Economic Outlook And The Fed's Rate Decision: A Likely Hold

Table of Contents

Keywords: Fed rate decision, interest rate hike, economic outlook, inflation rate, unemployment rate, GDP growth, monetary policy, Federal Reserve, economic slowdown, recession risk, interest rate hold

The Federal Reserve's upcoming interest rate decision is highly anticipated, with many economists predicting a hold, given the current economic outlook. This article delves into the key economic indicators, the Fed's recent communication, and potential alternative scenarios to assess the likelihood of an interest rate hike or a hold. Understanding the Fed's monetary policy is crucial for investors and businesses alike, as it significantly impacts economic growth and market stability.

Current Economic Indicators Pointing to a Rate Hold

Several key economic indicators suggest that the Fed is likely to hold interest rates at their current level. Let's examine the evidence:

Inflation Slowdown

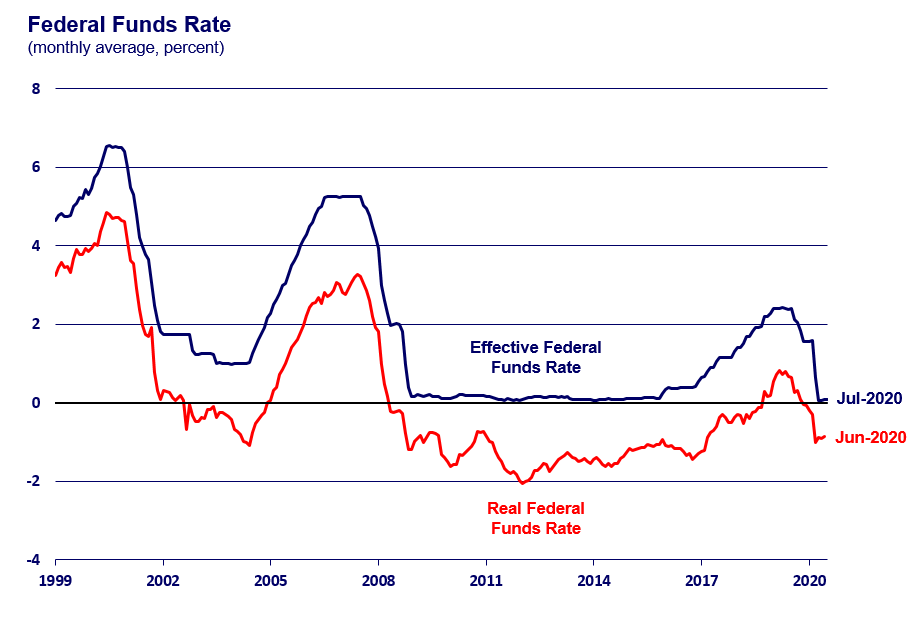

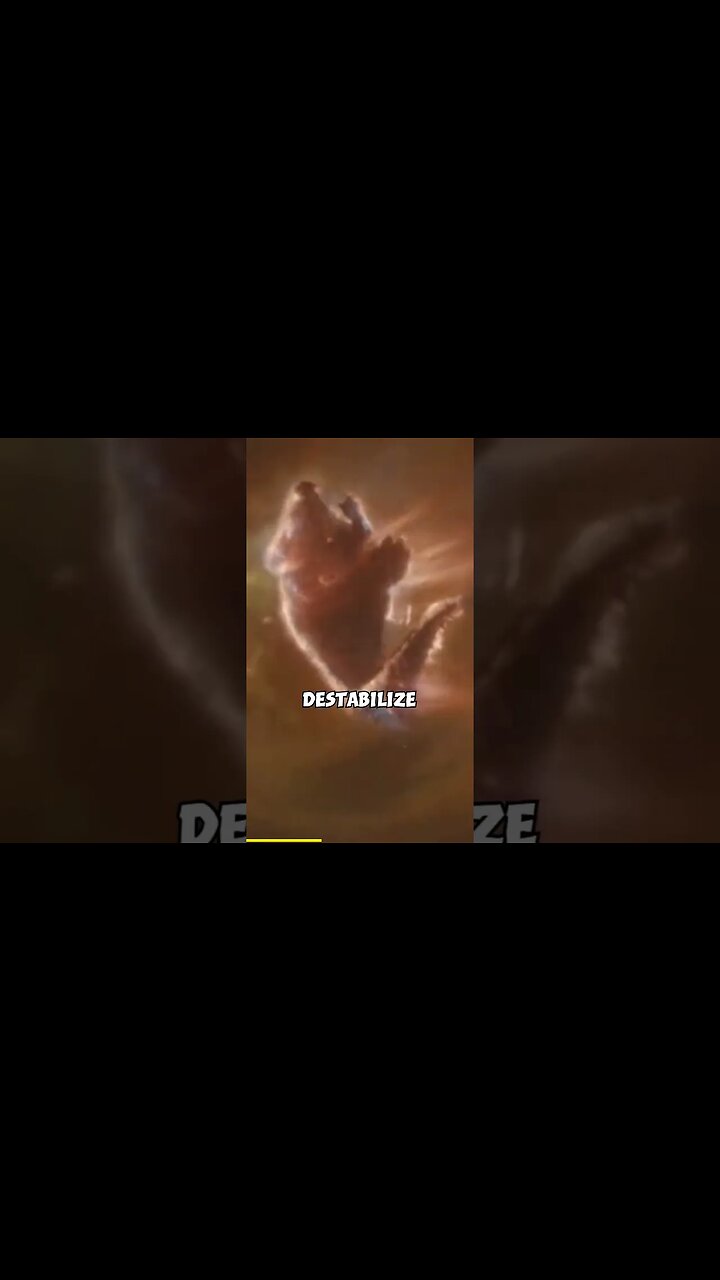

Recent data reveals a significant slowdown in inflation. The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index, both key measures of inflation, have shown a consistent decline over the past few months.

- Easing supply chain pressures: Global supply chains are showing signs of recovery, reducing the inflationary pressure stemming from shortages and bottlenecks.

- Cooling consumer demand: Higher interest rates and reduced consumer confidence have contributed to a decrease in consumer spending, lessening the demand-pull inflation.

- Effectiveness of previous rate hikes: The previous interest rate hikes implemented by the Fed appear to be gradually taking effect, curbing inflationary pressures.

[Insert a graph here showing the trend of inflation, clearly labeled with CPI and PCE data points and time periods.]

Unemployment Remains Low

The unemployment rate remains remarkably low, indicating a strong labor market. This presents a complex situation for the Fed, as a robust labor market can fuel wage growth, potentially leading to increased inflationary pressure.

- Strength of the labor market: The low unemployment rate signifies a healthy economy, with ample job opportunities.

- Potential for wage growth impacting inflation: While low unemployment is generally positive, sustained wage growth could push inflation higher if not managed carefully.

- Impact of labor shortages on businesses: Businesses continue to face labor shortages, which can hinder their ability to expand operations and contribute to upward pressure on wages.

GDP Growth and Recession Risks

Recent GDP growth figures have been mixed, reflecting the ongoing uncertainty in the economic outlook. While growth has slowed, the probability of a severe recession remains relatively low.

- Impact of interest rate hikes on economic activity: The previous interest rate hikes have already begun to slow economic activity. Further increases could potentially trigger a more significant downturn.

- Potential for a "soft landing": The Fed aims for a "soft landing," where inflation is brought under control without causing a severe recession. The current data suggests this remains a possibility, though a challenging one.

- Conflicting signals from various economic indicators: There are conflicting signals emanating from various economic indicators, making it difficult to predict the future trajectory with certainty.

The Federal Reserve's Stance and Recent Communication

The Federal Reserve's recent communication and the statements made by its officials provide valuable insights into its likely course of action.

Fed Officials' Statements and Hints

Recent public statements by Fed officials have emphasized the need to carefully monitor the economic data before making any further interest rate decisions.

- Quote relevant excerpts from speeches or press releases: [Insert quotes from Fed officials' statements, carefully attributed and contextualized.]

- Analyze the language used to gauge the Fed's intentions: The language used often provides clues about the central bank's thinking and intentions. A cautious tone often indicates a preference for a wait-and-see approach.

- Mention any disagreements within the Federal Open Market Committee (FOMC): While the FOMC generally aims for consensus, occasional disagreements among members can hint at the uncertainties surrounding the economic outlook.

Market Expectations and Reactions

Market participants have been closely watching the economic data and are anticipating the Fed's decision.

- Analyze the movement of bond yields and stock market indices: Bond yields and stock market indices often reflect market expectations regarding interest rates.

- Discuss the implications of market expectations on future economic activity: Market expectations can influence business decisions and consumer behavior, impacting future economic activity.

- Mention the impact of investor sentiment on the Fed's decision-making process: While the Fed is independent, it takes market sentiment into account when making its decisions.

Alternative Scenarios and Potential Risks

While a rate hold appears most likely, it's crucial to consider alternative scenarios and associated risks.

Reasons for a Potential Rate Hike

Several factors could lead the Fed to raise interest rates despite the current outlook:

- Unexpected surge in inflation: A sudden and unexpected surge in inflation could prompt the Fed to act decisively to contain price increases.

- Persistent strength in the labor market leading to sustained wage growth: If the labor market remains extremely tight and wage growth accelerates significantly, the Fed might feel compelled to act preemptively.

- Geopolitical events impacting the economy: Unforeseen geopolitical events could destabilize the economy and force the Fed to adjust its monetary policy.

Risks Associated with a Rate Hold

Maintaining interest rates at current levels also carries potential risks:

- Risk of inflation remaining stubbornly high: If inflation fails to decline as expected, a rate hold could allow inflationary pressures to persist.

- Potential for further wage growth fueling inflation: Continued strong wage growth could exacerbate inflationary pressures.

- Increased risk of asset bubbles in certain sectors: Low interest rates can contribute to the formation of asset bubbles in specific sectors of the economy.

Conclusion

Based on the current economic indicators, the Federal Reserve's recent communication, and market expectations, a rate hold at the upcoming Fed rate decision appears most probable. The slowdown in inflation, despite persistent low unemployment, suggests a cautious approach. While risks remain associated with both a rate hike and a hold, the potential for a "soft landing" and the uncertainties surrounding the economic outlook favor a continuation of the current monetary policy stance. However, it's vital to monitor future economic data releases and the Fed's ongoing communication for any shifts in the outlook. Unexpected surges in inflation or other unforeseen economic events could alter this projection.

Call to action: Stay informed about the upcoming Fed rate decision and its implications for your investments and financial planning. Continue to follow our analysis of the economic outlook and the Fed's rate decision for timely updates and insights. Learn more about how the Fed's interest rate decisions impact your financial future by subscribing to our newsletter or visiting our website.

Featured Posts

-

First Hand Accounts Nottingham Attack Survivors Tell Their Stories

May 10, 2025

First Hand Accounts Nottingham Attack Survivors Tell Their Stories

May 10, 2025 -

Zolotye Rytsari Vegasa Oderzhivayut Pobedu Nad Minnesotoy V Overtayme Pley Off

May 10, 2025

Zolotye Rytsari Vegasa Oderzhivayut Pobedu Nad Minnesotoy V Overtayme Pley Off

May 10, 2025 -

April 9th Nyt Strands Puzzle 402 Hints And Answers

May 10, 2025

April 9th Nyt Strands Puzzle 402 Hints And Answers

May 10, 2025 -

Uncovering Morgans Weakness The Intriguing Theory Of Davids High Potential

May 10, 2025

Uncovering Morgans Weakness The Intriguing Theory Of Davids High Potential

May 10, 2025 -

Before May 5th Your Guide To Investing In Palantir Stock

May 10, 2025

Before May 5th Your Guide To Investing In Palantir Stock

May 10, 2025