Economists Predict Bank Of Canada Rate Cuts Amid Weak Retail Sales

Table of Contents

Weak Retail Sales Indicate Economic Slowdown

Recent retail sales figures paint a concerning picture of the Canadian economy. The decline in consumer spending is sharper than anticipated, signaling a weakening of consumer confidence and a broader economic slowdown. This isn't just a blip; it's a significant indicator reflecting underlying economic vulnerabilities.

- Steeper-than-expected decline: Statistics Canada's latest report shows a [insert specific percentage and timeframe] drop in retail sales, exceeding economist forecasts. This indicates a substantial decrease in consumer spending.

- Key indicator of broader slowdown: Decreased consumer spending is a major component of GDP growth. This decline strongly suggests a more significant economic slowdown is underway. [Insert specific GDP growth projections and source].

- Specific sectors hit hard: The decline isn't uniform across all sectors. The hardest-hit areas include [mention specific sectors, e.g., durable goods like appliances and automobiles, and discretionary spending categories like restaurants and entertainment]. This suggests consumers are tightening their belts in response to economic uncertainty.

- Underlying reasons: This slowdown is likely a result of several factors, including [mention potential factors like high inflation, rising interest rates, and decreased consumer confidence]. Further analysis is needed to determine the relative contribution of each factor.

Bank of Canada's Response: Predicted Interest Rate Cuts

Faced with weakening retail sales and a slowing economy, many economists anticipate a response from the Bank of Canada in the form of interest rate cuts. This is a standard monetary policy tool aimed at stimulating economic activity.

- Interest rate cuts as stimulus: By lowering interest rates, the Bank of Canada aims to make borrowing cheaper for businesses and consumers. This encourages increased investment and spending, thereby boosting economic growth.

- Mechanics of rate cuts: Lowering the policy interest rate influences other borrowing rates, including mortgage rates and business loan rates. This, in turn, impacts borrowing costs for both consumers and businesses.

- Potential for additional tools: Beyond interest rate cuts, the Bank of Canada might also consider other monetary policy tools, such as quantitative easing (QE), to inject liquidity into the financial system. [Explain QE briefly and its potential impact].

- Dissenting opinions: Not all economists agree on the necessity or timing of rate cuts. Some argue that inflation remains a concern and that rate cuts could exacerbate this issue. [Include quotes from economists representing different viewpoints]. The Bank of Canada's decision will depend on careful weighing of these competing factors.

Impact of Rate Cuts on Consumers and Businesses

The predicted Bank of Canada interest rate cuts will have significant implications for both consumers and businesses.

- Reduced mortgage rates: Lower interest rates will likely translate to lower mortgage rates, potentially making homeownership more affordable and stimulating the housing market.

- Increased business investment: Reduced borrowing costs could encourage businesses to invest in expansion projects, creating jobs and boosting economic activity.

- Consumer confidence: While lower rates might be positive, their effect on consumer confidence will depend on the overall economic outlook. If the slowdown persists, the impact on spending may be limited.

- Variable vs. fixed rate mortgages: Consumers with variable-rate mortgages will immediately see lower payments, while those with fixed-rate mortgages will only benefit when their terms expire.

Alternative Economic Scenarios and Risks

While interest rate cuts are anticipated, it's crucial to acknowledge the uncertainties and potential risks involved.

- Recession risks: The severity of the economic slowdown remains uncertain. There is a risk that it could deepen into a recession, requiring more aggressive policy interventions from the Bank of Canada.

- Global economic conditions: The Canadian economy is interwoven with the global economy. Global economic uncertainty and geopolitical factors could significantly impact the effectiveness of domestic policy measures.

- Supply chain disruptions and inflation: Lingering supply chain disruptions and persistent inflationary pressures could counteract the positive effects of interest rate cuts.

- Alternative policy responses: The Bank of Canada may need to consider alternative policy responses, depending on how the economy evolves. These might include fiscal policy measures or targeted support for specific sectors.

Conclusion

Weak retail sales paint a concerning picture of the Canadian economy, leading many economists to predict interest rate cuts by the Bank of Canada. While lower interest rates could stimulate borrowing and investment, potentially benefitting both consumers and businesses, significant risks and uncertainties remain. The impact will depend on a complex interplay of factors, including the depth of the economic slowdown, global economic conditions, and the persistence of inflationary pressures.

Call to Action: Stay informed about the Bank of Canada's upcoming decisions on interest rates and monitor key economic indicators closely. Understanding the evolving economic landscape and its potential impact on your finances is crucial during this period of uncertainty surrounding potential Bank of Canada interest rate cuts. Take steps to manage your finances effectively to navigate these economic headwinds.

Featured Posts

-

Recognizing The Subtle Signs Of A Silent Divorce

Apr 28, 2025

Recognizing The Subtle Signs Of A Silent Divorce

Apr 28, 2025 -

Late Game Heroics Judge And Goldschmidt Secure Win For Their Teams

Apr 28, 2025

Late Game Heroics Judge And Goldschmidt Secure Win For Their Teams

Apr 28, 2025 -

Series Turning Point Judge And Goldschmidt Shine Bright

Apr 28, 2025

Series Turning Point Judge And Goldschmidt Shine Bright

Apr 28, 2025 -

Mntda Abwzby Nqlt Nweyt Fy Alabtkar Bqtae Tb Alhyat Alshyt Almdydt

Apr 28, 2025

Mntda Abwzby Nqlt Nweyt Fy Alabtkar Bqtae Tb Alhyat Alshyt Almdydt

Apr 28, 2025 -

Mapping The Rise Of New Business Hubs Across The Nation

Apr 28, 2025

Mapping The Rise Of New Business Hubs Across The Nation

Apr 28, 2025

Latest Posts

-

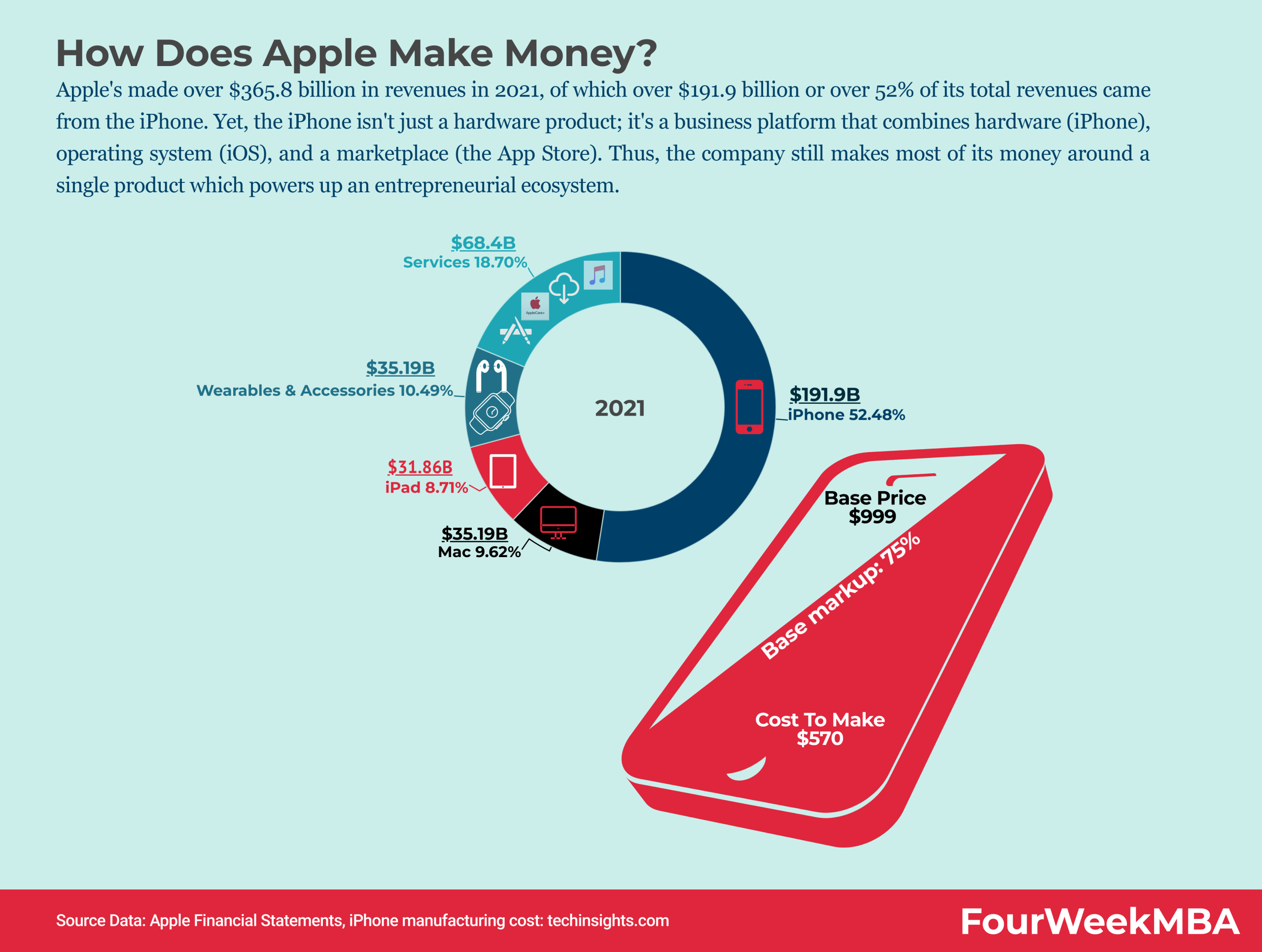

How Apples Ecosystem Could Be Helping Google Thrive

May 11, 2025

How Apples Ecosystem Could Be Helping Google Thrive

May 11, 2025 -

Apples Actions Unintentional Google Savior

May 11, 2025

Apples Actions Unintentional Google Savior

May 11, 2025 -

Is Apples Strategy Secretly Benefiting Google

May 11, 2025

Is Apples Strategy Secretly Benefiting Google

May 11, 2025 -

Apple And Google An Unexpected Symbiosis

May 11, 2025

Apple And Google An Unexpected Symbiosis

May 11, 2025 -

Efficient Podcast Creation Ais Role In Processing Repetitive Scatological Data

May 11, 2025

Efficient Podcast Creation Ais Role In Processing Repetitive Scatological Data

May 11, 2025