Elon Musk's Influence: Tesla Stock Decline And The Impact On Dogecoin

Table of Contents

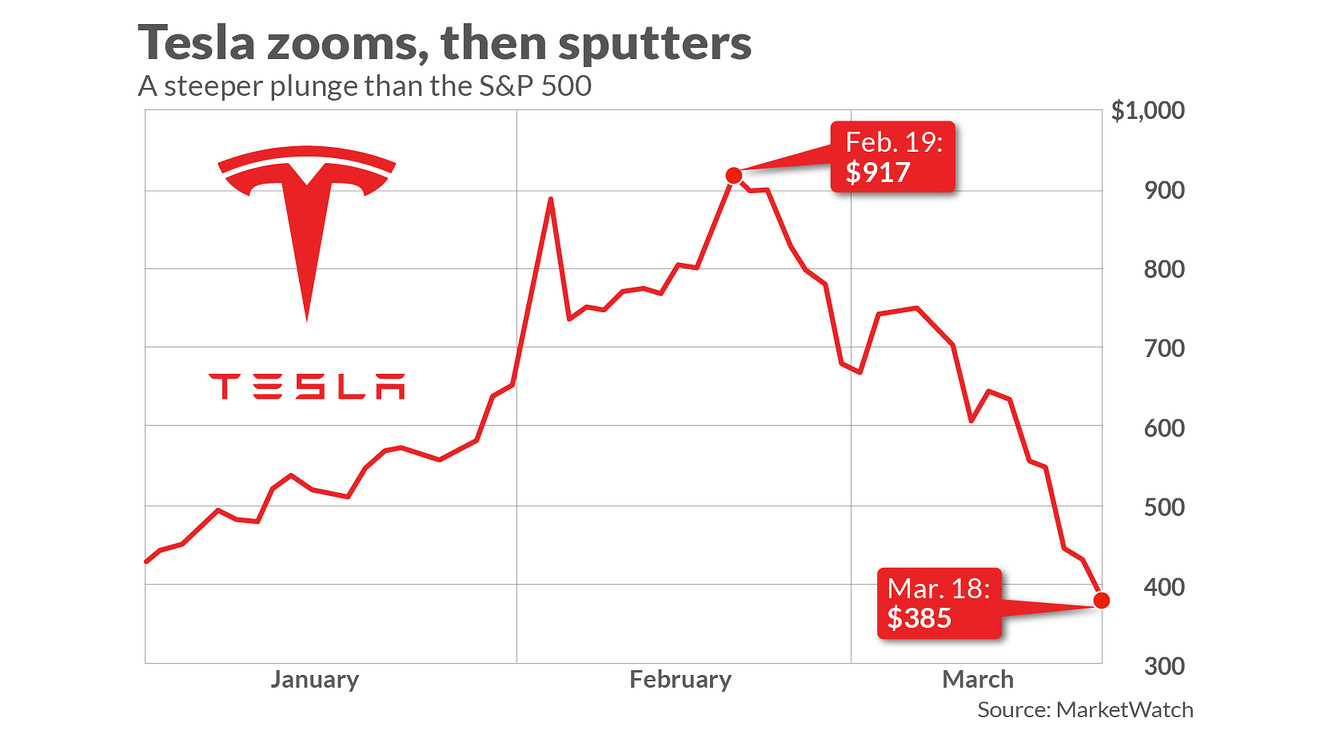

Tesla Stock Decline: Understanding the Contributing Factors

Tesla, once a darling of the stock market, has experienced a significant decline in its stock price. While various factors contribute to this downturn, Elon Musk's actions and statements play a prominent role.

Musk's Controversial Actions and Their Market Impact

Musk's recent activities have undeniably impacted investor sentiment. His controversial acquisition of Twitter, coupled with significant changes to its operations and subsequent layoffs, diverted attention and resources from Tesla. Furthermore, his often unpredictable tweets – sometimes promoting or criticizing Tesla directly – have created market uncertainty.

- April 2023: Musk's sale of Tesla shares to fund his Twitter acquisition sparked a significant drop in Tesla's stock price.

- Ongoing Twitter saga: Continuous distractions and controversies surrounding Twitter negatively impact investor confidence in Tesla.

- Production challenges: While not directly linked to Musk's actions, production delays and supply chain issues further exacerbated the stock decline.

The Impact of Economic Uncertainty on Tesla's Valuation

Beyond Musk's actions, broader macroeconomic factors significantly impact Tesla's valuation. Rising inflation, increased interest rates, and fears of a potential recession have created a challenging environment for growth stocks like Tesla. Investors are becoming more risk-averse, leading to a reassessment of valuations across the tech sector.

- Inflation: Increased production costs and reduced consumer spending impact Tesla's profitability.

- Interest Rate Hikes: Higher borrowing costs make expansion and investment more expensive.

- Recessionary Fears: Uncertainty about future economic growth dampens investor enthusiasm for riskier assets.

Dogecoin's Volatility: A Direct Correlation to Musk's Tweets?

Dogecoin, a cryptocurrency initially created as a joke, has experienced extreme price volatility, often directly correlating with Elon Musk's tweets.

Musk's Tweets and Their Influence on Dogecoin's Price

Musk's tweets mentioning Dogecoin have consistently caused significant price swings. A single positive tweet can send the price soaring, while a negative comment can trigger a sharp drop. This demonstrates the immense power of his social media influence on market psychology.

- Example 1: A tweet from Musk endorsing Dogecoin in 2021 caused its price to surge dramatically.

- Example 2: A seemingly innocuous tweet questioning Dogecoin's future led to a significant price correction.

- Ethical Concerns: The power to manipulate a cryptocurrency's price through social media raises significant ethical questions.

The Speculative Nature of Dogecoin and Musk's Role

Dogecoin's inherent volatility stems from its speculative nature. It lacks the fundamental value and utility of established cryptocurrencies. Musk's involvement further fuels this speculation, transforming it into a meme-driven asset whose price is heavily influenced by social media trends.

- Social Media Hype: Dogecoin’s price is often driven by hype and speculation on platforms like Twitter and Reddit.

- Lack of Intrinsic Value: Unlike Bitcoin or Ethereum, Dogecoin doesn't have a strong underlying technology or use case driving its value.

- Musk's Amplification: Musk's public pronouncements exponentially increase Dogecoin's volatility.

The Interconnectedness of Tesla and Dogecoin within Musk's Sphere of Influence

The perception of Musk's overall business acumen influences both Tesla's stock price and Dogecoin's value. Negative news regarding Tesla can negatively impact Dogecoin's price, and vice-versa. This interconnectedness highlights the importance of considering the broader context of Musk's influence.

- Shared Investor Base: Many investors hold both Tesla stock and Dogecoin, creating a shared sentiment.

- Brand Association: The association with Musk creates a perceived link between the two assets in the minds of investors.

- Future Correlation: The future correlation between Tesla and Dogecoin's performance warrants close monitoring.

Conclusion: The Enduring Influence of Elon Musk on Tesla and Dogecoin

Elon Musk's influence on both Tesla and Dogecoin is undeniable. His actions and statements significantly impact the stock market performance of Tesla and the volatility of Dogecoin. The interconnectedness of these assets within Musk's sphere of influence underscores the need for a nuanced understanding of this complex relationship. Understanding the interplay of macroeconomic factors, Musk's pronouncements, and the speculative nature of Dogecoin is crucial for navigating the risks and potential rewards associated with these assets. To stay informed about the latest developments and the evolving impact of Elon Musk’s influence on Tesla and Dogecoin, continue your research and stay tuned for future updates. Understanding Elon Musk's influence is key to successfully navigating the turbulent waters of these markets.

Featured Posts

-

Aoc Criticizes Pro Trump Fox News Commentary

May 09, 2025

Aoc Criticizes Pro Trump Fox News Commentary

May 09, 2025 -

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025

Brekelmans India Strategie Behoud Van Samenwerking

May 09, 2025 -

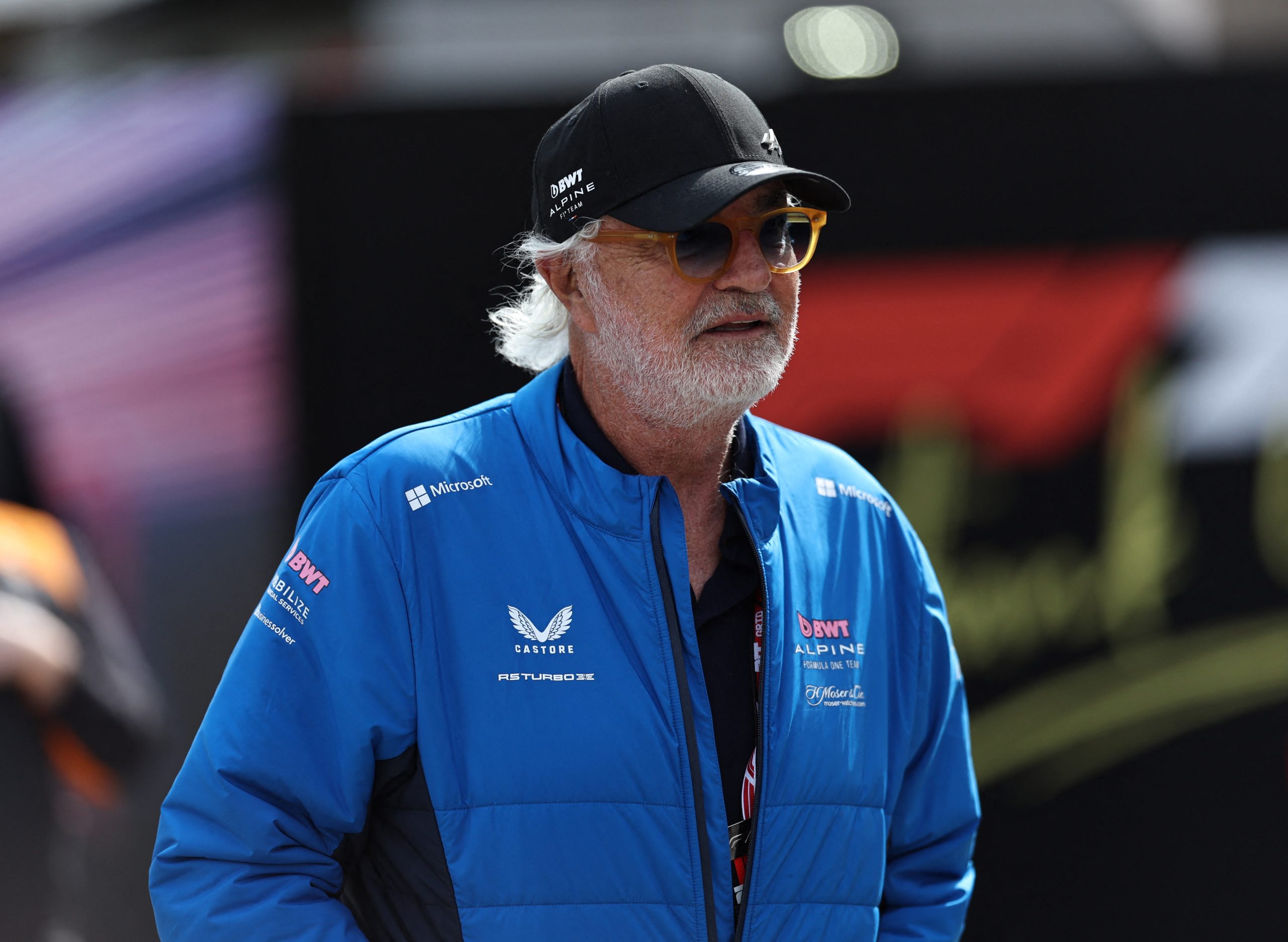

Briatores Power Play Jack Doohan And The I Control You Netflix Scene

May 09, 2025

Briatores Power Play Jack Doohan And The I Control You Netflix Scene

May 09, 2025 -

From Wolves Discard To Europes Elite His Rise To Success

May 09, 2025

From Wolves Discard To Europes Elite His Rise To Success

May 09, 2025 -

Aprel 2025 V Permi I Permskom Krae Prognoz Pogody S Uchetom Snegopadov I Pokholodaniya

May 09, 2025

Aprel 2025 V Permi I Permskom Krae Prognoz Pogody S Uchetom Snegopadov I Pokholodaniya

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025