ECB Rate Cuts: Economists Warn Against Delays

Table of Contents

The Urgent Need for ECB Rate Cuts

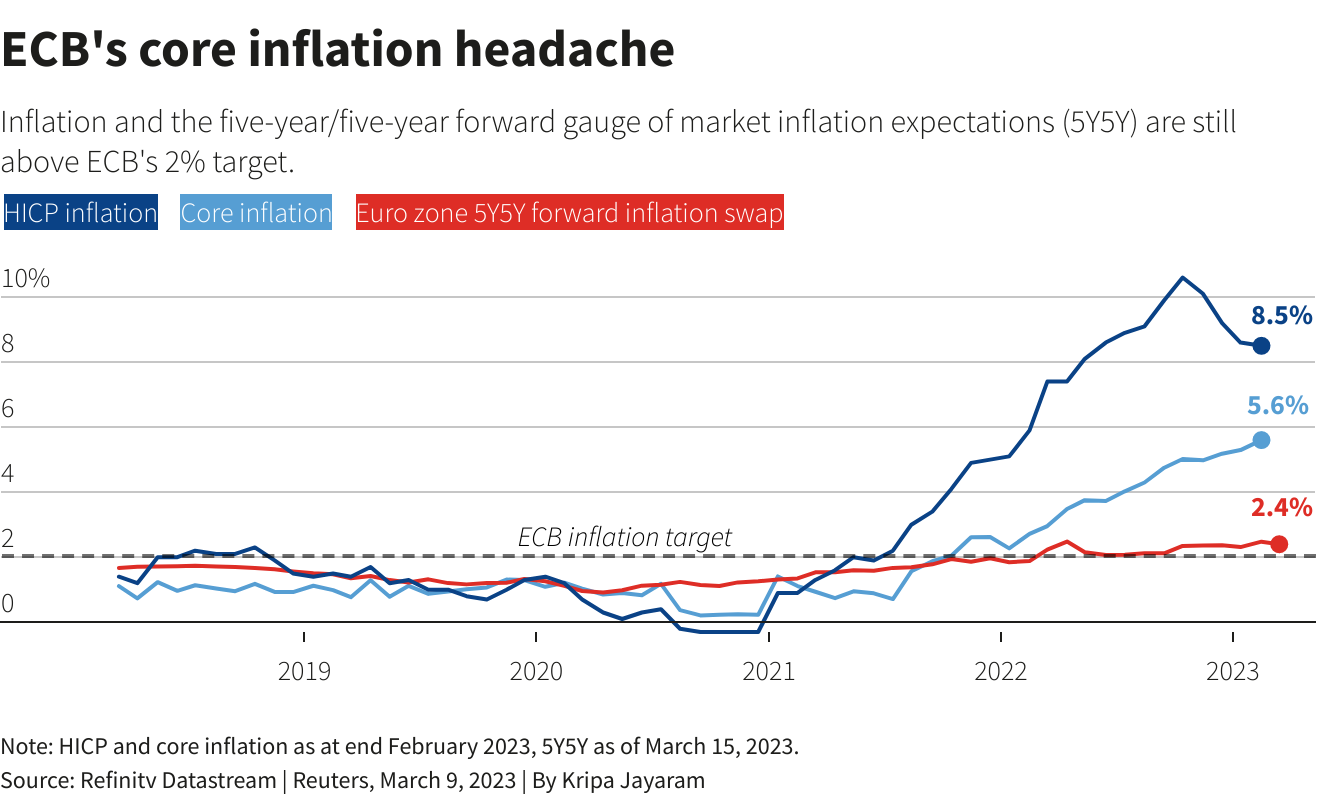

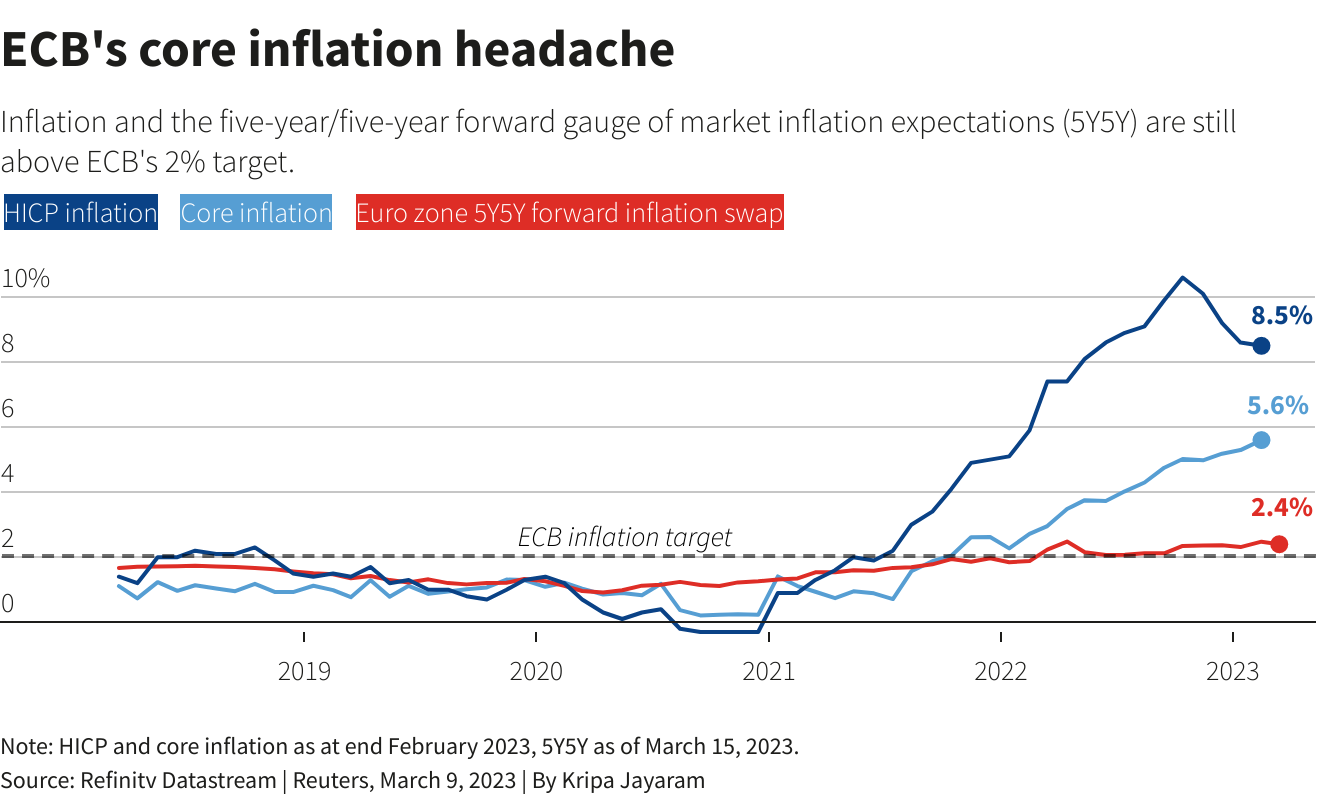

The Eurozone economy is currently grappling with a dangerous combination of high inflation and slowing growth. High inflation, driven by factors such as energy prices and supply chain disruptions, is eroding consumer purchasing power, leading to decreased consumer spending and overall economic slowdown. Simultaneously, economic growth across major Eurozone economies is decelerating, signaling a potential recession. High borrowing costs, a consequence of previously implemented interest rate hikes, are further dampening business investment, creating a vicious cycle of reduced economic activity.

Lower interest rates, through monetary easing, can provide crucial economic stimulus. By making borrowing cheaper, ECB rate cuts incentivize businesses to invest and expand, while also encouraging consumers to spend. This increased economic activity can help boost the Eurozone's growth trajectory and mitigate the impact of inflation. Delaying these necessary ECB rate cuts risks exacerbating the current situation, potentially leading to a deflationary spiral and a deeper, more prolonged economic crisis. Proactive monetary policy is crucial to avert such a scenario.

- High inflation eroding consumer purchasing power: Inflation significantly reduces the real value of wages and savings, dampening consumer confidence and spending.

- Slowing economic growth across major Eurozone economies: Several key Eurozone economies are experiencing a sharp decline in GDP growth, signaling a potential recession.

- Reduced business investment due to high borrowing costs: High interest rates discourage businesses from investing in expansion and modernization, hindering economic growth.

- Potential for a deflationary spiral if action is delayed: A prolonged period of low economic activity could lead to a deflationary spiral, making it even harder to stimulate economic growth.

- The need for proactive monetary policy to avert a deeper crisis: Timely and decisive action from the ECB is vital to prevent a deeper and more prolonged economic downturn.

Economists' Warnings and Forecasts

Prominent economists and financial institutions are increasingly sounding the alarm about the risks of delaying ECB rate cuts. Many predict a significant economic contraction if the ECB doesn't act decisively. These predictions are supported by statistical data showing a clear downward trend in key economic indicators. Forecasts for GDP growth are consistently lower when factoring in the absence of further interest rate reductions.

For instance, Goldman Sachs predicts a 0.5% contraction in GDP for the Eurozone in the next quarter without further ECB rate cuts, while with timely cuts, the prediction is for a marginal growth of 0.2%. Similarly, several other leading economic institutions have issued stark warnings. While there are dissenting opinions and alternative economic strategies proposed, the overwhelming consensus points towards the urgent need for ECB rate cuts to mitigate the impending recession.

- Quotes from leading economists supporting immediate rate cuts: Numerous economists have publicly called for immediate and significant rate cuts to stimulate the economy.

- Statistical data supporting claims of economic slowdown: Data on GDP growth, consumer confidence, and business investment clearly demonstrate a slowing Eurozone economy.

- Forecasts for GDP growth and inflation with and without rate cuts: Economic models highlight a significantly worse economic outlook in the absence of further rate cuts.

- Analysis of potential impacts on various sectors (e.g., manufacturing, services): Different sectors will be affected differently, but the overall impact of a recession will be negative.

- Mention of dissenting opinions and alternative economic strategies: While alternative approaches exist, the majority view supports immediate ECB rate cuts.

Potential Consequences of Delaying ECB Rate Cuts

Postponing interest rate cuts carries substantial risks. The most significant threat is a deeper and more prolonged recession. A prolonged downturn could lead to substantially higher unemployment rates across the Eurozone, causing significant social and economic hardship. Furthermore, the risk of a sovereign debt crisis in vulnerable member states increases significantly if economic conditions deteriorate further.

Delaying action will also likely result in a further decline in consumer and business confidence, compounding the negative impact on economic activity. International trade and investment will also suffer, as uncertainty and economic weakness discourage cross-border activity. In essence, delaying ECB rate cuts risks turning a slowdown into a full-blown crisis with severe and lasting consequences.

- Increased risk of a prolonged recessionary period: The longer the ECB delays action, the deeper and longer the recession is likely to be.

- Rise in unemployment rates across the Eurozone: A recession invariably leads to job losses, increasing social and economic instability.

- Potential for a sovereign debt crisis in vulnerable member states: Weak economic conditions increase the risk of debt defaults in countries with high debt levels.

- Further decline in consumer and business confidence: Uncertainty and negative economic news further dampen already weak confidence.

- Negative impact on international trade and investment: Economic uncertainty discourages international investment and trade.

The Impact on Specific Sectors

The effects of interest rate cuts will vary across different sectors. The real estate sector, highly sensitive to interest rates, could experience a boost in activity with lower borrowing costs. However, manufacturing might still struggle due to ongoing supply chain disruptions and global economic uncertainty. Tourism, particularly vulnerable to economic downturns, may also experience a prolonged period of low activity. A comprehensive analysis of the sector-specific impacts requires a deeper dive into individual industry dynamics.

Conclusion

The arguments for immediate ECB rate cuts are compelling. The Eurozone economy is facing a critical juncture, with high inflation and slowing growth creating a perfect storm for a potential recession. Economists' warnings highlight the potentially catastrophic consequences of delaying decisive action. The potential for a deeper recession, increased unemployment, and a sovereign debt crisis necessitates a swift and decisive response from the ECB. Failure to act decisively could lead to a far more severe and prolonged economic crisis.

Therefore, it is crucial to closely monitor the ECB's response to the unfolding economic situation. Proactive monetary policy, including further ECB rate cuts, is paramount to mitigate the risks associated with potential delays. Stay informed about future ECB announcements regarding interest rate decisions and their potential impact on the Eurozone economy. Further research on ECB monetary policy and its influence on the Eurozone is strongly encouraged to understand the complexities of this crucial economic challenge. The urgency of the situation necessitates immediate attention and action regarding ECB rate cuts.

Featured Posts

-

Who Are Bernard Keriks Wife And Children A Family Overview

May 31, 2025

Who Are Bernard Keriks Wife And Children A Family Overview

May 31, 2025 -

Memorial Day Weekend In Detroit City Braces For 150 000 Visitors

May 31, 2025

Memorial Day Weekend In Detroit City Braces For 150 000 Visitors

May 31, 2025 -

Navigating The Complexities Of The Chinese Market Lessons From Bmw And Porsche

May 31, 2025

Navigating The Complexities Of The Chinese Market Lessons From Bmw And Porsche

May 31, 2025 -

Saison Estivale A Ouistreham Programme Du Carnaval

May 31, 2025

Saison Estivale A Ouistreham Programme Du Carnaval

May 31, 2025 -

Navigating Trumps Tariffs A Small Wine Importers Story

May 31, 2025

Navigating Trumps Tariffs A Small Wine Importers Story

May 31, 2025