025 -

Live Bundesliga Schedules Teams And Top Performers

May 21, 2025

Live Bundesliga Schedules Teams And Top Performers

May 21, 2025 -

Find Everything You Need To Know About Bangladesh On Bangladeshinfo Com

May 21, 2025

Find Everything You Need To Know About Bangladesh On Bangladeshinfo Com

May 21, 2025