Economic Uncertainty Grows Amidst Rising Inflation And Unemployment

Table of Contents

The Impact of Rising Inflation on Consumer Spending and Business Investment

High inflation is a significant driver of current economic uncertainty. It erodes the purchasing power of consumers, meaning their money buys less than it did previously. This leads to decreased consumer spending, a cornerstone of economic growth. Businesses, too, feel the pinch. Increased production costs, driven by rising prices for raw materials, energy, and labor, squeeze profit margins. This often results in reduced investment in expansion and innovation, potentially leading to job losses and further dampening economic activity.

Industries heavily reliant on energy and raw materials, such as manufacturing and transportation, are particularly vulnerable. The food industry is also significantly impacted, with rising food prices disproportionately affecting low-income households.

- Reduced disposable income for consumers: Higher prices for essentials leave less money for discretionary spending.

- Increased borrowing costs for businesses: Higher interest rates make it more expensive to finance operations and expansion.

- Supply chain disruptions exacerbate inflation: Global supply chain bottlenecks further contribute to price increases.

- Potential for wage-price spiral: Rising prices can lead to demands for higher wages, further fueling inflation.

Unemployment's Role in Exacerbating Economic Uncertainty

Unemployment acts as a powerful amplifier of economic uncertainty. A rise in unemployment directly translates to reduced consumer spending as jobless individuals have less disposable income. The psychological impact on individuals and their families is significant, leading to stress, reduced confidence, and potentially impacting mental health. This ripple effect extends beyond the individual, impacting community well-being and overall economic growth.

- Increased social welfare burdens: Governments face increased expenditure on unemployment benefits and social support programs.

- Reduced tax revenue for governments: Lower employment levels lead to a decline in tax revenue, limiting government's ability to fund essential services.

- Potential for social unrest: High unemployment can fuel social unrest and political instability.

- Impact on housing markets: Job losses can lead to increased mortgage defaults and foreclosures, depressing the housing market.

Government Policies and Their Effectiveness in Addressing Economic Uncertainty

Governments worldwide are grappling with the challenge of addressing rising inflation and unemployment. Monetary policy, primarily controlled by central banks, often involves raising interest rates to curb inflation. Fiscal policy, managed by governments, may involve stimulus packages, tax cuts, or increased government spending to boost economic activity and create jobs. However, the effectiveness of these policies is often debated, and there are potential pitfalls. For example, raising interest rates too aggressively can stifle economic growth and increase unemployment. Similarly, excessive government spending can lead to increased national debt.

- Interest rate hikes by central banks: This aims to reduce borrowing and cool down the economy, but can also lead to slower growth.

- Government spending programs (stimulus packages): These aim to inject money into the economy and stimulate demand, but can be costly and ineffective if poorly targeted.

- Tax cuts or increases: Tax cuts can stimulate spending, but may increase the national debt; tax increases can reduce inflation but may dampen economic growth.

- Effectiveness of job creation initiatives: Government-funded job creation programs can be effective, but their impact can be limited and their success depends on careful planning and execution.

Strategies for Individuals and Businesses to Navigate Economic Uncertainty

Individuals and businesses need to adopt proactive strategies to mitigate the impact of economic uncertainty. For individuals, this means careful financial planning, including creating an emergency fund, diversifying investments, and budgeting effectively. Businesses need to focus on cost-cutting measures, exploring new markets and revenue streams, and prioritizing innovation to remain competitive. Financial planning and risk management become paramount during such times.

- Diversifying investment portfolios: Reducing reliance on any single asset class helps mitigate risk.

- Building an emergency fund: Having savings to cover several months of expenses provides a safety net.

- Negotiating better deals with suppliers: Seeking more favorable terms can help reduce costs.

- Exploring new markets and revenue streams: Diversification reduces reliance on any single market or product.

Mitigating Economic Uncertainty – A Path Forward

The interconnectedness of inflation, unemployment, and economic uncertainty is undeniable. The challenges and risks associated with the current economic climate are significant, but not insurmountable. By understanding these factors and adopting appropriate strategies, individuals and businesses can enhance their resilience. The potential for recovery and growth remains, albeit requiring proactive and informed action.

We encourage you to stay informed about economic trends, actively participate in discussions about addressing economic uncertainty, and prioritize strategic planning for personal and business financial stability. By understanding economic uncertainty and taking proactive steps, we can navigate these challenging times and build a more resilient future. Learning to navigate economic uncertainty is crucial for long-term success.

Featured Posts

-

Wybory Prezydenckie 2025 Niespotykana Dotad Kampania Mentzena

May 30, 2025

Wybory Prezydenckie 2025 Niespotykana Dotad Kampania Mentzena

May 30, 2025 -

Measles Outbreak Updates Tracking The Spread Of Cases Across The U S

May 30, 2025

Measles Outbreak Updates Tracking The Spread Of Cases Across The U S

May 30, 2025 -

Hhs Guidance On Transgender Care Controversy And Provider Concerns

May 30, 2025

Hhs Guidance On Transgender Care Controversy And Provider Concerns

May 30, 2025 -

Five Major Bc Lng Projects An Assessment Of Progress And Challenges

May 30, 2025

Five Major Bc Lng Projects An Assessment Of Progress And Challenges

May 30, 2025 -

Navigating Flight Delays At San Diego International Airport San

May 30, 2025

Navigating Flight Delays At San Diego International Airport San

May 30, 2025

Latest Posts

-

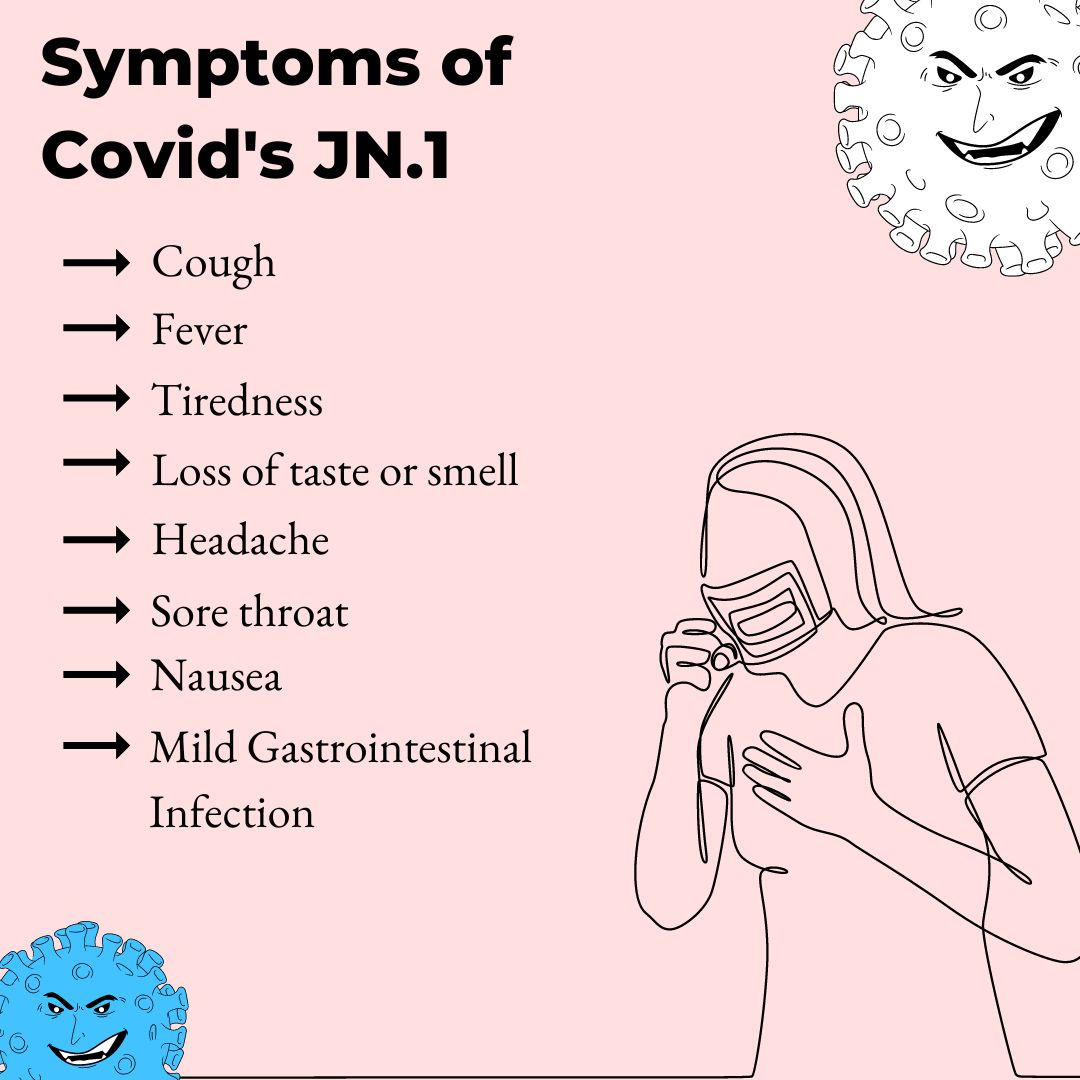

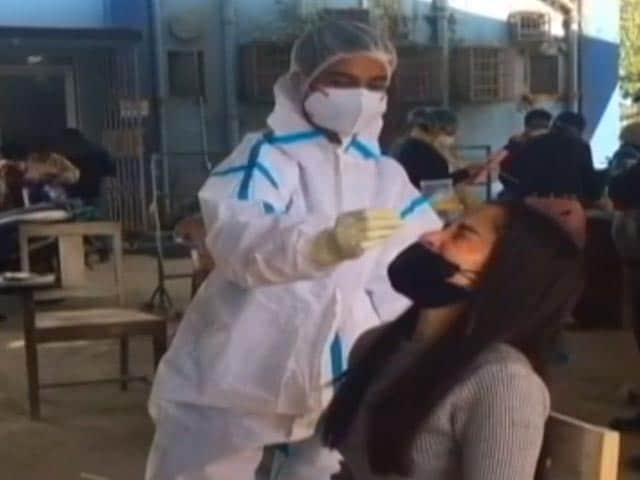

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025 -

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025 -

Covid 19 Variant Lp 8 1 A Comprehensive Overview

May 31, 2025

Covid 19 Variant Lp 8 1 A Comprehensive Overview

May 31, 2025 -

The Jn 1 Covid 19 Variant A Guide For Individuals And Communities

May 31, 2025

The Jn 1 Covid 19 Variant A Guide For Individuals And Communities

May 31, 2025 -

New Covid 19 Variant Jn 1 Rapid Spread In India And Warning Symptoms

May 31, 2025

New Covid 19 Variant Jn 1 Rapid Spread In India And Warning Symptoms

May 31, 2025