Economists Forecast Bank Of Canada Interest Rate Reductions Due To Tariff Impacts

Table of Contents

The Impact of Tariffs on the Canadian Economy

Tariffs, essentially taxes on imported goods, have far-reaching consequences for the Canadian economy. These increased costs are impacting various sectors and dampening overall economic growth.

Reduced Consumer Spending and Business Investment

Tariffs increase the price of imported goods, directly impacting consumer spending. Higher prices for everything from automobiles to agricultural products lead to decreased consumer purchasing power and a reduction in overall demand. This, in turn, discourages business investment as companies anticipate lower sales and profits.

- Automotive sector: Increased tariffs on imported auto parts have driven up the cost of vehicles, leading to a slowdown in sales and impacting manufacturing jobs.

- Agriculture sector: Tariffs on Canadian agricultural exports have reduced market access and impacted farmers' income, decreasing their ability to invest in their operations.

- A recent study by the Conference Board of Canada estimated a [Insert quantifiable data if available, e.g., "3% decrease"] in consumer spending due to tariff-related price increases in the last quarter.

- Business investment in new equipment and expansion projects has seen a [Insert quantifiable data if available, e.g., "1.5% decline"] attributed to economic uncertainty and reduced consumer demand.

Keywords: Tariff impact Canada, Canadian economic slowdown, consumer spending decline, business investment decrease.

Weakening Canadian Dollar

The negative economic impact of tariffs contributes to a weaker Canadian dollar (CAD). Reduced demand for the CAD stems from uncertainty about the future economic outlook and decreased exports. This weaker currency has both benefits and drawbacks.

- Mechanism: Reduced exports due to lower demand in international markets decreases the demand for the CAD.

- Impact: Increased import costs for businesses and consumers as the purchasing power of the Canadian dollar declines. While it might boost the export competitiveness of some sectors temporarily, the overall effect is generally negative.

Keywords: CAD exchange rate, currency devaluation, import costs, export competitiveness.

Inflationary Pressures

Tariffs contribute to inflationary pressures within Canada. Increased import costs translate into higher prices for consumers, directly impacting the Consumer Price Index (CPI).

- CPI Increase: The increased cost of imported goods directly feeds into a rise in the CPI, pushing inflation beyond the Bank of Canada's target range.

- Specific Goods: Goods like steel, aluminum, and agricultural products, significantly affected by tariffs, lead to increased prices in various sectors.

Keywords: Inflation Canada, CPI increase, monetary policy response, Bank of Canada inflation target.

The Bank of Canada's Response and Potential Interest Rate Cuts

The Bank of Canada's mandate is to maintain price stability and full employment. To achieve this, it primarily uses interest rate adjustments as a monetary policy tool.

Mandate and Tools

The Bank of Canada aims for a 2% inflation target. When the economy slows down or inflation falls below target, the Bank often lowers interest rates to stimulate economic activity.

- Lower Interest Rates: Lowering interest rates makes borrowing cheaper, encouraging businesses to invest and consumers to spend, thereby boosting economic growth.

Keywords: Bank of Canada mandate, monetary policy tools, interest rate cuts, economic stimulus.

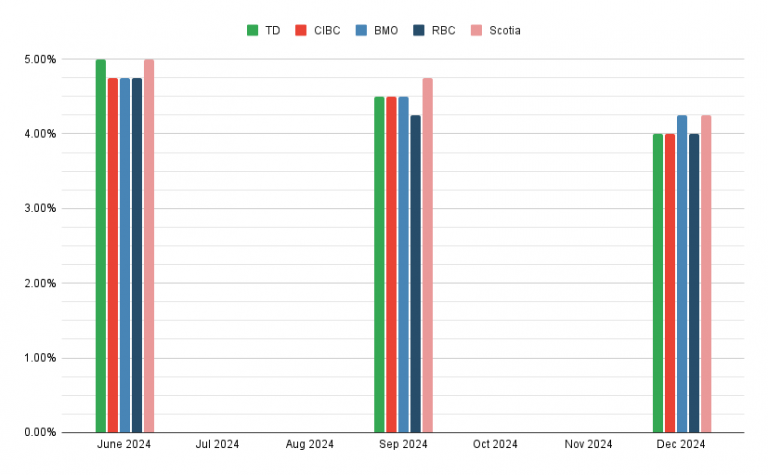

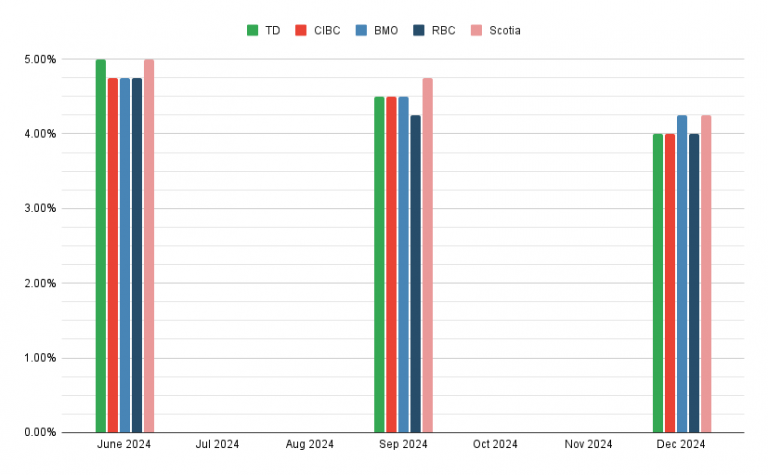

Forecasting Interest Rate Reductions

Many economists predict the Bank of Canada will respond to the negative economic impacts of tariffs by reducing interest rates.

- Predictions: [Cite reputable sources, e.g., Royal Bank of Canada, TD Economics] predict interest rate cuts of [Insert predicted percentage and timeframe].

- Quotes: [Include quotes from economists supporting the prediction].

Keywords: Interest rate forecast Canada, Bank of Canada prediction, economic outlook Canada, monetary policy forecast.

Potential Risks and Side Effects

While interest rate cuts can stimulate the economy, they also carry potential risks.

- Inflation Risk: Lower interest rates could lead to increased inflation, potentially exceeding the Bank of Canada's target.

- Asset Bubble Risk: Lower interest rates might inflate asset prices (e.g., real estate), creating an unsustainable bubble that could burst later.

Keywords: Inflation risk, asset bubble risk, economic risks, monetary policy side effects.

Conclusion: Economists Forecast Bank of Canada Interest Rate Reductions Due to Tariff Impacts

The negative impact of tariffs on the Canadian economy, characterized by reduced consumer spending, a weakening Canadian dollar, and inflationary pressures, is likely to prompt the Bank of Canada to reduce interest rates. While this could stimulate economic activity, it also carries inherent risks such as increased inflation or the formation of asset bubbles. This complex situation necessitates close monitoring of the Bank of Canada’s actions and their potential consequences.

Stay updated on the latest developments regarding Bank of Canada interest rate adjustments and their impact on the Canadian economy. Follow our updates for further analysis of the Bank of Canada interest rate reductions and their implications.

Keywords: Bank of Canada interest rate, Canadian economic policy, tariff impact analysis, interest rate implications.

Featured Posts

-

Rochelle Humes Roksanda Show Hairstyle A Front Row Look

May 11, 2025

Rochelle Humes Roksanda Show Hairstyle A Front Row Look

May 11, 2025 -

Holstein Kiel Relegated After Single Season In Top Flight

May 11, 2025

Holstein Kiel Relegated After Single Season In Top Flight

May 11, 2025 -

Was Marvel Right To Drop The Henry Cavill Show Exploring The Fallout

May 11, 2025

Was Marvel Right To Drop The Henry Cavill Show Exploring The Fallout

May 11, 2025 -

How To Meet Shane Lowry Tips And Advice

May 11, 2025

How To Meet Shane Lowry Tips And Advice

May 11, 2025 -

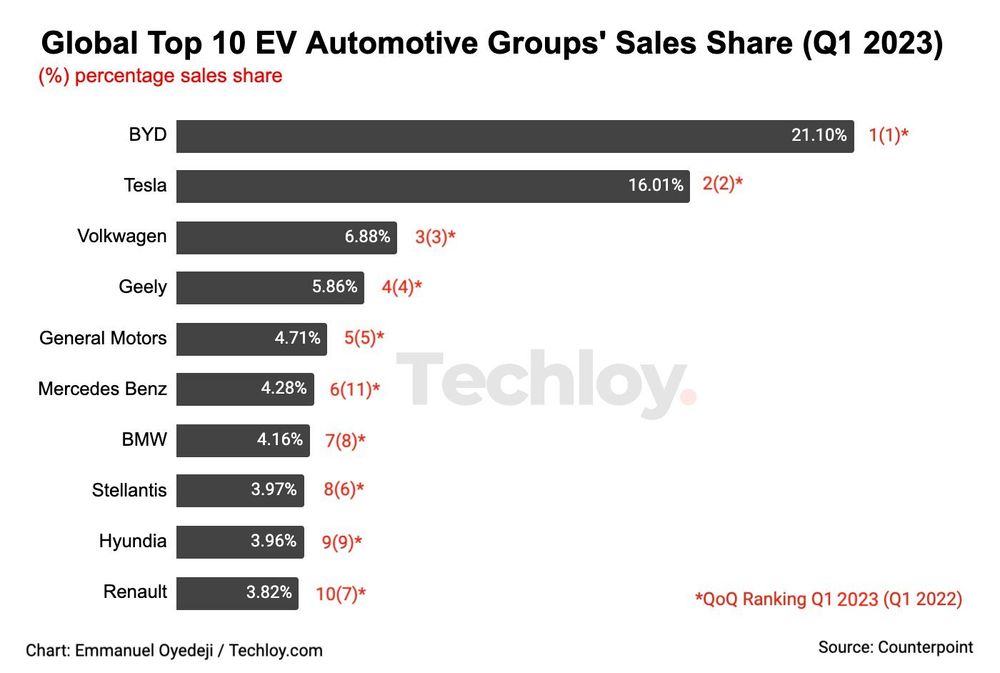

Analyzing The China Market Difficulties For Premium Car Brands Like Bmw And Porsche

May 11, 2025

Analyzing The China Market Difficulties For Premium Car Brands Like Bmw And Porsche

May 11, 2025