Dubai Holding Increases REIT IPO Size To $584 Million

Table of Contents

Reasons Behind the Increased IPO Size

The dramatic increase in the Dubai Holding REIT IPO size can be attributed to a confluence of factors, reflecting both the inherent strength of the Dubai real estate market and the strategic acumen of Dubai Holding.

Strong Investor Demand

The IPO attracted an overwhelming response from investors worldwide. This exceptional demand underscores the confidence placed in Dubai Holding's portfolio and the future of Dubai's real estate sector.

- Diverse Investor Base: The investor pool included prominent sovereign wealth funds, major institutional investors seeking stable, high-yield investments, and high-net-worth individuals attracted to Dubai's lucrative real estate market.

- Oversubscription: Reports indicate a significant oversubscription of the IPO, highlighting the intense competition for shares and reflecting the scarcity of such high-quality investment opportunities.

- Attractive Yields and Stable Market: Investors are drawn to the projected returns offered by the REIT, coupled with the perceived stability and resilience of the Dubai real estate market, which has demonstrated remarkable growth and stability even amidst global economic fluctuations. This confidence stems from Dubai's diversified economy and proactive government policies.

Market Conditions and Positive Outlook

Dubai's economic landscape currently presents a compelling backdrop for this increased IPO size. Several key factors have fueled this positive outlook:

- Robust Economic Growth: Dubai's economy continues to thrive, fueled by a dynamic tourism sector, ambitious infrastructure projects, and supportive government initiatives.

- Positive Real Estate Trends: The Dubai real estate market has shown consistent growth, with rising property values and rental yields, making it an attractive investment destination.

- Government Support: Dubai's government has played a crucial role in fostering a stable and transparent investment environment, further bolstering investor confidence. Initiatives focused on sustainable development and infrastructure modernization are enhancing the long-term prospects of the real estate sector.

Dubai Holding's Strategic Objectives

The increased IPO size aligns perfectly with Dubai Holding's broader strategic objectives. The larger capital injection allows the company to achieve its goals more effectively:

- Portfolio Diversification: The raised capital will enable Dubai Holding to diversify its investment portfolio, reducing risk and maximizing returns.

- Funding Future Projects: The substantial funds will fuel ambitious new development projects, contributing to Dubai's ongoing urban transformation.

- Enhanced Market Presence: The successful IPO strengthens Dubai Holding's position as a leading player in the Dubai real estate market and enhances its global visibility.

Implications of the Increased IPO Size

The success of this substantially increased IPO carries significant implications for various stakeholders:

Impact on Dubai's Real Estate Market

The influx of capital from the Dubai Holding REIT IPO will have a ripple effect on the Dubai real estate market:

- Increased Investment Activity: The IPO is expected to stimulate further investment in the sector, leading to increased development and construction activity.

- New Project Development: The additional capital will finance the development of new, high-quality projects, further enhancing Dubai's appeal as a prime real estate market.

- Positive Price Effects: The increased demand could potentially lead to a rise in property values, benefiting existing property owners and attracting new investors.

Attracting Foreign Investment in Dubai

The record-breaking IPO reinforces Dubai's image as a global investment hub:

- Enhanced International Appeal: The success of the IPO attracts international investors seeking lucrative opportunities in a stable and rapidly developing economy.

- Strengthened Investor Confidence: The substantial investment shows faith in Dubai's long-term economic stability and growth potential, creating a positive feedback loop.

Future Prospects for Dubai Holding

Dubai Holding is now exceptionally well-positioned for future growth:

- Expansion Opportunities: The company can pursue ambitious expansion plans, leveraging the raised capital to seize strategic opportunities in the real estate sector.

- Strengthened Financial Position: The significant capital infusion strengthens the company's financial stability, providing a solid foundation for future endeavors.

Conclusion: Dubai Holding's REIT IPO: A Sign of Confidence in Dubai's Future

The record-breaking $584 million Dubai Holding REIT IPO underscores the remarkable confidence in Dubai's economic future and the strength of its real estate market. The substantial increase, driven by strong investor demand and favorable market conditions, will have a significant positive impact on Dubai’s economy, attracting further foreign investment and fueling future growth. The successful IPO positions Dubai Holding for ambitious future projects and solidifies Dubai’s standing as a global investment powerhouse. Stay updated on the latest developments regarding the Dubai Holding REIT IPO and other exciting investment opportunities in Dubai's thriving real estate market. Consider exploring the potential of Dubai real estate investment to benefit from this exciting period of growth.

Featured Posts

-

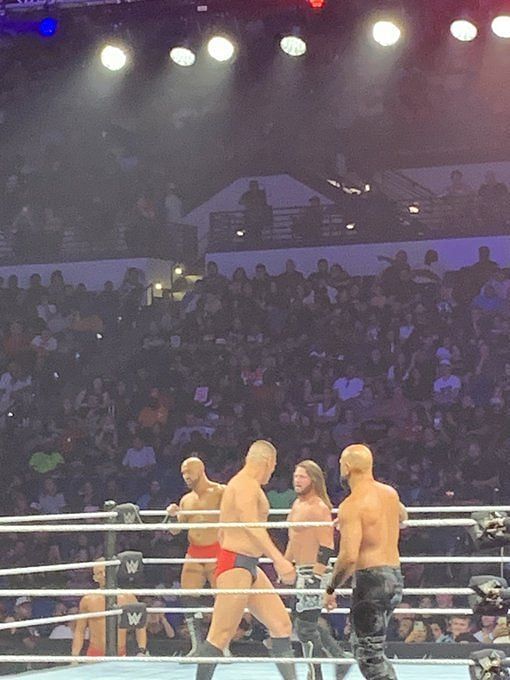

Zayn Under Siege Rollins And Breakker Dominate Wwe Raw

May 20, 2025

Zayn Under Siege Rollins And Breakker Dominate Wwe Raw

May 20, 2025 -

Suki Waterhouses Full Circle Met Gala Style Evolution

May 20, 2025

Suki Waterhouses Full Circle Met Gala Style Evolution

May 20, 2025 -

Wwe News Hinchcliffes Segment A Critical And Commercial Failure

May 20, 2025

Wwe News Hinchcliffes Segment A Critical And Commercial Failure

May 20, 2025 -

Protecting Yourself From Damaging Winds In Fast Moving Storms

May 20, 2025

Protecting Yourself From Damaging Winds In Fast Moving Storms

May 20, 2025 -

The Kite Runner And Nigeria Exploring Pragmatic Choices In A Challenging Context

May 20, 2025

The Kite Runner And Nigeria Exploring Pragmatic Choices In A Challenging Context

May 20, 2025