Elon Musk, Dogecoin, And The Trump Administration: A Comprehensive Look

Table of Contents

H2: Elon Musk's Influence on Dogecoin

H3: Musk's Tweets and Market Manipulation

Elon Musk's tweets have demonstrably impacted Dogecoin's price, leading to accusations of market manipulation. His pronouncements, often cryptic or playful, have sent the Dogecoin price soaring or plummeting within hours. This volatility raises serious regulatory concerns.

- Example 1: Musk's April 2021 tweet featuring a picture of a Doge-themed rocket sent the Dogecoin price skyrocketing.

- Example 2: Subsequent tweets referencing Dogecoin, sometimes with seemingly contradictory messages, have continued to cause significant price swings.

- The SEC is investigating Musk's tweets regarding Dogecoin, highlighting the potential legal ramifications of such actions. The ethical considerations of a single individual wielding this much power over a cryptocurrency's value are significant. The debate surrounding whether these actions constitute market manipulation remains ongoing.

H3: Musk's Business Interests and Dogecoin Adoption

Speculation abounds about the potential integration of Dogecoin into Musk's companies, Tesla and SpaceX. While no concrete plans have been announced, the possibility of Dogecoin payments for Tesla merchandise or SpaceX services remains a topic of discussion.

- Potential Benefits: Increased Dogecoin adoption could provide a boost to its legitimacy and widespread use.

- Potential Drawbacks: Integrating Dogecoin into established businesses carries risks, including the inherent volatility of the cryptocurrency and potential regulatory scrutiny. The strategic motivations behind Musk's support for Dogecoin remain somewhat unclear, ranging from genuine belief in the cryptocurrency to calculated marketing strategies. Further research into Musk's financial interests and the possible benefits to his businesses is warranted.

H2: The Trump Administration and Cryptocurrency

H3: Regulatory Stance During the Trump Era

The Trump administration's approach to cryptocurrency regulation was largely characterized by a lack of comprehensive, specific policies. This ambiguity left the cryptocurrency market relatively unregulated during this period.

- Limited Official Statements: While the Trump administration did not actively ban or heavily regulate cryptocurrencies, there weren't any significant policy initiatives aimed at either promoting or restricting them. This hands-off approach contrasted with the more active regulatory efforts seen in other countries.

- Key Figures: The lack of a clear policy meant that individual agencies and officials had limited influence in shaping the overall direction.

H3: Potential Trump Endorsement of Dogecoin (if applicable)

While there is no documented direct endorsement of Dogecoin by Donald Trump, his generally positive views on Bitcoin and other cryptocurrencies could be interpreted as indirect support for the broader space.

- Indirect Support: Trump's past statements expressing interest in Bitcoin could influence market sentiment and drive investor interest in the broader crypto market, including Dogecoin.

- Market Impact: Any perceived endorsement, whether direct or indirect, could create significant price volatility. This highlights the power of prominent political figures in influencing market perceptions and investor behavior.

H2: The Interplay of Musk, Dogecoin, and the Trump Administration

H3: Synergistic Effects on Market Sentiment

The combined influence of Elon Musk and a potential, even indirect, Trump endorsement (or lack thereof) significantly affects Dogecoin's price and market perception.

- Investor Confidence: Positive statements from either figure could boost investor confidence, driving up the price. Conversely, negative news or regulatory uncertainty could cause a significant downturn.

- Media Coverage: The actions and statements of these high-profile individuals receive substantial media attention, further amplifying their impact on market sentiment.

H3: Long-Term Implications and Future Predictions

The long-term implications of this interconnectedness are uncertain. Factors like increased regulation, technological advancements in cryptocurrency, and shifting public opinion will all play a role in shaping Dogecoin’s future.

- Regulatory Scrutiny: Increased regulatory oversight of cryptocurrencies could curb volatility and potentially limit the influence of individuals like Elon Musk.

- Technological Advancements: The development of new cryptocurrencies and blockchain technologies may affect Dogecoin’s market share.

- Shifting Public Perception: A change in public opinion regarding cryptocurrencies could impact investor confidence and subsequently affect Dogecoin’s price.

3. Conclusion

The relationship between Elon Musk, Dogecoin, and the Trump administration reveals a complex interplay of powerful personalities and unpredictable market forces. Dogecoin's price remains highly volatile, influenced by tweets, potential endorsements, and broader regulatory uncertainty. Understanding these interconnected factors is crucial for navigating the risks associated with investing in cryptocurrencies. To stay informed about developments surrounding "Elon Musk, Dogecoin, and the Trump Administration," follow reputable financial news sources and engage in ongoing research. Subscribe to our newsletter for updates and further analysis on this dynamic market. Understanding the intricacies of "Elon Musk, Dogecoin, and the Trump Administration" is key to navigating the volatile world of cryptocurrency investment.

Featured Posts

-

Trump Welcomes Musk To The Oval Office What Does It Mean

May 31, 2025

Trump Welcomes Musk To The Oval Office What Does It Mean

May 31, 2025 -

Gratis Wohnungen Diese Deutsche Stadt Sucht Neue Bewohner

May 31, 2025

Gratis Wohnungen Diese Deutsche Stadt Sucht Neue Bewohner

May 31, 2025 -

Wohnungsknappheit Diese Deutsche Stadt Bietet Kostenlose Unterkuenfte

May 31, 2025

Wohnungsknappheit Diese Deutsche Stadt Bietet Kostenlose Unterkuenfte

May 31, 2025 -

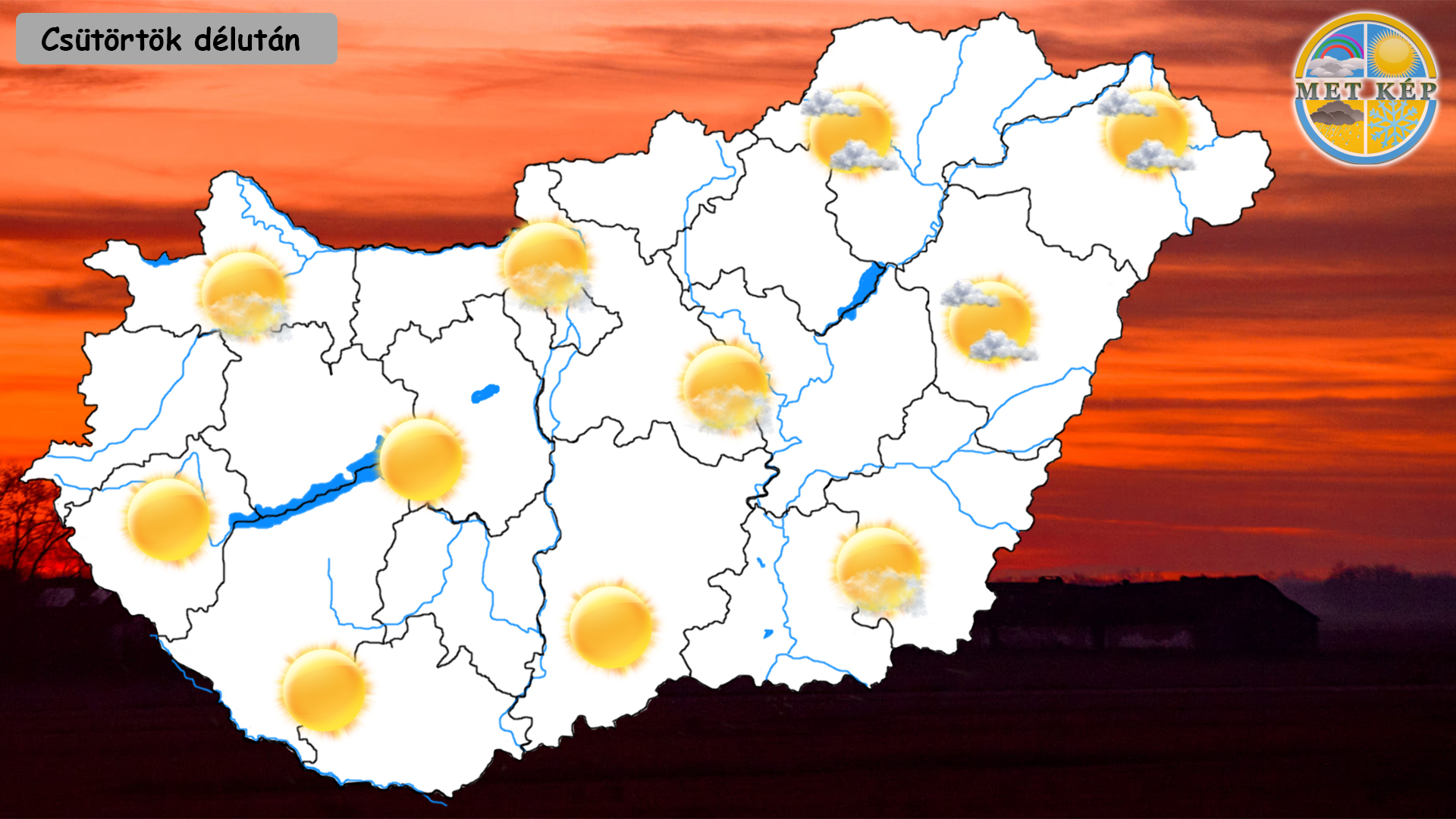

Idojaras Magyarorszagon Tavaszias Homerseklet Es Toebb Csapadekhullam

May 31, 2025

Idojaras Magyarorszagon Tavaszias Homerseklet Es Toebb Csapadekhullam

May 31, 2025 -

Live The Good Life Practical Tips For A Fulfilling Existence

May 31, 2025

Live The Good Life Practical Tips For A Fulfilling Existence

May 31, 2025