Entertainment Stock Price Drop: Analyst's Buy Recommendation

Table of Contents

Understanding the Recent Price Drop

The entertainment industry, like any other sector, is susceptible to market volatility. Several factors have contributed to the recent decline in entertainment stock prices. Understanding these underlying issues is crucial for assessing the current investment climate and determining if the risk is worth the potential reward.

-

Economic Downturn: Inflation and recessionary fears significantly impact consumer spending. As disposable income shrinks, discretionary spending on entertainment, including streaming subscriptions and movie tickets, is often the first to be cut back. This reduction in consumer demand directly affects the revenue and profitability of entertainment companies, leading to lower stock prices.

-

Streaming Wars: The streaming market is increasingly saturated with numerous players vying for a limited pool of subscribers. This intense competition has driven up production costs while simultaneously squeezing profit margins. The need for constant content creation and the high cost of acquiring and retaining subscribers make profitability a significant challenge for many streaming services.

-

Geopolitical Events: Global instability, such as the ongoing war in Ukraine and persistent geopolitical tensions, creates uncertainty in the global economy. This uncertainty can negatively impact investor sentiment, leading to a sell-off in various sectors, including entertainment.

-

Investor Sentiment: Negative news cycles, even if not directly related to a company's fundamental performance, can significantly influence investor sentiment. Fear and uncertainty can cause investors to sell off their holdings, further driving down prices, creating a self-fulfilling prophecy.

Bullet Points:

- Netflix, a leading streaming giant, has recently experienced stock price fluctuations directly tied to subscriber growth concerns and increased competition.

- Changing consumer habits, such as the rise of cord-cutting and the shift towards ad-supported streaming models, are forcing entertainment companies to adapt rapidly.

- While the short-term outlook might appear bleak due to immediate economic headwinds, the long-term potential for growth within the entertainment sector remains substantial.

Analyst's Buy Recommendation: Why Now?

Despite the recent price drop, many leading analysts are issuing buy recommendations for select entertainment stocks. Their optimism stems from a belief that the current market undervalues the long-term potential of these companies.

-

Undervaluation: Analysts argue that the current stock prices of several entertainment companies do not accurately reflect their intrinsic value. Using methodologies like discounted cash flow (DCF) analysis, they identify opportunities to purchase stocks at a significant discount to their estimated future earnings.

-

Growth Potential: The entertainment industry continues to show robust long-term growth potential. Emerging technologies like virtual reality (VR) and augmented reality (AR) offer exciting new avenues for entertainment experiences. Furthermore, the expansion into global markets presents significant growth opportunities for companies with strong international appeal.

-

Strong Fundamentals: Despite the current market challenges, many entertainment companies exhibit strong fundamental financial metrics. Revenue growth, although perhaps slower than in previous years, indicates ongoing demand and resilience within the sector.

-

Strategic Initiatives: Many companies are actively pursuing strategic initiatives to adapt to the changing landscape. This includes mergers and acquisitions, expansion into new markets, and the development of innovative content formats.

Bullet Points:

- Several reputable investment firms have published reports highlighting undervalued entertainment stocks with strong buy recommendations.

- Analysts employ a range of valuation methodologies, including DCF analysis and comparable company analysis, to justify their price targets.

- While the potential for long-term growth is significant, investing in entertainment stocks, like any other investment, carries inherent risk.

Diversification and Risk Management

Investing in the entertainment sector, while potentially lucrative, requires a well-defined investment strategy that emphasizes diversification and risk management.

-

Portfolio Diversification: Diversifying your portfolio across different asset classes and sectors significantly reduces overall risk. Avoid over-concentrating investments in a single sector, especially in volatile markets.

-

Risk Tolerance: Your investment decisions should always align with your personal risk tolerance. If you're risk-averse, you may wish to allocate a smaller percentage of your portfolio to entertainment stocks. Conversely, more risk-tolerant investors may see this as an opportune time to increase their exposure.

-

Due Diligence: Before investing in any stock, thorough due diligence is paramount. This includes researching the company's financial statements, understanding its business model, and assessing its competitive landscape.

Conclusion:

The recent drop in entertainment stock prices presents a potential buying opportunity for long-term investors. While the current market presents challenges, many analysts believe that several companies are currently undervalued and possess significant growth potential. Understanding the factors contributing to the price drop, evaluating the long-term prospects of individual companies, and employing sound diversification and risk management strategies are crucial for making informed investment decisions. Are you ready to capitalize on this potential buying opportunity in the entertainment stock market? Conduct your own thorough research and consider adding undervalued entertainment stocks to your portfolio for long-term growth. Remember, this is not financial advice, and always consult a financial professional before making investment decisions.

Featured Posts

-

Le Pen Calls Conviction A Witch Hunt Paris Rally Speech Highlights

May 29, 2025

Le Pen Calls Conviction A Witch Hunt Paris Rally Speech Highlights

May 29, 2025 -

Alastqlal Rmz Alkramt Walsyadt

May 29, 2025

Alastqlal Rmz Alkramt Walsyadt

May 29, 2025 -

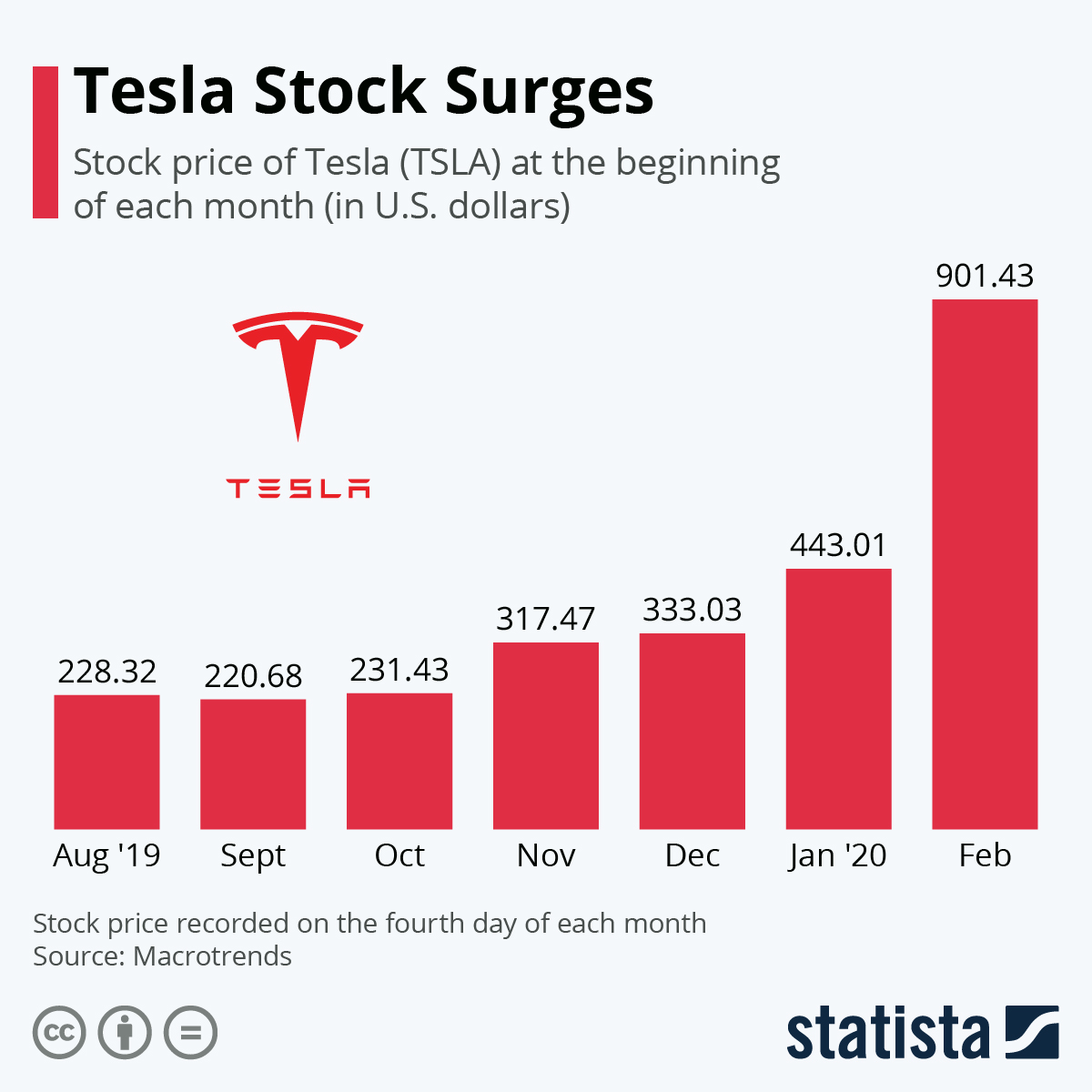

Chinas Impact On Bmw And Porsche Sales Are Other Automakers Facing Similar Issues

May 29, 2025

Chinas Impact On Bmw And Porsche Sales Are Other Automakers Facing Similar Issues

May 29, 2025 -

Tfawl Ardny Bshan Atfaqyat Almyah Aljdydt Me Swrya Frs Wthdyat

May 29, 2025

Tfawl Ardny Bshan Atfaqyat Almyah Aljdydt Me Swrya Frs Wthdyat

May 29, 2025 -

New Canadian Guidelines Offer Hope For Long Covid Patients

May 29, 2025

New Canadian Guidelines Offer Hope For Long Covid Patients

May 29, 2025

Latest Posts

-

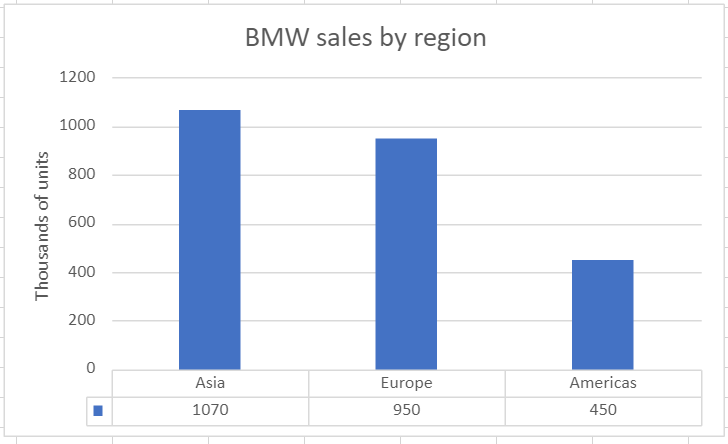

New Covid 19 Variant Lp 8 1 Expert Analysis And Updates

May 31, 2025

New Covid 19 Variant Lp 8 1 Expert Analysis And Updates

May 31, 2025 -

Who New Covid 19 Variant Fueling Case Rise In Some Regions

May 31, 2025

Who New Covid 19 Variant Fueling Case Rise In Some Regions

May 31, 2025 -

Covid 19 Jn 1 Variant Surge In India Recognizing And Preventing Infection

May 31, 2025

Covid 19 Jn 1 Variant Surge In India Recognizing And Preventing Infection

May 31, 2025 -

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025

Understanding The Jn 1 Covid 19 Variant Symptoms And Prevention In India

May 31, 2025 -

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025

Jn 1 Covid 19 Variant In India Symptoms Spread And Precautions

May 31, 2025