Eramet CEO: China's Lithium Tech Export Curbs Could Be Beneficial

Table of Contents

Reduced Reliance on Chinese Lithium Technology: A Global Shift?

China currently holds a near-monopoly in several key stages of lithium technology production, from refining raw materials to manufacturing battery components. This dependence creates significant vulnerabilities in global supply chains, exposing manufacturers to geopolitical risks and potential disruptions. However, export restrictions could act as a catalyst for change, forcing other nations to invest heavily in their own lithium processing and battery manufacturing capabilities. This would lead to a more resilient and diversified global lithium landscape.

- Increased investment in lithium mining and refining outside of China: We're already witnessing a surge in exploration and development projects in countries like Australia, Argentina, and the Democratic Republic of Congo, seeking to capitalize on the growing demand and reduced reliance on Chinese sources.

- Development of alternative battery technologies less reliant on Chinese components: The pressure to reduce dependence on China is encouraging innovation in battery technology, exploring alternative chemistries and manufacturing processes that lessen the reliance on specific Chinese-sourced components.

- Growth of domestic lithium-ion battery production in Europe, North America, and other regions: Governments are actively supporting the domestic production of lithium-ion batteries through subsidies, tax breaks, and strategic partnerships, aiming to strengthen their energy security and reduce reliance on foreign suppliers. This includes initiatives focusing on sustainable mining and responsible sourcing.

- Potential for job creation and economic growth in countries diversifying their lithium supply chains: The development of a robust domestic lithium industry will create numerous job opportunities across the entire supply chain, from mining and refining to battery manufacturing and recycling, stimulating economic growth in participating regions. These new jobs will range from highly skilled engineering and technical roles to operational and logistical positions.

This shift towards supply chain resilience is crucial for mitigating geopolitical risks and ensuring the long-term stability of the electric vehicle sector.

Opportunities for Eramet and Other Western Companies

Eramet, with its established presence in the mining and metallurgical sectors, is well-positioned to capitalize on this evolving landscape. The company's existing operations and strategic investments position it to benefit significantly from the decreased reliance on Chinese lithium technology.

- Increased market share for Eramet in lithium processing and battery materials: As countries invest in building their own lithium processing capacity, companies like Eramet, with their expertise and infrastructure, are poised to win significant contracts and increase their market share.

- Potential for new partnerships and collaborations with other companies: The shift towards a more decentralized lithium industry will create ample opportunities for strategic alliances and joint ventures to share resources and expertise, potentially leading to further innovation and growth.

- Access to new markets and investment opportunities: Eramet can expand its operations into new markets and regions, taking advantage of increased demand for lithium processing and battery materials. This expansion could encompass both upstream and downstream activities within the lithium supply chain.

- Strengthened position in the burgeoning electric vehicle market: A stronger presence in the lithium market will enable Eramet to solidify its position as a key supplier to the rapidly expanding electric vehicle industry, capitalizing on the long-term growth potential of this sector.

The export restrictions, therefore, can be viewed as a catalyst for Eramet’s growth and market dominance, shifting the competitive landscape and presenting lucrative opportunities.

Challenges and Risks of China's Lithium Tech Export Curbs

While the long-term outlook might be positive, it's crucial to acknowledge the potential short-term challenges and risks associated with China's export restrictions.

- Potential for price volatility in lithium and related materials: The immediate impact of the restrictions could lead to price fluctuations and potential shortages, affecting the profitability and stability of companies involved in the lithium supply chain. This could trigger short-term disruptions across the electric vehicle industry.

- Increased upfront costs for countries building new lithium processing facilities: Establishing new lithium processing facilities requires substantial investments, which could pose a financial challenge for some nations, potentially slowing down the diversification process.

- Potential for trade disputes and geopolitical tensions: The shift in the lithium market could exacerbate existing trade tensions and create new geopolitical challenges, requiring careful diplomatic management and strategic partnerships.

- The importance of sustainable and ethical lithium mining practices: As the world moves towards a more decentralized lithium industry, it's crucial to prioritize sustainable and ethical mining practices to minimize environmental impacts and safeguard human rights throughout the supply chain.

Navigating these challenges requires careful planning, strategic investment, and a commitment to collaboration amongst governments and private companies.

Conclusion: Navigating the Changing Landscape of the Lithium Market – A Call to Action

China's lithium tech export curbs present a complex scenario with both significant challenges and exciting opportunities. While short-term disruptions are likely, the long-term trend points towards a more diversified and resilient global lithium supply chain. This shift benefits companies like Eramet, while also enhancing global energy security and reducing reliance on a single dominant player. The strategic importance of securing reliable access to lithium and related technologies cannot be overstated. This is a crucial element in securing the future of the electric vehicle sector and the transition to clean energy. Stay informed about developments in the lithium sector, and consider investing in companies leading the charge toward supply chain diversification. Learn more about Eramet's strategic position in the lithium market and its role in shaping the future of lithium technology.

Featured Posts

-

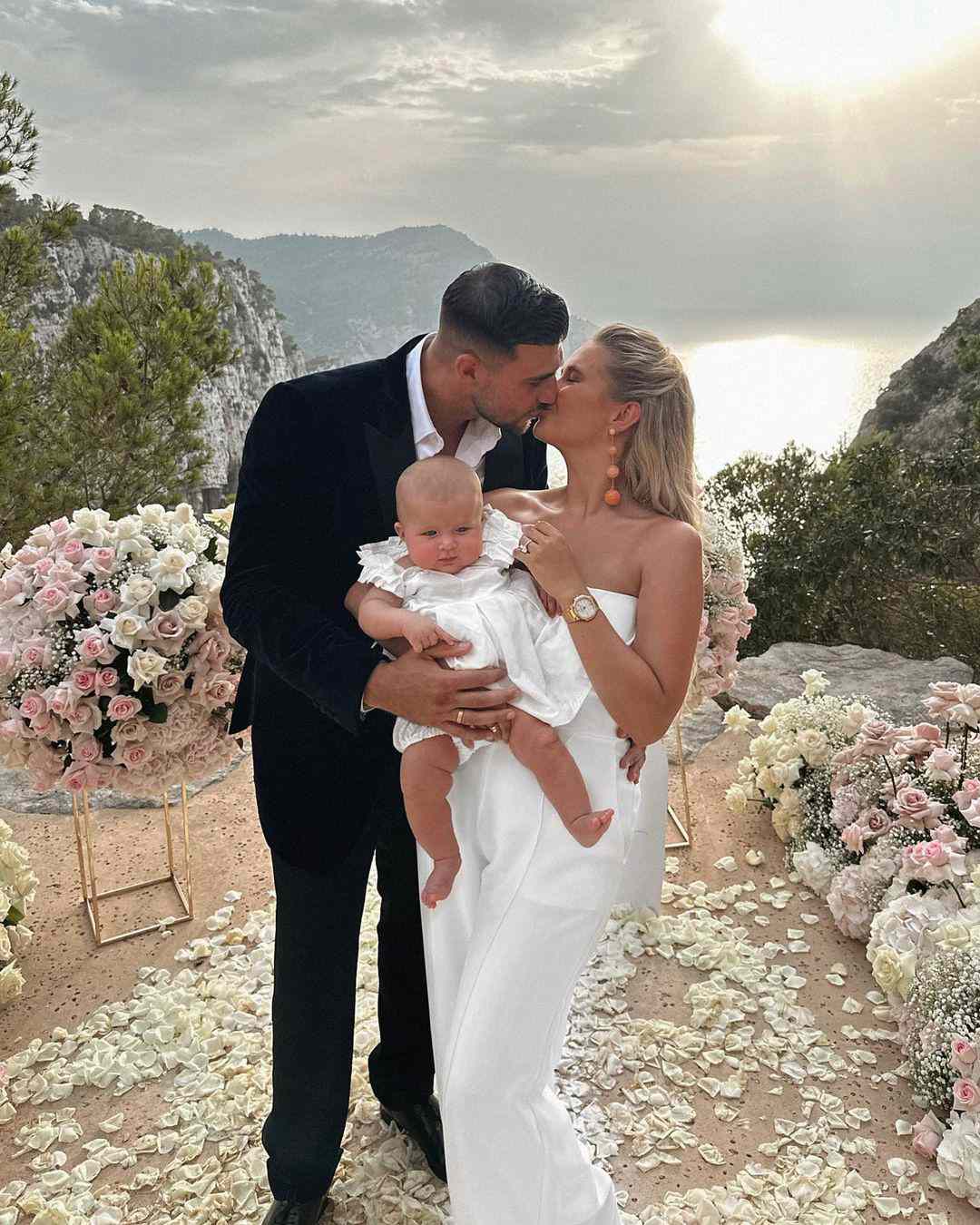

Tommy Furys Bold Stage Appearance A Decision Molly Questions

May 14, 2025

Tommy Furys Bold Stage Appearance A Decision Molly Questions

May 14, 2025 -

Riverhead Police Blotter Crime Summary For The Week Of February 9 2025

May 14, 2025

Riverhead Police Blotter Crime Summary For The Week Of February 9 2025

May 14, 2025 -

Laehes Puolen Miljoonan Euron Eurojackpot Voitot Neljae Onnekasta Voittajaa

May 14, 2025

Laehes Puolen Miljoonan Euron Eurojackpot Voitot Neljae Onnekasta Voittajaa

May 14, 2025 -

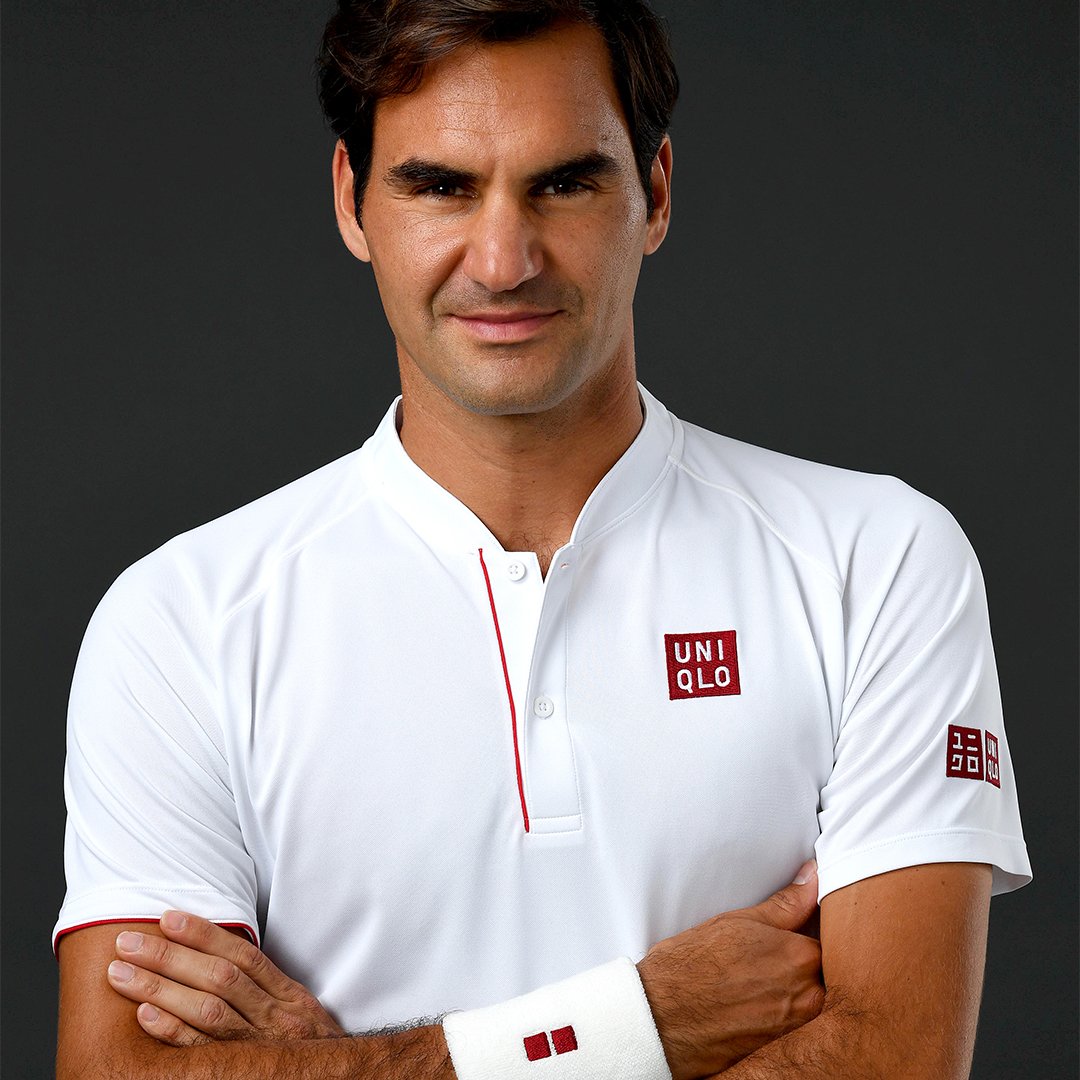

Lack Of Impact Why Sinners Fox Logo Lacks The Power Of Federers Rf

May 14, 2025

Lack Of Impact Why Sinners Fox Logo Lacks The Power Of Federers Rf

May 14, 2025 -

Is Sweden The Eurovision 2024 Winner

May 14, 2025

Is Sweden The Eurovision 2024 Winner

May 14, 2025