EToro's $500 Million IPO Push: A Closer Look

Table of Contents

eToro's Business Model and Platform

eToro's success hinges on its innovative social trading platform. Unlike traditional brokerage firms, eToro allows users to copy the trades of other successful investors, a feature known as "copy trading." This fosters a community-driven approach to investing, lowering the barrier to entry for novice traders. Its target audience encompasses both seasoned investors seeking diversification and beginners attracted by the platform's ease of use and social features.

However, this innovative approach also presents challenges. The platform's reliance on copy trading introduces inherent risks, as users might blindly follow unsuccessful traders, leading to potential losses. While the platform's ease of use is a significant strength, attracting a large user base, maintaining user engagement and retention requires continuous improvements and new features.

- Ease of use for beginners: The intuitive interface makes it easy for beginners to navigate the platform and start investing.

- Social features encouraging community interaction: Copy trading and the social feed foster a vibrant community where users can learn from each other.

- Potential risks associated with copy trading: The success of copy trading depends entirely on the chosen trader's performance, carrying significant risk.

- Mobile app functionality and user experience: A robust mobile app enhances accessibility and user experience, contributing to higher user engagement.

eToro's Financial Performance and Growth Potential

eToro's financial performance will be a crucial factor in determining the success of its $500 million IPO push. Analyzing its recent financial statements – revenue, profit margins, and user growth – is vital. Key financial metrics, such as customer acquisition cost (CAC) and lifetime value (LTV), will be closely scrutinized by potential investors. eToro's projected growth trajectory depends heavily on its ability to attract and retain users in existing and new geographic markets, particularly given increasing competition.

- Revenue streams: eToro generates revenue primarily through commissions, fees, and potentially other ancillary services.

- Profitability and margins: Achieving and maintaining healthy profit margins is crucial for attracting investors.

- User acquisition costs: Balancing user acquisition costs with LTV is vital for sustainable growth.

- Growth in specific geographic markets: Expansion into new markets presents both opportunities and challenges, including regulatory hurdles and cultural differences.

Competitive Landscape and Market Analysis

eToro operates in a fiercely competitive online trading space, facing established players like Robinhood, Webull, and others. While eToro's unique social trading feature offers a competitive advantage, it also faces challenges from competitors offering similar services or focusing on specific niche markets. The overall market conditions, including volatility and economic uncertainty, will significantly impact investor sentiment towards eToro's IPO. Navigating regulatory hurdles and ensuring compliance are also crucial for long-term success.

- Market share analysis: eToro's market share relative to its competitors will be a key indicator of its market position.

- Competitive pricing strategies: eToro's pricing model needs to be competitive while maintaining profitability.

- Regulatory compliance and risk management: Strict adherence to regulations is crucial to maintain investor trust and avoid legal issues.

- Emerging trends in the online brokerage industry: Adapting to emerging trends such as cryptocurrencies and decentralized finance (DeFi) will be critical.

Risks and Challenges Associated with the IPO

Despite the potential upside, eToro's $500 million IPO push faces several risks. Market volatility and economic uncertainty can significantly impact investor confidence and the IPO valuation. Changes in regulations, particularly concerning online trading and fintech, could affect eToro's operations and profitability. Furthermore, cybersecurity risks and data protection are paramount concerns in the online financial services industry.

- Valuation concerns and market sentiment: Achieving a favorable valuation will be critical to attract investors.

- Potential dilution for existing shareholders: Issuing new shares can dilute the ownership stake of existing shareholders.

- Regulatory scrutiny and compliance costs: Meeting regulatory requirements can be costly and time-consuming.

- Cybersecurity risks and data protection: Protecting user data from cyber threats is crucial for maintaining trust and avoiding legal liabilities.

Assessing the Success of eToro's $500 Million IPO Push

eToro's $500 million IPO push presents a compelling opportunity for growth, driven by its innovative social trading platform and potential for expansion into new markets. However, the competitive landscape, regulatory hurdles, and inherent risks associated with the online trading industry pose significant challenges. The success of the IPO will ultimately depend on eToro's ability to demonstrate sustainable growth, profitability, and strong risk management.

Stay tuned for updates on eToro's IPO journey and share your thoughts on this ambitious undertaking in the comments below! [Link to relevant financial news source]

Featured Posts

-

Separation Familiale Sous Oqtf L Histoire Dechirante De Deux Collegiens Et Leur Mere

May 14, 2025

Separation Familiale Sous Oqtf L Histoire Dechirante De Deux Collegiens Et Leur Mere

May 14, 2025 -

Final Reckoning Svalbard Featurette Production Insights

May 14, 2025

Final Reckoning Svalbard Featurette Production Insights

May 14, 2025 -

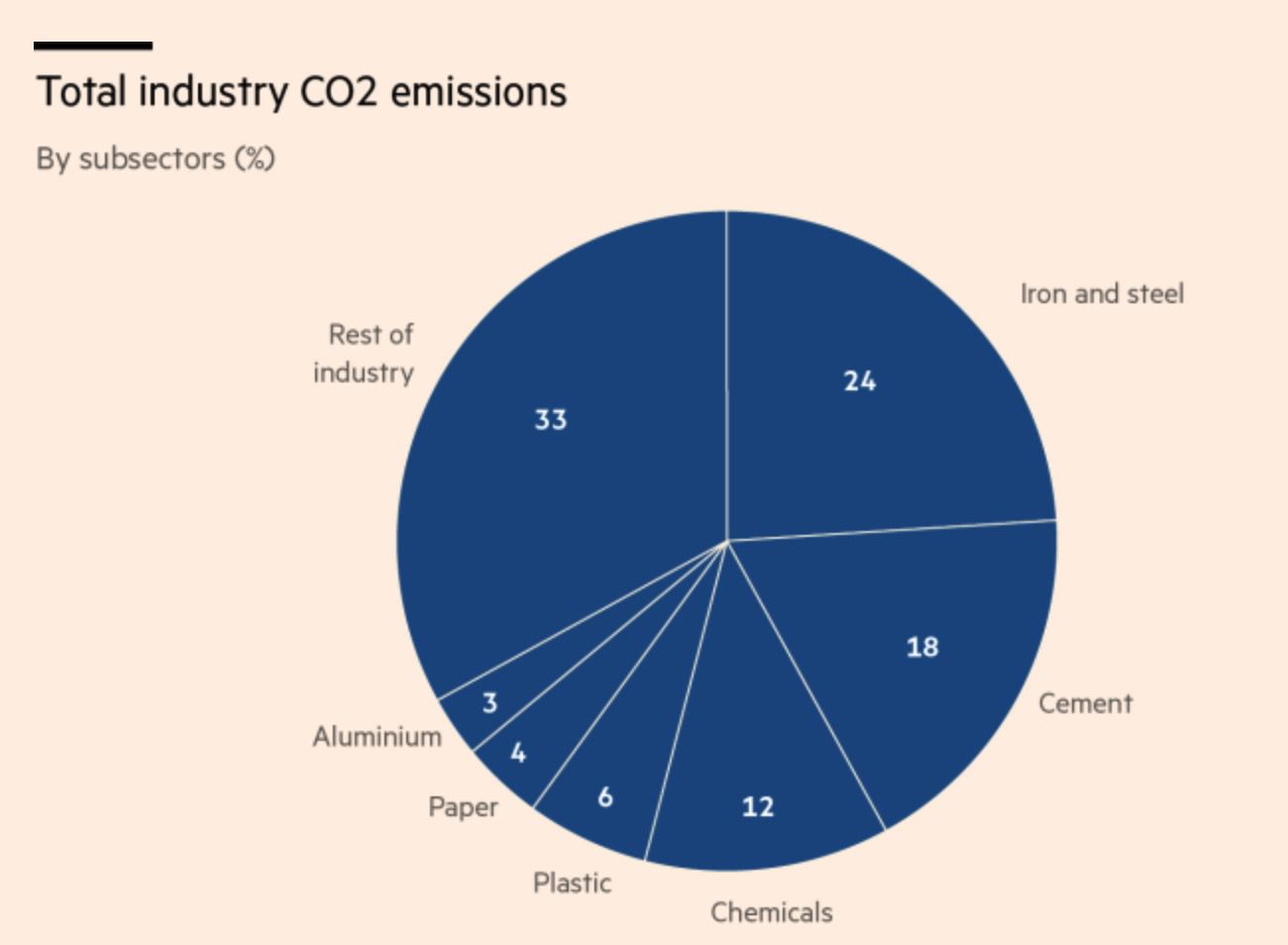

Eramets Era Low Reducing Co 2 Emissions In Steel Production With Manganese Alloys

May 14, 2025

Eramets Era Low Reducing Co 2 Emissions In Steel Production With Manganese Alloys

May 14, 2025 -

Mission Impossible Dead Reckoning Part Two Imax Opening Day Fan Event Tickets

May 14, 2025

Mission Impossible Dead Reckoning Part Two Imax Opening Day Fan Event Tickets

May 14, 2025 -

Uruguay Mujica Expresidente Muere A Los 89 Anos

May 14, 2025

Uruguay Mujica Expresidente Muere A Los 89 Anos

May 14, 2025