Elon Musk's SpaceX Stake Surges: Now Worth $43B More Than Tesla Holdings

Table of Contents

SpaceX's Valuation Explodes: Factors Driving the Surge

Several key factors have contributed to SpaceX's explosive valuation, pushing it beyond even the considerable value of Elon Musk's Tesla holdings.

Successful Starship Launches and Development

Recent Starship test launches, while not always completely successful, represent monumental strides in reusable rocket technology. These advancements, despite occasional setbacks, showcase SpaceX's relentless innovation and commitment to pushing the boundaries of space travel.

- Successful Starship prototype testing: While some tests have resulted in explosions, the data gathered from these events is invaluable for future iterations. The sheer ambition and scale of the Starship program are impressive to investors.

- Progress towards orbital flight and beyond: SpaceX is actively working towards fully reusable orbital Starship flights, a major milestone that will drastically reduce the cost of space travel. This capability is crucial for expanding commercial spaceflight opportunities.

- Technological advancements in rocket propulsion and design: SpaceX’s innovative approaches to rocket design and propulsion systems are key to its success. This ongoing innovation consistently attracts investment.

- Future plans for lunar and Martian missions: SpaceX's long-term vision, including plans for lunar landings and eventual human missions to Mars, further enhances its appeal to investors who see vast long-term potential.

Growing Commercial Contracts and Government Partnerships

SpaceX isn't just focused on ambitious government projects; it's also aggressively pursuing and securing lucrative commercial contracts. This diversified revenue stream is a significant factor in its soaring valuation.

- Increasing number of commercial satellite launches: SpaceX's Falcon 9 and Falcon Heavy rockets are highly sought after for launching commercial satellites, generating substantial revenue.

- Significant NASA partnerships: SpaceX's partnership with NASA, including contracts for astronaut transportation to the International Space Station (ISS) and future lunar missions, provides a stable and high-profile revenue stream.

- Emerging partnerships with other government agencies: Beyond NASA, SpaceX is forging partnerships with other governmental organizations globally, showcasing the broad international acceptance and demand for its services.

- Revenue generation potential from space tourism: SpaceX is also venturing into space tourism, a rapidly growing market expected to generate substantial revenue in the coming years.

Starlink's Expanding Global Footprint and Revenue Potential

Starlink, SpaceX's satellite internet constellation, is a major driver of the company's valuation. Its rapid subscriber growth and global expansion are creating a massive new revenue stream.

- Rapid subscriber growth and global expansion: Starlink has quickly amassed a large subscriber base, offering high-speed internet access to even the most remote locations. This growth continues at a phenomenal pace.

- Potential for massive revenue generation through broadband services: The potential market for global broadband internet access is enormous, and Starlink is uniquely positioned to capitalize on this.

- Long-term strategic implications of Starlink's success: Starlink's success establishes SpaceX as a major player in the global telecommunications market, opening doors for further diversification and growth.

- Technological advancements in satellite technology and network management: SpaceX is continually improving its satellite technology and network management capabilities, making Starlink even more efficient and appealing to consumers.

Tesla Holdings vs. SpaceX Investment: A Comparative Analysis

While both SpaceX and Tesla are associated with Elon Musk, comparing their valuations requires understanding their different structures.

Comparing Tesla's Market Performance and SpaceX's Private Valuation

Tesla, a publicly traded company, has a readily available market capitalization. SpaceX, however, is privately held, making its valuation less transparent and subject to more speculation.

- Tesla's market capitalization: Tesla's market cap fluctuates, but its publicly traded nature allows for real-time tracking.

- SpaceX's private valuation: SpaceX's valuation is based on private investment rounds and estimates from financial analysts, leading to some variability in reported figures.

- Challenges in accurately assessing SpaceX's true worth: The lack of publicly available financial data makes precise valuation challenging, though recent investment rounds provide strong indications of its worth.

- Factors influencing the valuation gap: Differences in public perception, investment strategies, and market volatility contribute to the gap between Tesla's and SpaceX's valuation.

Implications for Musk's Net Worth and Future Investments

The surge in SpaceX's valuation significantly boosts Elon Musk's overall net worth, further solidifying his position as one of the world's wealthiest individuals.

- Impact on Musk's overall net worth: The increased SpaceX valuation substantially contributes to Musk's overall wealth.

- Potential future investment strategies based on SpaceX's success: The success of SpaceX might lead to further investments in space-related ventures and related technologies.

- Impact on Musk's influence in the tech and space industries: SpaceX's success reinforces Musk's influence and leadership position in both the tech and space industries.

Conclusion: The Future of SpaceX and its Impact on the Space Industry

SpaceX's soaring valuation, surpassing that of Tesla, is a testament to its groundbreaking achievements in reusable rocket technology, commercial spaceflight, and satellite internet. The success of Starship, lucrative contracts, and the phenomenal growth of Starlink are all key drivers. The future looks exceptionally bright for SpaceX, with its potential to continue disrupting the space industry and pushing the boundaries of human exploration. Its impact on the global economy and our understanding of space is undeniable. Follow the latest SpaceX news and stay updated on Elon Musk's investments to witness the unfolding of this exciting chapter in space exploration. Learn more about the future of SpaceX valuation and its influence on the global landscape.

Featured Posts

-

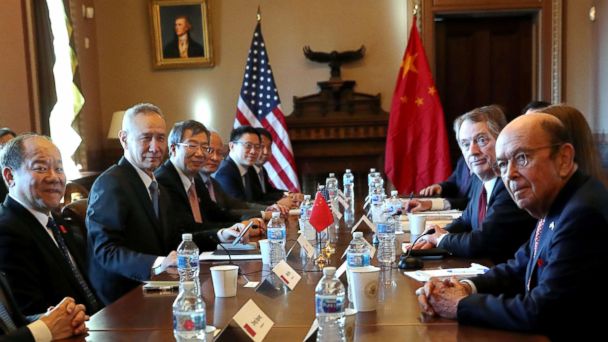

Fentanyl Crisis A Lever In U S China Trade Negotiations

May 10, 2025

Fentanyl Crisis A Lever In U S China Trade Negotiations

May 10, 2025 -

Navigating The Crossroads Apples Future In Artificial Intelligence

May 10, 2025

Navigating The Crossroads Apples Future In Artificial Intelligence

May 10, 2025 -

Uk Tightens Visa Rules Impact On Nigerian And Pakistani Applicants

May 10, 2025

Uk Tightens Visa Rules Impact On Nigerian And Pakistani Applicants

May 10, 2025 -

Legendarniy Stiven Fray Udostoen Rytsarskogo Zvaniya Ot Korolya Charlza Iii

May 10, 2025

Legendarniy Stiven Fray Udostoen Rytsarskogo Zvaniya Ot Korolya Charlza Iii

May 10, 2025 -

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025

Macron Announces Planned Signing Of France Poland Friendship Treaty

May 10, 2025