Economic Outlook: Why Powell's Fed Is Hesitant On Interest Rate Cuts Despite Pressure

Table of Contents

Persistent Inflation as a Primary Concern

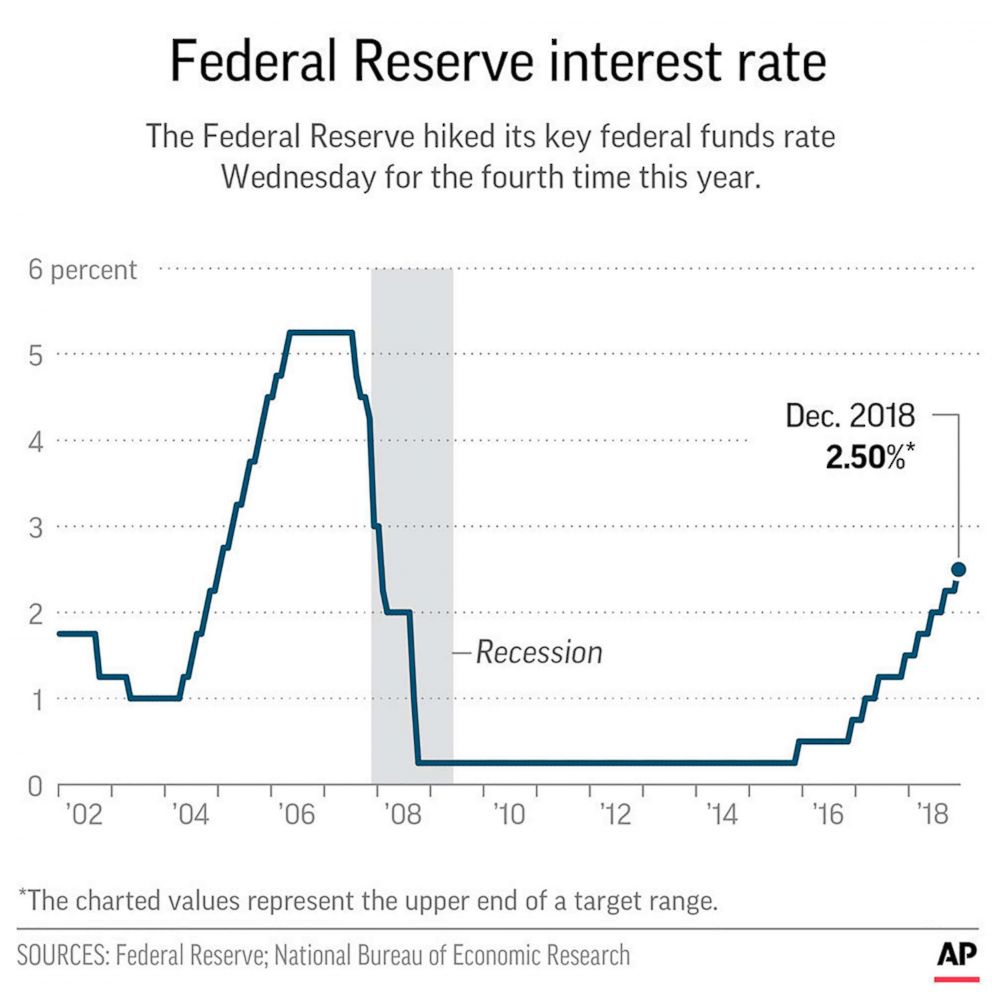

Inflation remains a primary concern for the Fed. The current inflation rate significantly deviates from the Fed's target of 2%, eroding purchasing power and hindering sustained economic growth. Persistent inflation creates a dangerous cycle; higher prices lead to wage demands, further fueling inflation. Cutting interest rates in this environment risks exacerbating the problem, potentially leading to a wage-price spiral.

- Recent inflation data shows consumer prices remain elevated, impacting household budgets and business costs.

- Interest rate cuts risk reigniting inflationary pressures before the underlying causes are addressed. Lower borrowing costs could stimulate demand, putting further upward pressure on prices.

- The Fed's inflation target remains 2%, a considerable distance from current realities. Until inflation shows consistent signs of returning to this target, interest rate cuts are unlikely.

The Labor Market's Strength and its Influence on the Fed's Decision

A surprisingly strong labor market presents a paradoxical challenge. While low unemployment is generally positive, it also contributes to inflationary pressures. High demand for workers leads to increased wages, pushing up labor costs for businesses, which are often passed on to consumers in the form of higher prices. This tight labor market makes the decision to cut interest rates even more complex.

- Unemployment rates remain historically low, indicating a robust labor market.

- Wage growth, while positive for workers, contributes to inflationary pressures by increasing labor costs.

- The Fed carefully weighs employment data against inflation concerns. While a strong labor market is desirable, it's unsustainable if it fuels persistent inflation.

Concerns about Triggering a Deeper Recession

Premature interest rate cuts carry the risk of exacerbating existing economic vulnerabilities and potentially triggering a deeper recession. Stimulating the economy through lower interest rates when inflation is still high could lead to a surge in demand, further fueling price increases. This could result in a more prolonged period of high inflation, forcing the Fed to implement even more drastic measures later.

- Rapid interest rate cuts could lead to asset bubbles and financial instability.

- Several economic indicators suggest a possible recession, making the decision to cut rates even more cautious.

- The trade-off between combating inflation and preventing a deeper recession requires a delicate balancing act, with the Fed prioritizing stability.

The Importance of Data-Driven Decision Making

The Fed emphasizes data-driven decision-making. Incoming economic data, including inflation figures, employment reports, and consumer spending data, will guide future monetary policy adjustments. The Fed carefully monitors these indicators to assess the effectiveness of its policies and adapt accordingly.

- Key economic indicators the Fed closely monitors include the Consumer Price Index (CPI), Producer Price Index (PPI), unemployment rate, and GDP growth.

- The Fed emphasizes the importance of waiting for more conclusive data before making significant policy changes. Rushing decisions based on incomplete information could have unintended and negative consequences.

- The Fed's decision-making process is iterative, meaning policies are continuously reviewed and adjusted based on new information.

Conclusion: The Outlook for Interest Rate Cuts Under Powell's Leadership

The Fed's cautious approach to interest rate cuts stems from a confluence of factors: persistent inflation, a strong labor market, and concerns about triggering a deeper recession. These challenges require a nuanced and data-driven approach, making the timing of future interest rate adjustments uncertain. While the pressure to stimulate economic growth is undeniable, the risks associated with premature cuts are significant. Powell's leadership will continue to be crucial in navigating this complex economic landscape.

To stay informed about the evolving economic outlook and the Fed's decisions regarding interest rate cuts, follow reputable economic news sources, subscribe to newsletters from leading financial institutions, and follow key economists on social media. Understanding the implications of Jerome Powell's actions on your personal finances and investment strategies is critical in today's dynamic economic environment. Staying informed about potential interest rate cuts is vital for effective financial planning.

Featured Posts

-

Nintendo Direct March 2025 Ps 5 And Ps 4 Game Announcements

May 07, 2025

Nintendo Direct March 2025 Ps 5 And Ps 4 Game Announcements

May 07, 2025 -

Papez Stabilno Stanje Zdravniki Previdni Glede Prognoze

May 07, 2025

Papez Stabilno Stanje Zdravniki Previdni Glede Prognoze

May 07, 2025 -

Adidas Unveils Anthony Edwards Second Signature Shoe A Detailed First Look

May 07, 2025

Adidas Unveils Anthony Edwards Second Signature Shoe A Detailed First Look

May 07, 2025 -

Baba Yaga In Las Vegas A John Wick Themed Immersive Experience

May 07, 2025

Baba Yaga In Las Vegas A John Wick Themed Immersive Experience

May 07, 2025 -

John Wick Experience Las Vegas Everything You Need To Know

May 07, 2025

John Wick Experience Las Vegas Everything You Need To Know

May 07, 2025