Elon Musk: SpaceX Holdings Exceed Tesla Stake By $43 Billion

Table of Contents

SpaceX's Soaring Valuation: A Deep Dive

SpaceX's meteoric rise is the driving force behind this remarkable turnaround. Its valuation surge is fueled by several key factors:

Factors Contributing to SpaceX's Increased Value:

-

Starlink's Explosive Growth: Starlink, SpaceX's satellite internet constellation, has experienced phenomenal subscriber growth, exceeding expectations and generating substantial revenue. With millions of subscribers worldwide and ongoing expansion plans, Starlink is a major contributor to SpaceX's valuation.

-

Lucrative Government Contracts: SpaceX secures significant contracts from NASA and the Department of Defense (DoD), solidifying its position as a key player in space exploration and national security. These contracts, worth billions of dollars, represent a steady stream of income and reinforce SpaceX's technological capabilities. For example, the contract for NASA's Artemis program is expected to inject significant capital into SpaceX's development efforts.

-

Reusable Rocket Technology: SpaceX's pioneering work in reusable rocket technology has significantly reduced launch costs, making space travel more accessible and economically viable. This technological advantage is a key differentiator, attracting both commercial and government clients. The success rate of SpaceX's Falcon 9 and Falcon Heavy rockets significantly outweighs that of its competitors.

-

Ambitious Future Projects: The development of Starship, a fully reusable transportation system designed for interplanetary travel, and the long-term goal of Mars colonization, represent immense potential for future growth. These ambitious projects attract significant investment and bolster SpaceX's long-term valuation.

Comparing SpaceX Valuation to Other Aerospace Companies:

SpaceX's valuation dwarfs that of many established aerospace companies like Boeing and Lockheed Martin. Its disruptive business model, characterized by innovation, efficiency, and vertical integration, has allowed it to capture significant market share and reshape the industry. While Boeing and Lockheed Martin focus primarily on government contracts, SpaceX has successfully carved a niche in both commercial and governmental sectors.

Tesla's Performance and Market Dynamics

While SpaceX is soaring, Tesla's performance has been more volatile.

Recent Tesla Stock Performance and Challenges:

Tesla's stock price has experienced fluctuations, influenced by various factors including overall market sentiment, increased competition in the electric vehicle (EV) market, production challenges, and the often unpredictable pronouncements of Elon Musk himself. While Tesla remains a dominant player in the EV market, competition is intensifying.

The Electric Vehicle Market Landscape:

The electric vehicle market is rapidly evolving, with numerous established automakers and new entrants vying for market share. Tesla, while maintaining a significant lead in some areas, faces growing pressure from competitors who are rapidly improving their EV technologies and production capabilities. This competitive pressure directly impacts Tesla's stock price and valuation.

Implications for Elon Musk's Net Worth and Future Investments

The shift in the relative valuations of SpaceX and Tesla significantly alters the composition of Elon Musk's vast net worth.

The Shift in Musk's Wealth Distribution:

The increased valuation of SpaceX now represents a larger portion of Elon Musk's total wealth, diversifying his holdings beyond his stake in Tesla. This shift might influence his investment strategies and future entrepreneurial ventures.

The Future of SpaceX and Tesla:

Both SpaceX and Tesla hold significant potential for future growth. SpaceX's expansion into satellite internet and interplanetary travel offers enormous opportunities, while Tesla continues to lead the charge in electric vehicle technology and sustainable energy solutions. However, each company faces distinct challenges that could impact their future success. There is potential for synergy between both companies, but also a level of competition for resources and investment.

Conclusion

The remarkable surge in SpaceX's valuation, surpassing that of Elon Musk's Tesla stake by $43 billion, underscores the transformative potential of space exploration and the dynamism of the entrepreneur's business ventures. SpaceX's success is driven by innovative technology, lucrative contracts, and ambitious future projects. While Tesla faces increased competition in a rapidly evolving EV market, the combined impact of both companies continues to shape the global landscape of technology and innovation. Stay informed on the future of Elon Musk's empire and the ongoing valuation battle between SpaceX and Tesla by subscribing to our newsletter for exclusive updates!

Featured Posts

-

What The Williams Team Principal Said About Doohan And The Colapinto Situation

May 09, 2025

What The Williams Team Principal Said About Doohan And The Colapinto Situation

May 09, 2025 -

Operation Sindoors Impact Kse 100 Halted After Sharp 6 Decline

May 09, 2025

Operation Sindoors Impact Kse 100 Halted After Sharp 6 Decline

May 09, 2025 -

Tidlig Sesongslutt For Skisentre Pa Grunn Av Uvanlig Mild Vinter

May 09, 2025

Tidlig Sesongslutt For Skisentre Pa Grunn Av Uvanlig Mild Vinter

May 09, 2025 -

Elon Musk Net Worth 2024 The Influence Of Us Politics And Teslas Performance

May 09, 2025

Elon Musk Net Worth 2024 The Influence Of Us Politics And Teslas Performance

May 09, 2025 -

Nyt Strands Game 376 Friday March 14th Solutions And Clues

May 09, 2025

Nyt Strands Game 376 Friday March 14th Solutions And Clues

May 09, 2025

Latest Posts

-

Broadcoms Extreme Price Hike On V Mware A 1 050 Jump Says At And T

May 10, 2025

Broadcoms Extreme Price Hike On V Mware A 1 050 Jump Says At And T

May 10, 2025 -

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025

Extreme V Mware Price Hike At And T Highlights Broadcoms 1 050 Increase

May 10, 2025 -

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025

1 050 V Mware Price Increase At And T Challenges Broadcoms Proposal

May 10, 2025 -

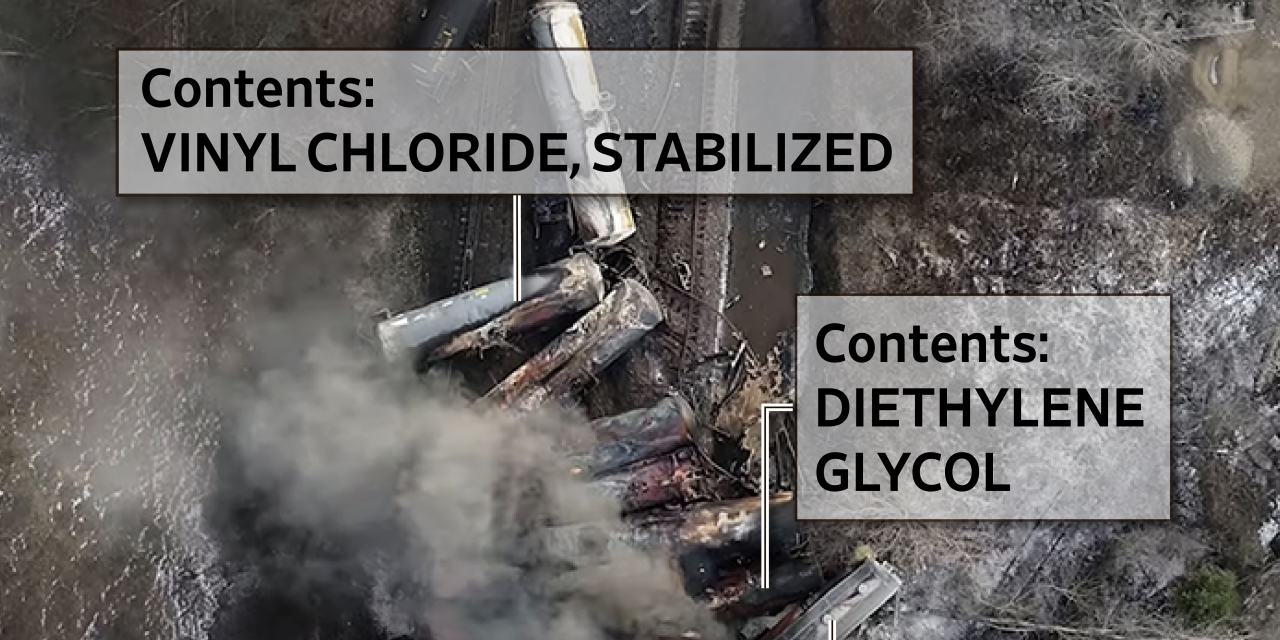

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025