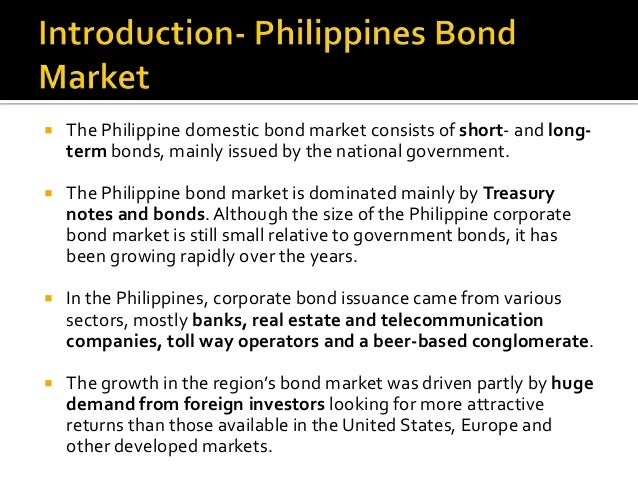

Easing Regulations For Bond Forwards: A Boon For Indian Insurers?

Table of Contents

Increased Risk Management Capabilities for Indian Insurers

Bond forwards are derivative instruments that allow investors to agree to buy or sell a bond at a future date at a predetermined price. For Indian insurers, this provides a powerful tool for hedging interest rate risk and other market risks. Currently, restrictive regulations limit the extent to which insurers can utilize these instruments, hindering their ability to effectively manage their investment portfolios.

- Reduced exposure to interest rate volatility: Bond forwards allow insurers to lock in interest rates, protecting their portfolios from adverse movements in the bond market. This is especially crucial given the volatility often seen in emerging markets like India.

- Improved portfolio diversification: By incorporating bond forwards into their strategies, insurers can diversify their investment portfolios and reduce overall risk. This helps to achieve a better balance across asset classes.

- Enhanced ability to meet solvency requirements: Effective risk management through bond forwards strengthens an insurer's financial position, making it easier to meet regulatory solvency requirements and maintain financial stability.

- Better matching of assets and liabilities: Insurers can use bond forwards to better align the maturity profiles of their assets and liabilities, reducing the risk of mismatches and improving their overall financial health.

Easing regulations around bond forwards would significantly improve the risk management capabilities of Indian insurers, allowing them to operate more efficiently and confidently in a dynamic market environment.

Enhanced Investment Opportunities and Return Potential

Access to bond forwards opens up new investment avenues for Indian insurers, significantly expanding their investment universe beyond traditional, often less lucrative, options.

- Participation in the wider bond market beyond traditional investments: Bond forwards allow insurers to access a broader range of bonds, including those not readily available in the primary market. This enhances their ability to find attractive investment opportunities.

- Opportunities for arbitrage and yield enhancement: Insurers can utilize bond forwards to exploit pricing discrepancies in the bond market and generate additional returns through arbitrage strategies.

- Access to a broader range of maturities and credit ratings: Bond forwards provide access to a wider spectrum of maturities and credit ratings, allowing for better portfolio construction and risk management.

- Potential for higher returns compared to current restricted investment options: By strategically employing bond forwards, insurers can potentially increase their investment returns and enhance overall profitability.

Increased investment choices, facilitated by relaxed regulations on bond forwards, translate directly to improved profitability and a stronger competitive position for Indian insurers in the global market.

Boosting Liquidity and Efficiency in the Indian Debt Market

Greater insurer participation in the bond forwards market will contribute significantly to a more liquid and efficient Indian debt market.

- Increased trading volume and price discovery: Increased use of bond forwards by insurers will lead to higher trading volumes, resulting in more accurate and efficient price discovery.

- Reduced transaction costs: Greater liquidity generally leads to lower transaction costs for all market participants, including insurers.

- Improved price transparency: Higher trading activity improves price transparency, benefiting both buyers and sellers of bonds.

- Enhanced market depth and stability: A more liquid and efficient market is inherently more stable and resilient to shocks.

A more efficient debt market benefits the entire Indian economy, supporting economic growth and development by lowering the cost of capital for businesses and promoting investment.

Potential Challenges and Mitigation Strategies

While the benefits of easing regulations are substantial, potential risks associated with increased bond forward usage must be acknowledged and addressed.

- Need for robust risk management frameworks within insurance companies: Insurers need strong internal risk management systems to effectively manage the risks associated with bond forwards. This includes rigorous modeling, stress testing, and oversight.

- Importance of regulatory oversight to prevent excessive leverage and speculation: Regulatory oversight is crucial to prevent excessive leverage and speculative trading, which could destabilize the market.

- Potential for market manipulation and the need for strong regulatory measures: Appropriate regulations are necessary to deter market manipulation and ensure fair and transparent trading practices.

Careful consideration of these potential challenges and implementation of appropriate mitigation strategies are vital to ensure that deregulation leads to positive outcomes. A phased approach to deregulation, coupled with strengthened regulatory frameworks, is a prudent path forward.

Conclusion

Easing regulations on bond forwards presents a significant opportunity for Indian insurers to enhance their risk management capabilities, improve investment returns, and contribute to a more robust and efficient debt market. While potential risks exist, careful regulatory oversight and strong internal risk management can mitigate these challenges. The potential benefits of easing regulations on bond forwards for Indian insurers are undeniable. Further research and a phased approach to deregulation, coupled with robust risk management frameworks, are crucial to unlock the full potential of this vital market segment. Let's continue the discussion on optimizing bond forwards regulations for the benefit of Indian insurers and the broader financial landscape.

Featured Posts

-

10 20 Cm Of Snow Expected In Western Manitoba Stay Safe

May 09, 2025

10 20 Cm Of Snow Expected In Western Manitoba Stay Safe

May 09, 2025 -

Nottingham Attacks Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025

Nottingham Attacks Inquiry Judge Who Jailed Boris Becker Appointed Chair

May 09, 2025 -

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025

Bond Forward Market Reform The Indian Insurers Perspective

May 09, 2025 -

Zatrudneniya V Rabote Aeroporta Permi Iz Za Obilnogo Snegopada

May 09, 2025

Zatrudneniya V Rabote Aeroporta Permi Iz Za Obilnogo Snegopada

May 09, 2025 -

Benson Boone Vs Harry Styles A Look At The Similarities And Differences

May 09, 2025

Benson Boone Vs Harry Styles A Look At The Similarities And Differences

May 09, 2025

Latest Posts

-

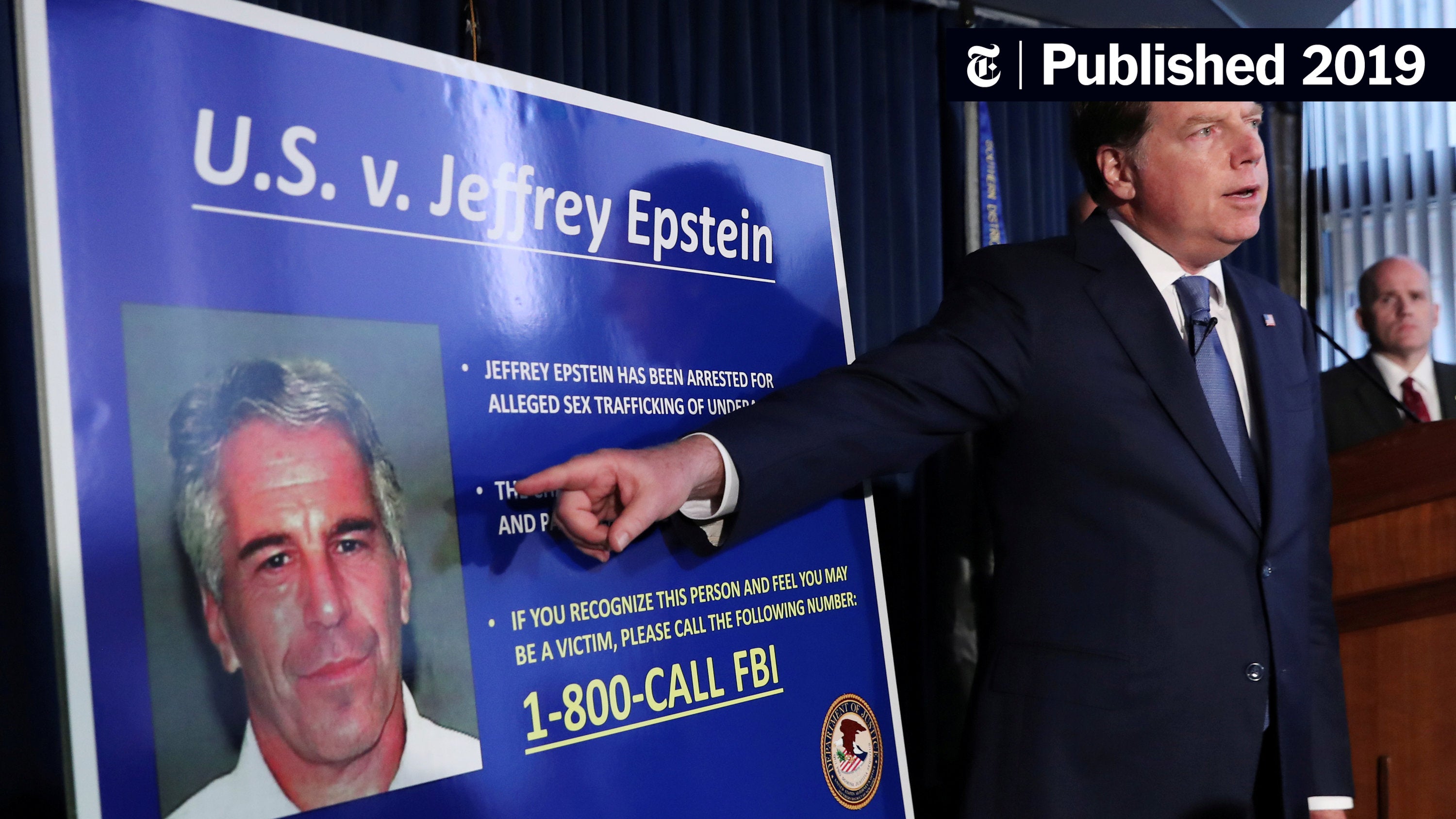

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025

Beyond The Epstein Case Analyzing The Us Attorney Generals Media Strategy

May 10, 2025 -

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025

Focusing On The Bigger Picture Why The Us Attorney Generals Fox News Appearances Matter

May 10, 2025 -

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025

The Us Attorney General And Fox News A Question Of Priorities

May 10, 2025 -

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025

The Daily Fox News Appearances Of The Us Attorney General A Deeper Look

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than Epstein

May 10, 2025