Dutch Stock Market Downturn: Impact Of US Trade Dispute

Table of Contents

Impact on Key Sectors of the Dutch Economy

The US trade dispute has rippled through the Dutch economy, significantly impacting several key sectors. Understanding these impacts is crucial for navigating the current Dutch Stock Market Downturn.

Agriculture

The Dutch agricultural sector, renowned for its efficiency and export-oriented nature, has been severely impacted by US tariffs on agricultural products. This has resulted in:

- Decreased export volumes to the US: Tariffs have made Dutch agricultural products less competitive in the US market, leading to a significant drop in exports. This directly impacts the profitability of Dutch farmers and related businesses.

- Reduced profitability for Dutch farmers: Lower export volumes and increased production costs due to tariffs have squeezed profit margins, forcing many farmers to operate at a loss or even cease operations.

- Potential job losses in the agricultural sector: The reduced profitability and decreased export volumes threaten job security throughout the supply chain, from farmers to processing and logistics companies.

- Increased reliance on other export markets: Dutch agricultural businesses are increasingly seeking alternative markets to reduce dependence on the US, but finding comparable volumes and prices proves challenging. This necessitates significant strategic shifts and investment.

Technology

While not as directly affected by tariffs as agriculture, the Dutch tech sector faces indirect consequences from the broader global trade uncertainty created by the US trade dispute. These indirect consequences include:

- Supply chain disruptions due to global trade uncertainties: The unpredictability of trade policies creates uncertainty for businesses reliant on global supply chains, leading to delays, increased costs, and potential shortages.

- Impact on investor confidence leading to decreased investment: Global trade tensions negatively impact investor confidence, leading to reduced investment in the Dutch tech sector, hindering growth and innovation.

- Potential for reduced innovation and growth: Decreased investment and supply chain disruptions can stifle innovation and slow the growth trajectory of Dutch tech companies. This could have long-term consequences for the sector's competitiveness.

Financial Services

The Dutch financial sector, a cornerstone of the Dutch economy, is experiencing increased volatility due to the global market uncertainty stemming from the trade dispute. This manifests as:

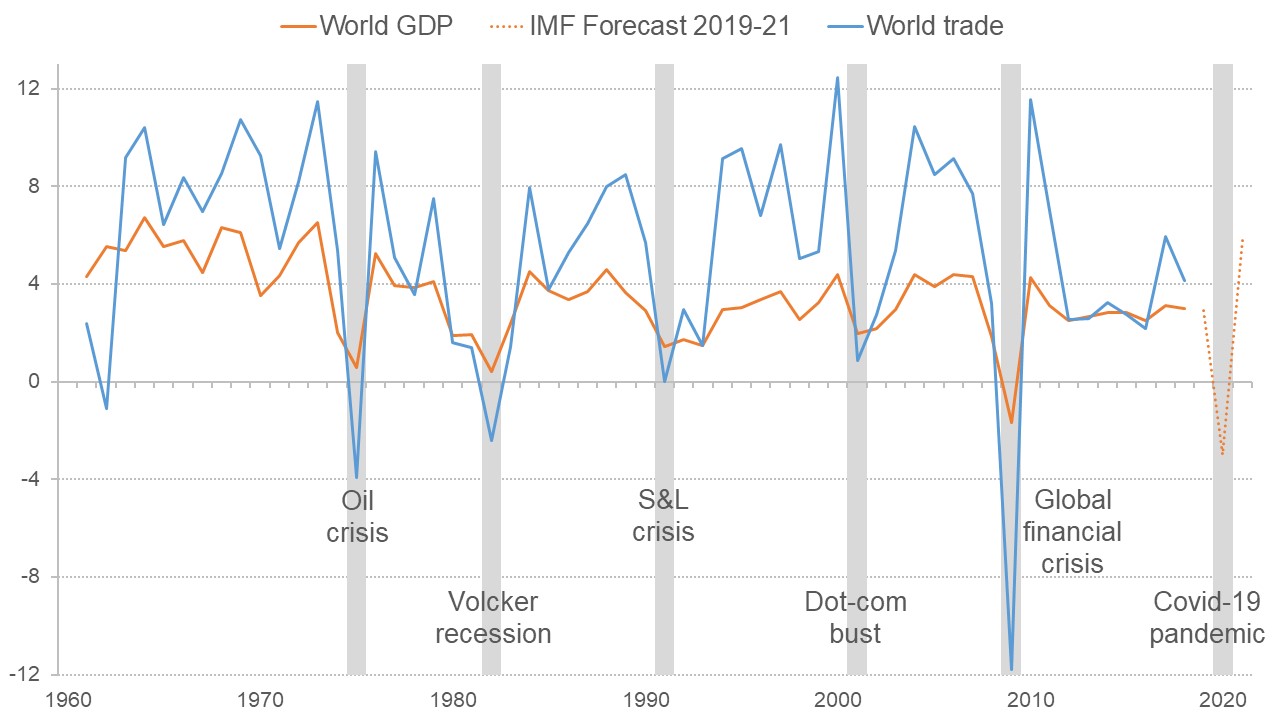

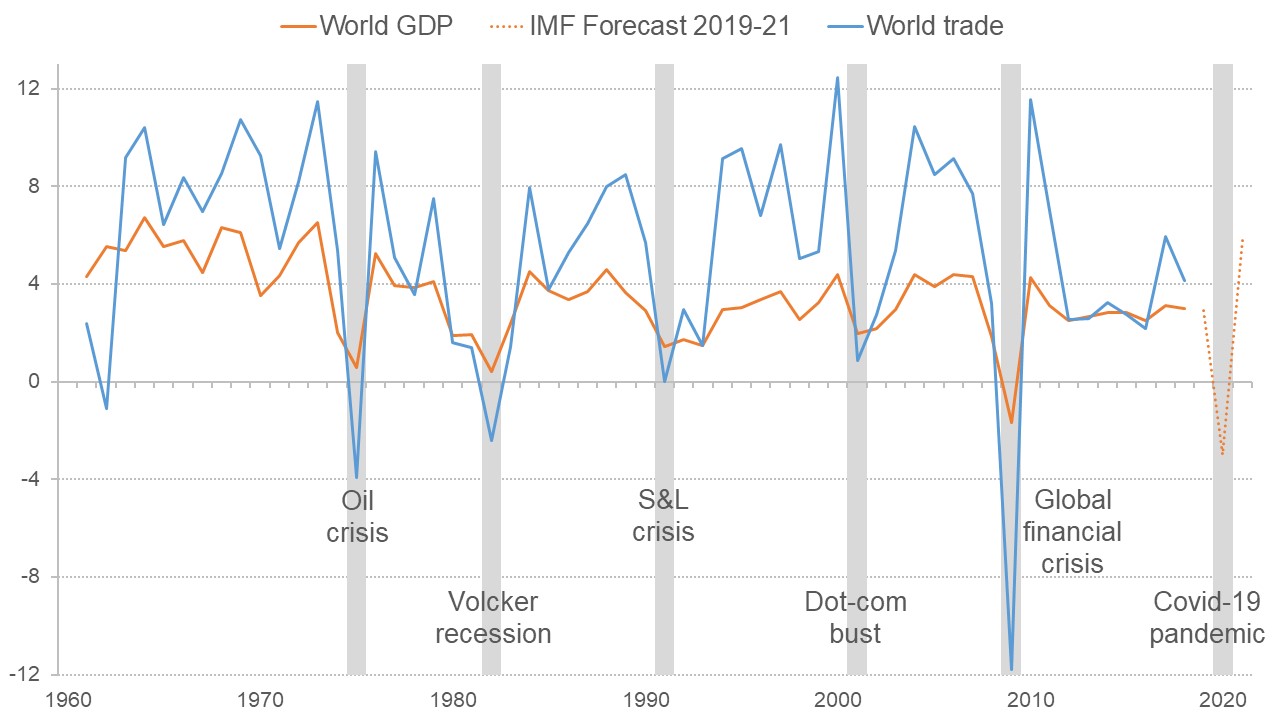

- Increased market volatility impacting investment strategies: The uncertainty surrounding trade relations leads to increased market volatility, forcing investors to adjust their strategies and potentially reduce risk appetite.

- Potential for decreased investment in Dutch financial institutions: Global market uncertainty can deter international investment in Dutch financial institutions, impacting their growth and stability.

- Impact on banking and insurance sectors: The increased market volatility affects lending, investment decisions, and risk assessment within the banking and insurance sectors, potentially limiting credit availability and raising insurance premiums.

Investor Response and Strategies

The Dutch Stock Market Downturn has forced investors to adapt their strategies. The prevailing sentiment is one of caution and risk mitigation.

Diversification

Investors are actively diversifying their portfolios to reduce exposure to the risks associated with the current market situation. This involves:

- Shifting investments towards less volatile markets: Investors are seeking refuge in more stable markets perceived as less susceptible to the impact of the trade dispute.

- Increased allocation to international assets: Diversification across geographical regions and asset classes is a key strategy to mitigate risk and improve portfolio resilience.

- Focus on defensive stocks: Investors are prioritizing stocks considered less sensitive to economic downturns, such as consumer staples and utilities.

Risk Management

Sophisticated risk management strategies have become paramount for navigating the increased volatility. This includes:

- Hedging strategies to protect against further losses: Investors are employing various hedging techniques to limit potential losses from further market declines.

- Closer monitoring of market indicators: Increased vigilance in tracking economic data, market trends, and geopolitical developments is crucial for informed decision-making.

- Reduced exposure to high-risk assets: Investors are reducing their exposure to assets perceived as highly sensitive to market fluctuations, such as speculative stocks and emerging market investments.

Increased Volatility and Trading

The heightened uncertainty is leading to:

- Short-term trading strategies become more prevalent: The focus has shifted towards shorter-term trading strategies, exploiting short-term price movements rather than long-term investment horizons.

- Increased use of derivatives for hedging and speculation: Derivatives are being increasingly utilized for both hedging against risks and for speculative trading, capitalizing on market volatility.

Government Response and Potential Solutions

The Dutch government is actively working to mitigate the impact of the Dutch Stock Market Downturn and support affected sectors. This includes:

- Government initiatives to support affected sectors: Subsidies, tax breaks, and other financial aid are being provided to businesses struggling due to the trade dispute.

- Negotiations with the US to resolve trade disputes: The government is actively engaged in diplomatic efforts to resolve the trade disputes and reduce their negative impact on the Dutch economy.

- Exploration of new trade partnerships to diversify export markets: The government is pursuing new trade agreements and partnerships to diversify export markets and reduce dependence on the US.

- Policy measures to boost investor confidence: The government is implementing policies designed to restore investor confidence and attract foreign investment.

Conclusion

The Dutch Stock Market Downturn, significantly influenced by the US trade dispute, presents significant challenges for the Dutch economy. Understanding the impact on key sectors, investor responses, and government initiatives is critical. The ongoing uncertainty requires careful monitoring and adaptive strategies. By diversifying investments, employing robust risk management techniques, and staying informed about developments in the trade dispute, investors can navigate this challenging period. Staying informed about the ongoing developments in the Dutch Stock Market Downturn is vital for making sound investment decisions and navigating the complexities of this situation. Regularly review your portfolio and adapt your strategies as needed to mitigate risks and potentially capitalize on opportunities arising from this period of market volatility.

Featured Posts

-

2025 Porsche Cayenne Interior And Exterior Detailed Photo Showcase

May 25, 2025

2025 Porsche Cayenne Interior And Exterior Detailed Photo Showcase

May 25, 2025 -

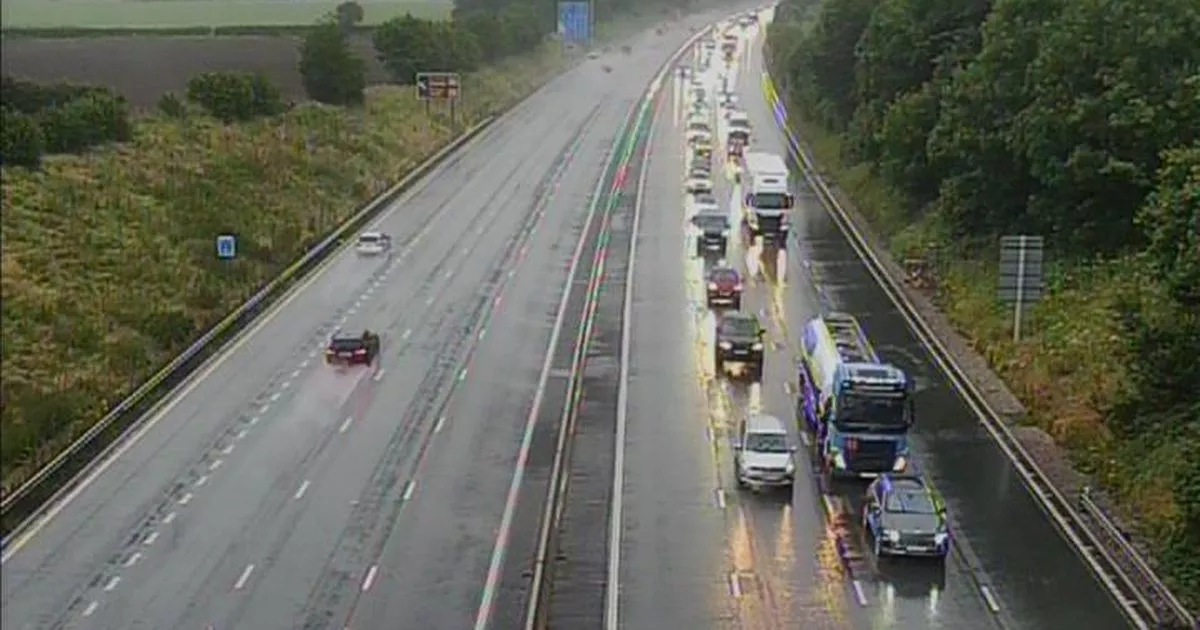

Live Updates M56 Traffic Disruption After Serious Crash

May 25, 2025

Live Updates M56 Traffic Disruption After Serious Crash

May 25, 2025 -

Rowing For A Cure A Fathers 2 2 Million Mission For His Son

May 25, 2025

Rowing For A Cure A Fathers 2 2 Million Mission For His Son

May 25, 2025 -

Emergency Services Respond To M56 Overturned Car Accident

May 25, 2025

Emergency Services Respond To M56 Overturned Car Accident

May 25, 2025 -

Property Investment Lessons From Nicki Chapmans 700 000 Success

May 25, 2025

Property Investment Lessons From Nicki Chapmans 700 000 Success

May 25, 2025

Latest Posts

-

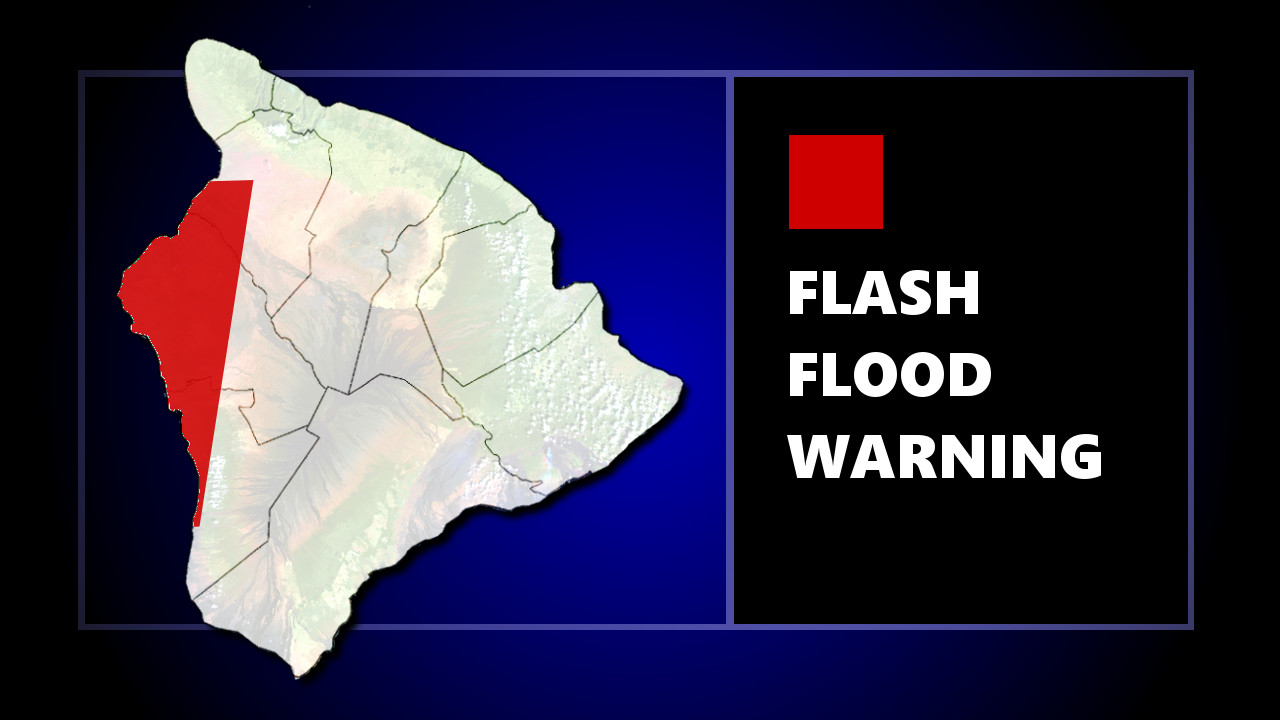

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Hampshire And Worcester

May 25, 2025 -

Hampshire And Worcester Counties Under Flash Flood Warning Thursday

May 25, 2025

Hampshire And Worcester Counties Under Flash Flood Warning Thursday

May 25, 2025 -

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of Pennsylvania

May 25, 2025 -

Severe Weather Alert Flash Flood Warning For Pennsylvania Until Thursday

May 25, 2025

Severe Weather Alert Flash Flood Warning For Pennsylvania Until Thursday

May 25, 2025 -

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 25, 2025

Pennsylvania Flash Flood Warning Heavy Rain Until Thursday

May 25, 2025