Emerging Market Stocks Outperform US In 2024: A Year Of Contrasts

Table of Contents

Emerging markets are economies transitioning from developing to developed status. They are characterized by rapid economic growth, often coupled with significant volatility. Key examples include Brazil, India, Indonesia, Mexico, and South Africa, each showcasing diverse economic profiles and investment opportunities within the broader emerging market landscape. This article argues that several factors contributed to the outperformance of emerging market stocks in 2024, making it a compelling area for investors to consider, despite inherent risks.

Macroeconomic Factors Favoring Emerging Markets in 2024

Several macroeconomic trends significantly favored emerging markets in 2024, leading to their superior performance compared to developed markets like the US.

Divergent Monetary Policies

The divergence in monetary policies between developed and emerging economies played a crucial role. The US Federal Reserve, for example, continued its interest rate hike strategy throughout the first half of 2024 to combat inflation, while many emerging market central banks adopted more cautious approaches, or even began easing monetary policy.

- US: Aggressive interest rate hikes strengthened the US dollar, making US assets more attractive to international investors but simultaneously impacting emerging market currencies negatively in the short term.

- Emerging Markets: Many emerging market economies, experiencing slower inflation, adopted more moderate interest rate policies. This, in some cases, stabilized their currencies and attracted investors seeking higher yields compared to the relatively lower yields in developed markets. For example, Indonesia's measured approach to interest rate adjustments attracted significant foreign investment. Brazil, despite its own challenges, saw some positive growth fueled by a more stable currency compared to other emerging markets.

Commodity Price Fluctuations

Fluctuations in commodity prices – particularly oil, metals, and agricultural products – had a significant impact on emerging market economies, many of which are major producers and exporters of these commodities.

- Rising Prices: Initially, rising commodity prices boosted the economies of commodity-exporting nations like Brazil (iron ore) and Indonesia (palm oil), leading to increased corporate profits and higher stock valuations.

- Falling Prices (later in the year): However, later shifts in commodity prices, influenced by global demand and supply, moderated these gains and added to the overall market volatility. The impact varied greatly depending on the specific commodity and country.

Geopolitical Shifts

Global events profoundly influenced investment flows into emerging markets. The ongoing war in Ukraine, for instance, disrupted global supply chains and energy markets, leading to increased volatility.

- Diversification Strategies: Some investors viewed emerging markets as a form of diversification away from the geopolitical risks associated with the war in Europe. The reduced reliance on specific regions by emerging economies was seen as beneficial.

- Trade Tensions: While trade tensions between major economic powers persisted, emerging markets that managed to navigate these complexities efficiently benefited from increased trading opportunities with nations less impacted by these tensions.

Sector-Specific Growth Drivers in Emerging Markets

Beyond macroeconomic trends, sector-specific growth contributed to the outperformance of emerging market stocks in 2024.

Technology Sector Boom in Select Emerging Markets

Several emerging markets experienced a technology sector boom, driven by increasing digital adoption and government support.

- India: India's tech sector continued its rapid expansion, with companies like Infosys and TCS demonstrating robust growth.

- Indonesia: Indonesia's burgeoning e-commerce sector, fueled by a growing middle class, attracted significant investment. Gojek and Tokopedia are examples of successful companies.

Infrastructure Development and Investment

Significant government investment in infrastructure projects further boosted economic growth and stock market performance in various emerging markets.

- China's Belt and Road Initiative: Although not strictly emerging market focused, its impact on countries along the routes led to notable economic expansion in some regions.

- India's Infrastructure Push: Major investments in roads, railways, and renewable energy projects positively impacted related sectors.

Increased Domestic Consumption

The expanding middle class in many emerging markets led to increased domestic consumption, driving growth in consumer-driven sectors.

- Consumer Goods: Companies focused on consumer goods and retail experienced strong growth, benefiting from this increased spending power.

- Tourism: In countries where tourism recovered strongly after the pandemic, this sector contributed significantly to economic growth.

Risks and Challenges Associated with Emerging Market Investments

Despite the positive performance in 2024, investing in emerging markets carries inherent risks.

Political and Economic Instability

Political instability, currency volatility, and economic uncertainty remain significant concerns.

- Political Risk: Sudden changes in government policies, social unrest, or corruption can negatively impact investments.

- Currency Fluctuations: Significant currency depreciations can erode returns for foreign investors.

Regulatory Uncertainty

Unpredictable regulatory environments in some emerging markets pose challenges for businesses and investors.

- Policy Changes: Changes in regulations, including tax laws or trade policies, can impact profitability and investment returns.

- Bureaucracy: Navigating bureaucratic processes can be time-consuming and costly for investors.

Liquidity Concerns

Lower liquidity in some emerging markets can make it difficult to buy and sell assets quickly.

- Limited Trading Volume: Limited trading volume can lead to wider bid-ask spreads and increased transaction costs.

- Market Volatility: This limited liquidity can amplify market volatility, making it harder to exit investments when needed.

Investing in Emerging Market Stocks: A Strategic Opportunity?

The outperformance of emerging market stocks in 2024 was driven by a combination of macroeconomic factors, sector-specific growth, and global events. However, it's essential to remember the contrasting performance compared to US markets highlights the inherent volatility in this asset class. Diversifying investment portfolios to include emerging market assets can be beneficial for long-term growth, but a thorough understanding of the risks is crucial. While emerging market stocks present opportunities, thorough research and a well-defined investment strategy are crucial. Learn more about navigating the complexities of emerging market investments and discover how you can build a diversified portfolio including high-potential emerging market stocks.

Featured Posts

-

China Market Headwinds Bmw Porsche And The Future Of Luxury Auto Sales

Apr 24, 2025

China Market Headwinds Bmw Porsche And The Future Of Luxury Auto Sales

Apr 24, 2025 -

Are Bmw And Porsche Losing Ground In China Analyzing Market Trends

Apr 24, 2025

Are Bmw And Porsche Losing Ground In China Analyzing Market Trends

Apr 24, 2025 -

Bold And Beautiful Liams Promise Hopes Dilemma And Lunas Impact A 2 Week Spoiler

Apr 24, 2025

Bold And Beautiful Liams Promise Hopes Dilemma And Lunas Impact A 2 Week Spoiler

Apr 24, 2025 -

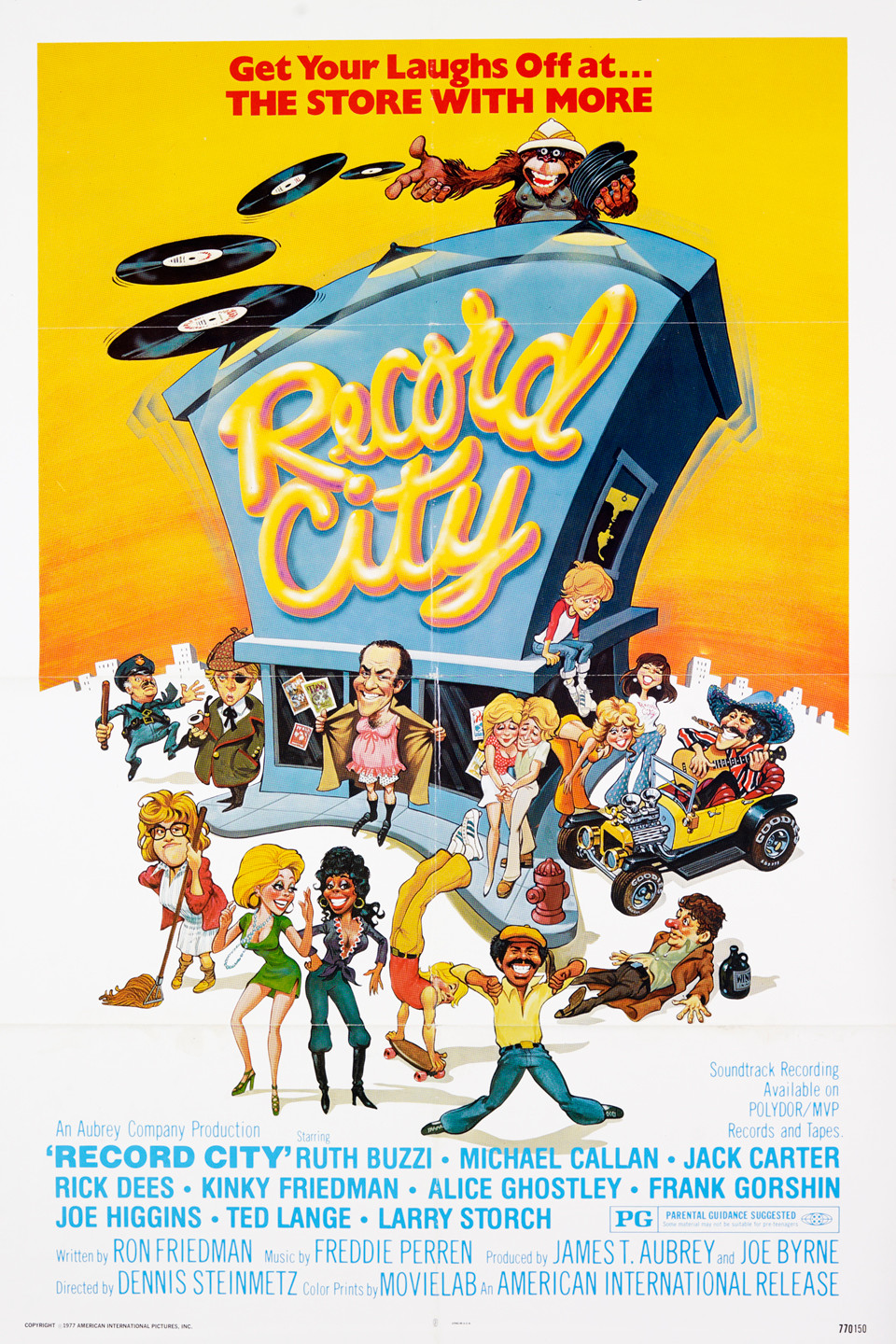

High Rollers First Look At John Travoltas New Action Movie Poster And Photos

Apr 24, 2025

High Rollers First Look At John Travoltas New Action Movie Poster And Photos

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025

John Travoltas Rotten Tomatoes Record Is It Really That Bad

Apr 24, 2025