eToro investment opportunity.

EToro's Return To The IPO Market: A $500 Million Target

Table of Contents

eToro's Financial Performance and Growth Trajectory

eToro's financial performance in recent years has been a key driver behind its ambitious $500 million IPO target. The company has demonstrated consistent revenue growth, a rapidly expanding user base, and improving profitability, all crucial factors for attracting investors. Analyzing key performance indicators (KPIs) reveals a strong growth trajectory.

- Revenue Growth Year-over-Year: eToro has consistently reported significant increases in annual revenue, demonstrating a healthy growth rate in its core business. Specific figures would need to be sourced from their financial reports to populate this section.

- Number of Registered Users and Active Traders: The platform boasts millions of registered users globally, showcasing the broad appeal of its social trading features. The number of active traders — those actively engaging in transactions — is a key indicator of platform engagement and revenue generation. Again, specific numbers should be included here.

- Key Market Share Data: eToro holds a significant position within the competitive online brokerage and social trading market. Data on its market share relative to competitors should be cited here.

- Profitability Metrics (e.g., Net Income, EBITDA): Demonstrating a clear path to profitability is vital for securing a high valuation in the IPO. Positive net income and EBITDA figures would significantly bolster investor confidence in the

eToro investment.

These eToro financials, along with other key metrics, will be crucial for assessing the company's readiness for the public markets and justifying the targeted $500 million valuation.

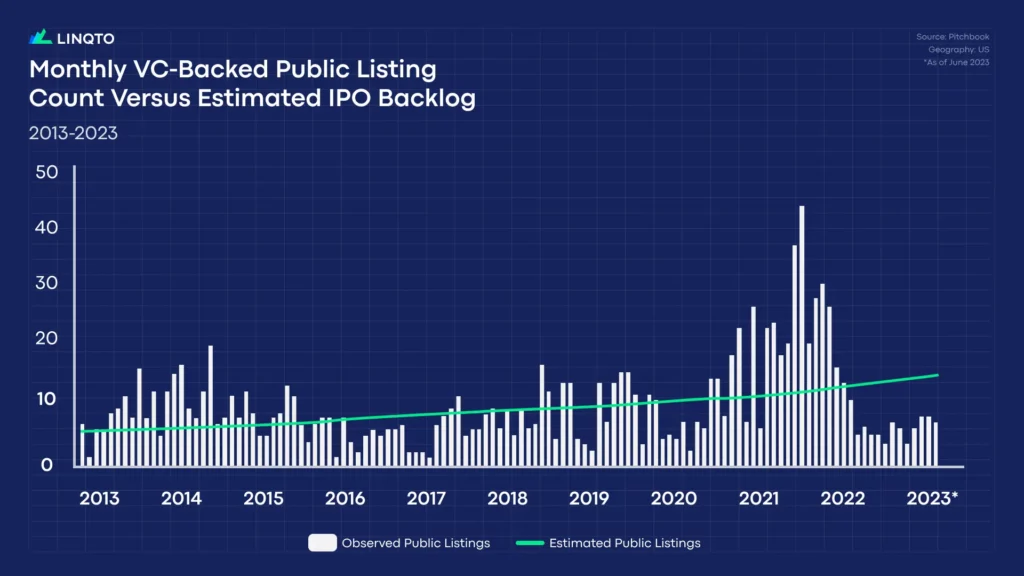

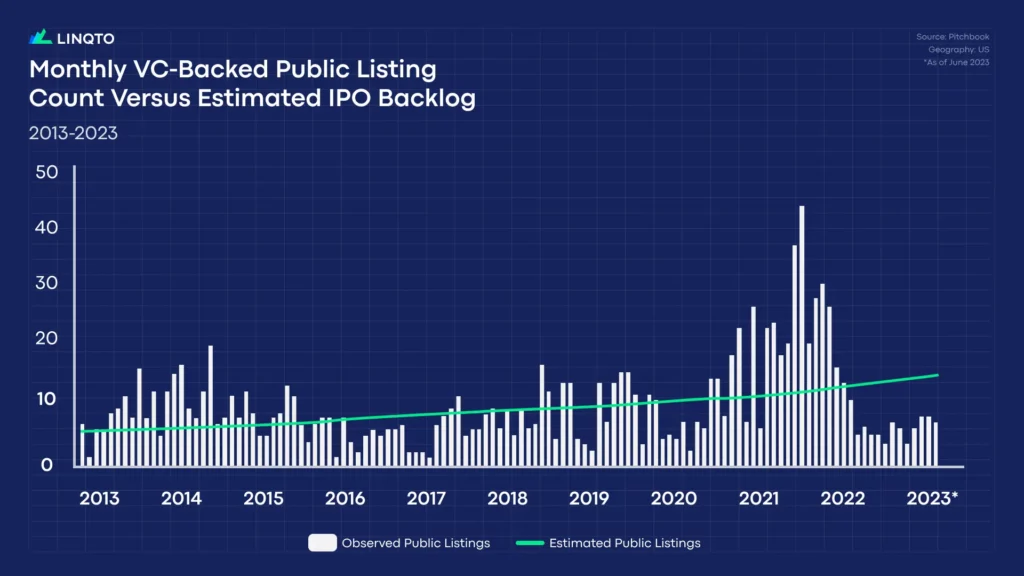

Market Conditions and Investor Sentiment

The success of eToro's IPO hinges significantly on prevailing market conditions and investor sentiment. The current state of the IPO market, characterized by [insert current market conditions – e.g., volatility, investor appetite for tech stocks, etc.], will undoubtedly influence the final valuation.

- Current Market Volatility: High market volatility could either hinder or boost the IPO's success, depending on the prevailing investor risk appetite.

- Investor Appetite for Tech and Fintech Stocks: The overall enthusiasm for technology and fintech investments will play a crucial role in determining the success of the

eToro IPO. - Competition within the Fintech Sector: eToro faces stiff competition from established players in the brokerage and investment space. A thorough competitive analysis is crucial.

- Regulatory Landscape and its Potential Impact: The regulatory environment for fintech companies can significantly impact their operations and valuations. Any potential regulatory changes must be considered.

Understanding these factors is critical for assessing the eToro valuation and the potential risks associated with investing in the fintech investment opportunity presented by the eToro IPO. The IPO market conditions must be carefully analyzed.

eToro's Competitive Advantage and Future Outlook

eToro's success stems from its unique features and strategic positioning within the crowded brokerage market. Its social trading platform, coupled with copy trading functionalities, sets it apart from traditional brokers. This eToro competitive advantage contributes significantly to the anticipated success of the IPO.

- Key Features and Functionalities of the eToro Platform: Highlight features like copy trading, social sentiment analysis, and educational resources that attract a broad user base.

- Target Audience and Market Penetration: Identifying and analyzing the platform’s target audience and market share will showcase the

eToro growth strategy. - Technological Innovations and Future Developments: eToro's commitment to innovation, including advancements in AI and blockchain technology, will shape its future outlook.

- Expansion into New Geographical Markets or Product Offerings: Expansion into new markets and the development of new products will be key drivers of future revenue growth.

The company's eToro future outlook is bright, given its strategic focus on innovation and expansion. This eToro innovation helps justify the ambitious $500 million target.

The $500 Million Valuation: Realistic or Ambitious?

The $500 million valuation target for eToro's IPO is undoubtedly ambitious. Several factors contribute to this figure, including its rapid growth, strong user base, and innovative platform. However, a thorough analysis comparing eToro to similar companies in the fintech sector is necessary to assess whether this valuation is realistic.

- Comparable Company Valuations: Benchmarking eToro against publicly traded competitors with similar business models will provide a realistic context for its valuation.

- Price-to-Earnings (P/E) Ratio Analysis: A detailed analysis of the company's P/E ratio, compared to its peers, will provide insight into its valuation.

- Potential Valuation Range: Considering the various factors influencing the valuation, a realistic range should be presented.

- Factors Influencing the Final Valuation: This includes market conditions, investor sentiment, and the company’s performance in the lead-up to the IPO.

The eToro valuation analysis is key to understanding the potential returns and risks associated with this eToro IPO price. The ultimate eToro market capitalization will depend on a multitude of factors.

Conclusion: Investing in eToro's Future: A $500 Million Opportunity?

eToro's return to the IPO market with a $500 million target represents a significant opportunity for investors. While the valuation is ambitious, the company's strong financial performance, innovative platform, and growth potential support its prospects. However, potential investors should carefully consider the market conditions and associated risks before making any investment decisions. The eToro IPO investment presents a compelling opportunity, but thorough due diligence is crucial.

Stay informed about the progress of eToro's $500 million IPO and explore investment opportunities in this exciting fintech company. Learn more about the eToro IPO and how you can potentially participate in its success. Consider this a potential $500 million IPO opportunity to invest in eToro stock.

Featured Posts

-

Disney Snow White Jewelry Kendra Scott Collection Highlights Under 100

May 14, 2025

Disney Snow White Jewelry Kendra Scott Collection Highlights Under 100

May 14, 2025 -

Is Disneys Snow White The New Worst Movie Im Dbs Ranking Causes A Stir

May 14, 2025

Is Disneys Snow White The New Worst Movie Im Dbs Ranking Causes A Stir

May 14, 2025 -

Budapest Tommy Fury Visszater Es Uezen Jake Paulnak Fotok

May 14, 2025

Budapest Tommy Fury Visszater Es Uezen Jake Paulnak Fotok

May 14, 2025 -

Chimes New 500 Instant Loan A Boon For Direct Deposit Users

May 14, 2025

Chimes New 500 Instant Loan A Boon For Direct Deposit Users

May 14, 2025 -

Jannik Sinners Fox Logo Why It Falls Short Of Roger Federers Branding

May 14, 2025

Jannik Sinners Fox Logo Why It Falls Short Of Roger Federers Branding

May 14, 2025

Latest Posts

-

Epl Newcastle United Vs Team Name Awoniyis Fitness Confirmed

May 14, 2025

Epl Newcastle United Vs Team Name Awoniyis Fitness Confirmed

May 14, 2025 -

Santos Pre Newcastle Epl Update Awoniyi Ready To Play

May 14, 2025

Santos Pre Newcastle Epl Update Awoniyi Ready To Play

May 14, 2025 -

Awoniyi Fit For Newcastle Santos Positive Epl Update

May 14, 2025

Awoniyi Fit For Newcastle Santos Positive Epl Update

May 14, 2025 -

Ramadan Iftar Nottingham Footballer Taiwo Awoniyis Act Of Charity

May 14, 2025

Ramadan Iftar Nottingham Footballer Taiwo Awoniyis Act Of Charity

May 14, 2025 -

Nottinghams Muslim Community Celebrates Ramadan Thanks To Taiwo Awoniyis Iftar Sponsorship

May 14, 2025

Nottinghams Muslim Community Celebrates Ramadan Thanks To Taiwo Awoniyis Iftar Sponsorship

May 14, 2025