EToro Aims For $500 Million In IPO Relaunch

Table of Contents

eToro's Previous IPO Attempt and its Lessons Learned

eToro's initial attempt at an IPO faced challenges, ultimately leading to its withdrawal. While specific details regarding the reasons for the failure haven't been fully disclosed, several contributing factors can be analyzed.

-

Market Conditions: The previous attempt coincided with a period of market volatility and uncertainty, impacting investor sentiment and making it difficult to secure a favorable valuation for the eToro stock. The global economic climate played a significant role.

-

Strategic Adjustments: Since the previous attempt, eToro has likely implemented several strategic changes. These might include expanding its product offerings, enhancing its user experience, focusing on regulatory compliance, and strengthening its financial performance to present a more compelling case to potential investors. This includes diversifying their offerings beyond social trading.

-

Regulatory Landscape Shifts: The regulatory environment for online trading platforms has evolved significantly. Navigating these changes, including adapting to new compliance requirements and demonstrating regulatory adherence, is crucial for a successful eToro initial public offering. This includes adapting to the evolving regulatory landscapes in various key markets.

The $500 Million Target and its Significance

The $500 million target for the eToro IPO is significant, reflecting the company's ambitious growth projections and current valuation. This substantial sum indicates investor confidence in eToro's long-term prospects.

-

Allocation of Funds: The funds raised will likely be used for several key areas: expanding into new markets, developing innovative trading tools and features, potentially acquiring smaller fintech companies to bolster its capabilities, and strengthening its technological infrastructure.

-

Market Share Impact: A successful IPO could significantly enhance eToro's market share within the competitive landscape of social trading and online brokerage platforms. This increased capital can fuel marketing efforts and product development, attracting a larger user base.

-

Investor Implications: For existing investors, a successful IPO represents a potential liquidity event, offering an opportunity to realize returns. For potential new investors, the IPO provides access to a company with a strong track record in the growing social trading sector. The eToro stock performance after the IPO will be closely watched.

eToro's Competitive Landscape and Market Position

eToro operates in a dynamic and competitive market. Understanding its position within this landscape is crucial to assessing the success potential of the eToro initial public offering.

-

Key Competitors: eToro competes with established players like Robinhood, Interactive Brokers, and other social trading platforms. Each competitor possesses unique strengths and weaknesses. eToro's success hinges on differentiating itself effectively.

-

Unique Selling Proposition: eToro's strength lies in its social trading features, allowing users to copy the trades of experienced investors. This unique element differentiates it from traditional brokerage platforms, attracting a broader range of users.

-

Social Trading Market Growth: The social trading market is experiencing robust growth, presenting a significant opportunity for eToro. The company's ability to capitalize on this growth, coupled with technological advancements, will be key to its long-term success.

Regulatory Considerations and Future Outlook

Navigating the regulatory environment is paramount for the success of eToro's IPO.

-

Key Market Regulations: eToro must comply with regulations in various jurisdictions where it operates, including those concerning data privacy, financial security, and anti-money laundering.

-

Regulatory Hurdles: Potential regulatory hurdles could include compliance costs, potential delays in the approval process, and evolving regulations that might require adaptation and increased investments in compliance.

-

Long-Term Prospects: The long-term prospects for eToro are positive, given the growth of the online trading and social trading markets. However, consistent regulatory compliance, continued innovation, and effective competition management will be crucial for sustained success.

Conclusion

eToro's renewed push for a $500 million IPO represents a significant milestone for the social trading platform. This relaunch, informed by lessons from its previous attempt, demonstrates a renewed commitment to growth and market leadership. The success of this eToro IPO will be greatly influenced by several factors, including market conditions, competitive pressures, and regulatory compliance. The substantial funding sought highlights eToro's ambitious plans for expansion and innovation within the increasingly competitive fintech sector.

Call to Action: Stay informed about the progress of eToro's $500 million IPO relaunch. Follow reputable financial news sources for updates and insights into this pivotal moment for the future of eToro and the social trading landscape. Keep an eye on the eToro stock market performance once the IPO is complete and consider the implications for your own investment strategy regarding the eToro initial public offering.

Featured Posts

-

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025 -

Dean Huijsen A Premier League Transfer On The Cards

May 14, 2025

Dean Huijsen A Premier League Transfer On The Cards

May 14, 2025 -

Lindts Central London Chocolate Shop A Paradise For Chocoholics

May 14, 2025

Lindts Central London Chocolate Shop A Paradise For Chocoholics

May 14, 2025 -

Zvezda Ot Anatomiyata Na Grey I Euforiya Se Bori S Als

May 14, 2025

Zvezda Ot Anatomiyata Na Grey I Euforiya Se Bori S Als

May 14, 2025 -

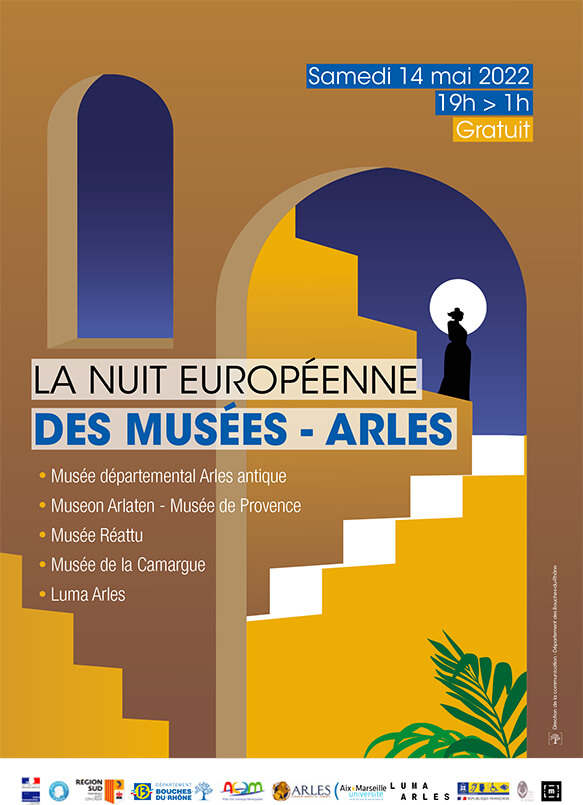

Fondation Seydoux Pathe Nuit Des Musees 2025 Une Exploration Cinematographique

May 14, 2025

Fondation Seydoux Pathe Nuit Des Musees 2025 Une Exploration Cinematographique

May 14, 2025